Energy transition: Oil and gas industry at a crossroads

The Covid pandemic has led to a doubling down of scrutiny of the overall environmental, social and governance (ESG) performance of companies and other organizations on a whole raft of topics. For many sectors, the primary focus is on tackling climate change. The oil and gas industry, in particular, is called on to lead the way in reducing global carbon levels and change business models, to provide alternative sources of power and fuel and to deliver a net-zero emissions environment.

Large integrated oil companies, with significant resources, have made much progress, while smaller firms are challenged to develop strategies to advance low-carbon goals. To accompany the emissions-related ESG pressures, and with forecasts indicating that the world has reached peak oil demand, the market disruption due to Covid only served to exacerbate market challenges.

With many consumers and policymakers wanting more sustainable energy choices, and a company’s overall ESG performance increasingly becoming the license to operate, the time to initiate change is now. The level of change will depend on an assessment of the company’s core business, resource availability and competencies, commercially viable opportunities to enter low-carbon businesses or projects, and investors supporting a strategic business model change.

Will smaller firms be willing and able to commit capital to practices and projects that may have low or no return on investment to adapt to the emerging energy transition and carve a niche out to remain in the oil and gas space? Or is this the beginning of the end of small and mid-sized oil and gas companies being able to sustain profitability and remain competitive?

Whether small or large, super-major or independent, the oil and gas industry will continue to see major changes. The firms that will survive this transition will be those that can identify and implement sustainable changes that can address the changing business environment, consistent with their own ambitions.

The industry at a crossroads. Producers are faced with the reality that the landscape shaping the industry is constantly changing. The world’s reaction to the Covid pandemic and the resulting transportation cessation caused immediate changes in petroleum fuel demand, resulting in a supply surplus driving oil futures into negative territory for the first time in history. Recognizing the need for energy and having learned a great deal about the impact of petroleum on the global economy, policymakers and the public are pushing for energy diversification, with a focus on green technology and renewable sources, with the goal of reducing and eliminating fossil fuel’s carbon footprint. We have reached an energy tipping point that is changing the industry and creating a set of challenges that require what is, for some, a major shift in thinking and behavior.

These changes affect petroleum producers and marketers and those companies that service them, at all strata of the industry. Oil and gas companies, themselves, are expected to participate in the move to greener energy, with pressure from investors, employees, policymakers and non-governmental organizations looking to ensure sustainable energy with limited climate impact.

With renewed membership in global agreements and new national policies aimed at reducing greenhouse gas emissions, most notably the U.S. rejoining the 2015 Paris Accord, increased emphasis has been placed on reducing global temperature and reaching a low-carbon future. As a result, further changes in the oil and gas industry will be needed in the short term, and sustainable change will be expected in the long term—and those changes need to start now, where they have not already.

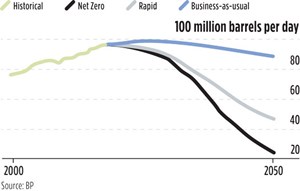

Energy transition and global peak oil demand. Traditionally, the oil and gas producer has focused on the value of an asset, based on the production rates and quality of the commodity making it into the marketplace. Providing petroleum products to the consumer is a costly endeavor requiring a keen eye on the entire value chain, to ensure corporate and investor returns. Many sources predict that globally, we have reached peak demand for crude oil. BP is one company that forecasts that peak oil demand has been achieved—a prediction not solely based on supply side availability but demand side desire for crude oil as an energy source. In each of three emissions level scenarios, it is clear that oil demand is reaching its peak. Consumers are increasingly demanding energy options that reduce emissions, stabilize price volatility, and advance toward a low-carbon future, Fig. 1.

Some parts of the oil industry have already embraced efforts to reduce emissions, increase production efficiency, convert to alternate energy sources for onsite equipment, and deploy new digital technologies to monitor and improve operations and maintenance activities. Though great strides have been made, there is much more to be done for the industry to progress toward expected decarbonization levels—leading to net zero—and maintain a sustainable business model.

