Permian basin natural gas prices up as a new pipeline nears completion

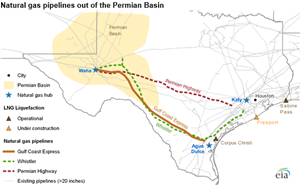

WASHINGTON – The EIA reports that natural gas spot prices at the Waha hub in western Texas, located near Permian basin production, settled at $1.55/million British thermal units (MMBtu) on August 15, the highest price since March 2019. This price increase coincides with the 2 Bcfd Gulf Coast Express Pipeline (GCX) preparing to enter service. GCX will provide much-needed additional natural gas takeaway pipeline capacity from the Permian region of western Texas and southeastern New Mexico.

Limited natural gas pipeline takeaway capacity from the region has kept prices very low, or even negative, in recent months. During the first eight months of 2019 (through August 19), the Waha spot price averaged just $0.65/MMBtu. The Waha spot price has been consistently lower than the Henry Hub spot price—the national benchmark price for natural gas. However, in recent days, that differential has significantly decreased, and Waha spot prices posted $0.65/MMBtu lower than the Henry Hub spot price last Thursday, which was the lowest daily differential since January. In comparison, this differential averaged between $2/MMBtu and $3/MMBtu between March and June of this year.

This recent uptick in the Waha natural gas price coincides with flows on the GCX. Deliveries into the pipeline began on August 8. S&P Global Platts reported that deliveries at El Paso Natural Gas Pipeline’s interconnection with GCX reached nearly 0.26 Bcfd on August 14. Industry reports suggest that this level means that GCX is packing its lines in anticipation of entering service late next month, ahead of its announced in-service date of October 1. Once fully operational, the pipeline will be capable of sending about 2.0 Bcfd of natural gas eastward to the Agua Dulce receipt point near the Texas Gulf Coast.

The Permian Basin in western Texas and southeastern New Mexico has seen large increases in natural gas production in recent years. Natural gas produced in the Permian Basin is largely associated natural gas, which is produced as a byproduct of crude oil production. Crude oil takeaway capacity in the region expanded in early 2019; however, GCX is the first addition to takeaway capacity for natural gas since this date. Producers in the region may vent or flare limited volumes of natural gas, and the Texas Railroad Commission regulates these activities.

After GCX enters service, several additional new natural gas pipelines are currently planned from the Permian to the Gulf Coast, which may further reduce the Waha-Henry Hub price differential. These projects include

- The Permian Highway Pipeline (2.1 Bcfd)

- The Whistler Pipeline (2.0 Bcfd)

- The Permian 2 Katy Pipeline (1.7 Bcfd to 2.3 Bcfd)

- The Pecos Trail Pipeline (1.9 Bcfd)

- The Permian Global Access Pipeline (2.0 Bcfd)

- The Bluebonnet Market Express Pipeline (2.0 Bcfd)

- The Permian Pass Pipeline (2.0 Bcfd)

Of these additional projects, currently only the Permian Highway Pipeline and the Whistler Pipeline have reached a final investment decision (FID) and are currently scheduled to enter service in 2020 and 2021, respectively. These projects plan to serve growing natural gas demand along the Gulf Coast, in particular at liquefied natural gas export facilities.