Nova Scotia’s re-starting of exploration is a solid move, says exploration expert

Given the greater success of neighboring Newfoundland and Labrador, it has been easy for some in the upstream industry to dismiss the more modest oil and gas achievements offshore Nova Scotia. This has been compounded by less-than-encouraging exploratory success in recent years. And yet, it seems that the province’s offshore sector, given a little more concerted effort, could be on the verge of a breakthrough.

This opinion is held by Searcher Seismic, which is brokering as well as rectifying, reprocessing and/or interpreting over 13,000 km² of key 3D datasets and nearly 14,000 km of 2D and the Canada Nova Scotia Offshore Petroleum Board, which is in the middle of conducting a new licensing round. Accordingly, World Oil Editor-in-Chief Kurt Abraham visited with Searcher Seismic Vice President for Global New Ventures Karyna Rodriguez, to get her assessment of the situation.

World Oil (WO): How would you summarize the history of Nova Scotia’s oil and gas exploration and development efforts up to now?

Karyna Rodriguez (KR): Offshore Nova Scotia holds many Canadian offshore firsts, including first offshore well, first offshore discovery, first offshore field and first offshore production project. These can be attributed to favorable geology, proximity to markets and infrastructure, as well as the mildest offshore Canadian environment. Over 2.2 Tcf of natural gas and approximately 44.5 MMbbl of oil have been produced, only scratching the surface of the full potential.

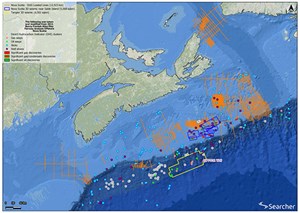

History, together with a Play Fairway Analysis, confirm that offshore Nova Scotia is a proven oil-and-gas-rich region with a hydrocarbon potential resource estimate of 120 Tcf of gas and 8 Bbbl of oil. That analysis did not cover all of offshore Nova Scotia, nor did it have access to more recent seismic acquisition and Searcher’s recent work, Fig. 1.

While conducting presentations, I have learned that the vast majority of the energy industry remains unaware of the successful history of Nova Scotia’s offshore oil and gas exploration and development and are even less aware of the undeveloped discoveries and the tremendous potential of the offshore. This is one of the reasons why offshore Nova Scotia remains vastly underexplored. An additional key reason has been the lack of multi-client seismic data, which has now been corrected with the arrival of Searcher in Nova Scotia and Searcher’s ongoing work.

I am confident that people looking at Nova Scotia’s offshore E&P at this point in history will agree that this play is just getting started.

WO: Do any particular factors stand out, as to why Nova Scotia has had lackluster results in recent years? Is it poor geology in spots, or is it poor drilling selection, or is it regulatory failings, or maybe it’s a combination of all of these?

KR: I would not term production of over 2.2 Tcf of natural gas and 44.5 MMbbl of oil lackluster. Instead, I would term the results as the beginning of an exciting future. The work, thus far, has shown that offshore Nova Scotia is a proven oil-and-gas-rich region with an estimated potential for more than 120 Tcf of gas and 8 Bbbl of oil. Similarly, the work has resulted in the acquisition of extraordinary seismic, well, and other data. Later in this interview, I will outline the key learnings from the Aspy well.

If there was any failing in the past, it would be lack of access to multi-client seismic data. Multi-client seismic data has been, and continues to be, the key proponent that fosters exploration, discoveries and ultimately production. This potential failing has now been addressed with the arrival of Searcher Seismic in offshore Nova Scotia. Searcher’s offshore Nova Scotia database, for the first time, offers energy companies access to key data on a multi-client basis. Searcher has already done a substantial amount of rectification and interpretation work on the data, with new reprocessing and interpretation work upcoming.

WO: So, the Canada-Nova Scotia Offshore Petroleum Board (CNSOPB) issued a Call for Bids, NS22-1, on Sep. 29, 2022, which will remain open for bids until Sept. 19, 2023. That seems like a fairly long period—is there a reason for so much time?

