ShaleTech: Permian Basin Shales

Having thawed out from a generational freeze, a shrunken roster of Permian basin players is finding a turf markedly changed from the one they were forced to largely downplay this time last year.

Those left standing after no less than $26.2 billion in acquisitions over the first quarter, alone, continue to emphasize capital discipline over production growth, despite the rollout of Covid vaccines that is helping to lift demand and prices significantly. Reflecting the strategy of constraint, Baker Hughes says 224 rigs were active in the first two weeks of April, a drop of more than 100 rigs from early April 2020 after Covid was proclaimed a worldwide pandemic and began a ravenous assault on demand, Fig. 1.

“From a macro perspective, what I’m seeing is that we still are under-supplied on rigs to keep the Permian basin (production) flat,” Travis Stice, CEO of Diamondback Energy Inc, said in a Feb. 23 call.

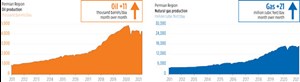

Federal production data bear that out. Even compared to the year-ago month when the effects of the pandemic-invoked demand and price destruction were firmly taking hold, April oil production in the Permian region is estimated at just under 4.3 MMbpd, down some 214,000 bpd year-over-year, according to U.S. Energy Information Administration (EIA) guess estimates, Fig. 2. Gas production, likewise, is expected to drop to 17,041 MMcfd, compared to 17,081 MMcfd in April 2020, the EIA estimates.

First-quarter production was skewed, however, by a freakish winter storm in February that dropped temperatures to a more than 30-yr low, freezing up multi-zone shale wells across West Texas and southeastern New Mexico. Aggravated by the Permian’s notoriously high water cut, the deep freeze is estimated to have taken at least 1 MMbopd and 11.8 Bcfgd off-line for more than a week. By Feb. 24, pure-play Pioneer Natural Resources Co. had largely restored some 55,000 boed of production from wells that were frozen-in a week earlier, but the company suggests the wildly atypical storm does not justify the costs of wholesale winterization of wellheads and associated facilities. “No decisions today, but we’ll definitely look at it just from a lessons learned. But, in general, it was such a 50-year event or 100-year event, that given the freak nature of it, at this point, we don’t see any substantial changes that we would make,” said President and COO Richard Dealy.

Reining in costs remains a basin-wide obsession, even as West Texas Intermediate (WTI) oil prices reached a two-year high of $67.87/bbl on March 8—a remarkable climb from an historic low of negative-$37.63/bbl at one point last April. “If oil prices continue to improve this year, we will not increase capital in support of production growth,” Occidental Petroleum Corp. President and CEO Vicki Hollub said in a Feb. 24 call, reflecting the basin-wide sentiment.

Occidental plans to hold full-year 2021 Permian production to around 485,000 boed, roughly flat with the fourth-quarter 2020 production rate. The company expects to run 5 net (11 gross) rigs this year and put between 175 and 205 wells on-line.

Oxy also is building what is said to be the world’s largest direct air carbon (DAC) capture facility in the Permian, as part of a broader narrative, where decarburization, emission mitigation and other environmental, societal and governmental (ESG) initiatives have taken an outsized influence on investment decisions.

Those decisions, however, are in the hands of fewer operators, as once-established companies have been gobbled up by their better-heeled peers. The deals that closed, or are pending, in early 2021 do not include Chevron’s nearly $5-billion acquisition of Noble Energy and its 92,000-net-acre Permian leasehold last October. Like fellow super-major ExxonMobil, Chevron has tempered a once-ultra-aggressive Permian development campaign, with plans to maintain a flat activity level this year, based on five rigs and two completion spreads.

Two years after projecting its Permian asset would generate more than 1 MMboed by 2024, ExxonMobil, likewise, has set a less-ambitious target. “Based on the current market price projections, our plans result in Permian volumes of approximately 700,000 oil equivalent barrels per day by 2025,” says CEO Darren Woods.

