Regional Report: Middle East - Amid oil pleas, gas taking center stage

With a contentious cohort largely sidelined, the Saudi Arabia-led OPEC+ alliance is reinforcing a hard truth: the coalition is firmly in control of the global oil market.

With crude from Ukrainian aggressor Russia “verboten” in most Western markets, OPEC and allied producers raised hackles on Oct. 5 by cutting production beginning in November by 2 million bbld, but likely less when adjusted for unmet quotas. This comes two months after the International Energy Agency (IEA) confirmed that the alliance holds only 3.74 MMbopd of effective spare capacity. Nearly 60% of the emergency buffer is controlled by Saudi Arabia, with 1.39 MMbopd, and the United Arab Emirates (UAE), with 840,000 bopd. These countries, along with Iraq, Iran and Kuwait, represent the Middle East in the 13-member OPEC alliance. Russia is among 10 allied producers, which also include Bahrain and Oman.

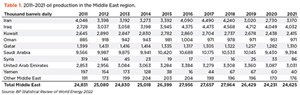

Middle East oil production, excluding Egypt, averaged 24.625 MMbpd in 2021, up a mere 2% over pandemic-riddled 2020 (Table 1), according to the BP 2022 Statistical Review of World Energy (World Oil carries a figure of 24.765 MMbpd, up 1.5%). Total gas production, however, hit a 10-year high of 714.9 Bcm (Table 2), with 2022 seeing a regionwide increase in production and exports, partly in response to Russia's retaliatory cutback to Europe. "We are focusing on new LNG import capacity in Europe," Shell CEO Ben Van Beurden said on July 28, three weeks after acquiring a stake in the world's largest liquefied natural gas (LNG) expansion project under development in Qatar.

Meanwhile, a pre-cut county-by-country look at recent development points to the heterogeneity across the Middle East from emerging unconventional to deepwater plays.

SAUDI ARABIA

Fresh off a record second-quarter profit of $48.4 billion, Saudi Aramco is charged with increasing maximum oil production capacity to 13 MMbpd within four years, even as the kingdom envisions a more diversified economy. Production hovered around 12 MMbopd, until an estimated 520,000 bbl/d was taken off the market with the controversial reduction. .

For now, Aramco's strategy to meet the 2027 mandate includes squeezing more oil from some of the world's oldest and largest fields, like mega-giant Ghawar. Aramco recently installed the Ghawar-1 supercomputer to identify more potential pay zones in the world's largest conventional oil field, which is still producing around 3.8 MMbopd.

Amid the drumbeat for oil, Saudi Arabia plans to increase gas production more than 50% by 2030. To that end, Aramco is advancing development of the Jafurah unconventional field, southwest of Ghawar—the largest unconventional gas play outside of the U.S. Aramco is in the initial construction and design phase of the associated Jafurah gas plant, which, when fully operational by 2027, will have a processing capacity of 3.1 Bcfd. Jafurah is expected to commence production by 2025 and reach a sustainable rate of 2 Bcfd by 2030.

Meanwhile, as the first of 50 newbuild land rigs started work in the second quarter, under a joint venture with Houston's Nabors Industries, a significant offshore drilling program also appears afoot, Fig. 1. "Aramco has been very public about bringing significantly more jackups into the Kingdom," says Piers Middleton, V.P. of sales and marketing for Tidewater, Inc, which operates the world's largest offshore support vessel (OSV) fleet. "And, in turn, came out for a large 20-plus OSV tender in the second quarter to support this uptick in activity."

IRAQ

OPEC's second largest producer intends to increase production from around 4.5 MMbopd to 8.0 MMbopd within four years, says the Iraqi Oil Ministry. Of that, Basra Oil Co (BOC) projects export capacity to increase from 3.3 MMbopd to 3.45 MMbopd.

Activity centers largely in the northern Kurdistan region, where Genel Energy plc, UK, operates the Sarta heavy oil field. Gross production averaged 5,380 bopd in the first half of 2022. Test results from the recently completed Sarta-6 well are expected in the third quarter.

Elsewhere, the DNO ASA-operated Tawke and Peshkabir oil fields together averaged gross production of 106,465 bopd in the first quarter, down from 107,742 bopd at year-end 2021. The Norwegian operator mobilized a fourth rig in the second quarter, after drilling five wells in the first quarter.

To the south, Iraq plans to increase peak production at the supergiant Rumaila oil field by 200,000 bopd to 1.7 MMbopd. Since 2021, the world's third-largest conventional oil field has been under the umbrella of Basra Energy Company Ltd, the newly rebranded joint venture of BP and PetroChina.

