Maybe it’s a recovery. . .

Shhh… Don’t scare this thing off. After four years of declining drilling activity, permits are up, rig count is up, and there is cautious optimism afloat on a bubbling current of hallelujahs.

MARKET OVERVIEW

Oil prices, planning, and lots of cost-cutting are yielding positive movement in Gulf of Mexico activity, including the first rig count uptick in years. How much optimism is warranted varies, but at present, things are clearly looking up.

Drilling in the GOM should improve 7.7% to 140 wells, with an 8.3% gain in total footage this year, according to World Oil’s 2019 forecast. That bump follows four years of decline and is made particularly noteworthy—and welcome—after a 17% decline in 2018. However, even with efficiencies that have reduced break-even costs to $40/bbl, the outlook doesn’t foresee a meaningful resurgence in deepwater drilling during 2019 and, perhaps, early 2020.

Still, Wood Mackenzie says it expects U.S. Gulf of Mexico exploration activity this year to increase 30%, led by Shell and Chevron, with exploration growth from new entrants Kosmos Energy, Equinor, Total, Murphy and Fieldwood. Perhaps more conservative optimism was voiced by Bureau of Safety and Environmental Enforcement (BSEE) Director Scott Angelle, who observed that a 2018 uptick in deepwater drilling permits that his agency issues makes him optimistic for 2019 and beyond.

Outside U.S. waters, there is also room for optimism. In Mexico, concerns over the path that the new president might take are offset somewhat by a major new production initiative, a shallow-water lease sale, and the arrival of the massive Abkatun platform.

Even in Cuba, which continues to look at offshore production from the perspective of shore-drilled wells, there is anxious optimism over the potential shown by a new set of seismic data.

GOM NUMBERS

Daily average oil production from the U.S. federal GOM was 1.92 MMbpd in November 2018, ahead of Energy Information Administration (EIA) 2017 projections of 1.7 MMbpd in 2018 and 1.8 MMbpd in 2019.

A ranking of GOM operators according to production volume shows little change, although the number of companies is dropping. In 2018, BSEE counted 65 producers in the GOM. In order of oil production, the top four were Shell Offshore Inc. (114,111,623 bbl of oil; 184,113,607 Mcf of gas), BP Exploration & Production Inc. (109,701,796 bbl; 86,251,765 Mcf), Anadarko Petroleum Corporation (67,422,217 bbl; 58,215,334 Mcf), and Chevron U.S.A. (51,261,067 bbl; 29,772,044 Mcf).

There were 68 operators in 2017; the top four were BP, Shell, Anadarko and Chevron. In 2016, there were 72 producers, with Shell on top, followed by BP, Anadarko and Chevron. Back in 1996, the first, single yearly period listed by BSEE, there were 139 producers, and the top oil producers were Shell, Chevron and Marathon; BP was number five, and Anadarko was ranked 47.

A BSEE snapshot of deepwater drilling and workover activity in late January identified 41 active facilities, led by Shell with 10 active prospects, Anadarko with six and BP with four.

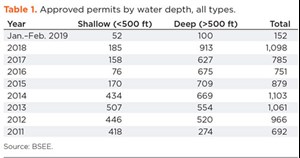

Approved permits for shallow and deepwater wells in the U.S. GOM increased to 1,098 in 2018, a gain of 313 over 2017, Table 1. That figure includes 913 permits in deeper water, up from 627 in 2017. Following that lead, the U.S. GOM rig count for January 2019 was 21 rotaries, up from 18 during January 2018. (The highest on record is 128 rigs in January 2001; the lowest is nine in August 1992.)

U.S. LEASE SALES

Two GOM lease sales were held in 2018, and two are planned in 2019. Lease sale 251 in August had 171 bids for 144 shallow and deepwater tracts from 29 companies, with high bids totaling $178.1 million. ExxonMobil acquired 25 deepwater blocks in the Desoto and Lloyd Ridge areas. BP acquired equity in 19 deepwater blocks. Lease sale 252 in March 2019 had 257 bids from 30 participating companies, with high bids totaling $244.3 million. Shell was the leading bidder, with 87 high bids for $84.8 million. Anadarko had 27 high bids for $24.1 million.

