Oil and gas in the capitals

Russia has emerged relatively unscathed from Covid-19. The recession was less severe, there, than in Europe. The rebound in hydrocarbon prices since fourth-quarter 2020 has undoubtedly helped. But the government seems more in a hurry to resume a policy of austerity, the consequences of which could be harmful on growth.

Prices and production. This rebound in hydrocarbon prices—the result of production volume restriction agreements decided with the OPEC countries—however, came about with a stabilization of the exchange rate in a context of recovery in export earnings. This should limit the growth of imports, and support domestic producers.

According to the Institute for Economic Forecasting, the growth in production that was observed during early 2021 is not just associated with a general recovery in demand after the acute phase of the coronavirus crisis. It is also due to significant support measures provided by the government. However, the dynamic of public spending in 2021, marked by lower spending, could become one of the factors slowing down economic activity in the second half of the year, when the effect of support measures will begin to weaken.

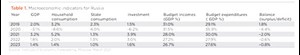

Government stimulus. The Russian economy has reacted well to various monetary and budgetary stimuli. With the exception of the oil and gas sector, and activities that were directly dependent on the epidemiological situation, in all other sectors the recovery of production and demand during first-quarter 2021 was quite active, Table 1. But, the reduction in the fiscal stimulus policy will, most likely, lead to a return to economic growth rates of 1.5–2%, as early as 2022–2023, after the recovery of oil production in 2021.

Effect of global factors. A slow and uncertain return of global demand for hydrocarbons to its 2019 level, and the IEA does not announce it until 2023, could become an additional factor limiting growth. Forecasts are based on an average price of oil (Brent) of $61–62/bbl for 2022–2023. Even if the price were to be around $70 in 2022, this would only push the growth forecast to 2%–2.5% per year, which is insufficient to guarantee a harmonious development of Russia.

Whether to stimulate demand. Of course, investment and consumer demand can support economic recovery. But who needs priority support? If consumer demand will pick up under the influence of large macroeconomic aggregates, then it would be natural to focus on supporting investment. So, the growth in income and demand of the population would be the end result of economic dynamics. However, there are strong arguments in favor of the growth of incomes of the population being a priority, which should become a necessary condition to overcome the consequences of the crisis as quickly as possible. Budgetary expenditure would have to be significantly higher than what is currently planned.

A sustained recovery in demand also would come from the presence of deferred demand from the population, low remunerations on bank deposits, and continued restrictions on travel abroad. In general, all of this is considered to offer a potential for household consumption growth of 5% or more. However, this growth in consumption may face structural constraints.

The potential for increased consumption by higher income population groups is limited. Even under conditions of a decrease in the attractiveness of deposits and other financial instruments, one can expect a rather limited increase in demand from this part of the population. A further restriction of internal demand may arise in the event of the opening of the external borders, due to notable progress in the field of vaccination.

Potential of consumer demand. The middle and lower income groups of the population, meanwhile, have retained significant growth potential in consumer demand. However, its implementation would require the continuation of measures guaranteeing the improvement of the lowest incomes. Actions of limited scope to increase wages in the public sector, or to expand the level of social support to low-income families, could become a necessary condition. This is especially true, if we keep in mind the consumption and income levels of 2013, which remain an objective whose achievement should become a guideline of social policy in the years to come.

The growth in demand would also make it possible to give more importance to production facilities that respond to domestic demand and to motivate investments in this part of the economy, which does not directly depend on the actions of the State. Fiscal policy choices will, therefore, be decisive in ensuring sustained growth during+ 2022 and 2023, and these choices should be made by summer 2021 and later.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Dallas Fed: Oil and gas expansion continues; cost pressures, supply-chain delays persist (November 2022)

- Digital transformation: Harnessing the power of data science (September 2022)

- Oil and Gas in the Capitals: Resupplying Europe: Questions (August 2022)

- Russian Regional Report: Isolation 2.0 (June 2022)

- The Last Barrel: What a difference a war makes (May 2022)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)