Regional Report: Latin America Is Latin America’s fragile market cracking under pressure?

However, recent discoveries and licensing rounds have attracted a strong uptick in foreign investment, which could be the region’s key to economic resurgence.

|

| Left: PDVSA, Venezuela’s state-owned oil and gas company, has ambitious plans for the future, as it aims to reach 6 MMbopd by some time after 2019, despite its recent dropin output. Photo: PDVSA. Center: Repsol has been actively operating in Trinidad & Tobago since 1995, and holds rights to four offshore blocks. Photo: Repsol. Right: Last year,Wintershall launched its second operated pilot project in Argentina’s western Neuquén basin. Photo: Wintershall. |

ARGENTINA

Due to high inflation and declining production, Argentina is putting forth an effort to counteract the deterioration of its E&P sector. Since its 2001 default, caused by a severe economic recession, Argentina has worked to escape its financial crisis. The country, home to abundant shale reserves, has gone from a chief net exporter to a net importer of gas in recent years. To keep its energy industry above water, the government is promoting development of complex reservoirs.

Argentina’s largely undeveloped Vaca Muerta shale, in particular, is said to hold upwards of 16 Bbbl of oil and 308 Tcf of recoverable gas. The unconventional shale formation covers a very large area within the Neuquén basin. After numerous incentives were proposed by President Mauricio Macri last year, in an effort to reduce the high cost associated with development of unconventional wells, international oil majors and investors are showing more interest in the region.

Last May, Wintershall launched its second operated pilot project, spudding the first of three horizontal pilot wells in the Bandurria Norte Block, in western Neuquén. According to the company, its operations had, until now, been focused primarily on conventional reservoirs as a non-operator. The company, alongside partner GeoPark Limited (operator, 50%), discovered a new oil field in August. The Rio Grande Oeste 1 exploration well was drilled and completed to a 5,500-ft TD in the CN-V Block of Argentina’s Mendoza Province. GeoPark reported that early production tests showed a flowrate of 300 bopd and de-risked other delineated light oil prospects in the block.

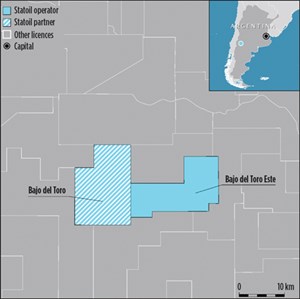

Several majors partnered with state-owned YPF last summer, to explore the coveted shale formation. Statoil and YPF (operator) entered an agreement to explore the Bajo del Toro Block of the Neuquén basin. Holding 50% each, the companies will jointly explore the 38,800-acre block in Argentina’s western region. Statoil was subsequently awarded the Bajo del Toro Este exploration license, situated east of Bajo del Toro (Fig. 1), in November. As operator, with a 90% working interest (Gas y Petroleo del Neuquén holds 10%), the major said it is committed to one wildcat within its four-year exploration period, beginning this year.

Additionally, a $1.15-billion joint investment in the Vaca Muerta formation was announced in July, after the provincial government divided the Aguada Pichana area into two sections and combined it with the Aguada de Castro area. YPF, Total, Wintershall and Pan American Energy agreed to the joint investment, which has Total operating the eastern part of Aguada Pichana with a 41% stake, while BP unit Pan American Energy operates the western part, as well as Aguada de Castro, with a 45% stake.

ExxonMobil is another active oil major in Argentina’s Neuquén basin. The company says that it has invested more than $500 million in the exploration and development of its Vaca Muerta assets since entering the region. In October, it announced that its investment plan for the development of resources in the Los Toldos I South Block, about 108 mi northwest of Neuquén City, had been granted government approval. The initial $200-million investment funds a pilot project that should put seven wells into production. It also will support construction of production facilities and associated export infrastructure.