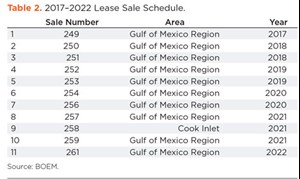

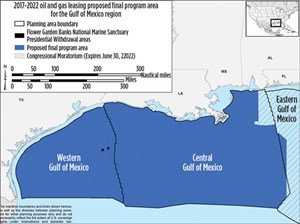

The 2017-2022 GOM leasing program includes 10 proposed sales—the 2017 sale, along with two sales, each, in 2018, 2019, 2020 and 2021, plus one more in 2022, Table 2. The sales are all in the Central and Western program areas, Fig. 1.

There are about 15.9 million acres of the U.S. OCS leased for oil and gas development (2,994 active leases) and 4.3 million of those acres (870 leases) are producing oil and natural gas. More than 97% of these leases are in the Gulf of Mexico; about 3% are on the OCS off California and Alaska.

U.S. OPERATOR HIGHLIGHTS

Shell operates five major deepwater and ultra-deepwater production hubs, three fixed platforms, numerous subsea production systems, and one of the largest contracted drilling rig fleets in the Gulf of Mexico. Production hubs are Auger, Olympus, Perdido, Ursa and Stones. Fixed platforms are Enchilada, Salsa and West Delta.

Recent projects include Mars B/Olympus, expected to extend the basin life to 2050 (Fig. 2); Cardamom, which pipes production through the upgraded 20-year-old Auger TLP; and the ultra-deep Stones facility, producing to an FPSO.

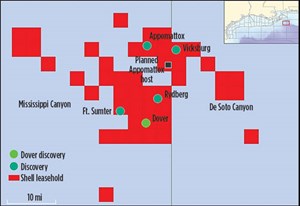

Shell’s Appomattox semisubmersible floating production system arrived onsite in August 2018, and production is expected to start this year. The largest floating platform in the Gulf of Mexico, it will initially develop Appomattox and Vicksburg fields.

A potential tie-back to Appomattox was presented in May 2018, with the Dover discovery (Fig. 3) drilled by the Deepwater Poseidon drillship. The Norphlet well, which encountered more than 800 net ft of pay is approximately 13 mi from the Appomattox host.

The Vito deepwater development, approved in April 2008, initiated construction and fabrication of a simplified host design and subsea infrastructure, aimed at a break-even cost less than $35/bbl. The redesign, started in 2015, has reduced cost estimates by more than 70% from the original concept, based on a simplified design and vendor collaboration on items including well design and completions, subsea, contracting, and topsides design. The field is expected to reach peak production of approximately 100,000 boed and has estimated, recoverable reserves of 300 MMboe.

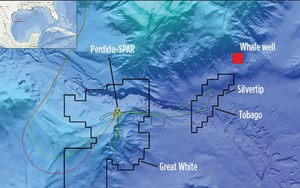

Shell is conducting appraisal drilling on its January 2018 Whale discovery, Fig. 4. The area is about 10 mi from Shell’s big Perdido platform and near leases recently acquired in Mexican waters. Shell says it is one of its largest U.S. GOM exploration finds in the past decade. The Whale well encountered more than 1,400 net ft (427 m) of oil pay.

Kaikias (Fig. 5) began producing in May 2018, one year ahead of schedule. It has an estimated peak production of 40,000 boed. Shell describes the development as “economically resilient” and points to cost-cutting of around 30% since taking the investment decision in early 2017. Expected break-even price is less than $30/bbl.

BP expects to grow production from a current 300,000 boed to approximately 400,000 boed through the middle of the next decade. Its expectations are based on start-ups that include the Thunder Horse Northwest and Thunder Horse South expansions, and the Thunder Horse Water Injection project. In addition, a second platform (Argos) at Mad Dog field is due to go onstream in late 2021. Also on the horizon are potential developments, Atlantis Phases 4 and 5, further developments at Thunder Horse, Na Kika subsea tie-backs, and Mad Dog field extensions.

Early in the year, BP announced a major expansion at Atlantis field and identification of significant new oil resources around its regional production hubs. The $1.3-billion Atlantis Phase 3 project is based on seismic imaging and reservoir characterization that has revealed 400 MMbbl of additional oil-in-place at Atlantis field. The company is using proprietary algorithms to enhance Full Waveform Inversion (FWI) seismic imaging and do a year’s worth of data processing in weeks. Application of the technology also has added 1 Bbbl of oil-in-place at Thunder Horse field.

