ShaleTech: Free cash flow overrides excessive gas flow

Following December weather that was generally more fitting for backyard cookouts than sleigh rides, a “landmark” arctic blast ushered in the new year across most of the U.S. eastern seaboard. As usual, it sparked healthy prices for Appalachia basin natural gas.

However, unlike winter heating seasons past, the February 2022 forward price spikes of more than $2/MMBtu came on top of multi-year highs in the still-volatile gas market. Also indicative of the current environment, most producers in the dry and wet gas-laden Marcellus and Utica shales across the Pennsylvania, West Virginia and Ohio fairway are, for now, refraining from exponential drilling and production growth, even as prices are expected to settle out around $4/MMBtu this year.

While acknowledging current gas prices are “well above our break-evens,” Chesapeake Energy Corp. President and CEO Domenic Dell’Osso echoed a number of his contemporaries, telling analysts on Nov. 3, “We don’t want to chase higher prices in the near term with a rapid growth ramp. We feel prices should moderate, but the backwardation (current vs. futures pricing) you see out to 2023, and even out to 2024, delivers a pretty great price for natural gas.”

Chesapeake may not be chasing higher prices, but it certainly is not shying away from deals. On Jan. 25, the company agreed to pay around $2.6 billion to acquire a reported 113,000 net Marcellus acres and up to 200 MMcfd of incremental production from tightly held Chief E&D Holdings LP. The cash and stock deal—Chesapeake’s second major acquisition since emerging from bankruptcy on Feb. 9, 2021—is expected to close in the first quarter.

In the meantime, Chesapeake plans to continue a three-rig Appalachian drilling program in 2022, with 50 to 60 wells drilled and turned-in-line and projected cumulative year-end production of 1,095 to 1,125 Bcf, up from around 790-810 Bcf in 2021. “When we laid out 2022 spend ($1.45 billion), we knew the Marcellus has takeaway constraints, so there’s a limited amount of capital that makes sense to spend there,” he noted.

Nagging takeaway constraints got some relief in December, when Williams Companies’ Leidy South expansion went in service with a designed capacity of 582.4 MMcfd. The pipeline and gas gathering project expands the company’s existing Pennsylvania infrastructure to connect with the consumer-rich Atlantic Seaboard.

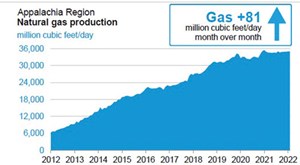

Meanwhile, the U.S. Energy Information Administration (EIA) estimates the Appalachian region will produce 35,069 MMcfd of gas in February (Fig. 1), up by 559 MMcfd compared to production during the epic freeze-out of February 2021.

As for new drills, around 42 rigs were active in the combined Marcellus and underlying Utica plays in January and early February, with the former down two rigs from the same 2021 timeline, according to Baker Hughes. The wetter and costlier Utica, however, saw a sizeable year-over-year jump, going from an average four active rigs in January 2021 to 11 rigs last month.

Gulfport Energy Corp. is running one of those rigs in eastern Ohio, where it exclusively targets the Utica in a 193,000-net-acre leasehold, where full-year 2021 net production was expected to average 980 to 1,000 MMcfed. Gulfport drilled roughly 20 net wells last year with 17 net wells turned-in-line.

Third-quarter production came in at around 700 MMcfed, of which 250 MMcfed came courtesy of the six-well Angelo pad in Jefferson County, Ohio, with average horizontal reaches of 17,026 ft, Fig. 2. The pad was completed with simul-frac technology and put online some 30 days ahead of schedule. The five-well Limestone pad and the four-well Extreme pad to the immediate north, with planned lateral reaches averaging 17,039 ft and 13,866 ft, respectively, figure prominently in the company’s 2022 development program.

While 90% of the activity of pure-play Antero Resources Inc. will continue to be in the lower-cost Marcellus, the company deployed one rig to the Ohio Utica in late 2021 for the first time in nearly four years. Antero, the nation’s second-largest natural gas liquids (NGL) producer, averaged net production of 3.25 Bcfed in the third quarter. The company’s long-range guidance calls for net production of 3,300 to 3,400 MMcfed between 2021 and 2025.

Antero wrapped up 2021 with 65 to 70 net wells drilled and 60 to 65 completed. The company is operating three rigs and one completion crew on a more-than-542,000-net-acre leasehold in the southwestern core of the Marcellus and Utica.

DIVERSE CONSUMER BASE

The historical price increases of late have been attributed in no small part to the advancing globalization of the domestic natural gas sector, namely the proliferation of liquefied natural gas (LNG) exports, concentrated primarily along the U.S. Gulf Coast. To tap into that market, deeply rooted Appalachian producers Chesapeake and Southwestern Energy Co. paid just over $4 billion, combined, last year to either expand their foothold or establish a position in Louisiana’s gas-rich Haynesville shale.

Appalachian pure-play operator EQT Corp., however, negotiated ample firm transportation commitments to the Gulf Coast, thereby precluding the need to snap up assets closer to LNG terminals. “We’ve got over 1.2 Bcf a day of firm transportation down to the Gulf, which is almost the largest position of any producer down there in the Haynesville. So, we’ve got a significant amount of exposure down there,” says President and CEO Toby Rice.

On the other hand, between a growing petrochemical network, increasing residential and commercial power generation, not to mention the 1.8-Bcfd export capacity of the Cove Point LNG facility in Lusby, Md., others believe in-basin demand is more than sufficient to absorb regional production. Cove Point officials have not responded to requests for current export volumes.

“We had opportunities for taking additional firm transportation out of the basin and we turned it down,” said Tom Jorden, CEO of four-month-old Coterra Energy Corp., on Jan. 6 during the Goldman Sachs Global Energy and Clean Technology Conference. “We think there are in-basin opportunities, and we see a robust set of future opportunities as we look at coal-to-gas power switching.”

