Energy industry largely approves of UK Government’s Energy Security Strategy

(World Oil) — Energy companies and organizations are reacting positively to the UK Government’s Energy Security Strategy, which was published considering rising global energy prices, provoked by surging demand after the pandemic and Russia’s invasion of Ukraine.

The strategy will be central to weaning Britain off expensive fossil fuels, which are subject to volatile gas prices set by international markets and boosting Britain’s diverse sources of homegrown energy for greater energy security in the long-term, the government said of the report published Tuesday.

Prime Minister Boris Johnson said in the strategy that Britain will take advantage of its wind, sunshine, nuclear reactors, and ability to produce hydrogen, while working with industry to minimize needless and repetitive red tape.

“Energy companies tell me they can get an offshore wind turbine upright and generating in less than 24 hours but that it can take as much as 10 years to secure the licenses and permissions required to do so,” Johnson said in the foreword.

The strategy sends a clear message to investors that the UK is re-open for business, Neptune Energy CEO Pete Jones said.

“By recognizing the inter-related importance of North Sea production, renewables, nuclear and energy efficiency, the strategy will help bring forward the investment needed to maximize the UK’s gas and oil reserves, reduce emissions and increase the sector’s contribution to achieving net zero,” Jones said.

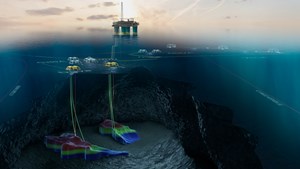

Neptune’s role in this includes increasing production from the Duva field in Norway to supply enough gas to heat 350,000 UK homes, he said. That number could be greater if the government altered gas entry specifications to enable more gas to flow from Neptune’s Cygnus field in the UK.

“Early next year, we will bring online new energy supply from our Seagull field in the UK. And, together with our partners, we will invest £100 million ($1.3 million) in an appraisal well at the Isabella discovery in the UK’s Central North Sea,” Jones said.

Offshore Energies UK CEO Deidre Michie said the energy strategy will be a defining moment for how the industry achieves the goal of having secure, reliable and clean supplies of energy, emphasizing that the country should make the most of its own resources and workforce, instead of outsourcing.

Many companies involved in UK oil and gas are already expanding into offshore wind, creating infrastructure for mass hydrogen production, and building carbon capture and storage systems.

“Those companies and their workforces are the bedrock on which the UK should build its new low carbon energy infrastructure,” Michie said. “I want to remind politicians of all parties and countries that energy security is now national security and ask them to recognize the vital role that our oil and gas operators and supply chain play in providing energy now – and to support them as they evolve to build our low-carbon future.”

Professor John Underhill, director of the University of Aberdeen’s Centre of Energy Transition, said the strategy shows a deep appreciation of where and from whom the country gets energy from, the role oil and gas plays in the UK energy mix, and how to move toward a low carbon energy future.

“The strategy recognizes the inherent complexity of our energy supplies and shows an appreciation of what contributes to our current energy system, as well as identifying the low carbon technologies needed in the future,” Underhill said. “It presents a holistic approach governed by the need for secure, affordable, ethical, environmentally sustainable, and low carbon energy supplies.”

The UK relies on oil and gas to fulfill 75% of its total energy needs, including 40% for electricity, so it is important to move away from fossil fuels in a way that does not risk fuel poverty, a major impact on industry, or “at worst, lead to the lights going off,” he said.

While the strategy commits to a new North Sea licensing round in the fall, any oil and gas production that follows from an exploration licensing round would be years away, so it is not a short-term solution for the UK’s gas supplies, Underhill said.

“Whilst the strategy paints a long-term picture, in the short term there may be a need to develop existing gas discoveries in the North Sea and West Shetlands and re-purposing depleted gas fields in the Southern North Sea as new sites for gas storage.”