Over $57 billion to be spent on Oceania’s upstream projects by 2025, GlobalData says

LONDON -- An average capex of $7.1 billion per year is forecast to be spent on 31 upcoming oil and gas fields in Oceania between 2018 and 2025, according to GlobalData, a leading data and analytics company.

Capital expenditure (capex) into Oceania’s conventional gas and coal bed methane (CBM) projects would add up to $48.6 billion and $4.6 billion respectively over the eight-year period. Conventional oil projects will require $3 billion, while the investments into heavy oil projects would total $0.8 billion in upstream capex by 2025.

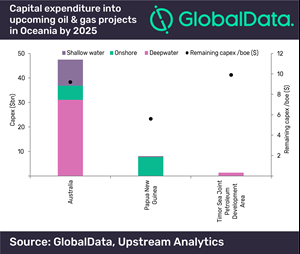

GlobalData expects the 31 upcoming oil and gas projects in Oceania will require $140 billion in capex to produce over 1,160 MMbbl of crude and 64,759 Bcf of gas over their lifetime. Upcoming shallow water projects in Oceania will have the highest total capex at $63.7 billion, while deepwater and onshore projects carry a total capex of $56.6 billion and $19.6 billion, respectively.

Australia accounts for over 83% of the $57 billion of capital expenditure in Oceania for the period of 2018 to 2025. The country has 23 announced and planned fields. Among these, top fields in terms of capex for the period are Browse LNG with $15.2 billion, Scarborough with $7.1 billion and Prelude with $3.8 billion.

Papua New Guinea has 14% share in Oceania’s planned and announced capex over 2018 and 2025. The country has six planned and announced fields. Elk-Antelope, P'nyang and Elevala are the top fields with capex for the eight-year period of $3.9 billion, $2.2 billion and $0.7 billion, respectively. All three are conventional gas projects located in onshore.

Timor Sea Joint Petroleum Development Area is expected to contribute about 2% to the total capex spending in Oceania between 2018 and 2025. Greater Sunrise is the only conventional gas deepwater field, with a capex of $1.4 billion for the eight-year period.