The challenge for the oil and gas producer centers around reducing carbon emissions, meeting the challenges posed by the predicted reduction in crude oil demand, and maintaining economic sustainability. Decarbonization will necessitate a new level of effort that will require time, resources and capital to implement, which will have a significant impact on the small producer. Large integrated oil companies with a greater capital and resource base have dedicated billions of dollars in the effort to develop technologies and strategies to meet emission reductions, well in advance of reaching this tipping point in the industry. Smaller producers with fewer resources must look at other energy transition and decarbonization strategies.

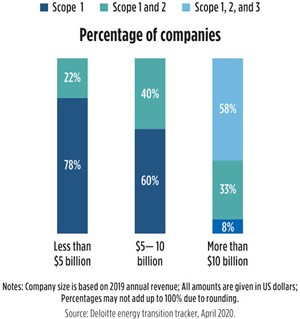

Decarbonization strategies. The transition to a low-carbon future will come in many shapes and sizes, with no “one size fits all” solution. There are three greenhouse gas (GHG) categories that oil and gas production companies of any size can track and work to reduce. These categories are noted as Scope 1, Scope 2 and Scope 3, Fig. 2.

Scope 1 emissions are defined as direct emissions from operations, Scope 2 is indirect emissions from sources used to power operations, and Scope 3 is indirect emissions generated by suppliers and customers, as well as those generated by using the company’s produced commodities. Reducing Scope 1 and 2 emissions tends to require shorter-term efforts, less complex project opportunities, and a lower overall cost structure.

Scope 3 emissions are more challenging and more costly, as the efforts focus on third-party supplier emissions, the use of the produced commodities, or on managing the by-products of their use. Although company size can be a good predictor of the decarbonization strategy employed, it will be up to each entity to determine their financial status, resource availability, and the benefit of achieving lower carbon output.

Most companies have already begun directly addressing Scope 1 emissions. Reduced natural gas flaring, replacing leaking valves, lowering volatile organic compound emissions, upgrading equipment, and increasing the efficiency of operations not only addresses emissions and carbon reduction goals but also makes good business sense. Producers must continue to explore ways to address Scope 1 emissions, as these are well within their operational control, the least expensive to implement, and likely the best way to make their contributions to the energy transition effort. Companies that have embraced and are implementing digital solutions to their operation and maintenance activities find additional Scope 1 savings, as well as operational efficiency benefits.

Scope 2 emission reductions require a commitment to purchase power and other energy from sources focused on a low-carbon outcome. Onshore producers are likely to find the availability of low carbon options in remote production areas to be limited or non-existent. Natural gas driven rotating equipment, heaters, and other equipment cannot operate in areas where grid electricity from renewable energy sources is not available. Some companies have accepted Scope 1 savings in lieu of Scope 2 reductions by utilizing wind power or solar energy to power smaller electrical equipment in the absence of large-scale alternative energy sources.

Scope 3 emission reductions will have the greatest impact on lowering carbon footprint, as these efforts address the issue at a supplier and consumer level where most of the emissions occur. It is estimated that 80% of all greenhouse gas emissions occur in the Scope 3 category. Larger oil and gas companies are already entrenched in efforts to provide alternative fuels and renewable sources of energy as part of their strategic business approach.

Offshore wind farms, utilizing years of offshore exploration and production experience and technology, increased use of biofuels, and hydrogen fuel technology research are a few of the ways Scope 3 emissions are being addressed. Companies are also developing and implementing net negative carbon technologies, such as carbon capture, sequestration and storage. Establishing new businesses based on capturing, utilizing and storing carbon from multiple other emitters is unlikely to be an option for all but the largest companies.

Pivoting to an energy transition viewpoint. Energy transition impacts permeate the oil and gas industry at all levels throughout the value chain. Increasingly executive leadership and boards of directors are embracing change, moving from business as usual to a focused plan toward a more sustainable business model. Now, more than ever, corporate leadership is being required to pivot to a new point of view.

