Regional report: Russia

Russia offers no easy answers. Producing its rich oil and gas resources is confounded by a political landscape as complex as its challenging geography and geology. To increase production, the country is maximizing the potential of aging assets while developing offshore, Arctic and unconventional resources. But, it is constrained by obligations to OPEC, and the financial and technological barriers of U.S. sanctions.

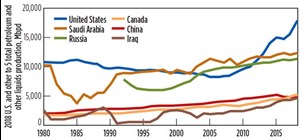

This all takes place in the context of its global production share. The country has led world oil production for more than a decade, neck and neck with Saudi Arabia’s relatively steady output rates. In 2018, the ranks were rearranged, as rapidly increasing U.S. crude oil production first exceeded Saudi Arabia, and in June and August surpassed Russia for the first time since February 1999, Fig. 1.

The lines crossed at about 10.7 MMbopd, with Saudi Arabia lagging at less than 10.5 MMbopd. That gap may grow. In January, Rystad Energy predicted that the U.S. may surpass 24 MMbpd by 2025, exceeding the combined production of both countries.

Russia’s gas production has been increasing steadily since the low of 611 Bcm in 2015, reaching 695 Bcm during 2018. Last year, Gazprom exported approximately 202 Bcm of gas, with most volumes heading to Europe, said Rystad Energy. Pipeline exports could reach 270 Bcm, as Gazprom increases its export pipeline capacity to Europe, Asia and the Middle East.

OUTLOOK

Oil production will grow in the short term, but declines in older fields must be offset with successful investment in discoveries and development, and advances in technology.

One should expect production gains while averaging 10.91 MMbopd this year, and increasing to 11.1 MMbopd in 2019, predicts Rystad. After that, active development of discoveries must minimize decline rates in mature fields.

Near-term increases will come from projects already in the works, with little impact from sanctions and technologies, according to World Oil’s sister publication, Petroleum Economist (PE). Beyond that, the outlook for oil production looks less optimistic because of rapid depletion of existing fields. PE predicts that by 2030, brownfield production is likely to decrease to 5.0 MMbopd. Maintaining current output levels after 2020 requires offsetting production declines with new production, developing conventional brownfields with hydraulic fracturing and tertiary recovery, creating technology for unconventional fields, and developing offshore fields.

PRODUCTION

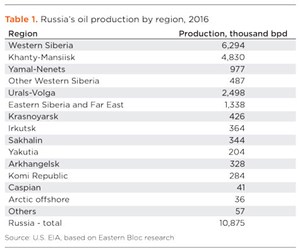

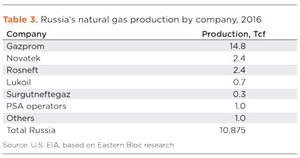

Most Russian oil production is from Western Siberia and the Urals-Volga regions, with increasing contributions from East Siberia, the Far East, and the Arctic, Table 1. Leading oil producers ranked by EIA’s 2016 data are Rosneft, Lukoil, Surgutneftegaz and Gazprom. They produced 74% of total daily production. Gazprom dominates gas producers at about 65% of daily production, according to Tables 2 and 3, respectively.

Current activity by top Russian oil and gas firms describes a broad effort to increase production and export capabilities. The mix includes onshore and offshore E&P, production processing and LNG facilities, transportation infrastructure, and investment in technology.

COMPANY ACTIVITY

Rosneft said that it increased proven hydrocarbon reserves 4% in 2018, to 41.431 Bboe, a gain of 1.524 Bboe. It attributed the growth to exploration operations, development of new fields and improved development performance in the Yuganskneftegaz and Nyagan-neftegaz regions, plus new projects in Eastern Siberian fields, Fig. 2.

In 2019–2022, the company said it plans to replace a minimum of 100% of produced hydrocarbons. The accelerated reserves development will be accompanied by speeding up project preparation, conversion of resources to reserves, and improving exploration drilling success rates.

LWD and testing technology for horizontal well drilling is the objective of an agreement between Rosneft and Bashnefte-geofizika. The company cites increasing volume and complexity of horizontal wells. Horizontal wells in 2017 were 36% of total drilling, and last year, multi-stage hydraulic fracturing increased 67% over 2017’s level.

