ESG issues: UK’s NSTA finds ESG disclosures remain on the upswing with some caveats

This inaugural report sets out the observations from NSTA analysis and the NSTA’s view of industry progress on ESG disclosure. The report builds on previous recommendations of the NSTA and its ESG Taskforce, published in March 2021 (“2021 Recommendations”), and further discussed in the NSTA’s open letter to all licensees in March 2022. It is our intent to update this report annually.

The report is designed to assist industry in navigating the ESG reporting landscape and to highlight the importance of high-quality, focused, non-financial reports. Cognizant of the broad UK ESG disclosure regime and the flexibility that is afforded to companies in their reporting, we recognize the improvements in disclosure that have been made across the sector. Nevertheless, we continue to encourage more consistency and clarity, through meaningful metrics and clear and credible commitments to net zero.

The NSTA will continue to encourage licensees to report in a manner that drives trust, and delivers action, authenticity and evidence. This will help safeguard the sector’s social license to operate, embedded in the supporting obligation on governance in the NSTA’s Strategy.

INTRODUCTION

With over 600 global ESG reporting frameworks, companies are faced with a significant challenge as to how they harmonize and clarify what is described by many commentators as a “confusing muddle” of conflicting frameworks, metrics and guidance. Overwhelmed with choices, a roadmap to harmonization and clarity is needed for the sector: both providers and users of ESG data face significant challenges with uniformity and standardization.

Investors, lenders and wider society cannot be experts in interpreting potentially hundreds of different definitions of what ESG means. Equally, companies need to be able to easily identify exactly what is expected of them to be able to efficiently allocate resources to the creation of a high-quality reporting process.

This report sets out the NSTA’s observations on the evolution of ESG reporting in the UK oil and gas sector and its views on the development of a more standardized approach to ESG reporting. The NSTA reviewed the public ESG reports of 31 licensees to assess and compare their ESG disclosure status against the NSTA’s ESG Taskforce recommendations and other commonly used ESG frameworks. We did this with the intent of making it easier for licensees to report, to maintain the sector’s attractiveness to investors and to help protect its social license to operate.

The NSTA follows a lifecycle approach to net zero regulation and, in its most recent Corporate Plan–2022-2027, set out priorities for the next five years, including promoting the importance of, and compliance with, ESG reporting standards.

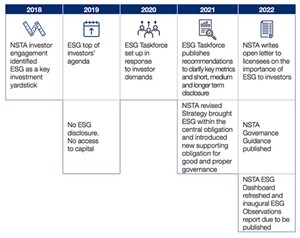

The NSTA remains committed to supporting the sector in its efforts to provide meaningful ESG disclosure and will continue to work with a variety of stakeholders to improve ESG standards. Since 2018, as outlined in Fig. 1, we have been integrating our expertise as an authoritative voice on ESG, to reflect the needs of an investor community and a wider society that are both increasingly focused on ESG-related matters.

Our ESG Taskforce was set up in August 2020 to bridge the expectation gap between disclosers and users of ESG information by delivering recommendations to enhance and standardize disclosure. During 2021, it issued recommendations designed to assist in the delivery of manageable, repeatable, and achievable environmental disclosure metrics, being the ‘E’ of ESG.

In relation to the ‘G’ of ESG, we published new NSTA Governance Guidance in early 2022, outlining when we may review licensee governance arrangements and the factors that we may consider. The guidance also sets expectations for boards in relation to environmental governance and corporate social responsibility.

KEY FINDINGS

The report includes the following key findings:

- Reporting is on a positive trajectory with considerable alignment overall to the 2021 Recommendations;

- Continued focus on the ‘E’ of ESG, which remains easier to quantify, with less focus on the ‘S’ and the ‘G’;

- Data are scattered and often difficult to find across several reports issued by each company, which could be addressed by using a standard set of templates held within a centralized “Data Centre.”

Environmental disclosure. Overall, we are encouraged that the majority of companies continue to make good progress in their disclosures and are on a positive trajectory. The vast majority included in the NSTA’s analysis are disclosing in line with most aspects of the 2021 Recommendations.

New regulatory disclosure requirements have improved environmental disclosures on climate-related risks and carbon reduction targets for all companies, but particularly for those licensees with producing assets. Mandated regulatory compliance with ever more regulations and requirements ensures that many larger companies must consider their environmental impact. Regimes include Streamline Energy and Carbon Reporting (“SECR”) and the Task Force on Climate-related Financial Disclosures (“TCFD”) framework, which is reported against by listed companies on the Main Market, and AIM companies with more than 500 employees.

