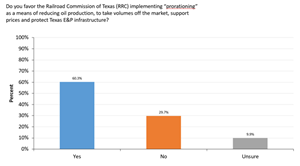

World Oil survey: Texas E&P professionals favor prorationing by wide margin

Railroad Commission of Texas (RRC) Chairman Wayne Christian’s sudden April 29 declaration against prorationing appears to run counter to what a majority of Texas E&P professionals would like the agency to do on May 5, according to results of a new World Oil survey. Among our Texas readership, 60.3% of them favor prorationing by the RRC. Just 29.7% are against it, and 9.9% are unsure.

The chairman factor. Late in the day on April 29, Christian published a long op-ed piece in the Houston Chronicle, detailing extensive thoughts and reasons that shaped his decision to say “no” to prorationing. The announcement was a surprise, given that Christian had said at the RRC’s April 21 meeting that he wanted a quickly formed Blue Ribbon Task Force—guided by six Texas oil and gas associations—to study the oil market situation as thoroughly as it could. The panel was supposed to keep all options on the table and then make recommendations back to the three commissioners closer to the RRC’s next meeting on May 5, when a formal vote on whether to prorate—as well as to implement any other remedies—is supposed to be held.

However, Christian’s op-ed announcement seems to have made the agency’s upcoming May 5 vote a moot point. Commissioner Christi Craddick has been considered an opponent, early on, of a prorationing remedy, while Commissioner Ryan Sitton has been a vocal supporter. As the swing vote, Christian now makes the outcome a likely 2-1 vote against prorationing. But if the agency does decide against such action, it will not doubt leave many Texas E&P professionals displeased, to say the least, based on our survey numbers.

Survey dimensions. During this week, April 27-May 1, World Oil surveyed just its Texas subscribers/ readers on their views of what the RRC should do, and 1,116 individuals responded to the full slate of questions. This survey covers a cross-section of companies, including majors, independents, equipment/service firms, drilling and workover contractors, and engineering firms and consultants. And the personnel responding from these firms include top executives, middle managers and rank-and-file engineers, geologists, geophysicists, etc.

Additional results. In addition to the basic concept of prorationing, we asked respondents whether they favor a 20% cut, as proposed by Sitton, or some other percentage reduction in Texas oil production. An even 50.0% said that they favor the 20% option, while another 14.4% said they would like to see a cut at a different level. There were 25.6% that reiterated that they don’t favor prorationing, while 10.0% were “unsure.”

We also asked Texas professionals whether they thought that any RRC prorationing needed to be done in coordination with other states and/or the U.S. federal government. Thus, 32.7% said they favor prorationing unconditionally. A slight plurality, 38.9%, said they wanted prorationing to be done in coordination with other states and federal officials. Another 23.7% remained against prorationing, while 4.7% were unsure.

Other potential actions. In addition to prorationing, the RRC has been looking at other actions that it could take to improve the oil market for Texas companies. We asked respondents if they would favor such actions, with or without prorationing. Accordingly, 43.4% said they would support additional measures, regardless of whether prorationing occurs. Another 14.8% will favor such actions, but only in tandem with prorationing. A further 10.0% said they would favor additional measures, only if prorationing is not implemented. There were 19.8% that are completely against any action, while 12.0% are unsure.

Task Force impressions. When asked about the effectiveness of the RRC’s Blue Ribbon Task Force, Texas professionals didn’t seem particularly impressed. Only 16.2% said they thought the Task Force could be effective and accomplish its mission in just two weeks. Another 29.1% said that the Task Force might be effective, but would be hampered by having only two weeks. A significant 43.1% expressed the belief that the Task Force couldn’t possibly accomplish its mission in two weeks and be effective. And 11.5% were unsure.

A pessimistic outlook on price behavior. Last, but not least, at the beginning of the survey, we asked respondents how much longer they think the E&P industry will be saddled with very low (below $40/bbl) oil prices. The most optimistic group, just 5.3%, said that they think low prices will last just one to three months. Another 16.5% believe that this period will last three to six months. But 29.3% think it will take six to nine months to get above $40, and a whopping 44.5% think that these low prices will be around for longer than nine months. Finally, 4.4% were unsure.

- Electric actuation in the Permian basin (July 2024)

- ESP challenges in an EOR project after breakthrough: An analysis of continuous improvement for ESP designs towards the reduction of OPEX (June 2024)

- Explaining sand erosion in oil and gas production (June 2024)

- Rethinking sand management for optimized production (June 2024)

- Leveraging artificial lift to optimize production (June 2024)

- New technology allays permanent magnet motor safety concerns, enables better ESP performance (June 2024)