KR: Although Searcher Seismic is not privy to the decision-making of the joint federal-provincial entity responsible for the Call for Bids (the Canada-Nova Scotia Offshore Petroleum Board), there are many great reasons for a Call for Bids being open for nearly 12 months. For example, after the early 2022 return of exploration acreage held by BP, Hess and Equinor, and the perceived results of the Aspy well, many believed that E&P had no future. I expect that the authorities understood this perception and knew that it would take energy companies some time to learn about the fantastic potential of offshore Nova Scotia that includes undeveloped discoveries, great DHI’s, oil slicks, as well as great indications of reservoir.

Regarding the Aspy well, similarly, I believe the authorities knew that it would take a while to change the industry’s perception about that well. Albeit, not well known, the Aspy well had oil shows and proves a working oil system. I expect the authorities also knew that it will take a while for Searcher to rectify and interpret data, and for Searcher’s clients to specify their reprocessing needs and then for the reprocessing to occur.

There are also many practical items that take time; for example, approvals to license seismic and other data, as well as budgets and approvals to bid. Meanwhile, boards often require partnerships, particularly when bidding for exploration acreage or when entering a new margin. Arranging a joint venture and entering a partnership takes time. Finally, I believe the authorities considered both the energy transition and the recent geopolitical changes, and how offshore Nova Scotia can help the world with CO2 sequestration and storage, as well as energy security.

WO: Why do you think the CNSOPB finally decided to issue this new call for bids?

KR: I would assume there are many reasons, including all the positive recent developments in offshore Newfoundland and Labrador. Less than a year ago, some were predicting that the future of oil and gas exploration and production in that province was over. Instead, offshore Newfoundland has become a beehive of activity and multiple offshore oil projects, led by ExxonMobil, Equinor, Suncor and Cenovus, which have expanded or recommenced operations and/or drilling. Meanwhile, the Newfoundland and Labrador round that closed in early November 2022 received bids from ExxonMobil, QatarEnergy, BP and Equinor.

Perhaps interest from energy companies is the key reason this Call for Bids was launched. Geopolitically, the world has changed tremendously over the past year. Places that were open for E&P at this time last year are today sanctioned or pose too high a risk to enter. Energy companies are looking for places that have undeveloped discoveries; that have great DHI’s, oil slicks and indications of reservoirs; that have infrastructure; that have competitive terms; that can offset emissions of future CO2 production via sequestration—offshore Nova Scotia provides all the listed and much more.

The Call for Bids process requires independent nomination of parcels available in a Call for Bids, Fig. 2. This means that the parcels available in this Call for Bids would have been nominated. Upon nomination, the parcels available would have been reviewed and approved by the Canada-Nova Scotia Offshore Petroleum Board (CNSOPB). Then the CNSOPB decision would have been ratified by both the federal Canadian and provincial Nova Scotian governments, resulting in the issuance of this Call for Bids.

WO: There are eight parcels up for bidding in this round. Which of them do you believe holds the most promise for fresh oil and gas discoveries?

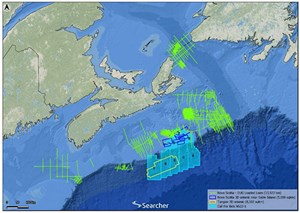

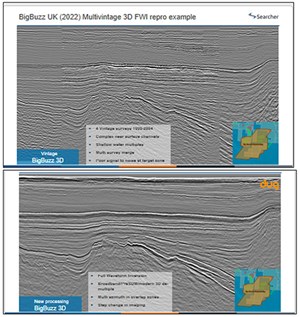

KR: The parcels in the round cover a significant area that includes different play types at different stages of the exploration cycle. The shelf not only has a series of undeveloped discoveries, which are estimated to hold at least 1.9 Tcf of gas, but also several untested play types that have been successfully exploited in other similar settings. The available 5,008 km2, merged and filtered full stack 3D datasets available from Searcher over the shelf, were acquired between 1996 and 2001. Most importantly, these data have not been reprocessed since acquisition. Using modern processing algorithms, imaging can be improved significantly by reprocessing, and this is expected to not only provide a better understanding of the discoveries, but also to reveal a series of deeper targets and undrilled amplitude anomalies, Fig. 3.

