BP deploys drilling automation package on Alaska’s North Slope to decrease connection times, improve safety and efficiency

Drilling automation is arguably the oil and gas industry’s most talked-about subject, with a multitude of papers and articles written to discuss the topic and committees formed to explore its relevance and potential. Much has been said of the value of linking surface rig equipment with downhole sensors and real-time predictive models to enable optimized drilling, and that value will be taken a step further as more and more aspects of well construction are automated.

The path to this point has not been without struggle, as financial, operational, and cultural issues have challenged drilling automation’s ability to deliver the results necessary to justify the investment. Companies across the board, from operators and drilling contractors to service and manufacturing companies, have worked to develop some form of drilling automation, but uptake has remained slow over the past several years due to budget cuts, substantiated by the industry’s risk aversion to such a sweeping, non-traditionally linear, integrative technology change. As the industry has slowly emerged from the downturn, however, the business of drilling a well has begun to shift.

THE NECESSITY OF AN UNBIASED TECHNOLOGY INTEGRATOR

Two things have become increasingly clear as the industry has shifted and grown over the past decade. First, it has become clear that no single company has acted as a true technology integrator—a company that will take risks, capital or otherwise, to redefine a business that has typically evolved very slowly, conservatively, and traditionally—but that such a role is a critical necessity to help facilitate industry-level progress. Second, companies that establish a new type of paradigm for industry growth must be able to overcome historical perception and clearly position themselves as adopters of new technology.

To move beyond the typical limiters of drilling automation, the industry must buy into the idea that this is not just a solution to be implemented on a project-by-project basis. In short, drilling automation has no beginning, middle, or end; it is an actual way of optimally conducting business in 21st century oil and gas markets. The oil and gas industry is generally slower to adopt new technologies than other industries, and many of the technologies the industry does ultimately adopt are still not as advanced as those of other industries. Understanding and accepting this truth is the first step to moving forward and accelerating growth in meaningful ways.

Working within the bounds of the standard technology life cycle and understanding how the products and technologies will move beyond the research and development phase and into maturity (and commercial viability) will also help companies on all fronts to maximize the return on investment when implementing automation. This will occur simultaneously as the implemented systems provide the greatest possible benefit to the industry, redefining well construction and driving a push beyond “knowledge hoarding” to advanced, product-focused integrated technology ecosystems.

National Oilwell Varco (NOV) has acted as a first-mover technology integrator in drilling automation while recognizing the need to surmount the industry’s hesitance to implement fully automated systems. This article explores NOV’s drilling automation initiative and a recent project, which has seen the broadest and most successful implementation of the automation package to date, with BP Alaska and Parker Drilling. It is a multi-business story, with nine groups from within NOV—covering everything from rig equipment to wellbore technologies—unified via a strategic services delivery team to ensure the results achieved justified the operator’s investment in automated drilling.

THE AUTOMATION VALUE PROPOSITION: TECHNOLOGY IN SCOPE

NOV began developing a closed-loop drilling automation system several years ago to address the challenges of well construction in an industry that was increasingly adopting technology to accomplish its goals. This early version of the drilling automation system continued to mature as incorporated technologies were refined, new products were integrated, and project implementation revealed strengths and weaknesses. The culmination of this cycle of improvement was a closed-loop system that uses sensor output to control both the rig machinery and the processes performed via that machinery, creating an effective feedback loop where high-speed downhole data drives the decision-making and automation of the surface equipment. Closed-loop control of the machines ultimately enables drilling optimization, a sought-after value driver for operators.

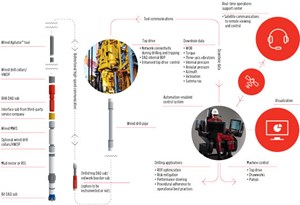

The full drilling automation system (Fig. 1) incorporates a host of intelligent applications that are designed to improve drilling performance. These applications reside in NOV’s drilling process automation platform, which is deployed in an NOV control system. The applications use various methods of data collection and algorithmic analysis to identify and address performance limiters, accomplishing everything from controlling downhole weight on bit (WOB) and mitigating stick-slip to identifying equivalent fluid density (EFD) in real time—in multiple drillstring locations—or optimizing mechanical-specific energy (MSE) parameters.

Data are collected with a downhole-drilling-dynamics sub and sent to the surface in real time via wired drill pipe, allowing the software applications to then interpret and analyze the data and distribute demands accordingly to the rig’s control system to adjust the functions of the equipment. Along-string measurement (ASM) tools round out the capabilities of the automation system by sending more precise measurements on borehole conditions, which enables downhole phenomena identification and drillstring dynamics management.