President Energy—which holds a working interest and is the operator in the Puesto Flores and Estancia Vieja concessions, as well as the Puesto Guardian license and two exploration areas surrounding it—announced significant upgrades to its prospective resources in November, Fig. 2. According to a company release, results of an integrated basin study and geochemical survey showed aggregate Paleozoic gas/condensate prospects net to the company with mean unrisked prospective resources (MUPR) of over 7 Tcf, with an upside case of over 20 Tcf and 185 MMbbl of condensate. Additionally, results showed previously unreported Cretaceous oil prospects of over 40 MMbbl, MUPR.

Just a few months later, the company reported that its Neuquén basin 2P net reserves had increased 66%, from 4.82 MMboe to 8 MMboe, while its 1P reserves increased more than 30%, from 3.2 MMboe to 4.5 MMboe, since the assets were acquired. The success is a direct result of a successful four-well workover program at Puesto Flores. The company said that it expects further upgrades in reserves as it moves forward with its 2018 capex program.

VENEZUELA

Although it has some of the world’s largest oil and natural gas reserves, Venezuela has failed to retain its status as a top oil exporter in the Americas. When the industry downturn took hold in 2014, Venezuela’s financial situation was already precarious. Since President Nicolás Maduro took office in 2013, production reportedly has tumbled nearly 40%. Petroleum Economist (PE) reported that approximately 600,000 bpd of that decline took effect last year, as the nation’s economic depression continued to worsen.

This year, the situation is deteriorating even further. In the May 2017 issue of World Oil, we reported that Venezuela’s production rate had reached a low of 2.15 MMbopd. Since then, it has continued its unrelenting descent to a meager 1.5 MMbopd. The country’s production decline is now five times greater than the amount it pledged to cut in the October 2016 OPEC deal. According to EIA, the number of active rigs in Venezuela also has fallen, from about 70 in first-quarter 2016 to an average of 43 in the last quarter of 2017.

Until recently, production of extra-heavy crude from the Orinoco Belt was helping to keep Venezuela’s industry afloat. The belt, which is in Venezuela’s Guárico state, overlies some of the world’s largest petroleum deposits. Nevertheless, by the end of 2017, Orinoco output had fallen to a reported level of 882,000 bpd—a decline of more than 300,000 bpd from the year prior.

The drop in production could, in part, be due to reports that the quality of Venezuelan oil has been waning, as well. Refiners in the U.S. and Asia have reported issues in crude quality, including high salt and water content. In some cases, buyers have turned away cargoes entirely.

Moreover, the Venezuelan government initiated a comprehensive purge of PDVSA’s executive leadership last year, as part of President Maduro’s promise to temper corruption within the state oil producer. In a matter of months, more than 50 company officials reportedly were arrested, including former company head Nelson Martínez and ex-oil minister Eulogio del Pino. A number of officials at Citgo, PDVSA’s U.S. refining company, were detained as well.

Additionally, PDVSA’s operational and cash-flow issues continue to prevent the company from climbing out of debt. Although the company made multi-billion-dollar debt payments late last year, it reportedly still owes millions. To shore up its economy, Venezuela introduced its own commodity-backed cryptocurrency earlier this year. According to the government, each “petro” is backed by a barrel of oil and is sold at the same price. Despite the reservations of many, President Maduro said that the petro is sure to be “a total success for the welfare of Venezuela.”

PDVSA has ambitious plans for the future, however, and says it wants to increase Venezuelan crude production to about 6 MMbpd by 2019, of which 4 MMbpd are anticipated to come from the Orinoco belt. Additionally, the company’s national plan calls for a significant boost in natural gas production, up to 10.5 Bcfd by 2019. Also by 2019, it hopes to reach an export goal of 1.3 MMbopd to Latin America and the Caribbean, and 3.2 MMbopd to Asia.

BRAZIL

While much of Latin America’s energy sector is struggling, Brazil’s pre-salt layer remains a hotspot for explorers. The attractiveness of pre-salt blocks in the deep waters of the Campos and Santos basins helped bring in billions during the country’s latest licensing round. In late October, key E&P players, including Shell, Statoil and ExxonMobil, won PSCs for pre-salt blocks in the region.

