Carbon+Intel: Capturing the potential of CCUS

The International Energy Agency (IEA) projects that global energy consumption will increase by nearly 33% over the next three decades. Meeting this demand will require a diverse energy system, with contributions from renewables, natural gas, and eFuels, such as hydrogen. Only through the co-existence of sources can we achieve net-zero without impeding economic development or quality of life. For companies across the oil and gas industry and other industrial verticals, such as cement, fiber and metal, the pressing question is how emissions reduction targets can be met cost-effectively.

Carbon capture, utilization and storage (CCUS) technologies will play a key role in achieving this objective. IEA estimates that more than 700 megatons (mt) of CO2 emissions from oil and gas activities can be avoided using CCUS (the equivalent to annual emissions from more than 150 million passenger vehicles, assuming annual emissions per vehicle of 4.6 metric tons of CO2). Moreover, it’s estimated that 250 mt could be captured at the cost of less than $50/ton.1

Despite its enormous decarbonization potential, the deployment of commercial-scale CCUS solutions across the industry is still somewhat limited. One of the primary reasons has been operators’ inability to identify practical cases for implementation. In addition, optimizing capture solutions around the constraints of facilities also can be a difficult challenge. This article will outline some of the emerging opportunities for CCUS in oil and gas and summarize several critical considerations for successful project execution.

CCUS market drivers. Several factors have contributed to the growing interest in CCUS across oil and gas and other industrial verticals in recent years. In addition to increasing pressure from governments and regulatory bodies to reduce emissions, virtually every major operator and large oilfield service supplier has established their own formal timelines for reaching net-zero.

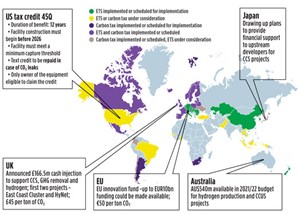

Another driver has been evolving carbon taxation frameworks. Currently, there are more than 65 carbon pricing regimes across the globe, Fig. 1. Some of the most mature policies exist in regions that are strategically important to the oil and gas industry and global natural gas supply (e.g., the North Sea). In Norway, for instance, a carbon tax on combustibles from petroleum-related activities has been in place since 1991. The tax currently stands at approximately $70/ton of CO2 emitted; however, Norway has announced plans to more than triple the tax to $237/ton by 2030. Overall, it is expected that in many regions (particularly Europe), the price of CO2 will exceed CCUS costs by 2025.2

Changes to tax credit policies are also fostering CCUS implementation. One example is in the U.S., where recent amendments to Section 45Q of the Internal Revenue Code have made carbon capture a more attractive long-term investment. So, too, has the increased availability of project financing through climate action funds—perhaps the most notable being the EU’s Innovation Fund, one of the world’s most extensive monetary programs for developing and implementing low-carbon technologies.

Capture opportunities in upstream. The above factors, coupled with the increasing number and maturity of capture technologies on the market, have opened up significant decarbonization opportunities across the oil and gas value chain. This is particularly the case upstream, where there is potential for captured CO2 to be injected directly into field formations to boost production (i.e., enhanced oil recovery or EOR), thus eliminating the need to develop a dedicated CO2 storage and transport network.

Production facilities are also ideal candidates for carbon capture, as most utilize gas turbines for power generation and/or mechanical drive duties. Gas turbines are now recognized as one of the cleanest options for meeting production power demands; however, they still represent a substantial portion of total facility emissions. For example, in the North Sea offshore Norway, it’s estimated that upwards of 80% of all emissions from oil and gas operations are generated from gas turbines.3 Gas turbines also generate a substantial amount of thermal energy that can be captured and used to meet the significant heat demands of carbon capture processes. Ultimately, any waste heat that can be recovered from the gas turbines, and other facility equipment can strongly impact the overall business case for implementation.

It’s important that the amount of heat directed to the capture process be balanced with production-related heat demands. As this demand changes over the facility’s lifecycle, system design can be a difficult task that requires extensive coordination between project stakeholders. The selection of compression equipment is also critical and impacts overall process efficiency and return on investment (ROI).

FEED critical to project success. As a leading supplier of gas turbines, compressors and other auxiliary equipment critical to CCUS projects, Siemens Energy has seen increased customer inquiries for front-end engineering design (FEED) studies to identify optimal equipment configurations for capture systems. In our experience, we have found that the most successful projects are those where the rotating equipment OEM, process licensor, and end-user engage early and work together to optimize cycle performance around the operational constraints of the facility. One critical decision that must be made early on is the type of capture technology that will be employed. Post-combustion capture is the most pragmatic approach for most production facilities, especially offshore.

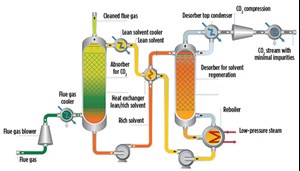

Several post-combustion capture technologies exist on the market today, the most mature being absorption using Amine-based solvents, Fig. 2. In these processes, Amine (short for monoethanolamide) is fed into an absorber, where it reacts with CO2 contained in the exhaust from the gas turbine. This forms a CO2-rich medium that is fed into a regenerator, where heat is applied to separate the CO2 from the Amine. The pure CO2 can then be compressed and stored/utilized, while the fresh Amine is returned to the absorber so the cycle can repeat.