To better understand the potential of closed-loop drilling automation, one needs to better understand the financial due diligence that goes into drilling a well. Speed has been a main driver, as it has a clear impact on day-to-day financials in relation to how quickly the well is drilled. Drilling consistency and HSEQ management, which have less upfront financial impact but provide greater long-term benefits for drilling programs and operations, have typically followed.

Speed has been the most immediately visible component of the value proposition, often creating the false perception that speed is the most important value driver. However, pilot deployments have demonstrated the other two components of the value proposition—drilling consistency and HSEQ management—actually enable faster operation without sacrificing safety. This justifies requiring the operator to take a more balanced planning approach when assessing how drilling automation can assist them in accomplishing their business goals.

Speed—with the main objective being to reduce the time it takes to complete standard drilling activities—is measured across performance categories, from connection times to ROP, and is prioritized, due to the impact of speed on critical financial drivers like CAPEX, OPEX, and AFE. With speed as a main driver, the secondary concern becomes consistency. If increased performance can be achieved, how does the operator ensure that results are repeatable—can the technology, that is, be relied on to obtain similar results throughout the operation in a predictable fashion? HSEQ management completes the value proposition, with the understanding that improved HSEQ management is effectively improved decision-making.

This could be interpreted literally—with automated drilling processes taking personnel out of harm’s way in many instances—or with regard to identifying and mitigating harmful drilling dysfunctions and downhole phenomena that impact both safety and performance. Note that in this model, HSEQ management being the final component in the hierarchy does not imply any lack of commitment to proper HSE practices by an operator, but rather a mindset toward the potential impact of drilling automation. To further this point, the bottom-line value proposition to the industry is a complete inversion of the time immediacy of each benefit within the three-pronged value proposition. When ordered according to organizational value, the order of the automation value proposition is HSEQ management, consistency, and speed.

With this project, BP was one of the first operators to rise above the drilling-speed-focused automation business model of the downturn, with HSEQ supplanting speed as the primary value driver. By taking the focus away from purely speed-based drilling improvements, the benefits of consistency and better decision-making were made clear. This essentially allowed BP to improve evaluation capabilities in both well planning and execution by seamlessly integrating lessons learned into every automated well program. Measurable benefits included: mitigation of downhole events, increased downhole and surface equipment service life, simplifying and continuously improving processes, strengthening competencies, managing costs, and maintaining open and honest reporting.

Beyond the obvious advantage of BP being an IOC—and having the time flexibility and capital allocation associated with that designator—the company also benefitted from having a culture that embraced innovation and recognized the comprehensive impact of the new technology to drive a step change if properly implemented. The role of Parker Drilling as a partner and technology enabler was also foundational to the success achieved, as drilling contractors in the oil and gas industry are the physical end-users of drilling automation technology as value contributors to their customers’ bottom lines.

CASE HISTORY

Background. The Alaskan North Slope hydrocarbon drilling area is a region located on the northern slope of the Brooks Range along the coasts of the Chukchi Sea and Beaufort Sea. Drilling for oil and gas in this environment has presented companies with significant environmental and operational hurdles, including sub-zero temperatures, heavy winds, advancing sea ice, flora and fauna sensitivity, fragile geological conditions, and stringent local regulations. Despite these challenges, BP has spent more than 50 years in Alaska, beginning with its first project in 1959.

In 1968, the company began to drill at the massive Prudhoe Bay oil field, which remains one of the most prolific fields in the United States. Beyond this accomplishment, Prudhoe Bay has also often served as a proving ground of sorts for new and innovative drilling techniques and technologies and is one of few onshore drilling areas regarded as relevant for drilling technology validation before taking them to offshore applications. Everything from multi-lateral drilling and enhanced oil recovery to coiled tubing and drilling automation has been deployed and, in some cases, pioneered in the field and integrated into BP and other major companies’ operations.

As time passed, it became clearer that improved efficiencies and technologies, as well as sound fiscal policy, would be necessary to maintain the competitive status of Alaska’s oil and gas industry without compromising safety. What has been called the “easy oil” is largely gone, and the resource-rich North Slope has become increasingly challenging and costly to drill. The remote location and extreme climate of the region contribute to the difficulty of both drilling and transporting resources, driving up the already-significant capital investment necessary to do business there.

In addition, the high cost of further development makes any prospect a risky endeavor, due to nonexistence of typical infrastructure. In their role as a technology pioneer and innovator—and to determine an economically sound option that would enable more efficient and safer drilling as well as leverage the benefits of digitalized drilling—BP partnered with Parker Drilling, NOV, and a third-party service company to deploy drilling automation for a multi-well pilot project.