POLITICAL “OVER-REACTION”

Operators also are reckoning with the fallout of President Joe Biden’s supposedly temporary moratorium that froze new leasing on federally owned land. The Jan. 27 decree affects the Permian’s New Mexico Delaware Basin component, where much of the acreage, especially in core Lea and Eddy counties, is under control of the U.S. Bureau of Land Management (BLM). The pause did not affect existing leases or permits, though it raises questions on future drilling authorizations. Occidental, for one, says it has stockpiled more than 350 approved federal drilling permits for its New Mexico Delaware assets.

In hindsight, Cimarex Energy Co. admitted that it may have overreacted, when two days after the Executive Order, all Delaware basin activity was diverted to the friendlier confines of Texas. “We overreacted, in my opinion, but bully for us for that,” said President and CEO Thomas Jorden. “After further analysis, we are confident that permit activity on existing federal leases will continue relatively unabated, and we have restored significant New Mexico activity into our 2021 program.”

Cimarex owns 234,800 net acres in the Delaware basin, including 79,000 federally controlled acres in New Mexico. The company has 35 federal drilling permits approved, with another 11 applications pending as of Feb. 23, with 46 wells planned through 2023.

After a significant pull-back in 2020, Cimarex is running five rigs and two completion spreads that likely will be directed to help reduce an inventory of drilled-but uncompleted (DUC) wells that stood at 39 net (52 gross) wells at year-end. In the latest available data, the EIA has the Permian region holding a nation-leading 3,272 DUC wells, as of February.

The company put 48 net (92 gross) wells on-line in 2020, compared to 75.5 net (131 gross) wells in the year prior, with full-year production averaging 184,001 boed, down year-over-year from 190,735 boed.

Meanwhile, in the last quarterly lease sale held before Biden took office, the BLM collected around $3.9 million in the Jan. 14 offering of roughly 5,900 acres in Lea and Eddy counties. New Mexico’s Oil Conservation Division (OCD) also issued a cumulative 104 drilling permits for the two counties from January to March, after approving 386 new drills in Lea and Eddy counties for all of 2020.

Across the border, the Texas Railroad Commission (RRC)—that state’s chief regulator— issued 837 horizontal drilling permits between Jan. 1 and March 5 in the pertinent Permian districts, compared to 1,242 new well authorizations for the same 2020 period.

MEGA-DEAL FRENZY

Among the spate of multi-billion-dollar deals this year, ConocoPhillips Co. acquired pure-play Concho Resources in January, in an all-stock transaction valued at $9.7 billion. The acquisition added 550,000 net (800,000 gross) Midland and Delaware basin acres to the company’s Lower 48 portfolio. ConocoPhillips’ Permian production averaged 88,000 boed in the fourth quarter, while this time last year, Concho guided average production of 316,000 to 325,000 boed.

“Demand recovery is taking longer, spare supply remains, and inventories remain elevated. It makes no sense to grow into this market environment, so we’re choosing to stay at a sustaining level for the year,” says CEO Ryan Lance.

If nothing else, 2020 brought a sharp reduction in the cost of supply, says Tim Leach, executive VP of the Lower 48 and former Concho CEO. “I think we saw declining capital costs, but then also enhanced efficiencies from better-designed wells, better-designed spacing across the board. So, I do think the cost of supply came down dramatically in 2020.”

In twin transactions, Diamondback Energy snatched up two in-basin rivals. The Midland-based company on Feb. 26 closed an estimated $862-million cash-and-stock deal to buy the 32,500 net acres of tightly-held Guidon Operating LLC, and followed up with the roughly $2.2-billion all-stock acquisition of QEP Resources Inc. and its 49,000 net acres. The two deals give Diamondback a largely contiguous 429,000-net-acre position, primarily in the Midland basin, enabling average lateral lengths beyond 10,000 ft, the company said.