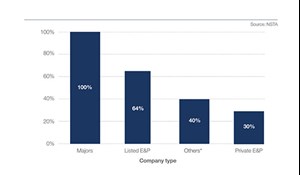

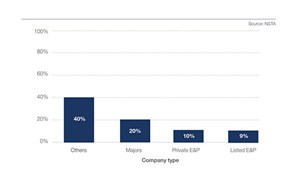

Figure 2 shows the types of companies that are opting to report against the TCFD framework. Apart from those required to report via TCFD, a variety of other frameworks are applied in reports, with the most frequent alternatives coming from the Global Reporting Initiative (“GRI”), the Sustainable Accounting Standards Board (“SASB”), the International Petroleum Industry Environmental Conservation Association (“IPIECA”), and the UN Sustainable Development Goals (“UN SDGs”). Materiality assessments are a practical way to understand stakeholder expectations and to focus reports on what matters. Further consideration should be given as to how these are presented to key stakeholders to ensure these remain useful for investors.

In completing our analysis, certain companies have emerged as “best in class.” These entities are typically using a standardized and central “ESG Data Centre,” which pulls all ESG data into one easy-to-find location, lends itself to common templates and which the NSTA believes helps to provide additional consistency and clarity. A common data set, which is focused on material and relevant information, will provide more balance between the size of the company and its ESG disclosure requirements: there is no need to provide a large report, if it is not value-adding. Keep it consistent, relevant and accurate.

By pulling together key disclosures from recognized reporting standards and frameworks into an annual data sheet, a wealth of information can be made easily available. An ESG Data Centre should provide information on performance against materiality issues, using GRI, TCFD, or Carbon Disclosure Project (“CDP”), and a summary of progress to net zero. It can be included as part of the sustainability or annual report.

The following are suggestions for what a ‘good’ Data Centre and ESG Datasheet might look like:

- One-stop shop for investor and other stakeholders on ESG data

- Description of ESG strategy, materiality assessment, goals and KPIs

- Considerations relating to socioeconomic reporting: increasing disclosure on taxes paid, number of jobs supported directly and indirectly by the organization, etc.

- Transparent annual set of ESG metrics with accompanying methodology or independent verification report.

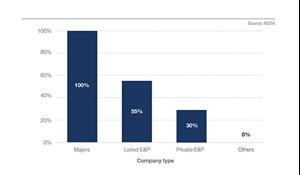

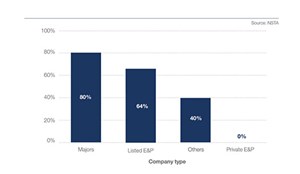

Figure 3 shows the percentage of companies reviewed that are using a Data Centre approach.

Social disclosure. We have analyzed social disclosures by referring to metrics relating to people management, workforce standards, community relations, and gender and ethnic diversity. These metrics are found in recognizable frameworks, such as the UN SDGs, SASB framework and GRI.

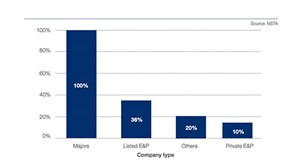

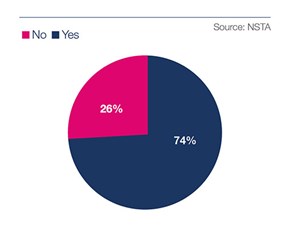

While there is some way to go in the development of uniform and standardized social metrics, the majority of companies are disclosing well. However, reporting of ethnic diversity is lagging, as can be seen in Fig. 4. It is apparent that diversity is still viewed primarily through the lens of gender.

In the NSTA’s 2021 Inclusion Report, we committed to engage operators and tier one contractors to hear some of the best practice examples of diversity and inclusion from around our sector. The lessons learned were included in the 2022 Inclusion Report.

Expectations across all sectors are being raised with regards to social responsibility. This relates to internal staff, contractors and employees of suppliers. Strong performance is pivotal to driving the North Sea Transition Deal, attracting skills and talent, investment, and maintaining industry’s social license to operate.

As responsible licensees, the sector should continue in its commitment to create great places to live, work and do business. The NSTA encourages transparent and tangible steps to minimize negative impacts, such as the cost-of- living crisis and to maximize positive impacts against the three Ps, “Profit, People and the Planet.” Data collected and disclosed as part of the ESG process can be leveraged to improve corporate culture and employee engagement; companies can use the information in their workforce plans, helping them to attract and retain diverse talent and support diversity, equity and inclusion.