UAE

While seeking international help to exploit an estimated 22-Bbbl unconventional oil prospect, Abu Dhabi National Oil Co. (ADNOC) and partners are occupied with developing the world's largest offshore sour gas resources. The Ghasha concession is expected to deliver first gas by 2025 from artificial islands in the Persian Gulf, ramping up to more than 1.5 Bcfd by the end of the decade.

ADNOC and Occidental Petroleum Corp. also are completing an estimated $10-billion expansion of the Al Hosn processing plant, at the onshore Shah sour gas-condensate field. Al Hosn has maxed out at 1 Bcfd and the expansion, which includes more than 500 tie-ins, will increase capacity 50%. "The expansion is progressing as planned, with the capacity increase expected to be online toward the middle of next year," says Occidental President and CEO Vicki Hollub.

Occidental, with a 40% interest, netted record production of 237 MMcfd from Al Hosn in the second quarter. Oxy also holds the operating license to Block 3 in the western Al Dhafra region, where an estimated 100-MMbbl oil discovery was announced in May.

In July, Eni S.P.A. (operator) said a deeper reservoir in offshore Block 2 indicated up to 1.5 Tcf of gas in place. In February, a shallower Block 2 zone yielded between 2.5 Tcf and 3.5 Tcf of gas reserves.

Meanwhile, as ADNOC solicits partners with shale expertise to help develop the Al Dhafra unconventional oil prospect, it hopes to build on the successful development of the Ruwais Diyab unconventional gas play, where ADNOC and partner TotalEnergies, hope to ramp up shale gas production to 1 Bcfd by 2030.

QATAR

With the $30-billion North Field expansion, Qatar is determined to regain its rank as the world's leading LNG exporter, which it ceded to the U.S. this year. QatarEnergy's two-phase expansion will increase its LNG export capacity to 126 million tons/year by 2025.

The LNG complex will take feedstock from North Field offshore, the world's largest non-associated gas field. On July 5, Shell became the latest international company to invest in the project, joining ExxonMobil, TotalEnergies, Eni and ConocoPhillips.

According to Bloomberg, Qatar's LNG exports dropped to less than 35 million tons between January and May, down year-over-year from 36 million tons.

EGYPT

Though a comparatively small player on a global scale, Egypt has emerged as one of the fastest-growing LNG exporters among the Organization of Arab Petroleum Exporting Countries (OAPEC). Egypt averaged 561,000 bopd in 2021 while total gas production reached a 10-year high of 67.8 Bcm, says BP.

According to Egyptian Natural Gas Holding Co. (EGAS), exports from the Idku and Damietta facilities on the Mediterranean coast are expected to reach 7.5 million tons by the end of FY2022. After recording a 10-year high in 2021, gas and LNG exports averaged 3.5 million tons over the first half of the current fiscal year.

Two additional production wells are expected to go online this year at Eni-operated Zohr field in the Shorouk concession, the largest gas discovery in the Mediterranean Sea, with production of around 2.7 Bcfd.

Chevron also holds operating interests in the Western and Eastern Mediterranean. "We are turning our attention toward Egypt, where we have a very nice exploration position," says Jay Johnson, Chevron EVP, upstream. "We're shooting seismic. These are in areas that have been unexplored before, because they've been in restricted areas and now available to us."

Current drilling activity, however, is concentrated mostly in the Western Desert, where predominant leaseholder APA Corp. recorded the most significant quarterly increase in oil production in four years. "Gross oil production in Egypt increased by more than 7,000 barrels per day versus the prior quarter, which was our first material quarterly increase in Egypt oil production since 2018," said President and CEO John Christmann.

The former Apache Corp. holds 5.3 million gross acres in six separate concessions and produced 141,896 bopd of oil in the second quarter. APA averaged 12 rigs (Fig. 2) and drilled 12 gross and 12 net wells during the first quarter.

ISRAEL

Following a June commitment to send gas to Europe via Egypt, Israel defied since-resolved rebukes from Lebanon with the Energean plc-operated Karish gas field set to begin production in the third quarter from a once-disputed area in the eastern Mediterranean. The field is in the newly delineated Olympus area that Israel claimed falls outside Lebanon's maritime boundary.

At an estimated 1.75 Tcf of reserves, Karish is much smaller than Leviathan (35 Tcf) and Tamar (7.1 Tcf) fields, operated by Chevron, which has not disclosed current production volumes. An eighth Leviathan production well is slated to be connected to the subsea production system in early 2023.

