Industry must find ways to survive increasingly authoritarian U.S. government

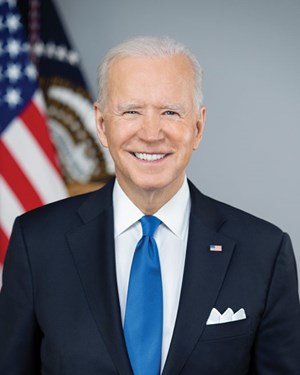

Writing back in January about President Joe Biden’s order to kill the Keystone XL Pipeline, I warned that that action was just an opening volley in a war on the domestic oil and gas business that would only intensify over the four years of his presidency. Anyone who may have thought the President would be satisfied with killing one pipeline and holding up new federal leases for a few months did not understand the gravity of the industry’s situation, as this new government took power and began to exercise it.

Indeed, in the intervening seven months, the President and his Democrat compatriots in the U.S. Congress have now opened so many new fronts in this ongoing war that they have become too numerous to adequately document, Fig. 1. Let’s take a look at a few of the larger and most potentially damaging ones.

IGNORING A COURT DECISION

Even adverse decisions in the U.S. courts do not appear to affect the administration’s drive to punish what it obviously sees as a disfavored industry. Secretary of Interior Deb Haaland’s ongoing enforcement of Mr. Biden’s ban on the conduct of new federal lease sales is a prime example.

Shortly after that order was issued in January, 13 state attorneys general filed a suit in a Louisiana federal court, challenging its constitutionality. On June 14, U.S. District Court Judge Terry A. Doughty (Western Louisiana district) issued a decision in that case, overturning that order, applying it nationwide, Fig. 2. In his ruling, the judge stated that the plaintiff states had established that they would suffer severe economic harm due to the leasing ban, noting that “millions, and possibly billions, of dollars are at stake.”

In a statement following the judge’s decision, an Interior Department spokesperson said the agency would issue a report that “will include initial findings on the state of the federal conventional energy programs, as well as outline next steps and recommendations for the Department and Congress to improve stewardship of public lands and waters, create jobs, and build a just and equitable energy future.”

The industry celebrated this victory, with Louisiana Attorney General Jeff Landry calling it “a victory, not only for the rule of law but also for the thousands of workers who produce affordable energy for Americans.” But the celebration was short-lived, as Interior appeared to be taking no real action in response to the judge’s order. In late July, Secretary Halland claimed the “report” would be coming soon. “We promised early summer,” Haaland said during a visit to Colorado. “It’s early summer. We’re still working on it.”

Perhaps she was biding her time, waiting for the U.S. Senate to approve Biden’s nominee to become the director of the Bureau of Land Management, a long-time anti-development radical and alleged domestic terrorist named Tracy Stone-Manning. Ms. Manning spent years working for an anti-logging group that engaged in the practice of spiking trees with metal spikes, an act that endangered the lives of loggers working in the forest. In 1989, this group inserted 500 pounds of these spikes into trees in an Idaho forest, in order to halt the operations there.

She has been unapologetic for her actions and was what one agent called an uncooperative and evasive witness during FBI investigations, providing conflicting accounts of her involvement in these acts. One retired agent told reporters that she “absolutely refused to do anything” to help in the investigations.

On the same day that Haaland issued her statement regarding the report, Stone-Manning’s nomination was advanced from the Senate Energy and Natural Resources Committee on a straight party-line vote. Coincidence? Smart people don’t believe in them.

CONGRESSIONAL DEMOCRATS GO AFTER WASTEWATER DISPOSAL

Congressional Democrats rolled out another frontal assault on the nation’s oil and gas industry in early summer, this time in the form of language contained in their massive CLEAN Future Act, sponsored by New Jersey Cong. Frank Pallone.

As detailed in a report from Rice University’s Baker Institute, the language would reclassify returned water from oilfield drilling operations as a “hazardous waste” under the provisions of the federal Resource Conservation and Recovery Act (RCRA). From the Baker Institute report:

Section 625 of the act holds particular importance, as it would task the administrator of the U.S. Environmental Protection Agency (EPA) with determining whether certain oil and gas production by-products—including produced water—“meet the criteria promulgated under this section for the identification or listing of hazardous waste” within one year of the bill’s enactment. The EPA defines produced water as “the water (brine) brought up from the hydrocarbon-bearing strata during the extraction of oil and gas.”

Such a change could do great harm to the upstream industry’s ability to get its business done. This brine—which is basically all that’s left once any solids have been removed from the returned water—has always been disposed of in Class II disposal wells, which exist in the tens of thousands across the country. Such wells are regulated by state agencies like the North Dakota Industrial Commission, the Oklahoma Corporation Commission and the Texas Railroad Commission.

But this reclassification would require the water to be disposed of in Class I wells governed by the U.S. EPA and its delegees, like the Texas Council on Environmental Quality. As the Baker Institute points out, only a few hundred such wells exist in isolated pockets currently, most along the Gulf Coasts of Texas and Louisiana.