Diamondback also has fully embraced simultaneous fracing (simul-frac), which compared to zipper fracs, is said to cut the completions time by half. Diamondback expects to employ three simul-frac crews and one spot frac spread this year, to complete 220 to 225 wells, but will not boost production. “We are still operating in a market supported by supply that’s been purposefully withheld to allow global inventories to decline, as demand recovers from the depths of the global pandemic. Diamondback continues to see no need to grow oil production into this artificially under-supplied market,” Stice said.

To point, after averaging oil production of 180,800 bpd last year, Diamondback expects to hold full-year 2021 production at a relatively flat 178,000-185,000 bopd. Drilling and completions, likewise, will nearly mimic 2020 activity with between 180 and 200 gross new drills and 215 to 235 gross completions.

In what has been described as a joining of equals, Devon Energy Corp acquired fellow Oklahoma-based operator WPX Energy in a $2.56-billion all-stock deal that closed on Jan. 7. Operating exclusively in the Delaware basin, the now-combined company holds 400,000 net acres, 65% of which reside on privately-owned land. More than 500 approved drilling permits are in the can across the federally controlled portion of the leasehold. The then-separate operators averaged a combined 15 rigs in the fourth quarter, with Devon putting 23 wells on-line in its legacy Southeast New Mexico position, while WPX put 26 wells on production in a stateline co-development program targeting the Upper Wolfcamp and Bone Spring benches.

On a pro forma basis, the two companies averaged 305,000 bopd in the fourth quarter, but Devon plans to hold 2021 oil production to 280,000 to 300,000 bpd. “We have no intentions of adding any growth projects until demand fundamentals recover, inventory overhangs clear up, and OPEC-Plus-curtailed volumes are effectively absorbed by the world markets,” President and CEO Rick Muncrief said on Feb. 17.

FATHER-SON MERGE

Pioneer’s $4.5-billion acquisition of Parsley Energy in January and its 250,000-net-acre asset took on a familial complexion. Parsley’s co-founder and former CEO, Bryan Sheffield, is the son of Pioneer chief Scott Sheffield, who followed up the Parsley acquisition on April 1 with a $6.4-billion all-stock deal for privately held Doublepoint Energy LLC. With the additional 97,000 net acres in the Midland basin, Pioneer now controls a more-than-1-million-net-acre leasehold.

Pioneer, which boasts one of the world’s lowest levels of associated CO2 emissions/boe produced, plans to average 18 to 20 rigs and five to seven frac crews this year. Even with the freeze-related curtailments, now-combined first-quarter production is expected to range from 533,000 to 559,000 boed (310,000 to 325,000 bopd).

Along with a sweeping technology suite that includes machine learning for optimizing completion designs, Pioneer completed its first simul-frac job just before the winter storm hit and intends to incorporate the technique into its Permian operations.

BACK TO WORK

After spending 2020 on the sidelines and ending the year with Permian curtailments of 11,500 boed, Apache Corp. sees the stars as sufficiently aligned to justify a return to active duty, albeit subdued. “We ended 2020 with zero rigs in the Permian, and the combination of higher WTI prices and lower service costs make this an appropriate time to restart a very modest drilling program,” CEO John Christmann told analysts on Feb. 25. “Our goal is not to pursue growth but to sustain oil production beyond 2021.”

Apache started the year with a single rig and expects to add a second rig by mid-year. “We will likely need to add a third rig at some point to fully arrest the decline,” he said.

One asset that is unlikely to be hosting any rigs this year is the once ballyhooed Alpine High resource play in Reeves County, Texas, Fig. 3. As of now, Alpine High activity will be confined to completing five previously drilled wells this spring, following the initial flowback of two DUC wells in January.

Elsewhere in the 86,000-sq-mi basin:

Ovintiv Corp. expects to operate three rigs and up to two completion crews, and drill 22 net wells and turn 29 net wells in line within a 115,000-net-acre Permian leasehold. Following an attributable savings of around $18.5 million in 2020, Ovintiv said up to 95% of the 2021 program will incorporate simul-fracs. Full-year production averaged 109,000 boed, with drilling and completion costs of $470/lateral foot, down 30% year-over-year.

