Industry at a glance

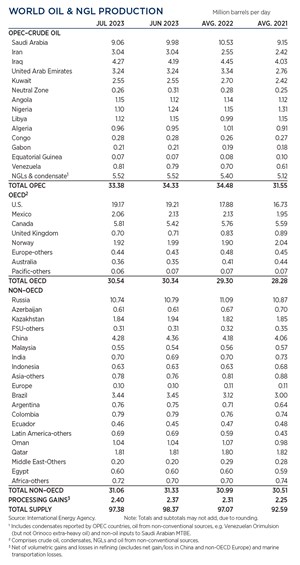

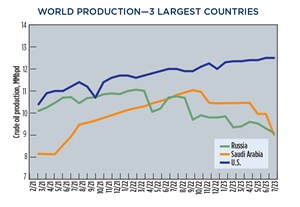

Benchmark crude prices surged in July, as global demand reached near record highs, boosted by strong summer air travel, increased oil use in power generation and higher Chinese petrochemical activity. The price increase was also fueled by a sharp reduction in Saudi production, which saw collective output from OPEC+ fall 1.2 MMbopd to 50.7 MMbopd in July. The one-two punch caused Brent to surge 7%, up to $80.11/bbl in July, $5.27/bbl higher than June’s average. In the U.S., the average price for WTI jumped to $76.07/bbl in July, up 8.3%, compared to June ($70.25/bbl). Prices are expected to rise further, as Brent futures rallied $11/bbl to $86/bbl in July, as the global economic outlook improved with signs of easing inflation and tightening physical inventories.

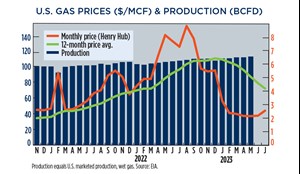

U.S. natural gas outlook. After a precipitous 10-month decline in U.S. natural gas prices, the market showed signs of recovery, with the commodity at Henry Hub trading at $2.55/MMBtu in July, up 17% compared to June ($2.18/MMbtu). However, the July price is 71% less than averaged in August 2022, when operators were receiving $8.81/MMbtu for product.

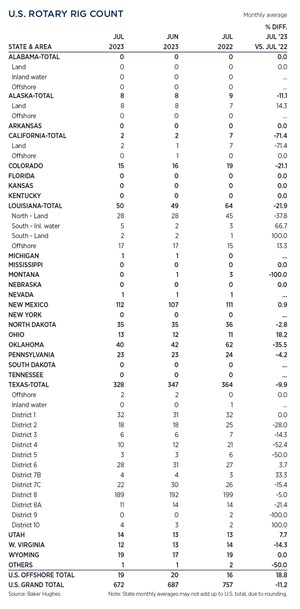

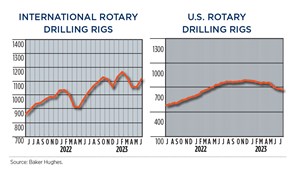

U.S. rig count. The sharp uptick in crude prices did little to lift U.S. drilling activity, with the rig count dropping 15 units in July, down to 672 rigs. The overall Texas count declined 19 rigs to 328, with an eight-rig loss reported in RRC District 7C (22). Three rig declines occurred in District 8 (189), District 6, (28) and District 8A (11). On a positive note, activity in New Mexico jumped five rigs higher, to 112.

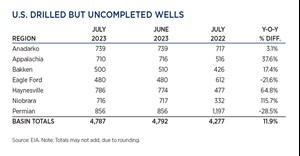

Drilled but uncompleted. Despite depressed U.S. natural gas prices, operators continue to drill in gas-dominated regions. In July 2023, there were 4,787 DUCs in the U.S., 510 more than the 4,277 tallied in July 2022 (+12%). In recent months, the build in the DUC inventory has slowed, but only two of the seven regions mapped by EIA show y-o-y declines. In the Niobrara region, DUCs are up to 716 (+116%), Haynesville has 786 (+65%), Appalachia has 710 (+38%), with 500 DUCs reported in the Bakken inventory (+17%). On a positive note, the Permian and Eagle Ford experienced y-o-y declines of -29% and -22% in their DUC inventories, respectively.

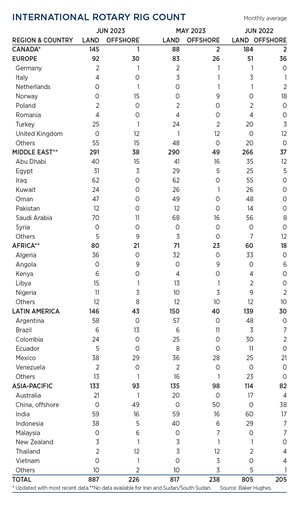

International rig count. Drilling activity outside the U.S. remained relatively steady, with the exception of Canada. In June, the international rig count averaged 1,113, 58 more than the 1,055 units working in May. The largest increase was reported in Canada, which enjoyed a 56-rig increase, as muddy lease roads continued to dry out after the spring thaw. The increase in Canada was augmented by a 13-rig surge in European activity, to average 122 in June.

- Dallas Fed: Outlook improves, even as activity little changed; break-even prices increase (April 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)