Atlantis Phase 3 construction includes a subsea production system from eight new wells that will be tied into the current platform. Scheduled to go onstream in 2020, the project is expected to boost production at the platform by a peak estimate of 38,000 boed.

The Thunder Horse Northwest Expansion, started in October 2018, is expected to boost production to an estimated high of 30,000 boed and push total field output to over 200,000 boed. Following on two previous field expansions, the project adds a new subsea manifold and two wells tied into existing flowlines, 2 mi to the north of the Thunder Horse platform.

BP announced two Miocene oil discoveries, Manuel and Nearly Headless Nick, near the Na Kika production facility. The Manuel discovery will be developed via subsea tie-back to the Na Kika platform. The LLOG-operated Nearly Headless Nick discovery will likely be tied back to the nearby LLOG-operated Delta House facility.

The Argos platform’s hull and topsides for Mad Dog Phase 2 are under construction in South Korea, with production expected to begin in late 2021. The $9-billion development will produce up to 140,000 bopd through a subsea production system, comprised of up to 14 production wells and eight water injection wells. The existing Mad Dog spar is about 6 nautical mi from the Argos site.

Anadarko said its Horn Mountain facility continues to outperform expectations, with total facility gross oil production rates at the highest level in more than 12 years. A platform rig program was slated to start in early 2019, after completion of facility preparations last year.

Holstein drilled a third development well in late 2018. Platform rig work started in November 2017, and the first two wells went online in third-quarter 2018. First production from the Constellation development began in January 2019 as a tie-back to the Constitution spar. At Lucius in Keathley Canyon, the end of the year saw a second Hadrian North well completed. The project also completed the ninth producing well in the original Lucius unit.

Chevron started Big Foot production in November 2018 (Fig. 6), immediately after BSEE concluded its final pre-production inspection of the TLP. The project was delayed after technical difficulties involving the 16 mooring tendons during the initial installation in 2015. It has a capacity of 75,000 bopd and 25 MMcfgd.

Chevron has contracted a new drillship for GOM operations, starting in the second half of 2021. The vessel is one of two dynamically positioned ultra-deepwater drillships being built by Transworld at Jurong Shipyard in Singapore. The rig will be the first ultra-deepwater floater rated for 20,000-psi operations.

MEXICO PLANS BIG

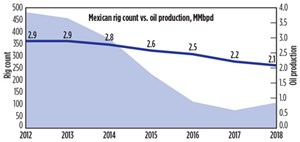

Oil-and-gas uncertainty has accompanied newly elected President Andrés Manuel López Obrador. A review of upstream contracts and leasing delays has cast a shadow over 2013 changes that allowed private companies to lease drilling rights. Still, there are positives that promote optimism, including an increasing rig count and an ambitious new injection of funding, Fig. 7.

Recent funding of offshore ventures has yielded rig count improvements, with 18 offshore rotaries working in December 2018, up from 12 in 2017, and down one from the previous month, according to the BHGE tally.

A new National Plan for Hydrocarbon Production may significantly boost drilling and other operations. Announced in December 2018, the program aims to stabilize production in 2019 and produce a “rebound” that will increase production in following years, said Pemex CEO Octavio Romero Oropeza. He observed, “The problem is so critical that today we are exploiting the same amount of oil as 40 years ago: one million, 730 thousand barrels of oil per day.”

The program will boost Pemex resources to 288 billion pesos ($15 billion) this year, almost 36% more than in 2018. The funds will go toward development of 20 new fields; 16 in shallow waters and four onshore. “We will have development, the likes of which we haven’t seen in many years,” said Oropeza.

Pemex said it will contract out of all marine infrastructure, including platforms, mooring, transport and installation, as well as pipelines. Drilling will be turnkey contracts, with Pemex providing engineering and supervision.

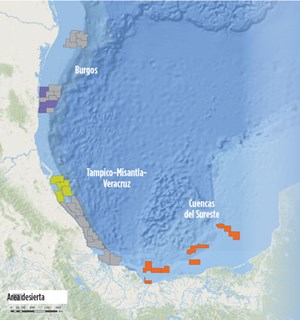

Lease sale. In its latest Round Three shallow-water lease sale in August 2018, Mexico offered 35 contract areas, divided into three sectors: Burgos, Tampico-Misantla-Veracruz and Southeast basins, Fig. 8.