As Latin America’s largest country, Brazil’s influence on the future of the international energy marketplace continues to grow. Accordingly, the country joined the International Energy Agency (IEA) as an association country in October, inserting itself into the global discussion on important energy policy issues. “Brazil’s experience shows that policies do matter,” said IEA Executive Director Dr. Fatih Birol. “It’s determined and ambitious long-term energy policies, developing deepwater oil resources and expanding biofuels output, set an example to countries around the world. As a result, our latest data shows that Brazil will become a net oil exporter this year, the first major consumer in recent history to ever achieve such a turnaround.” According to IEA, Brazil is on track to be a net exporter of nearly 1 MMbpd by 2022. This results from a reported 50% increase in oil production over the last 10 years, which can largely be accredited to the country’s budding deepwater sector.

Libra, one of the world’s biggest deepwater discoveries, began producing in November. Soon after, the Libra Consortium—made up of Petrobras (operator, 40%), Shell (20%), Total (20%), CNOOC (10%) and CNPC (10%)—affirmed commerciality of the oil accumulation in the northwestern section of the block, calling it Mero field. According to Petrobras, the newly-named field has an estimated recoverable volume of 3.3 Bbbl of oil. Plans for the development of Mero field, nearly 112 mi off the coast of Rio de Janeiro in the Santos basin, include four new production systems. According to Total, Libra production should reach more than 600,000 bpd in the coming years.

Statoil tripled its production in Brazil late last year, with the acquisition of a 25% interest in Roncador field in the Campos basin. The field is Petrobras’ (operator, 75%) third-largest producing asset, with approximately 10 Bboe, in-place, and an anticipated remaining recoverable volume of over 1 Bboe. During November 2017, it was reported that the field was producing about 240,000 bopd, in addition to about 40,000 boed of associated gas.

During Brazil’s 15th licensing round, Statoil, with several major partners, further strengthened its position in the deep waters of Brazil with winning bids for four blocks—C-M-755, C-M-657, C-M-709 and C-M-793—in the southern part of the Campos basin. Other key players, including Shell and ExxonMobil, also won deepwater blocks during the licensing round. Wintershall, however, bolstered its position in a big way, becoming the country’s fourth-largest producer with newly-awarded interests in seven licenses. As operator of four of those licenses, the company said the areas “show huge potential.”

Last month, Petrobras reported the start of production at Bùzios field, one of its principal pre-salt projects. The P-74 platform, situated about 124 mi off the coast of Rio de Janeiro, reportedly is the 13th platform to begin producing in the Brazilian pre-salt. According to Petrobras, the field’s potential for high output is cause for the four additional platforms that are planned through 2021.

GUYANA

Following a series of major discoveries by ExxonMobil, Guyana has become a highly sought-after region for explorers. As yet, Guyana has not been an oil producer. However, Wood Mackenzie says it anticipates that the country will be one of Latin America’s top producers by 2026, with an estimated output of approximately 350,000-to-400,000 bopd.

ExxonMobil’s Liza development, which holds resources between 2 Bboe and 2.5 Bboe, reached FID last June after positive results were reported from the Liza-4 well. The first phase of development will include a subsea production system and an FPSO vessel capable of producing 120,000 bopd. The field, which is approximately 118 mi offshore in the Stabroek Block, is expected to start producing by 2020.

ExxonMobil reported more success offshore Guyana in July, when its Payara-2 well encountered 59 ft of high-quality, oil-bearing sandstone, confirming a second giant field in the Stabroek Block. The positive well results increased Payara field’s estimated resources to approximately 500 MMboe.

By October, ExxonMobil had struck its fifth discovery offshore Guyana. The company’s Turbot-1 well encountered 75 ft of high-quality, oil-bearing sandstone within the southeastern part of the Stabroek Block. The well, situated about 30 mi southeast of Liza, was drilled to a depth of 18,445 ft in 5,912 ft of water. “ExxonMobil continues with its successful exploration campaign offshore Guyana with the discovery of Turbot. This shows that deep water can still be attractive. After [this] announcement, ExxonMobil’s Liza and Payara complex might approach the 2 Bbbl mark in commercial reserves,” Pablo Medina, Wood Mackenzie’s senior analyst, said in a release. “ExxonMobil’s Latin American footprint has increased significantly with its recent streak of discoveries in Guyana and its aggressive bidding in Brazil’s latest licensing round.”