In 2019, the Harvard Business Review published an article titled “Investor Revolution: Shareholders are Getting Serious About Sustainability,” which stated that at that time, “the impression among business leaders is that ESG just hasn’t gone mainstream in the investment community.” In 2021, this could not be further from the truth. Institutional investment firms have broadened the determination of investment risk to include that of sustainability and ESG accountability. Focusing on the issue of climate change, Larry Fink of Blackrock investments wrote in a landmark letter to CEOs and Boards of Directors, “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity.” Further, Mr. Fink wrote, “to prosper over time, every company must not only deliver financial performance but also show how it makes a positive contribution to society.”

Large international oil companies have sought to address climate change and other ESG issues over a number of years, as evidenced in company policies, strategies and investments. Among others, oil and gas giants BP, Chevron, Total and Shell have pivoted from predominantly fossil fuels to investing in renewable energy and adopting lower-, or in some cases, net zero-carbon corporate strategies, including for Scope 3 emissions. BP and Shell recognized the need to address climate change as far back as the late 1990s. BP established a series of renewables businesses to give life to their initial “Beyond Petroleum” ambitions.

Current CEO Bernie Looney continues this direction with additional investments in low-carbon businesses. Joe Blommaert, Exxon Mobil’s President of Low Carbon Solutions, states that “Exxon Mobil believes, and experts agree, that carbon capture and storage will have to play a critical role, if the United States and other countries are to meet emissions reduction goals” citing the Paris Agreement limits.

Many mid- to-small-sized E&P company executives and boards are also adopting a sustainable business viewpoint. Hess CEO John Hess clearly states that the company “recognizes climate change is one of the greatest scientific challenges of the 21st century that must be addressed while at the same time providing the safe, affordable and reliable energy that is fundamental to human prosperity and world economic growth.”

He went on to state Hess’ support of the Paris Agreement and the global ambition to achieve net zero emissions by 2050. Other smaller companies in this segment are focused primarily short-term and in sustainability reporting focus on achieving Scope 1 emissions reductions. They seem to have made strides toward sustainability without a clear embracing of the world of new energy options. Limited resources play a major role for these smaller firms to achieve these environmental wins while operating in a low-margin space. This is compounded by the absence of core skills and experience with different types of business model which, itself, can undermine investor

confidence.

ESG investment impact. Oil and gas companies of all sizes are increasingly aware that demonstrating robust policies, practices and performance on key ESG topics can play a direct role in securing equity and debt financing. ESG enters into corporate thinking, as public expectations focus on corporate sustainability, accountability, and effectively managed financial systems. A company must demonstrate that they value the environment, embrace and behave in a socially consciousness way, and hold company leadership accountable for affecting positive change.

Traditionally mainstream investors have been primarily interested in the return on capital invested. There has been major growth in the sums invested with specifically ESG funding. ESG performance is now increasingly factored into investment strategies from what have historically been viewed as mainstream investment entities. This is partly a function of pressure on investment firms from activists and partly a change in the assessment of the extent to which good ESG performance will create competitive advantage and avoidance of, and reduction in, value-destroying problems. Regarding climate change, companies across sectors are expected to set out how they are addressing climate risk in their strategies, operations investments and decision-making.

Sentiment toward the oil and gas sector has been trending negatively as a function of wider market perspectives, as well as concern around climate change. The pace of energy transition and the consequent potential for stranded assets on companies’ books may never be monetized. Clearly, how oil and gas companies demonstrate their climate risk management is the most significant ESG issue that investment firms, ESG ratings providers and other interested parties take into account. It can impact recommendations, inclusion in funds, indexes and voting decisions on resolutions.

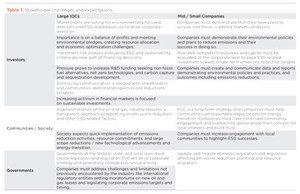

For the smallest companies, a recognition of the relevance of risks from the evolving business environment and plans, and clear progress in mitigating these risks is expected. Navigating investor expectations may require setting new priorities, upgrading company metrics to include enhanced environmental performance indicators, and greater engagement with investors. Investment decisions must change to include these components, which may have a negative impact on company returns in the short term. These challenges and stakeholder pressures have been a catalyst for the oil and gas industry to make changes and pivot from a traditional business model to embrace and lead a more environmentally focused future, Table 1.

