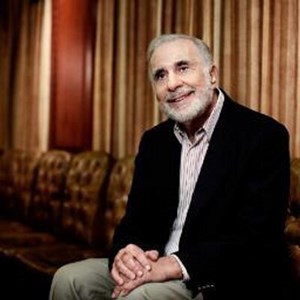

Octogenarian Billionaire Carl Icahn is said to build a small position in Oxy

NEW YORK (Bloomberg) -- Activist investor Carl Icahn has built a small position in Occidental Petroleum Corp. as the oil producer tussles to win a bidding war for Anadarko Petroleum Corp., according to people familiar with the matter.

Icahn hasn’t yet decided whether to push for any changes at the company, said the people, who asked not to be identified as the details aren’t public. The billionaire investor would like to see Occidental’s $37 billion offer for Anadarko go to a shareholder vote if it’s accepted, they said.

Occidental is locked in a bidding war with Chevron Corp. to win control of Anadarko and become the leading producer in the fast-growing Permian Basin of West Texas and New Mexico. The Woodlands, Texas-based Anadarko agreed to resume talks with Occidental over its $76-a-share bid two weeks after announcing a $65-a-share deal with Chevron.

Icahn’s stake could set up a battle between two octogenarian billionaires, after Warren Buffett invested $10 billion in Occidental this week to help the company’s bid succeed. His investment, which came after Occidental CEO Vicki Hollub flew to visit him in Omaha, Nebraska last week, is contingent on the deal going through.

Icahn vs. Buffett

It wouldn’t be the first time the legendary investors have clashed. In 2014, Icahn wrote a piece for Barron’s criticizing Buffett for a lack of action at Coca-Cola Co., a longtime holding of his Berkshire Hathaway Inc. Icahn objected to Buffett abstaining from a vote on a compensation plan at the beverage giant, writing that if a man of Buffett’s stature didn’t take a stand, “how can we expect other board members in this country to voice their opinions, especially if they are opposed to the CEO’s interest?”

A representative for Icahn declined to comment. An Occidental spokesman didn’t immediately respond to a request for comment.

Buffett Gave Shareholders Something to Ask Him About: A Big Deal

Some Occidental investors have expressed disdain for Hollub’s deal with Buffett, which includes an 8% dividend each year for preferred stock -- versus about 5.3% for common shareholders. Berkshire Hathaway will also receive the option to buy 80 million more Occidental shares, about 10% of the company, at $62.50 a share, potentially further diluting existing shareholders.

With Buffett’s backing, a shareholder vote on the transaction may be less certain, giving executives a way around investors’ concerns that the arrangement would put the company’s balance sheet at risk.

This weekend, thousands are expected to head to Omaha for Berkshire Hathaway’s annual meeting Saturday, where Buffett and Vice Chairman Charles Munger will hold court for several hours on topics that can be as diverse as succession and dealmaking plans to the U.S. economy and global trade.

Energy accounted for 22% of Icahn’s holdings, totaling $20.4 billion as of Dec. 31, according to data compiled by Bloomberg. That included a stake in CVR Energy Inc. worth $2.46 billion and $1.38 billion in Cheniere Energy Inc.