At the start of the Biden administration, it was apparent that energy derived from hydrocarbons was on the way out, to be quickly replaced by renewables and clean energy alternatives. The government and environmental groups were convinced that an energy transition could be accomplished with unproven/under-scaled technology, catastrophic climate-change rhetoric, and pressuring authorities to restrict and/or ban leasing and drilling activities. The tactics worked and created an unprecedented reduction of investment in hydrocarbon-based energy, in favor of developing unreliable clean energy.

Renewables leave Texas shivering. Texas experienced a major failure of its power grid in February 2021, which led to multiple weather-related deaths. The failure was caused primarily by placing green politics over energy reliability/security. Texas Railroad Commissioner Wayne Christian outlined the recklessness of putting climate change politics above energy reliability. “One night of bad decisions would not have had such devastating consequences, had it not been for decades of poor policy decisions prioritizing unreliable renewable energy sources at the expense of reliable electricity,” Christian stated.

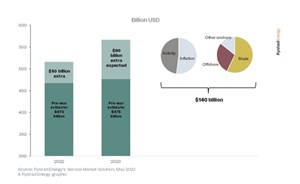

Oil and gas spending skyrockets on security concerns. However, power-hungry politicians that put their political agenda over energy security have triggered a surge in oil and gas investments. But the uptick may be temporary, and service companies should capitalize now before the focus returns to the energy transition according to Rystad Energy. After Russia invaded Ukraine, expected investments in fossil fuels in 2022 and 2023 surged by $140 billion. Before the war, the two-year total was projected at $945 billion, but as the war sparked shortages and sky-high prices, expected spending surged to $1.1 trillion, Fig. 1.

Shale focus. Of the $140 billion growth, shale production attracted most investment, with an additional $80 billion increase as activity climbed 30%, and pricing for oilfield services jumped nearly 50%. Offshore production accounted for $40 billion in growth, while other onshore activities expanded by an additional $20 billion. “Service companies should make the most of this upturn now, while keeping one eye on the future. The energy transition is not slowing. Large investments in renewables and clean technology are imminent. To ensure their long-term success, OFS companies should adapt their offerings to capitalize fully on the inevitable green push,” says Rystad analyst Audun Martinsen.

Last year’s sudden need for more rigs and completions, combined with increased greenfield sanctioning, was so strong that the oilfield supply chain could not meet the record demand for services and equipment that emerged in shale, offshore and conventional markets. As a result, service prices rose, and 50% of the additional spending resulted in a five-percentage-point increase in suppliers’ profit margins, rather than more activity.

Energy security concerns have unlocked significant additional investments in oil and gas, boosting spending forecasts and sending the expected timing for peak oil demand out in time. The first wave of extra spending over the past 15 months mainly went to oil and gas, while low-carbon industries faced a slowdown, due to high inflation and shortages in the supply chain. But low-carbon spending is expected to recover. The U.S. Inflation Reduction Act and Critical Raw Mineral and Technology Act in the EU will strengthen the investment cycle brewing in the renewable and clean-technology sectors.

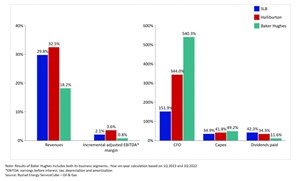

Major OFS companies benefit. SLB, Baker Hughes and Halliburton are on course for strong financial performances in the coming quarters, after the trio of major oilfield services giants all experienced excellent results for the first quarter of 2023, says Rystad V.P. Binny Bagga. All three companies posted improved topline numbers, margins and cash flow in the first quarter, compared to the same period a year earlier. Following a similar strategy to E&P operators, the trio have focused on returns to shareholders and increasing dividends, with two launching a share repurchase plan for the year.

With energy security being a priority for most countries, and supply chains’ remaining capacity constrained on many fronts, analysts believe market fundamentals necessary for OFS companies to boost their financial performance will remain strong for the rest of the year. This aligns with previous analysis highlighting the revenue growth potential and margin improvement trend expected for the OFS sector as a whole in 2023.

Surging revenues. The three OFS majors all posted robust results for this year’s first quarter and saw steady growth year-on-year (y-o-y), Fig. 2. The companies’ results revealed new highs in first-quarter revenues, with upstream revenues for both SBL and Halliburton close to levels not seen in the first quarter in the four previous years, while for Baker Hughes said they were at their highest in eight years during the first quarter.

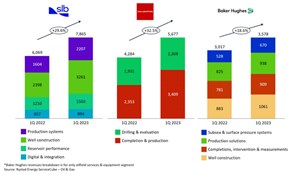

SLB saw first-quarter revenues increase 30% y-o-y, fueled by growth in the well construction and production systems segments, which both saw 30% growth, Fig. 3. This was fueled by price increases in North America and Latin America, with both regions witnessing 45% growth in the well construction segment. The onset of increased drilling demand was also evident in Halliburton’s revenues, with the company posting over 30% y-o-y growth in the first quarter, supported mainly by the completion and production unit, which was 45% higher, as demand for pressure pumping services increased, sales for completion tools improved, and Kuwait and North American onshore saw improved need for artificial services.

The higher demand for drilling-related services globally saw Halliburton’s drilling and evaluation segment post 17% y-o-y growth. Baker Hughes also posted good results, with revenues surging 18% y-o-y in 2023 but remaining flat from last year’s fourth quarter. The growth in revenue from last year’s first quarter was based on higher volumes across the oilfield services and equipment and industrial and energy technology business segments.

Improved margins. Along with the increase in revenues, all three companies also benefitted from an improvement in both their adjusted earnings before interest, tax, depreciation and amortization (EBITDA) margins and net income margins. This was driven by capacity constraints in many service segments within the service industry, along with some general easing of inflation and an increase in service prices.

Cash flow. All the three companies reported significant improvements in cash flow from operations (CFO) relative to the same period last year, with Halliburton’s CFO growing 500%. Additionally, the companies have made incremental capital expenditures in their businesses. With a full-year capital budget of between around $2.5 billion and $2.6 billion, SLB spent $410 million in the first quarter of this year alone. The company also launched a share buyback program, with repurchases totaling $200 million-worth of shares. Added to that, the company paid $249 million in dividends to shareholders. Overall, SLB targets a total return of $2 billion to shareholders in dividends and share buybacks.

What Paris Agreement?. China permitted more coal power plants in 2022 than at any time in the last seven years, according to a report by the Centre for Research on Energy and Clean Air. That’s the equivalent of two new coal power plants/week. The Global Energy Monitor reported that China quadrupled the amount of new coal power approvals in 2022, compared to 2021. The coal power capacity starting construction in China is six times as large as that in all of the rest of the world, combined.

https://energyandcleanair.org/publication/china-permits-two-new-coal-power-plants-per-week-in-2022/

Common sense approach. It’s perfectly clear that China, India and Pakistan have no intention or interest in curbing their carbon emissions. Because of this fact, net-zero goals are clearly too aggressive and are jeopardizing global energy security. Thankfully, industry leaders are increasing investment in oil and gas reserves while we develop and build cleaner-energy alternatives and technologies.

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)