Rosneft’s “2022 Strategy” is to increase high-yield horizontal wells by up to 40% by 2020, and to actively apply high-tech completion methods, including multi-stage hydraulic fracturing of both new and existing wells.

Geomechanics modeling software was unveiled in January. Roseneft said that it is the first industrial model of RN-SIGMA corporate software for geomechanics that is used for borehole stability calculation and risk reduction while drilling horizontal wells. The simulator was developed by Rosneft subsidiary RN-UfaNIPIneft, an R&D design institution.

An autonomous power generation center was completed this year, to provide power to horizontal drilling and processing operations in North-Komsomolskoye onshore field. The facility comprises mobile smart gas-turbine units with a capacity of 2,500 kW, each. Rosneft said the power generation is five times cheaper than diesel-driven generators.

Rosneft identified two additional Kara Sea appraisal well blocks as East Prinovozemelsky-1 and 2. Prior to U.S. sanctions, Block 1 had been worked with ExxonMobil under a 2011 agreement for joint development of the three East Prinovozemelsky blocks.

Production from Taas-Yuryakh Neftegazodobycha field in Eastern Siberia increased in 2018 to 2.9 million tonnes, more than twice the previous year. The gain follows commissioning of a second stage of oil production, preparation and transportation facilities, and the start of a multi-lateral drilling program featuring “fishbone” horizontal sidetracks, with total lengths of more than 5,000 m.

In Russkoe field, also in Eastern Siberia, 15 fishbone laterals or “downhole splitters” were drilled in 2018. The horizontal wellbores and laterals total over 16 km in length, increasing initial oil production by 20% to 30%, compared to conventional horizontal wells.

Over the past three years, the well design has resulted in a 30% increase in drilling speed and a 16% reduction in the drilling cycle, said Rosneft. More than 100 fishbone wells are planned.

Horizontal drilling is ongoing in Suzunskoe oil and gas field in Krasnoyarsk Territory, and an oil treatment unit and other construction are underway. The field, which has produced 10 million tonnes of oil since 2016, comprises 43 wells in nine cluster pads. Initial recoverable reserves are 61 million tonnes of oil and condensate, and 38 Bcm of gas. Discovery of oil in 1984 was key to development of the region.

Sanctions by the U.S. in 2017 led to ExxonMobil’s withdrawal from several joint ventures established with Rosneft in 2013 and 2014. The company continues as operator of the Sakhalin-1 project in the Far East.

Lukoil. In the Caspian Sea, Lukoil reported in April that a seventh well was completed from its second platform in Vladimir Filanovsky field. The field has 13 production and two injection wells. Phase three’s platform topsides were being readied for transport. Lukoil’s cumulative oil production from Russia’s northern Caspian fields exceeded 20 million tonnes in 2018. The company’s Caspian fields share a common production infra-structure, to which Vladimir Filanovsky field contributed 11.3 million tonnes of oil, Fig 3.

The third production well was drilled in the second-phase development of Yury Korchagin field. Stage 2 extends production into the eastern part of the field, and includes a multi-phase intra-field pipeline and power cable connections with the Stage 1 drilling platform. The field has 27 producing and six injection wells. Production from Rakushechnoye field is expected in 2020. Its fixed, ice-resistant platform, substructures and topsides are under construction, said Lukoil.

Gazprom announced full-scale development of Kharasaveyskoye field in a March ceremony highlighted by a call from Russian President Vladimir Putin. The field is described as the second-most important field (after Bovanenkovskoye field) in Gazprom’s Yamal gas production center.

Production start-up is planned for 2023. Estimated gas production from the Cenomanian-Aptian deposits is 32 Bcm/year. Later development is planned for deeper Neocomian-Jurassic deposits. While mostly onshore, the field also extends into the waters of the Kara Sea, and wells will be drilled into it from onshore.

The ceremony included the departure of the first truck convoy from Bovanenkovskoye field carrying construction and supporting equipment to Khraaveyskye field along a specially constructed seasonal road.