Governance disclosure. NSTA Governance Guidance was published in January 2022, and all licensees should familiarize themselves with the requirements. The NSTA is undertaking governance reviews where appropriate. The NSTA Governance Guidance requires the adoption of a recognized Corporate Governance Code, such as the UK Code, Wates Principles or the QCA Code.

However, the analysis of governance disclosure, as shown in Fig. 5, has found that a number of companies do not disclose the recognized corporate governance code they are following. The analysis also has identified gaps in the disclosure of whether a regular cycle of external board evaluation has been undertaken (Fig. 6), which the UK Corporate Governance regime highlights as important for continuous improvement. The NSTA encourages all companies to review their disclosure in both these areas.

Some licensees are using auditors or independent consultants to externally verify ESG Data or sustainability reports. This provides a more robust set of data, which provides a greater degree of comfort and credibility for investors, lenders and wider stakeholders. Misinformation and potential claims of greenwashing can cause significant reputational damage. Using an external assurance & verification process could support the reliability of data and enhance its credibility. In the best reports, demonstrable knowledge, understanding and training across all levels of the company is key, so that all employees understand the importance of, and reason for, an ESG report.

Figure 7 shows that a significant proportion of licensees are now disclosing that they are aligning ESG performance to remuneration. Senior leadership and the board must have a clear understanding and awareness of ESG requirements facing their companies. An increase in the use of ESG metrics in board or senior leadership remuneration plans can help develop strategies and highlight the importance of ESG reports.

REVISED RECOMMENDATIONS

The NSTA believes that clear disclosure of ESG metrics, external verification, common data tools and templates, accompanied by appropriate and responsible training and development from board down, will assist the sector’s continued access to finance, long-term corporate success and social license to operate.

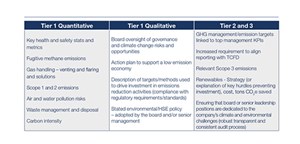

The NSTA’s 2021 ESG recommendations reflected optimal UKCS ESG disclosure and reporting at that time. A reminder of these recommendations is in Fig. 9.

The revised 2022 recommendations, shown in Fig. 8, reflect the pace of change in ESG since March 2021 and capture the key emerging best practice. We have removed the tiered approach, which, at the time, was designed to reflect short-, medium-, and long-term expectations. All ESG requirements are now deemed equally important.

The recommendations are not intended to create any new regulatory or additional mandatory burden and are not a substitute for any regulation or law, nor do they represent advice. However, the NSTA continues to expect voluntary buy-in and, in particular, expects the UKCS licensees to:

- Be a leader when it comes to improved ESG disclosure in the UK;

- Be diligent in reducing data gaps and ensuring better transparency;

- Lead from the top when it comes to improving ESG disclosure and driving effective data collection to deliver robust reporting.

The recommendations remain designed to assist industry in developing its ESG reporting package. They will be kept under regular review and may be amended, as appropriate, in light of further developing best practice and any change to the NSTA’s powers and responsibilities.

The 2022 recommendations reflect the ESG disclosures that licensees should be making in their reports.

CONCLUSION

The oil and gas sector has made good progress to improve transparency in ESG disclosure and reporting and must sustain efforts and improvements going forward. The NSTA, its strategy and associated guidance are in place to assist these efforts amid an ever-evolving landscape and corporate squeeze with security of supply and net zero challenges.

ESG remains, and will continue to remain, at the heart of investment decisions, and access to finance will, in part, depend on being able to communicate that strong E, S and G practices are embedded at the heart of an organization and integral to the long-term success of the industry’s social license to operate.

It is the NSTA’s intent to monitor developments in ESG disclosure practice over the next 12 months. We will be active in our commitment to enhanced collaboration and engagement with investors and the sector.

Where the NSTA makes any assessment of the ESG disclosure of a Licensee, this is done specifically and exclusively for the NSTA’s own purposes. This Report, and the NSTA’s observations, is not intended to replace any other ESG disclosure requirements with which each Licensee may have to comply. Third parties should not rely on any statement (or absence of any statement), decision, action or inaction of the NSTA, or rely on the NSTA in any other way, to satisfy themselves as to adequacy of a Licensee’s ESG disclosure. They will need to carry out their own due diligence on the ESG disclosure of Licensees.

Lead figure: The study on ESG disclosures is one of numerous reports put out by the NSTA.

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)