In this landmark drilling project, NOV installed its drilling process automation platform along with drilling performance applications on Parker Rig 272 (Fig. 2), an Arctic-designed modular drilling unit controlled by an integrated rig control system. The platform was then combined with downhole tools and sensors using wired drill pipe telemetry. KPIs were set for the automation pilot to determine the success or failure of the systems, with the initial project objectives including the following:

- Evaluate the readiness of the drilling process automation platform for wider deployment across BP

- Evaluate the reliability of the wired drill pipe connection

- Evaluate the maturity of the drilling performance applications running within the automation platform

- Evaluate the impact of the technology suite in reducing well costs on the Alaskan North Slope.

The wells that were drilled during the pilot were two-section sidetrack wells that served as production replacement wells. A phased approach was decided upon for the project, which began by proving the automation platform’s system and application functionality on the first well. On the second well, the automation platform was used to optimize drilling parameters with surface data using performance drilling applications. Wired drill pipe with high-speed downhole sensors was added on the third well, and on the fourth, wired drill pipe was integrated with the rotary steerable system.

A wired underreamer was added on the fifth well, and by the sixth well no additional technology was specified. The goal then became moving into greater degrees of automation and iterative application usage while achieving consistency and repeatability. A challenge for all wells was balancing ROP to remain within pressure and wellbore stability boundaries. Ownership by both the BP Alaska Drilling Team and Parker Drilling was key to the success of the project, as was ongoing technical support from the BP Central team in Houston, Texas.

Equipment/technologies. The following integrated suite of NOV automation technologies was used on this project:

- A drilling process automation platform that sits on top of the rig’s base-level control system. The platform uses an imported well plan that describes desired drilling parameter ranges, performing the planned operations until total depth is reached. On this project, exceptions to this (i.e., non-automated processes) included pipe handling while in slips, (i.e., torqueing and untorqueing connections), tripping, and BHA makeup and breakdown. In addition, the platform structures data and defines activities, which in this case enabled BP’s engineers to develop lessons learned and potentially scale best practices across other regions/

rig fleets. - Wired drill pipe, which incorporates a coaxial cable along the length of the drillstring from the rig sensors near the drill bit, and the wired pipe’s associated high-speed telemetry network, which uses inductive coils located in the drillstring connections to enable bidirectional data transmission between surface and downhole tools at up to 57,000 bits per second.

- An autonomous, two-parameter autodriller that uses surface WOB and rotary RPM to minimize surface MSE and maximize ROP. Advanced capabilities on this project added the ability to use high-speed downhole vibration and MSE to optimize surface parameter selection. Incorporating the downhole portion of the technology also allows the user to weigh the relative importance of the determined parameters—in this case, ROP versus MSE versus downhole vibration management.

- An autonomous, real-time downhole autodriller application that automatically accelerates and decelerates the drawworks by adjusting surface WOB to maintain a desired downhole WOB, specified by the driller.

- A stick-slip prevention software that uses automated vibration dampening to mitigate torsional vibration and reduce stick-slip oscillations during drilling operations.

- An enhanced measurement system (EMS) tool, placed on the bottom of the wired drillstring, that acquires high-frequency downhole data on WOB, torque on bit, bending, rotation, three-axis vibration, annular pressure, internal pressure, and temperature.

- A collar-based ASM tool that provides streaming visualization of downhole data when connected to the wired drillstring, acquiring data on three-axis vibration, temperature, annular and bore pressure, and rotational velocity in real time.

- A real-time visualization application that tells the story of the annulus—the four-dimensional health of the wellbore—by displaying surface parameters, equivalent circulating density (ECD) in a heat map, interpolated ECD at the shoe, and vibrations.

RESULTS

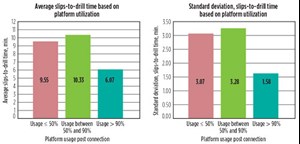

BP achieved time reductions using the drilling process automation platform, performance drilling applications, and wired drill pipe. Using the platform, BP saved approximately 4 min. per intermediate hole-section connection and 2 min. per production hole-section connection, when compared with relevant offsets. Weight-to-slip sequences showed comparable results between the driller and the platform in delivering the sequence, but much less interaction with the drilling control system was necessary. This meant that the driller could focus more on analytically supervising and managing the overall drilling operation versus manually performing each sequence.

Slip-to-weight sequence performance showed that the platform was faster than the driller’s manually controlled functions in executing the sequence, which led to several hours of time-savings throughout the program, Fig. 3. Additionally, the system was significantly more consistent than the driller’s manually controlled functions during each step of the process. As variations in human performance were a given, consistency was desirable due to the potential of the system to manage operational events (such as starting the pumps) and potentially prevent a major NPT event in unstable openhole scenarios.

The platform achieved a connection-time, standard-deviation reduction from 8 min. to 2 min. or less, with time reductions exceeding 75% in some cases. Vibration management during slips-to-drill and drill-to-slips sequences were also kept at low levels by the platform, helping to prevent premature bit/tool wear and extending run length.