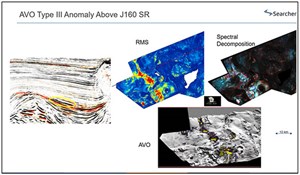

The parcels offered in the deeper water are largely covered by the state-of-the-art Tangier 3D dataset. Thorough source rock and reservoir de-risking indicate the presence of an extensive, good-quality, thick and mature Jurassic source rock actively generating hydrocarbons. A detailed interpretation study carried out in collaboration with Lyme Bay indicates the presence of Cretaceous to Tertiary age reservoirs that also have structure-related amplitude and AVO Type III anomalies (Fig. 4) in the vicinity of a source rock modelled to be in the hydrocarbon window. With the recent giant discoveries made in deep water, such as in the Guyana-Suriname and Orange basins, the deepwater parcels offshore Nova Scotia should generate a lot of interest from the industry, as there are indications of plays in similar conditions to the giant Venus discovery offshore Namibia, with a large basin floor fan directly overlying the mature source rock, with indications of AVO response and, in turn, overlain by a thick shale sequence that should provide an excellent seal.

To answer the question, depending on the exploration strategy from each company, there is acreage available in both the shelf and the deeper water with very promising potential indicated for future oil and gas discoveries.

WO: In terms of geoscience, what do you consider to be the main remaining risks offshore Nova Scotia?

KR: The shelf is a proven producing hydrocarbon province, where the main risk is identifying and evaluating undrilled reservoirs. This can be mitigated with reprocessed seismic 3D data. In the deeper water source rock presence, quality and maturity remain a key risk, despite the positive indications from the Aspy well and several seabed coring campaigns, such as Site 41, located in the eastern portion of the Tangier 3D, which have proven the presence of methane hydrate and provide the best direct evidence for a mature oil-prone source rock on the deepwater Scotian slope. Reservoir presence also remains a key risk. Detailed evaluation of the Tangier 3D, including source rock characterization and BSR-derived geothermal gradients, has largely de-risked the presence, quality and maturity of the mid-Jurassic age source rock. Reservoir presence has also been mitigated by the interpretation and seismic attribute analysis of over 200 horizons interpreted in the Tangier dataset.

WO: Again, with regard to geoscience, how can these risks be addressed?

KR: The risks are best addressed by carrying out an integrated regional interpretation and using the available 2D and 3D datasets. The shelf will be largely de-risked with Searcher’s reprocessed 2D and 3D datasets, and the deeper water has been largely de-risked by Searcher’s recent integrated interpretation of the Tangier 3D, Fig. 5.

WO: Regarding Shelf potential (Call for Bids parcels 6, 7 and 8), do you see any significant additional potential on the shelf?

In my view, there is huge untapped potential on the shelf. I do not know of many places left in the planet, where there are significant undeveloped discoveries, in shallow water, near facilities, and with a local and global market ready to take the gas produced. Another unique opportunity is presented by the expected imaging uplift, when the 2D and 3D datasets are reprocessed, as this should highlight additional amplitude anomalies, as well as deeper objectives unrecognized to date, due to the poor quality of the legacy seismic data.

WO: As concerns Slope potential and the BP/Hess Aspy well (Call for Bids parcels 1, 2, 3, 4 and 5), why do you think the Aspy well failed? Are there any untested plays in the deep water?