Coterra sprung out of the surprising $17-billion merger of Marcellus fixture Cabot Oil & Gas Corp. and West Texas/Oklahoma producer Cimarex Energy on Oct. 1. The former Cabot’s legacy 173,000 net acres, mostly concentrated in the Marcellus core of Susquehanna County, Pa., produced, on average, 2,363 MMcfd in the third quarter. Operating two rigs and two completion crews pre-merger, the former Cabot drilled 17 wells and completed 30 in the third quarter.

While the newly branded company sees production increasing to exploit “strong Appalachian winter pricing,” Jorden believes capital constraint will not dissolve anytime soon. “I think operators will remain disciplined. Right now, as we view the Appalachia market, there is less excess of capacity. Could it erode? Definitely, but I don’t see signs of it happening in 2022,” he said. “I think there’s lots to do in Appalachia, and we also need more pipelines. I don’t think you’ll find an Appalachia operator who won’t say that.”

CHASING CASH

For Appalachian first-mover Range Resources Corp., generating free cash flow supersedes escalating 2022 production, prices notwithstanding. “As we look forward to 2022, despite the recent improvements in strip pricing for oil, natural gas, and natural gas liquids, we remain committed to maintaining production at current levels, where the focus on harvesting cash flow, reducing debt, and further strengthening our balance sheet,” says Sr. V.P. and COO Dennis Degner.

Range projects full-year 2021 production of between 2.12 and 2.13 Bcfed, with around 60 new dry and wet gas wells hooked to production. Third-quarter production of 2.14 Bcfed was up 3% from the beginning of 2021. “Our operational program for the rest of the year will result in adding production from another seven wells in the fourth quarter, which are spread across our liquids-rich footprint,” Degner said on Oct. 27.

The company entered the fourth quarter operating two dual-fuel rigs and one electric-powered frac spread within a commanding 1.5 million net acres in Pennsylvania, with stacked play targets in the Marcellus, Utica and Upper Devonian shales.

CNX Resources Corp., likewise, is not inclined to ramp up activity to capitalize on futures prices that one analyst described as “the best they’ve been in a number of years.” “We like where we’re at with a one-rig, one frac crew array that’s generating a substantial amount of free cash flow. So, I think we stay within that operating plan for the foreseeable future,” said President and CEO Nicholas DeIuliis on Oct. 28. “What’s changed (in the industry) is probably where the popular focus has gone to recently, which is this concept of discipline and free cash flow generation, which we think obviously will be a good thing.”

After averaging 1,668.7 MMcfed in the third quarter, with six wells drilled and eight wells turned-in-line, CNX, which controls more than 1 million net acres, expects aggregate 2021 production of 570 to 580 Bcfe. The company wrapped up last year with a total of 35 Marcllus and two Utica wells put on production.

EQT, however, closed out 2021 with an increase in drilling and completion activity, as fourth-quarter production was expected to range between 510 Bcfe and 540 Bcfe, up from 495 Bcfe in the third quarter. The company averaged two to three rigs (Fig. 3) and three to four frac spreads last year.

In the fourth quarter, EQT planned to drill 32 wells with average lateral lengths of around 12,.000 ft—all but one targeting the Marcellus—with 33 Pennsylvania and West Virginia Marcellus wells slated for completion. This compares to 24 new drills and 23 completions in the third quarter. On the flip side, a total of 40 Pennsylvania and West Virginia Marcellus wells were turned-in-line in the third quarter, compared to 25 new producers on tap for the fourth quarter.

With the 300,000 net acres acquired in the more-than-$2.9-billion purchase of Alta Resources LLC in July 2021, EQT now controls more than 880,000 net acres in the Marcellus core.

Elsewhere, Seneca Resources Co., LLC, the exploration and production entity of National Fuel Gas Co. of New York, increased cumulative year-over-year production by 20% to 79.6 Bcfe in the fourth quarter. The company expects FY 2022 net production to jump between 335 Bcfe and 65 Bcfe from a 1.2-million-net-acre leasehold in Pennsylvania.

In FY 2022, Seneca expects to bring three pads online in Tioga County, Pa,. with two targeting the Utica and the other producing from the Marcellus. An undisclosed volume of new production will be directed to the now-operational Leidy South expansion. “Our plan to ramp up production over the course of the year, to fill our new Leidy South capacity, is right on track. I expect first-quarter production to be sequentially flat, and we are timing several pads to come online during the quarter in conjunction with the new Leidy South capacity,” said Seneca President Justin Loweth. “From there, production should ramp up in the second and third quarters and then level out around 1 Bcfd net toward the end of the fiscal year.”

While integrating the newly acquired Haynesville assets, Southwestern Energy delivered an estimated 3.0 Bcfed in 2021 from the 789,218-net-acre Appalachian position. After laying down two rigs, the company expected to average two rigs and two completion crews in the fourth quarter.

Third-quarter production totaled 280 Bcfe, with 15 wells drilled and 19 wells completed and put on production at lateral reaches averaging 14,147 ft.

Meanwhile, in early January, the U.S. arm of Spain’s Repsol S.A. snapped up the estimated 42, 897 net acres held by distressed Rockdale Marcellus for a reported $222 million. The bolt-on acquisition, which was part of Rockdale’s Chapter 11 bankruptcy process, adds to the 171,000 net acres that Repsol controls in the Pennsylvania Marcellus. Repsol also owns midstream assets in Pennsylvania, with pipeline delivery capacity of 1.5 Bcfd.

Repsol intends to run three rigs in the Marcellus this year, with 2022 production estimated at 120,000 boed. At last count, the former Rockdale asset produced around 110 MMcfd.

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)