OMAN

The Middle East's largest non-OPEC oil producer increased year-over-year production by 9.7% to 1.05 MMbopd during the first half of 2022, according to the National Centre for Statistics and Information (NCSI). The NCIS also said cumulative exports over the first six months rose to 162.4 MMbbl.

Gas production likewise is slated to increase significantly, as the sultanate looks to exceed the record 10.6 million tons exported last year. Exports are forecast to increase to more than 11 million tons/year, pending modifications on the LNG export terminal at the Port of Qalhat in Sur, says the state-run Oman News Agency.

Toward that end, BP-operated Khazzan and Ghazeer fields in central Oman, the largest tight gas fields in the Middle East, are projected to deliver record production of 1.5 Bcfd of gas and 65,000 bcpd this year.

Elsewhere, with operating licenses covering 6 million acres, Occidental netted second-quarter production of 62,000 boed (50,000 bopd), down from 68,000 boed (57,000 bopd) in the quarter prior. Occidental's licenses include Safah and Wadi Latham fields on Block 9, the Block 27 Khamilah field, and the Mukhaizna heavy oil field, Oman's largest conventional field.

IRAN

Though unlikely anytime soon, the reviving of an Iranian nuclear deal that would lift U.S. sanctions could immediately unleash some 93 MMbbl of oil in storage, according to Bloomberg. For now, state-owned Iranian Offshore Oil Co. (IOOC) says efforts are underway to restore production of Persian Gulf fields to pre-U.S. sanction levels, according to Tehran-based SHANA Petro Energy Information Network. That includes Hangman field in the Strait of Hormuz, where the IOOC says a new pipeline to shore-based process facilities will increase capacity above the 20,000-bopd limit. Iran shares the Hangman reservoir with Oman but developed the field on its own when earlier joint development talks collapsed.

The National Iranian Oil Co. (NIOC), meanwhile, reportedly plans to increase production of giant Azadegan onshore field by 380,000 bopd, from current production of 190,000 bopd. The development plan includes more than 420 new production and injection wells and associated pipelines, says NIOC.

CYPRUS

A Chevron-led consortium is moving closer to first production, in what has emerged as a promising Eastern Mediterranean gas province. Chevron plans to finalize a development concept by the end of 2022 for Aphrodite field, located in just under 5,600 ft of water on Block 12 of the Levant basin. The initial production phase is expected to comprise five production wells capable of producing up to 800 MMcfd, with another appraisal well scheduled for the first quarter of 2023.

In late August, Eni (operator) and TotalEnergies said their Covid-delayed Cronos-1 exploratory well, on Block 6 southwest of the island nation and European Union (EU) member, had yielded a significant gas discovery with more than 853 ft of net pay. That discovery comes on the heels of what ExxonMobil and Qatar Petroleum confirmed in March as a "huge gas reservoir" on the Glaucus-2 appraisal well on Block 10, Fig. 3.

BAHRAIN

State-owned Tatweer Petroleum also is looking for foreign shale expertise to develop the Khaleej al-Bahrain offshore unconventional prospect. Tatweer plans to start drilling before the end of 2022 on the west coast prospect, estimated to hold at least 80 Bbbl of tight oil.

KUWAIT

With its fields aging and shunning international upstream investment, Kuwait Petroleum Co. (KPC) may be hard-pressed to achieve an oil production target of 3.5 MMbopd by 2025 and 4 MMbopd by 2040, analysts say. Kuwait was producing around 2.65 MMbopd in June, according to the IEA, half of which comes from the 84-year-old Greater Burgan field. After a combination of gas injection and water flooding, Burgan is still producing roughly 1.6 MMbopd. Kuwait also nets roughly 350,000 bopd from Neutral Zone production shared with Saudi Arabia.

YEMEN

Hoping April's UN-brokered cease fire holds and ends the seven-year civil war, state-owned PetroMasila is working to restore oil production above the 40,000-bopd 2021 average. Further, the damaged LNG plant on the Gulf of Aden may resume operation by the end of 2022, depending on the stability of the cease-fire. At a capacity of 7 million metric tons/year, the terminal is fed with associated gas from the oily Marib basin, where the 2022 restoration plan of partners Octavia Energy Ltd., UK, and Australia's Petsec Energy Ltd call for initial production of 5,000 bopd, ramping up to around 10,000 bopd.