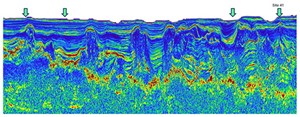

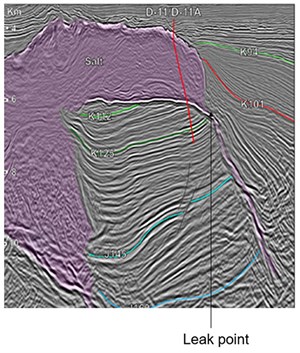

KR: According to the BP Executive Aspy Well Summary, made publicly available through CNSOPB, Aspy was identified as a potentially large economic prospect, chosen because of a large, long-lived 3-way structure with a simple charge model of hydrocarbons migrating into the trap since the Early Cretaceous. When viewed on seismic (Fig. 6), the main K125 target terminates against what is interpreted as a salt weld, introducing a risk of updip seal. Even when the well was classified as dry, there were oil shows (fluorescence) in the cuttings. This oil was analyzed and confirmed to come from a mature Jurassic source rock. This is an extremely valuable result confirming that there is an active oil system in the subsalt setting.

So why was it dry? Pressure data from the well indicate underpressured sands, which supports the lack of seal at the salt weld termination. Additionally, the main amplitude anomaly associated with K125 has an increase in acoustic impedance at the interface, a response not commonly associated with hydrocarbon accumulations. However, to the west of this anomaly—under the salt canopy—an interesting amplitude anomaly, missed by the well, with a decrease in acoustic impedance at the interface—a response commonly associated with hydrocarbon accumulations—has a fan geometry and spectral decomposition response indicative of reservoir.

At the same time, the thin sand encountered below the K125 horizon has been mapped regionally and shows an extremely promising reservoir fairway associated with it but not targeted by the well. This fairway not only has high amplitude but also a structure- related AVO anomaly.

Outside of the Aspy well location, huge potential has been identified. Source rock characterization has de-risked the presence, quality and maturity of an AVO Type IV Jurassic source rock. Overlying this source rock, a strong and extensive AVO type III anomaly associated with a channel and fan deposit has been identified. This is very similar to the Venus play offshore Namibia, where an AVO Type IV source rock is overlain by a Type III fan system, with an estimated potential resource of up to 13 Bboe. There are a lot of other plays that have been identified, which make the deep water a very attractive opportunity.

WO: Then there is the issue of Aboveground and CO2 emissions. How do oil and gas companies justify and approve exploration offshore Nova Scotia, considering that Canada enshrined legislation to achieve net-zero emissions by 2050?

KR: Great question. Offshore Nova Scotia is one of the very few margins globally that has the ability to be a net-negative margin. In other words, offshore Nova Scotia can sequester and store more CO2 emissions than would be emitted by the oil and gas produced in offshore Nova Scotia. These potential carbon sinks are immense; conservative estimates peg offshore Nova Scotia’s ability to sequester and store at over 100 years of Canada’s CO2 emissions.

As stated by the International Energy Agency (IEA), “Reaching net-zero will be virtually impossible without CCUS.” This means the only chance to reach net-zero will be offsetting production of oil and natural gas by CO2 storage. This is exactly what offshore Nova Scotia offers—massive oil and gas potential and immense carbon sinks. For the energy transition to be successful, the last molecules of oil and natural gas will need to come from offshore Nova Scotia and the very few other similar margins.

Equally important, offshore Nova Scotia’s ability to sequester and store over 100 years of Canada’s CO2 emissions provides Canada the unique ability to exceed its net-zero emission legislation requirements by sequestering and storing emissions from the U.S. Northeast. Many people do not realize that offshore Nova Scotia’s carbon sinks are less than 500 nautical miles from Boston and other cities in the U.S. Northeast. As is being done in Norway by Equinor, Shell and TotalEnergies in the Northern Lights joint venture, the CO2 could be transported by ship from the U.S. Northeast to offshore Nova Scotia. Meanwhile, the precedent for imported CO2 from the U.S. to Canada exists and has been ongoing for decades.

