Shaletech: Bakken-Three Forks Shale

North Dakota regulators do not have to bother with haggling over state-sanctioned production cuts. Operators throughout the Williston basin are taking care of that on their own.

With the rig count at an all-time low, and some 6,800 wells (and counting) shut-in as of May, the epicenter of the Bakken-Three Forks shale play is feeling the full brunt of the price collapse, aggravated by the demand-sucking new Coronavirus. At the mid-year mark, the game plan for most operators is to simply survive 2020 and lay a foundation for a hopeful rebound in 2021, which includes the continual build-up of a drilled-but-uncompleted (DUC) well stockpile that stood at 898 wells as of April, according to the latest data available from the U.S. Energy Information Administration (EIA). The EIA counted a Bakken DUC inventory of 841 wells in January.

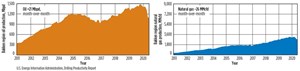

“We are choosing to store our oil in the reservoirs instead of producing at the netback prices being offered,” ConocoPhillips Co. CEO Ryan Lance said on April 16, echoing many of his contemporaries, who have shut down nearly a third of North Dakota’s active wells, Fig. 1. ConocoPhillips has suspended all completion activity, but the firm was still running two rigs in its 620,000-net-acre portion of the North Dakota-centered Bakken and underlying Three Forks shale that extend across Montana and into Canada.

The near-universal “keep in the ground” strategy is reflected in steadily declining production. According to the EIA’s best guesstimate, the Bakken region is expected to produce 1.114 MMbopd in June, down from 1.521 MMbopd delivered in January, Fig. 2. Associated gas production is forecast to dive from 3,174 MMcfd at the start of the year to 2,744 73 MMcfd in June.

Drilling, not surprisingly, has cratered, with a mere 14 rigs active the week of May 22, according to Baker Hughes, eclipsing the previous low of 22 active rigs in May 2016. In January, 52 rigs were at work in the Williston basin.

Despite the deteriorating climate, Lynn Helms, director of the Department of Mineral Resources (DMR), North Dakota’s chief regulator, said a suggestion to impose production restrictions “is a bridge too far at this point,” according to an April 21 Reuters report. There was little need to revive long-dormant proration, as most operators had already declared oil an economic waste at current prices and voluntarily closed off production. While Bakken pioneer Continental Resources Inc. ranks far atop the leaderboard in shutting down wells, Hess Corp. is taking a markedly different approach by keeping production flowing and storing mostly hedged crude offshore for sale later in the year.

Things were looking a bit better by late May, as the storage crunch eased, and oil prices began to creep up, albeit from negative territory, but remained well below what a Deutsche Bank analysis calculated as the average, $46.54/bbl/well, Bakken break-even cost. “We believe strongly that when the market returns to normal, we will see a multi-year horizon for vastly improved differentials for oil takeaway, from the slack capacity that will exist,” says Nicholas O’Grady, CEO of Northern Oil & Gas Inc., the basin’s largest non-operator.

Any improvement in the demand-price equation comes too late for once high-flying Whiting Petroleum Corp., which after producing 80,500 bopd over the second half of 2019, filed for bankruptcy protection on April 24. This came after Whiting laid out a 2020 program on Feb. 27 that called for three rigs, two completion crews and the drilling and completion of 74 and 78 net wells, respectively.

STATE MULLING HELP

The widespread shut-in of producing wells is certainly nothing new to Williston operators, given the wellhead freeze-offs that are all-too-common with the Arctic blasts that characterize the basin’s winters. The geological make-up and low water cut also make returning Bakken wells to service relatively straightforward, with little-to-no deleterious effect on estimated ultimate recoveries (EUR).

Wintertime curtailments, however, are typically brief, while the economic components of this iteration negate any timeline for restoring flow. In response, North Dakota officials are considering measures to help bring some semblance of economic health to distressed producers. The DMR’s newly created Bakken Restart Task Force figured the costs of returning an idled well to production, and meeting lease obligations, could range from $25,000 to $50,000/well, prompting regulators to consider a number of financial aid options, from regulatory and tax relief to low-cost financing.

Between its North Dakota and Oklahoma shale assets, Continental, for one, curtailed 70% of daily oil production in May, while cutting 55% of 2020 spending. Regardless, the operator is still planning to run two rigs, but zero frac spreads, in its commanding 797,000-net-acre Bakken leasehold for the remainder of 2020.

Prior to the wholesale shut-in, Continental’s Bakken production increased to 201,502 boed in the first quarter, up from 199,423 boed in the like quarter of 2019. “We can quickly bring this deferred production back online, once market conditions improve, and we will not see degradation in reservoir performance, as wells are brought online,” Executive Chairman Harold Hamm assured investors in a May 11 call.

Ironically, the self-described “America’s Oil Champion” is looking at gas to fill in some of the oil production hole. “In June, we intend to continue curtailing our oil production, selectively targeting sales that maximize our natural gas production to take advantage of the momentum in natural gas prices,” says CEO William Berry.

This follows the ongoing build-out of in-field processing, gathering and takeaway capacity (Fig. 3), driven in no small part by the state’s 88% gas capture regulation enacted to reduce flaring.