Mexico’s National Hydrocarbons Commission (CNH) reported 18 bids representing 18 companies. There were 16 contracts awarded to 12 bids representing 14 companies. A breakout shows five proposals in four of 14 Burgos sector areas; four proposals in four of 13 Tampico areas; and 26 proposals in all eight Southeast basin areas. The contracts represent commitments to nine wells.

In the Burgos sector, winners were Repsol and Premier. Tampico sector winners included groups comprised of Capricorn Energy and Citala Energy; Pemex, Deutsche Erdoel and CEPSA; and Pemex and CEPSA. In the Southeast sector, winners included ENI and Lukoil; Pemex; Deutsche Erdoel, Premier and Sapura; Total and Pemex; Total; and BP and Pan American won contracts.

Prior to the shallow-water sale, Mexico’s January 2018 auction focused on deepwater acreage in 29 offshore contractual areas in the Perdido, Cordilleras Mexicanas, and Salina basin. There were 19 offshore blocks awarded to 11 companies.

Mexican activity

CNH in August 2018 approved Eni’s development plan for discoveries in Area 1 of Campeche Bay. Production start-up is planned for late 2020, using an FPSO with a capacity of 90,000 bopd. Three additional platforms are planned.

The Abkatun platform (Fig. 9) installation in the Bay of Campeche started in November 2018, and commissioning was planned for February 2019. Built by McDermott in its Altamira, Mexico, facility, the 16,534-ton (15,000 mt) structure is the largest Pemex platform built in a decade. Capable of producing 220,000 bopd and 150 MMcfgd, it will provide replacement and expansion capabilities to the existing Abkatun Pol Chuc facilities.

The $454-million engineering, procurement, construction, installation and commissioning (EPCIC) project was awarded to McDermott in June 2016. At sail-away ceremonies in November 2018, Governor of Tamaulipas, Francisco Garcia Cabeza de Vaca predicted that the historic Abkatun structure is the first of many more platforms to be built at Altamira.

In March 2019, German firm DEA said that it had completed its previously announced acquisition of Sierra Oil & Gas. The deal makes DEA one of the largest exploration acreage-holders in Mexico. It also gives DEA a significant stake in the world-class Zama discovery.

CUBAN SEISMIC HOPES

Cuba’s already challenged economy is facing additional pressure from events in Venezuela, on which it is still very dependent, and from building U.S. pressure on both countries. Offshore assets in the north are being exploited with onshore extended-reach wells. But recent seismic holds the promise of bigger things and deeper waters.

Chinese firm BGP Offshore said in December 2018 that it would begin commercialization of its new 2D marine seismic program. It acquired 25,000 km of high-resolution seismic around the island in 2017, Fig. 10. BGP said it anticipated planning for a bidding round that would soon put up 20 exploration blocks.

The seismic announcement was made at Cuba’s second Conference on Energy, Oil and Gas of Cuba. In addition to the anticipated lease sale, a key topic at the event was the potential for LNG operations, said Cuba’s Radio Rebelde website.

Cuba’s yearly oil production has been about 2.97 million metric tons over the past half decade, and gas production increased by 16% during the same period, according to a 2017 report by CubaTrade website. State-owned CubaPetroleo (CUPET) produces about 80% and Sherritt, the largest independent producer in the country, produces the balance under production sharing contracts. Production comes mostly from offshore fields drilled from shore.

Sherritt, a Canadian company, says it produced about 15,452 bopd gross working interest in 2016. Most production is from onshore extended-reach wells tapping four offshore fields in northern Cuba.

Australia’s Melbana Energy in December 2018 said it had acquired exclusive rights to the Santa Cruz offshore oil field, northeast of Havana under a long-term incremental oil recovery production-sharing contract. Located in the North Cuba heavy oil belt, the field was discovered in 2004, and in 2012 was producing 1,600 bpd from 18 wells. The Santa Cruz agreement with CUPET consists of an initial eight-month study period followed by an implementation phase, which includes a minimum program of two sidetrack wells from existing wellbores to new geological targets, Fig. 11. WO

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- Driving MPD adoption with performance-enhancing technologies (January 2024)

- X80 heavy wall pipe solutions for deep/ultra-deepwater field developments in mild sour environment (November 2023)

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Wellbore seal control and monitoring enhance deepwater MPD operations (October 2023)