U.S. shale: Frac count grows, production leveling out

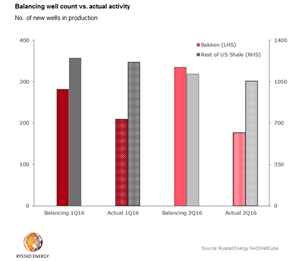

HOUSTON -- Rystad Energy expects horizontal oil completion activity in U.S. shale plays to outpace drilling operations by 30% in second-half 2016, resulting in the contraction of the DUC inventory by 800 wells.

These additional completions will support total U.S. oil output by providing an additional 300,000–350,000 bpd to the exit-2016 rate. The additional output will be more than sufficient to balance the base production decline. The inventory of 4,000 DUC oil wells is estimated to hold close to 2 Bbbl of reserves.

“Research shows that operators are now starting to complete wells that have previously been put on hold deliberately. This comes as more than 90% of the accumulated oil DUC inventory can be commercially completed at a WTI of $50/bbl,” Artem Abramov, senior analyst and product manager at Rystad Energy, said.

The recent extreme production decline—among the key crude producing states, North Dakota suffered from an all-time high historical decline rate of 70,000 bpd in April 2016—fell far outside a natural 10,000–20,000 bpd range, which one would expect as a result of current completion activity and mature base production. The significant decline acceleration appears to have come from older “low decline” wells brought on-line before 2016.

“It is not the first time such temporary shifts in base decline are observed, and they were caused by road restrictions imposed by the state over the month. This trend is unlikely to persist and should not be extrapolated to the U.S. shale industry in general,” Abramov said.