Decision analysis, business modelling and opportunities. Societal changes, increasing governmental regulation, volatile oil prices, and forecasted oil demand decline are driving oil and gas producers to choose between continuing in the traditional E&P space or becoming a more diverse energy player. There are many factors that influence decision analysis, business modeling, and the opportunity identification process to determine an appropriate path forward. These include establishing and clarifying the company’s core business, assessing resource availability and competency, evaluating the opportunities to enter low-carbon businesses, and managing investor and stakeholder expectations.

A company’s core business drives its current and future success by maintaining a consistent direction and providing financial stability. During challenging times, companies revert to the core business for support. A company of any size must evaluate core strength and sustainability long term, particularly a future forecasted to include lower oil demand and a focus on cleaner energy solutions. It must do this prior to deciding that a shift in strategy is necessary to meet future energy needs.

With the larger E&Ps adding clean energy solutions and lower-carbon fuels to their portfolio, many smaller producers continue with a traditional E&P model, at least in the short term. Moving forward toward a low-carbon future will likely not mean ceasing fossil fuel development; however, remaining in the traditional E&P space holds risk in a declining oil demand market and low-to-zero carbon environment. All considerations are necessary before deciding to pivot away from traditional E&P operations.

A transition from a traditional E&P model will require both the funding and the competency to execute successfully. Large IOCs maintain an advantage with economies of scale and more cash flow available to fund sustainability projects. Though risks still exist in making this key business decision, the margin for error is less than that of a small-to-mid-sized operator. However, ESG funds and institutional investors committed to ESG, and sustainability projects provide an option for these smaller E&Ps to secure funding and make decisions related to energy transition, provided they have a strong business case. Balancing capital expenditures toward ESG and sustainability projects, such as Scope 2 emissions reductions or renewable energy sources, and the returns on these projects, will play a key role in decision-making.

Institutional oil and gas industry competency and experience has been lost over the last few years, with workforce reductions, retirements, and personnel leaving the industry because of the cyclical nature of the business. An assessment of corporate competency and available resources is vital to success as a traditional E&P and even more important if deciding to transition the business model. Necessary support can be acquired by utilizing third-party contractors and management consultants with the necessary knowledge and experience in all aspects of the E&P space.

Low-carbon business opportunities exist on an ever-expanding, sliding scale, with new entrants needing to decide at what level to enter. Smaller E&Ps can choose to continue addressing Scope 1-type emissions reduction activities, with ambition to move to Scope 2 and 3, remaining firmly in traditional business models. Larger independents could examine a possible transition to greener energy options, such as wind or solar with capital from the many ESG funds willing to support and encourage sustainable business investments.

It is clear that numerous large integrated oil majors are transitioning to a new business model, including wind, solar, hydro-electric, hydrogen and other green energy options, as well as net-negative carbon opportunities, such as carbon sequestration and storage. The key to the transition decision will be the level of play and willingness to commit funding.

In today’s environment, engagement with key stakeholders related to ESG and sustainability issues is key. Large oil and gas majors have long been active, communicating with their investors, communities, and other stakeholders, highlighting their emissions reduction successes and advancements toward a lower-carbon future with varying degrees of success. Activist investors, institutional funds, and a consumer base that values a focus on ESG issues continue to influence the direction of larger companies.

Smaller-to-mid-sized E&Ps have, in the past, been active in emissions reduction, environmental compliance, safety, and community involvement. But, they have not all done well communicating with investors and other stakeholders to demonstrate their progress in these areas. Alignment must take place between companies and their stakeholders to ensure that decisions related to business strategy meet with expectations.

Planning and implementing change. Small and mid-sized companies navigating the wide-ranging challenges and decisions required during this chaotic time need to determine whether to make the changes needed to transition to a new business model. The option still exists to solely focus on tuning up the existing model without drastically changing direction. This decision has been, and will continue to be, a difficult one.