WO: Another aboveground issue is monetization. What are the existing and potential routes, as well as infrastructure, to monetize offshore Nova Scotia oil and natural gas production?

KR: The Maritimes & Northeast Pipeline, owned by Enbridge, Emera and ExxonMobil, was originally built in the late 1990s to transport natural gas from the prolific fields producing offshore Nova Scotia to markets in Atlantic Canada and the northeastern U.S. Over 2 Tcf of natural gas were monetized before the flow was reserved. Today, those markets that used to receive natural gas from offshore Nova Scotia are paying some of the highest natural gas prices in North America. As a direct result, substitution is occurring to higher carbon-intensive fuels.

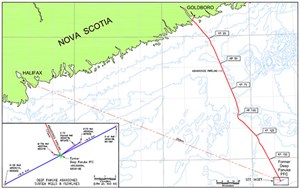

I am confident that new offshore Nova Scotia production will again be monetized via the Maritimes & Northeast Pipeline. Ovintiv’s 22-in. pipeline (Fig. 7), one of the two pipelines that used to transport natural gas from the offshore Sable Island area to the Maritimes & Northeast Pipeline in Goldboro, Nova Scotia, is available for sale. That pipeline commenced operations in 2009, and then it was decommissioned at less than half of its 25-year design life. That route can be used to produce the over-1.9 Tcf of undeveloped discoveries, as well as new discoveries. It’s important to emphasize that offshore Nova Scotia is highly underexplored. For comparison purposes, offshore Nova Scotia is two-thirds the size of the U.S. Gulf of Mexico and 1.6 times the size of the UK North Sea. Yet, for example, only 14 wells have been drilled in the deepwater slope, an area that encompasses more than 80,000 km².

Pieridae Energy is eager to build an LNG export terminal in Goldboro, Nova Scotia. After Searcher’s interpretative work, I am confident that more-than-sufficient discoveries of natural gas will be found in offshore Nova Scotia. They will exceed the requirements of the potential Goldboro LNG export terminal and other potential LNG export terminals in Atlantic Canada, as well as both the Canadian and U.S. requirements via the Maritimes & Northeast Pipeline.

Monetization of oil production is more straightforward, as pipeline infrastructure is not required, and the oil can be shipped by tanker anywhere globally. When compared to the Gulf of Mexico, transportation time is cut almost to half—eight days instead of 15 days. Besides lower costs and time-savings, this lowers the carbon footprint for transportation by nearly 50%.

WO: Is there anything else that you would like to comment on?

KR: Thanks for this opportunity to comment on other items. Nova Scotia’s land tenure system needs to be highlighted. It supports new exploration, which is key in today’s new geopolitical environment, where both energy transition and energy security are important. New exploration is necessary to achieve hydrocarbon and renewable energy projects, as well as hybrid and CCS projects. This is where Nova Scotia’s fiscal rights system shines.

For example, Nova Scotia’s system has an allowable expenditures credit worth 300% for all pre-licensed allowable expenditures, three years before the exploration license is issued. This means all energy companies pursuing projects in Nova Scotia that license Searcher’s seismic data, prior to bidding in this open Call for Bids, will be able to obtain a 300% credit upon parcel award.

To illustrate, a company licensing $5 million of Searcher seismic data will obtain a $15 million allowable expenditures credit. Then that same $5 million license of seismic data will also provide a $15 million work deposit for the successful bidder. By providing a 300% allowable expenditures credit and allowing successful bidders to offset their 25% work deposit via this credit, Nova Scotia facilitates seismic rectification, reprocessing and early access to invaluable geoscience data.

(Editor’s note: To learn more about the considerable E&P potential of offshore Nova Scotia and Searcher’s Nova Scotia seismic data, please visit Searcher’s Nova Scotia Explorer’s Guide: www.searcherseismic.com/nova-scotia/ or send an email to: sales@searcherseismic.com)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)