How the Gulf of Mexico can further the energy transition

As governments, industries, and consumers around the world consider how to achieve a low-carbon future, restricting supplies of fossil fuels may seem like an answer. But society needs affordable energy sources until the net-zero goal is met. In most pathways toward net-zero emissions, global demand for crude oil will require continued investments to ensure energy access and security for citizens across the world. That’s where large deepwater basins, particularly the Gulf of Mexico, come in.

Making the energy transition means focusing on the energy supply—and success hinges on where that energy comes from. Optimizing the supply mix to include responsibly sourced oil is important to meet the global oil demand while minimizing emissions during the energy transition. In this article, we discuss the emissions intensity for major oil and gas supplies around the world, the advantages of deepwater basins, and the ways in which the Gulf of Mexico can help satisfy energy demand while lowering emissions.

The gaps that oil producers will have to fill

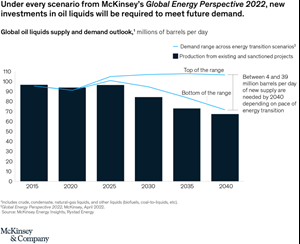

To understand the outlook for global oil liquids demand and sources of supply, McKinsey Energy Insights’ Global Energy Perspective 20221 models global energy trends under several energy transition scenarios.

Taking into consideration the future pace of government policy and regulatory changes, as well as the level of adoption of key technologies such as electric vehicles and renewable energy, our analysis leads to a range of possible outcomes for the oil markets, with a peak in demand occurring between 2024 and 2035. The common element across these scenarios is that additional sources of supply will be needed to meet demand and offset the natural decline of current online production.

These supplies are expected to come from the lowest-cost projects, which involve a variety of asset types—including shale, shallow water, deepwater, and heavy oil—and from different regions around the world, such as offshore Brazil, offshore West Africa, the Gulf of Mexico, and Middle Eastern countries. The future contribution of each is largely uncertain due to output decisions by OPEC, the asset performance of new investments, and many other factors.

The Gulf of Mexico’s emissions advantage

According to our Global Energy Perspective’s Current Trajectory scenario, deepwater basins are expected to provide seven million barrels per day (MMBPD) out of 24 MMBPD of new supply sources needed by 2040. The Gulf of Mexico could supply one to two MMBPD of this, with important implications for the US economy and global emissions.

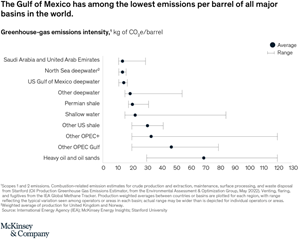

One of the world’s most prolific oil-producing regions, the Gulf of Mexico produces 1.7 MMBPD—15 percent of US crude oil production.2 Moreover, this basin is a significant source of government revenue and employment, garnering more than $22 billion through royalties and lease-sale proceeds over the past five years3 and supporting more than 175,000 jobs.4 It also stands out as one of the lowest emitting oil sources on a per-barrel basis.

The lower-carbon potential of the Gulf of Mexico is determined by the Scope 1 and 2 emissions that are associated with the direct and indirect greenhouse gases (GHG) released from development and production operations. In the oil and gas value chain, these steps are where the source of supply matters most. Conversely, associated emissions from midstream and downstream steps—refining and product transportation, for example—are largely independent of the oil source. The Gulf releases less than half of the emissions per barrel compared with other major basins. That potential matters to the many oil and gas companies that are investing in the Gulf of Mexico, especially to those that have announced net-zero emissions targets. And it matters for the world climate.

The Gulf of Mexico has a low-carbon advantage for four reasons. First, in contrast to other regions where flaring natural gas without a market is more commonplace, most of the natural gas produced in the Gulf of Mexico is sold to local markets, which results in minimal routine flaring and, consequently, less GHG emissions. Second, the facilities have efficient, modern designs that minimize methane leakage. Third, wells and production facilities have a high throughput, minimizing the number of energy-intensive processes required to bring on new supply, such as drilling. And fourth, operators have made active decarbonization efforts to stay in line with environmental sustainability goals and in compliance with regulations.

The recently passed Inflation Reduction Act also doubles down on the Gulf of Mexico’s role in the energy transition, coupling the development of offshore wind energy through lease sales (with a target of 30 GW of offshore wind capacity by 20305) with oil and gas lease sales, in addition to expanding government incentives for carbon capture and sequestration (CCS) activities. The bill also requires three additional lease sales through 2023.

However, there is still no clarity on lease activity beyond 2023 or on policies regarding seismic data collection, which is needed for oil exploration and continued resource access. The longer-term outlook for continued development is therefore uncertain, as is the relative contribution of the Gulf of Mexico’s low carbon oil to global supplies.

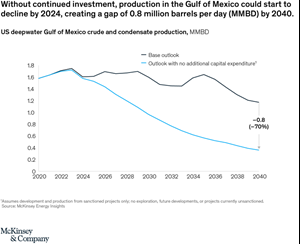

Low investment could hinder net-zero goals

In the extreme case, an absence of continued resource access and development in the Gulf of Mexico would result in less of the lower-carbon production needed during the energy transition. According to McKinsey’s Global Energy Perspective model, in the absence of development beyond currently sanctioned projects, production in this region could be 0.8 MMBPD lower by 2040—or 4.0 billion barrels of cumulative production loss for the period.

This supply reduction would have to be offset by alternative sources to meet global demand, which could hinder net-zero goals significantly. Because many other oil producing regions globally have total unit costs similar to those in the Gulf of Mexico, global oil price increases or substitution with other energy sources wouldn’t be expected, and global demand for oil would remain unchanged. Instead, the reduced Gulf supply would be offset by production increases from other sources, such as other deepwater basins, shale, and OPEC. Based on the higher emissions per barrel of this new supply, global emissions would increase by 50 million to 100 million metric tons of CO2e through 2040.

A shift in production from the Gulf of Mexico to other basins could also have broader implications for the US economy, including the loss of more than 100,000 jobs and a $30 billion to $40 billion reduction in federal government revenue from reduced royalties and lease-sale proceeds.6

Although the Gulf of Mexico is the world’s most mature deepwater basin, it still has a great deal of development potential to meet the growing need for supply, with only one-third of total estimated recoverable volumes (including undiscovered volumes) produced to date.7 This reserves base, coupled with existing infrastructure and project pipeline, can ensure continued supply during the transition to net-zero emissions. The low-carbon oil of the Gulf of Mexico can help fill the supply gap during the energy transition, while helping to balance the goals of policy makers and oil companies as they meet the world’s energy needs and prepare for a new energy future.

References

2 Rystad UCube, May 2022 data; US Energy Information Administration.

3 “Natural resources revenue data,” US Department of the Interior, accessed August 31, 2022.

4 Direct employment only; “Economic Contribution,” US Bureau of Ocean Energy Management (BOEM), accessed September 7, 2022.

5 “Biden-Harris administration advances offshore wind energy leasing on Atlantic and Pacific Coasts,” US Department of the Interior, updated

April 28, 2022.

6 Based on current revenue and employment figures scaled by production for base outlook versus reduced development scenario.

7 Based on analysis of basin-level resource estimates from Rystad Energy’s UCube and Wood Mackenzie, May 2022.