Efficiency, visibility, reliability: The keys to lower costs and greater profitability

(Siemens) Falling oil prices and collapsing profit margins are driving the industry to lower costs any way possible. While reducing labor costs and gaining supplier concessions can help, output must continue if not increase, especially on completed wells, to meet commitments to buyers. Some in the industry may persist in using time-tested manual methods and localized automation, but the economics of continuing to do so just don’t add up. Nor do they scale, as new drilling and completion techniques increase service densities along with operating complexities. This paper provides ways to think about how automation can increase operating efficiency, visibility and reliability to help lower costs and boost profitability. It also provides four steps to accelerating automation’s deployment in oil and gas operations, while improving overall effectiveness.

Today’s drive for greater profitability: Never stronger—or more urgent

In the last half of 2014, world oil prices fell by more than 50 percent. Few industries, notably capital-intensive ones like oil and gas, have suffered such drastic disruptions of their business models in so short a time. If prices don’t rebound substantially, many high-cost production fields may close. Meanwhile lower-cost ones must find ways to cut their operational expenses to boost profitability without affecting output. They’ve got dividends to pay and debts to service.

The latter must also maximize their utilization of assets—their capital infrastructure and, if they’re in upstream production, their in-ground reserves. That’s especially true in shale oil plays, where a horizontally fracked well produces most of its oil and gas within 18 months. Such inherent diminishing returns are spurring those producers to drill faster and faster just to keep pace.

In short, the drive to retain (or regain) profitability has never been stronger or more urgent. The fact is, oil and gas industry professionals—especially those involved in asset management, automation and controls, and production, transmission or plant management—can accelerate the development and deployment of technology solutions to lower the breakeven points of their operations. In one example that follows, we’ll show how engineering costs can be cut 30 percent or more.

Our guidance also applies to the many OEMs, ECPs and systems integrators who support end-users, whether in upstream production, midstream transport or downstream refining and processing. After all, their stake in raising end-user profitability with more automated technology has never been more critical to their own livelihoods and is just as urgent.

When prices fall, so do margins—if operating costs stay fixed. The effect on any business is similar to what an outgoing tide can do to an unattended boat: previously unseen rocks and shoals appear that will strand it, no matter how small or large it is.

Of course, for business, those rocks and shoals are the various, often not-so-obvious inefficiencies that high margins helped hide, even ones that might seem to have small percentage impacts. High margins can also induce complacencies that overlook existing inefficiencies, because they seem not worth the time, effort and cost to remedy. This was apparent with oil at $100-plus per barrel.

But that was then. Today, with oil prices now much lower, oil and gas industry operators have no time to lose. They must reduce their operating costs. Although cyclical personnel layoffs and supplier pricing concessions are ways to do that, they’re blunt-force approaches that can actually add near-term costs producers substantially, especially in terms of lost knowledge, skills and capabilities. Another way is to consider how advanced automation can improve operational performance, especially in these three important ways:

Efficiency: Oil and gas operations need more than incremental productivity improvements; they need quantum gains like what the latest automation technologies can deliver. Consider, for example, the savings from deploying a variable frequency drive (VFD) in a fluid flow control application versus the pairing of a fixed-speed motor with a regulatory control valve. By using the VFD to control the flow rate directly, as much as 50 percent less energy is needed.

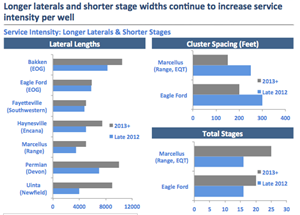

What’s more, service intensity is increasing, especially in U.S. shale oil fields, as indicated in Figure 1. It’s being driven by greater numbers of multiwell pads and increased use of horizontal drilling and stimulation technologies like stacked laterals and zipper fracking. This comprehensively introduces new complexities that must be managed efficiently because manual methods simply can’t scale, not to mention they’re labor-intensive and error-prone.

Visibility: Historically the industry has been slow to deploy advanced automation, especially smaller onshore operators with fields that may be easier to reach, even if remote, than those of their offshore counterparts. Many tend to prefer time-tested methods and technologies, often manual and no matter how outdated. If automation is used, it often comprises localized, standalone mechanical and relay-based solutions.

In contrast, modern automation technologies use intelligent sensors and can be networked, often wirelessly. Many feature onboard web servers, so they can deliver real-time operating data not only to someone sitting in a driller’s chair on-site but also to supervisory personnel thousands of miles away on their tablet computers or even smartphones.

Producers can use these capabilities to derive insights for making better, more informed decisions at all management levels—field office, corner suite or boardroom—about how to improve asset utilization, while gaining more operational visibility and information-sharing across a much wider reach of their oil and gas enterprises.

Reliability: Everyone in the oil and gas industry knows that downtime is costly, and it indeed does happen and must be addressed because costs can be extreme. While an idle onshore rig can cost upwards to $30,000 a day, not counting labor costs and lost output, an idle offshore rig can cost 10 times that or more. In one case, downtime at a floating production, storage and offloading (FPSO) unit cause a tanker to miss an offload, costing the producer $47 million.

Lack of reliability also can have consequences other than costs. Residing at the top of the list is safety to lives and habitat. Any losses in these areas can quickly make lost production a secondary concern and bring with them much greater costs in remediation, reparations, reputation and penalties. Even without any human or environmental impacts, regulatory violations due to equipment breakdowns can prompt penalties and even shutdowns for non-compliance.

But regulators and the fates don’t care that oil and gas facilities are inherently hazardous. Nor do they care that production facilities are usually located in remote, hard-to-reach places, onshore and offshore—and subject to some of the worst weather and environmental conditions possible.