Drilling is expected to begin in 2020. Plans include 236 gas wells, a gas treatment unit, a booster compressor station, and transport and power infrastructure. A 106-km gas pipeline connecting Kharasaveyskoye and Bovanenkovskoye fields will be built and tied into Russia’s Unified Gas Supply System.

The arctic field is characterized by complex geocryological conditions, including thick permafrost and high soil salinity, which makes construction difficult. To avoid the risks of permafrost melting, the project will use vapor-liquid cooling systems, and wells will be constructed with heat-insulated tubing and casing. A closed-loop water supply system will help avoid soil and water pollution. The facilities will be equipped with special crossings for deer and wildlife migration.

The plant will make it possible to increase Russian LNG exports and raise up LPG exports by 30% to 40%. The production of ethane, which is in high demand in the domestic industry, also will grow substantially. The ethane produced at the plant is to be supplied to a proposed gas chemical facility with a capacity over 3 million tons of polymers per year.

The main field in Yamal now has all of its key facilities up and running, according to Gazprom. Bovanenkovskoye field’s third and final gas production facility, along with the Ukhta–Torzhok 2 gas trunkline, were commissioned in December 2018.

Gazprom Neft is seeking to ensure uninterrupted, year-round shipments of ARCO and Novy Port crude. The Gazprom subsidiary said its Kapitan Arctic-logistics management system collects a broad scope of data from daily production volumes at Novoportovskoye and Prirazlomnoye fields, and tracks the position and movement of vessels with regard to enroute ice conditions.

Drilling in Tazovskoye field has been completed, including record-length horizontal sections running more than 2,000 m. The field has reserves of 438 million tonnes of oil and 186 Bcm of non-associated and gas-cap gas, said Gazprom Neft. Along with Severo-Samburgskoye field, it is the basis for development of a major new oil production cluster in Yamal.

Thirteen wells were drilled in 2018. Two were multi-lateral wells, with laterals exceeding 2,000 m. Gazprom Neft said the wells are comparable to offshore wells in their uniqueness and complexity. The operations used high-torque drilling equipment not typically used in standard drilling, Fig. 4.

Full-scale development of Tazovskoye field started in 2019 and there are plans to ultimately drill 132 oil and 10 gas wells. Well plans this year include laterals up to 2,500 m, plus three multi-lateral wells will use “fishbone” designs. The commissioning and start-up of commercial development is set for 2020, and peak production is forecast at about 2.1 million tonnes by 2021.

A record-setting multi-lateral “fishbone” well comprising eight sidetracks was constructed in Vostochno-Messoyakhskoye field, Russia’s northernmost onshore field, said Gazprom Neft. The well has a total length of 9.1 km and a 5.1-km lateral. The fishbone design is common in the field, where it can increase well productivity by 40% over traditional horizontal wells. Last year, 131 wells were constructed, and one in four used the fishbone design. Another 25 similar wells are planned for 2019. Total oil production from the field in 2018 reached 4.5 million tonnes.

Gazprom Neft said it successfully tested eight new drilling and downhole treatment technologies for developing non-traditional hydrocarbon reserves in the Bazhen shale formation of the Western Siberian basin. Ten wells in Krasnoleninsky field were completed in 2018 with commercial oil flows. Seventy frac stages were pumped last year at about 15 stages per 1,000 m.

Gazprom Neft said lead times for drilling the wells have been reduced from 47 to 35 days, and the time spent on each stage has been halved, from 48 to 24 hr. Stages are expected to increase in 2019 to 30 per 1,500 m.

Shale production from the formation was established in 2015 with two wells in Priobskoye field. The nearby Krasnoleninsky field, proven about the same time, is where new multi-stage fracing technologies are being developed. Gazprom Neft said they include a hydrocarbon-based borehole flushing fluid that is less reliant on pressure and temperature reductions; rotation cementing with elastic cements; high-speed, high-volume injection technologies; and pump-down, composite wireline plug technology.

The advances also include the ROST-MULTIFRAC software suite, developed last year by Gazprom Neft in conjunction with the Moscow Institute of Physics and Technology (MIPT). The fracing simulator supported all of the calculations and modeling for each of the 10 wells drilled in 2018, said the company.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)