Industry Trends

News

January 19, 2026

Baker Hughes says power generation and artificial lift equipment could drive near-term growth in Venezuela as oil producers seek to revive output amid renewed U.S. engagement and Chevron-led expansion.

News

January 14, 2026

Oil-Royalties says its Virtual Auction Marketplace is introducing standardized data, objective valuation tools and automated workflows aimed at improving transparency and reducing uncertainty for buyers of U.S. oil and gas royalty assets.

News

January 14, 2026

EWTC’s latest jobs report shows U.S. oilfield services employment ended 2025 slightly lower than earlier highs, highlighting a year shaped by market uncertainty and shifting labor conditions.

Article

December 2025

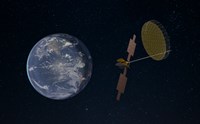

This article explores how advanced space technology and resilient satellite connectivity can support the development of autonomous oil rigs by addressing connectivity challenges in remote, hazardous environments. Improved remote monitoring, control and autonomous tools have the potential to enhance safety, increase operational efficiency and strengthen resilience across the energy sector.

News

January 13, 2026

Speaking at Abu Dhabi Sustainability Week 2026, UAE Energy Minister Sultan Al Jaber said surging AI and data-center demand will drive long-term growth in power consumption, with oil and gas continuing to supply most global energy needs alongside expanding renewables.

Article

December 2025

In the Middle East, operators are leveraging underbalanced coiled tubing drilling (UBCTD) to reduce formation damage, improve reservoir connectivity, and deliver higher production with lower completion complexity.

News

January 07, 2026

Siemens and NVIDIA expanded their industrial AI partnership at CES 2026, unveiling new digital twin and AI tools aimed at improving lifecycle efficiency across energy and infrastructure assets.

Article

December 2025

Progressive cavity pump applications are being redefined by with revolutionary electric submersible progressive cavity pump (ESPCP) systems.

Article

December 2025

This article examines Halliburton's data-driven approach to well control audits that use artificial intelligence (AI)-supported workflows, real-time data, and historical records to identify at-risk wells, streamline compliance, and reduce nonproductive time.

News

January 06, 2026

Expectations that Venezuela could quickly rebound to historic output near 3 MMbpd are running into hard infrastructure and capital barriers, according to commentary from global analyst firms.

Article

December 2025

Uncertainty continues to cloud investment on the UK Continental Shelf, as high taxation, limited licensing, declining production and policy shifts reshape the UK energy outlook to 2050.

News

January 05, 2026

Mozambique LNG illustrates how shifting climate policies, security assessments and political priorities in key financing countries are slowing African LNG projects, raising costs and extending development timelines across the continent.

News

January 02, 2026

Occidental has completed the $9.7-billion sale of its OxyChem chemical business to Berkshire Hathaway, strengthening its balance sheet and upstream focus.

News

January 02, 2026

Baker Hughes has completed the closing of its surface pressure control JV with Cactus, marking a shift in ownership and capital allocation within the upstream equipment sector.

News

December 22, 2025

Harbour Energy has agreed to acquire deepwater operator LLOG for $3.2 billion, entering the U.S. Gulf and adding long-life, oil-weighted offshore assets.

News

December 22, 2025

Bourbon has completed its financial restructuring, bringing Davidson Kempner and Fortress in as majority shareholders and positioning the offshore services provider for renewed growth.

News

December 18, 2025

bp has named Woodside Energy CEO Meg O’Neill as its next chief executive, effective April 1, 2026, as Murray Auchincloss steps down. The leadership change signals a new phase for the supermajor focused on tighter financial discipline and accelerated strategic execution.

News

December 17, 2025

Baker Hughes has secured a multi-year contract with Kuwait Oil Company to deploy advanced ESP artificial lift systems integrated with digital production technologies, strengthening its long-standing role in enhancing output from Kuwait’s oilfields.

News

December 12, 2025

Harbour Energy will acquire Waldorf Energy’s UK North Sea assets for $170 million, expanding its oil-weighted production and raising its stake in the Catcher field to 90%.

News

December 09, 2025

IWCF has launched its new “Quality Assured” framework, providing independent endorsement for non-accredited well control training and aiming to strengthen consistency, competence and safety standards across the global oil and gas industry.