Traditional Amine-based systems can be cumbersome, making them difficult to implement for facilities with space and weight constraints, including offshore installations and FPSOs. Several licensors have taken steps to address this issue by utilizing different equipment designs that aim to reduce the overall system footprint and Capex, making them more suitable for deployment offshore.

Other less mature capture technologies that use non-Amine solvents are also in development. However, many are not commercially proven and have yet to attract significant investment or interest from operators.

Increased need for innovative CCUS solutions. Cost-effectively capturing carbon from oil and gas activities is only the first step to making a business case for CCUS. If the CO2 cannot be used immediately for EOR, it must be stored or compressed and transported to another location where it can be utilized. This necessitates additional infrastructure, including pipelines and/or underground storage caverns, which can be costly, making the project uneconomical.

The facilities where CCUS will be most attractive in the near-term future are those close to an existing carbon storage and transport network. Several of these CCUS hubs are in development across the globe—perhaps the most notable being the Northern Lights CCS project in the North Sea. As more hubs come online, the adoption of CCUS in oil and gas and other process industries is expected to accelerate. There may be opportunities for sector coupling for certain onshore facilities, where large amounts of CO2 are generated. In such cases, captured CO2 can be used as a feedstock for industrial processes (e.g., mineralization) or combined with hydrogen to produce eFuels, such as methanol.

This past year, Siemens Energy entered into a partnership with Sweden-based Liquid Wind AB to develop an eMethanol plant. The plant will use an electrolyzer powered by renewable energy to split water into green hydrogen and oxygen. The green hydrogen will be combined with CO₂ captured from the flue gas of a nearby biomass plant to yield carbon-neutral methanol. The eMethanol will replace hydrocarbon-based fuels in shipping applications, removing approximately 100,000 tons of CO₂ emissions annually. Liquid Wind plans to build 10 additional plants, with an annual production volume of 50,000 metric tons of eMethanol, each, by 2030. The long-term vision is to develop 500 standardized plants worldwide by 2050.4 As global demand for eFuels and other feedstocks derived from CO₂ increases, similar opportunities for sector coupling will emerge, and with it will come an increased need for CCUS solutions.

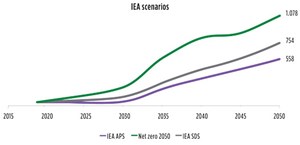

The importance of powerful partnerships. As previously mentioned, strong partnerships between operators, process licensors, and rotating equipment OEMs are critical to maximizing ROI from CCUS deployments. However, the government also has a vital role to play by instituting policies that foster growth. While progress has been made on this front in recent years, more will need to be done to accelerate technology adoption. For example, it’s estimated that 750 mt of annual CCUS capacity will be required by 2030 to reach the IEA’s Sustainable Development Scenario (SDS)—a 15-fold increase from where capacity stands today (50 mt), Fig. 3.

In its flagship CCUS report, the IEA lays out four high-level priorities for industry and governments that would accelerate the progress of CCUS over the next decade. These include:

- Create the conditions for investment by placing a value on reducing emissions and direct support for early CCUS projects.

- Coordinate and underwrite the development of industrial hubs with shared CO₂ infrastructure.

- Identify and encourage the development of CO₂ storage in crucial regions.

- Boost innovation to reduce costs and ensure that critical emerging technologies become commercial, including in sectors where emissions are hard to abate and for carbon removal.

Accelerating adoption for a successful energy transition. Delivering on the promise of CCUS in oil and gas and other industrial verticals will require collaboration on the part of many different stakeholders. To this end, the importance of early engagement cannot be understated. The economics of CCUS projects (while improving) are still difficult to justify in many cases. Maximizing ROI requires carefully selecting critical equipment, such as compressors and heat pumps to optimize the capture and storage/transport system around process and facility constraints. Specifying equipment after a capture technology has been selected will potentially result in an overdesigned and inefficient system.

In project execution, upstream operators possess the engineering and project management expertise to drive successful deployments. However, bringing down development costs and expanding the range of business cases will require co-creation across the value chain and between governments. Ultimately, everyone’s resources and expertise will have to be brought to bear to accelerate CCUS adoption and drive a successful energy transition.

REFERENCES

- International Energy Agency (IEA). World Energy Outlook, 2018.

- IEA 2021 (World Energy Outlook – Net Zero Scenario), 2021.

- N. P. Directorate- the Norwegian petroleum sector.

- Liquid Wind. Siemens Energy partners with Liquid Wind to produce green fuel https://www.liquidwind.se/news/siemensenergypartnerswithliquidwind

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Digital transformation: Accelerating productivity, sustainability in oil and gas (November 2023)

- Technological advances increase efficiencies and flexibility (November 2023)

- Volatile organic carbon emissions in oil and gas industry: Impact and mitigation (November 2023)

- Technological innovation delivers transformative product suite to upstream sector (November 2023)

- Executive viewpoint (August 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)