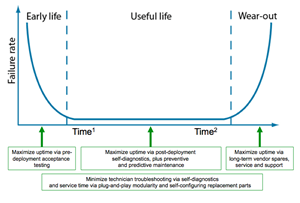

That’s why it’s critically important to deploy ruggedly engineered systems and components with safety built-in, not built-on. They must also have self-diagnostics and performance alerts to support predictive maintenance. This way, facility engineers can schedule upkeep and repairs proactively, instead of reactively. That’s because the latter can extend downtime while technicians are en route to address a problem.

If service is needed, knowing in advance what’s wrong can reduce or eliminate a technician’s troubleshooting time. Plug-and-play modularity and self-configuring components further reduce the time needed on-site and minimize the skills required for making the repair.

Figure 2 illustrates the classic “bathtub” curve of component and system failures over time due to early-life burn-in, random lifecycle failures and physical, end-of-life deterioration. Beneath the illustration are ways to mitigate failures in these phases to maximize uptime.

Four ways to accelerate greater automation in oil and gas operations

Based on decades of experience that Siemens has in automating literally millions of production processes worldwide—including hundreds of oil and gas projects, onshore and offshore, all over the world—here are four automation design principles that can help oil and gas companies accelerate putting more automation to work in their operations or those of their industry customers:

- Eliminate: Map processes in detail, then get rid of all unnecessary steps. Advanced automation technologies can render many process steps superfluous. If a step doesn’t add value, cut it out. And keep in mind what famed management expert Peter F. Drucker said, “There is nothing quite so useless as doing with great efficiency something that should not be done at all.”

- Simplify: After eliminating as many steps as possible, combine those remaining wherever feasible. Also think about simplifying the context of a process. That is, identify and eliminate (or minimize) external physical, data or schedule I/O dependencies. Reduce or eliminate custom engineering, which always adds cost, time and maintenance issues. Use proven, off-the-shelf hardware components, like those from Siemens, which then takes on the hardware lifecycle risks and costs. This enables much more focus on developing or enhancing value-adding software functionality.

- Standardize: Design and implement using open standards and uniform interfaces that span just about every facet of industrial automation and enable the use of lower-cost commodity hardware components. Standardized solutions can interoperate with legacy systems as well as those from other vendors. They also make installations and reconfigurations much easier and much more scalable. Maintenance, repairs and keeping spares all become more economical, too.

- Virtualize: Move as many hardware-based functions like relays, switches and terminals to software, which can then be reprogrammed as needs change. Software code can be stored in libraries and re-used across many different deployments. Wireless and cloud technologies can offer further cost savings because expensive infrastructure like cabling and data centers can be eliminated or greatly reduced, the latter by leasing shared cloud-based facilities instead of building and operating your own.

Efficient automation starts with efficient engineering

In considering their automation strategies for oil and gas operations, end-users as well as OEMs and other industry solution providers might heed the following observation, also based on decades of experience across just about every industry in the world: Efficient automation starts with efficient engineering.

With a comprehensive engineering framework like the Siemens Totally Integrated Automation (TIA) Portal, oil and gas solution developers can reduce their design and engineering costs by as much as 30 percent, while reducing their development time frames from months to weeks or even days.

Drag-and-drop, what’s not to like? For example, by using drag-and-drop code from vast software libraries of proven automation programming functions, engineering teams don’t have to develop custom code, which is time-consuming with all the steps of writing, compiling, testing and debugging required—and often the code is not reusable for other projects.

By using an integrated software development platform, developers can program all of a solutions components—the HMI, PLCs, drives, networking and other programmable devices—using a single environment. This eliminates having to program each set of components separately. That’s a big reason why the the TIA Portal is saving users as much as 30 percent on their design and engineering costs, sometimes even more.

The TIA Portal also lets geographically dispersed engineering teams access shared development databases 24x7 over corporate networks to collaborate much more. They can even pursue round-the-clock, “follow-the-sun” global development schedules to cut cycle times dramatically, to a fraction of what they once were. This also can provide with the flexibility to try out and easily test new approaches with little if any marginal costs.

The time to start is now

With capital budgets being cut back, the need for rapid paybacks on investments in automation technologies have never been more critical. The Siemens TIA Portal, as just described, illustrates how oil and gas solution developers, engineers and managers can cut engineering time and costs by as much as 30 percent or more.

To save even more time and money on their automation solutions, they should evaluate components from the broad Siemens TIA portfolio—a matched set of motors, drives, motor control centers, industrial controls, process analytics and instrumentation, plus automation controllers, I/O, HMIs, networking and configuration solutions.

Not only do these components have decades and billions invested in their development, but as mentioned previously they are also proven in millions of process applications worldwide, including aerospace, automotive, pharmaceuticals, semiconductor and, yes, oil and gas.

All Siemens TIA components share a common yet open architecture featuring uniform hardware and software interfaces, global standards for interoperability with legacy systems, and consistent data management. These also enable plug-and-play modularity and self-configuration for rapid installation, commissioning and serviceability; self-diagnostics for performance monitoring and predictive maintenance to improve reliability.

As oil and gas industry veterans know, the current downturn may be painful, but prices will rebound. In the meantime, highly leveraged or undercapitalized companies may close or consolidate with larger, better-capitalized firms. But when the rebound occurs, the capital investments made today by companies willing to carefully consider and deploy automation solutions will still be generating substantial returns through greater operational efficiency, visibility and reliability. For those companies, their competitiveness and profitability will never be greater.