Centennial Resource Development Inc. expects to run two rigs this fiscal year within its core Delaware basin position, to drill and complete up to 44 gross wells at the mid-point. Full-year production is targeted at 56,000 to 63,000 boed, essentially consistent with the fourth quarter. Centennial holds 81,700 net acres in Reeves County, Texas, and Lea County, New Mexico, with roughly 4% having federal exposure.

SM Energy Co. is back to work after a “severely contracted” level of activity in 2020, operating three rigs and two completion crews across 82,000 net acres under lease in the Midland basin. The company has programmed an estimated 55 net spuds and 72 net completions for 2021 at average lateral lengths of around 11,300 ft. In January, SM drilled and cased a Howard County, Texas, well with a 20,900-ft lateral, which it says is a state record.

Callon Petroleum Co. has cut 2021 capital spending by $60 million, compared to 2020, with around 70% of the now-$430-million budget directed to stacked pay development in the Permian basin, with two active rigs as of Feb. 25.

Laredo Petroleum, Inc., saw its full-scale transition to development of its Howard County assets interrupted by the freeze, forcing 12 planned completions to the end of the first quarter. Laredo had completed its first 15-well package in the county, which was averaging oil production of more than 10,000 bpd until the weather intervened. As of Feb. 23, Laredo was running two rigs and one completion crew on a largely contiguous 140,000-gross-acre holding in the Midland basin.

BP, meanwhile, faced pushback in January for filing 121 flaring requests, after earlier calling on the RRC to ban routine flaring. According to Bloomberg, BP justified the exemption filings, saying they were necessary while the company develops “several projects” aimed at meeting its zero routine flaring ambition.

During a Feb. 2 call, CEO Bernard Looney said routine flaring has declined from 15% to 4% over a 12-month period. “We’re actually all over it,” he said. “So, great progress, but 4% isn’t good enough. We have a goal to get to zero flaring in Texas, and that’s what we’re focused on.”

The company’s U.S. onshore entity, BPX Energy, will operate eight rigs this year, spread out between its Texas and Louisiana holdings. Activity in 2021 will be weighted heavily toward oily assets, which include 83,000 net acres in the Delaware basin, where less than 1% is federally controlled.

ESG AT FOREFRONT

With ESG initiatives playing an outsized role in operator plans, the typically amiable RRC is, likewise, taking a harder line on flaring requests. “Flaring is a necessary last resort during an upset, and we have work to do internally at the commission to ensure that we are not approving requests that go beyond that,” Commissioner Jim Wright said immediately after a Feb. 9 meeting that saw a number of flaring applications deferred.

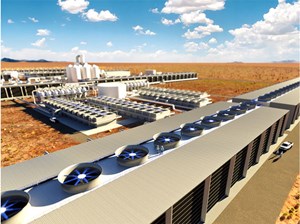

In one of the more ambitious ESG-related undertakings, Occidental’s Oxy Low Carbon Ventures and Rusheen Capital teamed up to form 1Point Five and develop the world’s largest direct air capture facility, Fig. 4. Using licensed technology from Carbon Engineering Ltd., the DAC facility is designed to capture up to 1 million metric tons/yr of atmospheric CO2 which would be housed permanently beneath the operator’s 3 million-net-acre conventional and unconventional Permian position. Occidental expects to begin construction in 2022, which should take up to two years.

“This creates opportunities way beyond the Permian,’ says CEO Hollub. “We wanted to prove it up in the Permian, because that is the best place—almost in the world—for enhanced oil recovery. The utilization of the CO2 is best there.”

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- When electric meets intelligence: Powering a new era in hydraulic fracturing (January 2024)

- Next-generation electric fracturing system improves efficiency, ESG performance (January 2024)