In January, Exxon’s sixth Stabroek Block discovery was reported. The Ranger-1 exploration well encountered about 230 ft of high-quality, oil-bearing carbonate reservoir, after it was drilled to a depth of 21,161 ft in 8,973 ft of water. “This discovery proves a new play concept for the 6.6-million-acre Stabroek Block, and adds further value to our growing Guyana portfolio,” Steve Greenlee, president of ExxonMobil Exploration Co., said in a release.

Just one month later, the oil giant—along with partners Hess Guyana Exploration Ltd. (30%) and CNOOC Nexen Petroleum Guyana Limited (25%)—reported its seventh discovery in the Stabroek Block, at the Pacora-1 exploration well. The well, which was drilled approximately 4 mi west of the Payara-1 well, encountered about 65 ft of high-quality, oil-bearing sandstone reservoir. It was drilled to a depth of 18,363 ft, in a water depth of 6,781 ft. According to the company, it will be developed in combination with Payara field, helping to bring Guyana output to more than 500,000 bpd.

MEXICO

E&P activity in Mexico has seen a dramatic decline of late. As the country’s drilling activity hit record lows last year, its proven reserves have been shrinking consistently. Energy reform in Mexico, however, has ended a 75-year state monopoly in the oil and gas sector, and has shifted the nation’s attention to attracting private capital and technical expertise that could help rebuild Mexico’s ailing economy.

During this year’s CERAWeek in Houston, Pemex CEO Carlos Treviño said that “the new name of the game, for Pemex, is ‘partnerships.’” Through an aggressive farm-out strategy, the company aims to lure foreign investment through a series of asset auctions that will, with any luck, help reverse the country’s output decline.

In January, Mexico awarded 19 deepwater blocks to oil majors, including Shell and Eni, reportedly bringing in billions of dollars’ worth of investment. In March, Mexico offered 35 shallow-water areas, which will be followed by an auction for 37 onshore developments in July. Overall, the country is expected to offer more than 100 permits to oil majors before its July election, when President Nieto’s term ends.

With its large-scale energy reforms, Mexico became the IEA’s first Latin American member country in February. “It is a historic day, because we welcome our first Latin American member country, with more than 120 million inhabitants, an important oil producer, and a weighty voice in global energy,” IEA Executive Director Dr. Fatih Birol said. “The ambitious and successful energy reforms of recent years have put Mexico firmly on the global energy policy map.” Mexico is the association’s 30th member.

Efforts to revive Mexico’s E&P industry showed progress last year, when Talos Energy reported a significant discovery in the shallow waters of the Sureste basin. The Zama-1 exploration well, situated about 37 mi from the Port of Dos Bocas, reportedly was Mexico’s first well to be drilled by the private sector. It reached an initial TVD of about 11,100 ft, encountering a contiguous gross oil-bearing interval of more than 1,100 ft, with 558–656 ft of net oil pay in Upper Miocene sandstones. “We believe this discovery represents exactly what the energy reforms intended to deliver: new capital, new participants and a spirit of ingenuity that leads to local jobs and government revenues for Mexico,” Talos President and CEO Tim Duncan said in a release.

According to the company, initial gross original oil-in-place was estimated between 1.4 Bbbl and 2 Bbbl, which exceeded pre-drill estimates. Following the installation of a liner, Talos says it plans to drill deeper prospects in pursuit of Zama Main and Zama Deep targets.