Companies evaluating a seismic shift in strategic direction will certainly benefit from an unbiased, informed and knowledgeable third party to evaluate the options, provide possible courses of action, and identify trade-offs. In this way, vital company resources can continue to focus on the core business, while at the same time making contributions to the decision-making process and remaining engaged in strategy development.

Endeavor Management has been acting as this third party for many companies dealing with ESG and the energy transition occurring in our industry. The oil and gas industry has reached and slipped beyond a historic tipping point, which is changing the energy landscape permanently. Companies that embrace the change and take the appropriate actions will certainly gain a strategic advantage over those that lag behind.

REFERENCES

- API and IPIECA, “Sustainability reporting guidance for the oil and gas industry 4th Edition, 2020,” 2020. https://www.api.org/-/media/Files/EHS/Environmental_Performance/voluntary-sustainability-reporting-guidance-2020.pdf?la=en&hash=735EC2C7401AF7BA703E67D20D1F762C977BDF12

- Asmelash, Elisa, and Ricardo Gorini, “International oil companies and the energy transition,” International Renewable Energy Agency, 2021. https://www.irena.org/publications/2021/Feb/Oil-companies-and-the-energy-transition

- Beck, Chantal, and Jayanti Kar, “The big choices for oil and gas in navigating the energy transition,” McKinsey and Company, 2021. https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-big-choices-for-oil-and-gas-in-navigating-the-energy-transition

- Bloomberg, “BP scanning for renewables deals to plan for life beyond oil,” JWN Energy, 2018. https://www.jwenergy.com/article/2018/1/23/bp-scanning-renewables-deals-plan-life-beyond-oil/

- Bloomberg NEF, “Energy transition investment trends: Tracking global investments in the low-carbon energy transition,” 2021. https://about.bnef.com/energy-transition-investment/

- Eccles, Robert G., and Svetlana Klimenko, Harvard Business Review, “The Investor Revolution: Shareholders are Getting Serious about Sustainability,” 2019. https://hbr.org/2019/05/the-investor-revolution

- Farsan, Alexander, et. al., “Best practices in Scope 3 greenhouse gas measurement,” Science Based Targets, 2018. https://sciencebasedtargets.org/resources/files/SBT_Value_Chain_Report-1.pdf

- Fitz, Rebecca, et. al., “Winning back investors’ trust—value creation in oil and gas 2019,” 2019. https://www.bcg.com/publications/2019/value-creation-oil-gas-investors-trust

- Kimani, Alex, “The very real possibility of peak oil supply,” Oilprice.com, 2021.

- https://oilprice.com/Energy/Crude-Oil/The-Very-Real-Possibility-Of-Peak-Oil-Supply.html

- Kimmeridge Energy Management Co., “Preparing the E&P sector for the energy transition: A new business model,” 2020. http://kimmeridge.com/wp-content/uploads/2020/02/Preparing-the-EP-Sector-for-the-Energy-Transition-A-New-Business-Model.pdf

- Porter, Stanley et. al., “Oil, gas and the energy transition: How the oil and gas industry can prepare for a low-carbon future,” Deloitte Touche Tohmatsu Limited, 2020. https://www2.deloitte.com/us/en/insights/industry/oil-and-gas/oil-gas-energy-sector-disruption.html

- Smart, Andrew et. al., “Fueling the energy future,” Accenture, 2019. https://www.accenture.com/_acnmedia/PDF-110/Accenture-Reinventing-Oil-Gas-New-Energy-Era.pdf

- Thyne, Salem, “Demystifying ESG,” Permian Basin Oil and Gas Magazine, 2020. https://pboilandgasmagazine.com/de-mystifying-esg/

- United Nations, “Paris agreement: United Nations framework convention on climate change,” 2016, https://unfccc.int/sites/default/files/english_paris_agreement.pdf

- World Resources Institute and World Business Council for Sustainable Development, “The greenhouse gas protocol: A corporate accounting and reporting standard,” 2004.

- https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- Energy Addition is what’s required (December 2023)

- Buddy, can you spare a credit? (December 2023)

- Digital transformation: Accelerating productivity, sustainability in oil and gas (November 2023)