Pure play Northern Oil & Gas, likewise, sees keeping oil in the ground as the only viable alternative in today’s price climate. “Oil production is a depleting resource, and we do not want our wells producing, hedges or not, in an environment such as this,” says O’Grady. “We are carrying a record number of drilled-but-uncompleted wells waiting to be turned to sales. This means that we have a coiled spring of sorts, if and when, commodity prices improve.”

Compared to the final quarter of 2019, half as many wells were turned to sales in the first quarter. Nevertheless, first-quarter net production of 43,735 boed (34,488 bopd) was 28% higher than the same quarter a year ago.

Working under a non-operating business model, the company has provided no production estimates for the year, but said in a May 15 email that “severe discounts” forced its operating partners to increase curtailments in April, with May likely to see higher cuts. “We believe operators have cut so much supply, that in-basin pricing is now at a premium to the benchmark WTI (West Texas Intermediate), because literally there isn’t enough supply. Many operators have suggested June will be similar,” according to the statement.

With the majority of expected production hedged, Northern says less production in April provides a net benefit, as most of those volumes “likely would have carried negative or near-negative net margins.”

NEW SOP

A sampling of fellow operators shows that shutting down drilling, completions and active wells, and increasing DUC stockpiles, have emerged, for now, as the standard operating procedures throughout the basin.

Orintiv Inc. has suspended all drilling and completions on the 82,000 net acres it holds as part of last year’s acquisition of Newfield Exploration Co. While the shut-in volumes “move daily,” by mid-May the company had closed off roughly 65,000 boed of net production, of which about 25% is in the Bakken, according to a spokesperson.

The same for Equinor ASA, which has stopped all activity in the Bakken and Marcellus-Utica plays, its biggest producing assets outside Norway. Shut-ins aside, first-quarter oil production from the company’s 236,000-net-acre Bakken/Three Forks leasehold amounted to around 70,000 bpd. “We have shut in 15% of the wells in the Bakken, and we have a list of another 10% of wells that we will just run to failure, which means that when they need maintenance to be able to continue to produce, we will not continue that maintenance under the current price environment,” said Executive V.P. and CFO Lars Christian Bacher.

WPX Energy, Inc., shut-in an aggregate 45,000 bopd, gross, from its Bakken and Delaware basin assets in May, with similar curtailments seen for June. Before laying down all completion crews, the company completed 11 Three Forks and six Bakken wells in the first quarter, and is running a single rig to build up a DUC stockpile, in preparation for 2021.

The 85,000-net-acre Williston basin position averaged first-quarter production of 79,500 boed, up 26% from the 63,100 boed produced in the same period a year ago. Second-quarter first sales, however, will be limited to the wells completed prior to the release of the frac crews. “We plan to develop one to two quarters of DUCs, which is something that will certainly benefit us in 2021,” says Chairman and CEO Richard E. Muncrief.

Conversely, Marathon Oil Corp. had curtailed “very little production,” as of May 6, but had suspended all completions over the second quarter. First-quarter net production averaged 110,000 boed.

The company will transition to one rig and one frac spread over the second half of the year, when it plans to hook around 25 wells to production, all in the Myrmidon section of the 260,000 net acres it controls in the Bakken. “We plan to exit the year with a comfortable level of DUCs. That will give us some momentum and some optionality, as we head into 2021,” said Sr. V.P. of Operations Mike Henderson.

Oasis Petroleum Inc dropped all rigs and completion crews across its 408,000-net-acre asset and curtailed approximately 25% of Williston basin production in May, which was higher than the April curtailments. With conditions starting to improve, Oasis suggested on May 18 that it might be ready to bring some wells back online. “Oasis has significant flexibility to bring volumes back online quickly. In fact, Williston pricing has materially improved from where we were a month ago,” said President and COO Taylor Reid.

STORAGE AT SEA

Hess, meanwhile, opts to produce at near full-throttle today, in hopes of selling at appreciably higher prices tomorrow. Exploiting “firm transportation to the U.S. Gulf Coast,” Hess chartered three very large crude carriers (VLCCs) to store a cumulative 6 MMbbl between May and July, to be sold in Asia by the fourth quarter. The production is largely hedged at the higher Brent pricing benchmark.

“In Asia, demand for oil is already improving. So, it is possible that we sell the oil before the fourth quarter, depending upon market conditions,” says Sr. V.P. and CFO John Reilly.”But the point is, we’ve hedged it, we’ve locked it in and, basically, the fact that we used Brent-based pricing offsets the cost of the charters.”

Net oil production in the first quarter jumped 34%, year-over-year, to 114,00 bpd from 85,00 bpd. Total production was up, from 130,000 boed to 190,000 boed, attributed in part to higher gas captured and processed at the Little Missouri 4 plant that began operations in July 2019. Hess drilled 41 wells, completed 50 and hooked 37 to production in the first quarter.

The 2020 exit rate is targeted at around 175,000 boed from a 530,000-net-acre position that represents the company’s largest operated asset. Roughly 70 wells remain on the drilling calendar this year, with 110 new wells expected to go online. “We do not plan to build any DUCs,” said President and COO Gregory Hill.

Hess, however, has adjusted to current market conditions, dropping from six rigs to a single rig at the end of May. “We plan to stay at one rig until WTI oil prices stabilize in a $50/bbl range,” said CEO John Hess.

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)

- Machine learning-assisted induced seismicity characterization of the Ellenburger formation, Midland basin (August 2023)