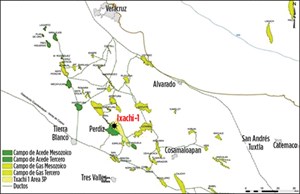

Mexico’s E&P sector continued to make headlines, when Pemex reported the country’s largest onshore discovery in 15 years in November. The Ixachi-1 well (Fig. 3), 45 mi south of the Port of Veracruz in the Veracruz basin, showed an original volume of over 1,500 MMboe, representing total reserves of about 350 MMboe. The reservoir’s close proximity to existing infrastructure reinforces its economic value further.

COLOMBIA

Canacol Energy and GeoPark are two of Colombia’s most active operators. Last year, Canacol identified a new commercial shallow gas play in the Lower Magdalena basin, after an exploration well tested at a combined rate of approximately 8,123 boed. The Toronja 1 exploration well, drilled to an MD of 7,200 ft on the VIM 5 Block, was the company’s eighth consecutive gas discovery in the basin. It was reportedly being tied into the Jobo gas processing facility, just south of the discovery.

Soon after, the company reported its ninth discovery. Its Pandereta 1 exploration well encountered 149 ft of gas pay in the Lower Tubara, Cienaga de Oro (CDO) and fractured basement reservoirs. Less than two months later, in December, the Canadonga-1 well reportedly encountered 32 ft of net gas pay in the CDO reservoir, confirming Canacol’s tenth consecutive discovery in Colombia’s Lower Magdalena basin. The Pandereta 2 appraisal well confirmed that the finds were of significance, encountering twice the amount of net gas pay of the Pandereta discovery well.

In September, GeoPark reported a new oil field discovery of its own. After drilling the Curucucu 1 to a TD of 14,600 ft, production tests resulted in a production rate of about 1,700 bpd. While the well was drilled from an existing well pad in the recently discovered Jacamar field, it reportedly is on a new fault trend to the east of the Tigana/Jacana fault trend, contiguous to Jacamar field. The company says the find marks its 11th discovery in the Llanos 34 Block since acquiring it in 2012.

The company saw recent progress at Tigana/Jacana, as well. Oil shows at the Tigana Norte 3 and Tigana Norte 4 appraisal wells indicated the potential for hydrocarbons in both the Guadalupe and Mirador formations. “With the success of these recently-drilled new wells, GeoPark has moved into becoming the third-largest oil and gas operator in Colombia, with more growth on its way,” CEO James F. Park said in a release.

TRINIDAD & TOBAGO

BP Trinidad & Tobago (BPTT) and Repsol are two of the most active operators in Trinidad & Tobago, the southern Caribbean’s twin-island state.

One of BP’s largest upstream projects of 2017, the Trinidad Onshore Compression (TROC) project started up in April. The facility, which reportedly has the potential to deliver about 200 MMscfd, is expected to improve production capacity by increasing output from low-pressure wells in BP’s existing Columbus basin acreage through an additional inlet compressor at the Point Fortin Atlantic LNG plant.

Later in the year, BP announced first gas from the Juniper development, the company’s first subsea field development in Trinidad. The facility produces gas from Corallita and Lantana fields via the Juniper platform, approximately 50 mi off of Trinidad’s southeast coast. Gas from Juniper’s five subsea wells flows to the Mahogany B hub via a new 6-mi pipeline. The project reportedly boosted BPTT’s gas production capacity by approximately 590 MMscfd.

BPTT also announced last year that its Angelin gas project was sanctioned. The project will include the construction of a new platform about 37 mi off of Trinidad’s southeastern coast, as well as four wells with a production capacity of about 600 MMscfd. Gas from the project will flow to the Serrette platform hub via a new 13-mi pipeline. According to BPTT, drilling is scheduled to begin in third-quarter 2018, and first gas is anticipated in first-quarter 2019.

Repsol, with BPTT, reported the discovery of its largest gas volume in five years. The Savannah and Macadamia exploration wells uncovered approximately 2 Tcf of gas in place. Savannah was drilled into an untested fault block of the Columbus basin, east of Juniper. Likewise, Macadamia was drilled to test exploration and appraisal segments below the existing SEQB discovery, which is situated 6 mi south of the producing Cashima field, in the Columbus basin. Both reservoirs will be tied back to the Juniper platform. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)