Brazilian pre-salt continues to deliver high productivity performance, says GlobalData

LONDON -- Presently, ultra-deepwater Brazilian pre-salt prevails by delivering high productivity performance assurance to the industry expectations and to the government advantage, according to GlobalData, a leading data and analytics company.

The top ten planned and announced pre-salt areas in Brazil will spend over $220 billion throughout their lifetime in capital and operating expenditure. These projects are Buzios I to Buzios V, Carcara, Libra Central, Sepia, Lula Oeste and Mero (Libra Noroeste), which together will contribute incremental capacity of 1.8 MMbpd to global oil supply by 2025.

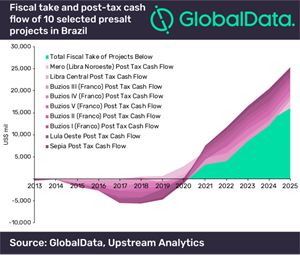

Current producing and planned pre-salt projects are quite profitable and, in spite of the high upfront investment, their cash flows are extremely robust. According to GlobalData, these top 10 projects will allow Brazil to double its total fiscal take by 2025 adding $16.01 billion and still have a total net post tax cash flow of $10.8 billion.

Adrian Lara, Oil & Gas Analyst at GlobalData says, “In the success story of pre-salt, Petrobras deserves recognition in its engineering achievements. The company remains a renowned offshore operator and has added incredible value to the industry by finding many of the biggest discoveries in recent years and by testing and starting the development of the pre-salt play.”

According to GlobalData Upstream Analytics, on top of the 1.4 MMbbl of oil from existing pre-salt producing fields, already accounting for 53% of Brazil’s oil production, an additional volume estimated at a minimum of 1.56 MMbpd of oil is expected by 2025 from other already awarded pre-salt blocks.

In order to maintain Brazilian pre-salt success not only engineering virtuosity will be needed, such as the improvement in seismic reprocessing and reinterpretation through the salt layer, but it is also key to maintain a favorable investment and regulatory environment. In November 2016 the Brazilian congress approved a modification, which removed Petrobras pre-salt operatorship compulsory requirement and instead would allow Petrobras to have the right of first refusal over operatorship of newly offered pre-salt blocks.

Lara adds, “Along the same lines, ANP very recently approved changes in local content rules related to waiving the local suppliers and local workers requirements. These changes signal more favorable conditions for investors which can be considered necessary to sustain and accelerate the pace of pre-salt production to soundly establish the position of Brazil as an oil exporting country in the next decade.”