Shale drilling drove rig count gains in 2018

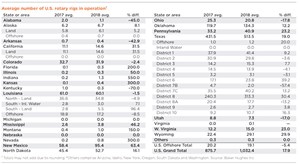

With crude prices rising during the first nine months of 2018, the U.S. rig count grew steadily, as production cuts by OPEC+ kept the shale plays humming. The total U.S. rig count exhibited an average 18% gain, from 876 working rigs in 2017 to 1,032 units during 2018.

Most of the growth in drilling that occurred during 2018 was concentrated in the nation’s major shale plays, like the Permian and SCOOP/STACK. Texas experienced an 19% average increase in rigs, from 432 units in 2017 to 514 units in 2018. Similar to last year, a large increase occurred in District 8, in the heart of the Permian, where the count of working rigs averaged 240 units in 2017, but increased to 313 in 2018. The largest percentage gain in Texas occurred in District 6, where drilling for Haynesville gas jumped 39% to 24 average units working.

On the New Mexico side of the Permian, the rig count skyrocketed 63%, from 58 rigs in 2017, to 95 units averaged in 2018. With operators gearing up to tap unconventional formations in Oklahoma, the rig count in the state jumped 12%, from an average 120 rigs in 2017 to 134 units in 2018.

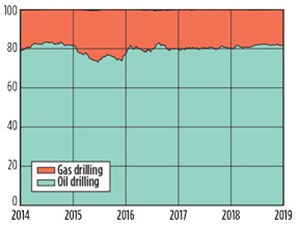

Other states with shale activity that encountered good percentage growth in 2018 included Wyoming, West Virginia, Pennsylvania and North Dakota. Shale play states that declined included Ohio and Colorado. Although activity in the Marcellus is slowing, the overall ratio of rigs targeting gas versus rigs drilling for oil remained fairly consistent, with 82% of rigs targeting oil, and 18% targeting gas.

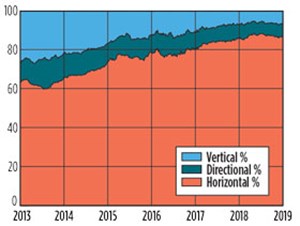

States that experienced annual declines included Utah, Texas District 7B and Louisiana. Another indicator of the shift toward shale drilling is the continuing dominance of horizontal drilling. During 2018, 87% of all wells drilled in the U.S. were horizontal.

The excessive expense and long start-up times required in deepwater GOM operations caused offshore drilling to drop 5% in 2018. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Rig electrification drives down emissions, bolsters efficiency while improving onshore drilling economics (October 2023)

- Mobile electric microgrids address power demands of high-intensity fracing (July 2023)

- Utilizing electronic data captured at the bit improves PDC design and drilling performance (July 2023)

- EOR/IOR technology: Advanced shale oil EOR methods for the DJ basin (May 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)