U.S. output builds on OPEC cutbacks, gas rides LNG expansion

Shale operators are increasing U.S. crude production in response to oil prices that are, so far, trending more favorably this year, due largely to decisions by OPEC and Russia to curb production. Natural gas output also could bump higher, as the U.S. continues to develop its capacity to export LNG.

Crude oil. Brent and WTI prices have risen substantially since January 2017, from around $50/bbl to $55/bbl in the early part of last year, to around $60 to $70/bbl in the last two months. A major driver for this is the sustained effort by OPEC and Russia to continue with oil supply cuts into the foreseeable future, although shale oil production has trended upward, along with oil prices.

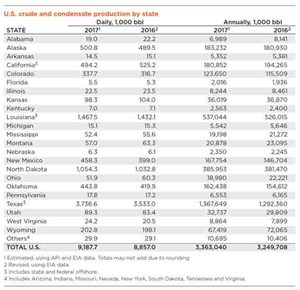

Annual U.S. crude production increased about 3.5% from 2016 to 2017, and the growth was driven by greater shale activity, most notably in the Permian basin. In Texas, annual oil production grew about 6%, to 1.368 Bbbl, and New Mexico experienced an estimated 14% gain, to 168 MMbbl. Outside of the Permian, other shale plays with growing production include the SCOOP/STACK of Oklahoma and Colorado’s Niobrara. Oklahoma’s annual production increased about 11% during 2017, to about 162 MMbbl, while output grew by 7.2% in Colorado, to about 124 MMbbl.

By contrast, production dropped in many states that are dominated by conventional oil activity. Annual production in Alabama, Arkansas, Kansas and Mississippi dropped about 4%—an obvious indicator that most new capital is being steered toward unconventional plays.

Natural gas. Though natural gas pricing has been more volatile in the past year, the Henry Hub spot price spiked from a low of about $2.600/MMBtu in December 2017 to a high of about $3.200/MMBtu in January 2018. Demand for natural gas energy is expected to remain steady, as the U.S. prepares to increase its LNG export capacity. The U.S. has one export facility, the Sabine Pass terminal in Louisiana, but at least two new LNG export facilities are planned to launch during 2018.

As long as free trade of energy between the North American countries remains intact, the U.S. will increase its supply of natural gas via pipeline to Mexico. Net exports of U.S. natural gas are estimated at 0.4 Bcfd in 2017, up from net imports of 1.8 Bcfd in 2016, according to the U.S. EIA. Marketed gas production was 80.8 Bcfd in October 2017 versus 75.8 Bcfd in October 2016. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)