If your goal is to damage the U.S. domestic oil and gas industry, this is a fairly ingenious approach. As the report’s authors point out, the language in the bill envisions a short timeline for implementation that would afford the industry little time to adjust. One industry executive I contacted said the change would be “potentially disastrous” for the business.

While it all sounds quite dire, one elected official in Texas is not so sure. Given his background in the waste disposal business and his current status as one of the state’s three members of the Railroad Commission, I contacted Commissioner Jim Wright (Fig. 3) to get his thoughts on the subject. Though he acknowledged the seriousness of this proposed change, he was a little more sanguine about the industry’s ability to cope with anything that comes down from Washington over the next few years.

“I think we are in for a crazy four years. There is going to be a lot of stuff thrown at the wall – what sticks, I’m not real sure,” he said. “If this does come to reality in whatever fashion, I think that our industry will adapt.” Not an unreasonable presumption, given the industry’s long history of successfully adapting to a constantly changing regulatory environment.

Wright pointed out that advances in technology in this century have enable the industry to create uses for the returned water that are viable and scalable. He focused on two in particular: “One is for re-fracing, and the second is to utilize it for irrigation. We have seen a lot of development of technology related to both,” he said. “We are going to be looking very hard at trying to simplify the process of encouraging recycling of that water.”

While Commissioner Wright’s optimistic outlook has as strong basis in fact for many companies, there is no question that if passed, this provision would have a significant impact on some operators’ ability to get their business done. Which, of course, is the reason why it is being pursued by Biden and congressional Democrats.

DEMAGOGUING THE INDUSTRY ON MYTHICAL TAX “SUBSIDIES”

Nowhere has the intensification of this war on oil and gas become clearer than in Democrats’ current efforts to raise taxes on the industry. In its “Green Book” related to the administration’s gargantuan omnibus budget bill, the Treasury Department uses this coded language to describe one of the overarching goals of the program: “Replacing fossil fuel subsidies with incentives for clean energy production.” This, of course, is nonsense, as I have written many times over the past decade.

It is a simple fact that the oil and gas industry does not receive “subsidies” of the type that wind, solar and electric vehicles enjoy, i.e., direct transfer payments from the government to enormous corporations like Tesla, General Motors and Ford totaling billions of dollars every year. Some in the industry—mainly small producers and royalty owners—do benefit from the expensing of intangible drilling costs, which is similar to appliance manufacturers or pharmaceutical companies expensing their own costs of goods sold every year. Small independents and royalty owners also benefit from percentage depletion, a provision that is similar to depreciation of inventory in other industries.

Despite these realities, Biden proposes to single out oil and gas by repealing those provisions, which have existed in the tax code for more than a century, along with every other tax treatment in the IRS tax code specific to the industry today. In all, the Green Book contains a whopping total of $147 billion in new industry taxes, which would negatively impact mainly the red states where oil and gas is produced in the U.S.: Texas, Alaska, Wyoming, Montana, Louisiana, North Dakota, Ohio and Pennsylvania, Fig. 4.

In most respects, it is the same nakedly political move that was attempted during all eight years of the Obama/Biden administration without success. We’ve seen it all before; most of it, anyway.

One clever new means of attacking America’s oil and gas industry is the proposal by the administration and many congressional Democrats to double the rate of taxation from a little-known tax provision called the Global Intangible Low-Taxed Income (GILTI) tax. Created as part of the 2017 tax reforms, GILTI was originally intended as a way to tax companies that move their intangible assets—like intellectual properties—overseas to lower tax havens. The tax was specifically intended to target industries like pharmaceuticals and technologies, in which companies have easily moveable, intangible assets.

International producers in the energy industry have become unintentional collateral damage of the tax. The industry is capital-intensive and has tangible assets. Companies have to operate where the resources exist in the ground, often in far-away countries like Niger, Guyana, The Gambia and Suriname. They are not operating overseas as a way to game the tax system.

Responding to the GILTI proposal, Jessica Boulanger, a spokeswoman for the Business Roundtable, said, “The potential international tax increase is as large as any corporate rate increase and at least as damaging for the competitiveness of U.S. companies, because it hurts their ability to compete in foreign markets head-to-head with foreign companies, whose countries don’t impose such a tax.”

The Biden/Democrat proposal to double the rate from 10.5% to 21% would make U.S. companies less competitive in the global marketplace, likely raising little real, new tax revenues to the government, as companies sell off international assets. It’s a fool’s game entirely designed as a punitive measure on a disfavored industry, the sort of policy move one would expect to see from authoritarian governments in Third-World countries.

But this is not some Third-World country. It is the United States of America, and the domestic oil and gas industry must find ways to survive this increasingly authoritarian government for at least another 31/2 years. As Commissioner Wright told me, “These years truly are going to be crazy.”

- U.S. producing gas wells increase despite low prices (February 2024)

- Executive viewpoint: TRRC opinion: Special interest groups are killing jobs to save their own (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Management issues: New U.S. House Speaker is strong supporter of oil and gas industry (December 2023)

- Oil and gas in the Capitals (October 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)