Wired drill pipe saved time in both surveys and downlinks, with the most substantial result being the effective elimination of all flat time and invisible lost time related to downlinking. The addition of wired drill pipe telemetry eliminated the need to use mud-pulse telemetry to send downlinks to the BHA, allowing 5.5 min. to be saved per off-bottom downlink. This measurement includes the time taken to pick up, send the downlink, and run back to bottom. The real-time downlink, made possible by the high speed of the telemetry network, also provided uninterrupted data to surface during downlinking, while mud-pulse downlinking creates a period without receiving data from the downhole tools.

Achieving desired toolface in real time was made possible by high-speed telemetry transmission when drilling with a mud motor and setting whipstocks for sidetracked wells, which was a significant benefit to both the directional drillers and the operations teams. Surveying was also improved by using the wired drill pipe. The northern location of the project, combined with complex well trajectories and well proximity in a mature field, meant that multiple surveys were often required, adding 10 min. or more of wait time per stand.

With wired drill pipe, the process was effectively identical, but the surveys were available much faster—approximately 20 sec after the pumps were at tool-operating flowrates. These activities, when done via the drilling process automation platform, were completed in 2.5 to 3 min. less per survey versus surveys done with mud-pulse telemetry. The wired drill pipe telemetry achieved network uptime—measured as the percentage of wired drill pipe uptime versus the amount of time the wired pipe was connected to surface—of more than 99%, exceeding BP’s expectations across more than 48,000 ft and 800 hr of on- and off-bottom drilling time.

The drilling performance applications that were integrated in the process automation platform and wired drill pipe network functioned in harmony to tailor the operation of two key surface machines to the drilling application while on bottom: the top drive and drawworks. The stick-slip prevention application, which was run almost always when in rotary drilling mode, was able to consistently prevent the torsional vibration fundamental frequency from manifesting and becoming an excitation source for the drillstring. The dual-parameter and DWOB autodrillers (Fig. 4) were able to consistently reduce MSE versus offsets, and in formations that were not performance-limited by ECD or formation concerns, ROP increases of 10 to 50% were consistently seen.

The EFD viewer also proved to be an invaluable tool to assess hole cleaning in real time and help mitigate the negative impact of a stuck-pipe event. The EFD viewer allowed much faster root-cause analysis than if only traditional telemetry speeds were available and had far greater visibility than what was provided by only a single MWD placement. Unique to this application, wellbore breathing was a high-risk phenomenon that was traditionally time-consuming to diagnose and characterize with typical pre-automation technology packages. The EFD viewer’s capability to illustrate a multi-node, four-dimensional “story of the annulus” allowed rig crews and drilling engineering teams to much more quickly—and much more reliably—identify and mitigate wellbore breathing events. The EFD viewer (Fig. 5) also proved valuable in helping to optimize tripping speeds by allowing the calibration of the customer’s tripping speed models in real time, leading to substantial time savings in areas where tripping speed models were conservative.

All results were underpinned by procedural adherence through automation. Once the automation system was implemented, not only could historical precedents and standard operating procedures be guaranteed, but new lessons only had to be learned once before they could be systematically implemented. This highlights the benefit of a system driving consistent procedural adherence rather than relying on variable human performance. In addition, all parties took forward lessons learned for future project work. Beyond KPIs, there were several critical elements that made the project a success.

First, there was a phased technology approach, starting with implementation of the drilling process automation platform and moving through drilling applications, wired drill pipe on the motors, and wired drill pipe on the RSS. Doing this helped ensure that the crew was not overburdened by having to use so many new processes and systems from the project’s outset. Secondly, front-end simulator training on each technology element helped familiarize the crew with these components before actual field use as part of the phased deployment. Third, NOV helped frame the expectation that BP, and more specifically the drilling engineering team, would be the owners and drivers of the project’s success, responsible for inspiring the team to achieve results and embrace the new technology.

CONCLUSION

Driving a paradigm shift in drilling automation demands that a transition occur and that technology integrators take a more consultative business approach. This transition must occur simultaneously with increases in adoption rates for automation technology, improvements in infrastructural support driven by growing regional implementation, and demonstrations of successful projects that prove value and continually lower the cultural adoption hurdle. In addition, companies must graduate from a project mentality and approach drilling automation as an easily implementable way of doing business. Moving forward, adopters in this space must ask the question: how will they weight their value proposition between performance, consistency, and HSEQ management?

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- Digital transformation: A breakthrough year for digitalization in the offshore sector (January 2024)

- Offshore technology: Platform design: Is the next generation of offshore platforms changing offshore energy? (December 2023)

- 2024: A policy crossroads for American offshore energy (December 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)