U.S. oil, gas reserves see modest decline

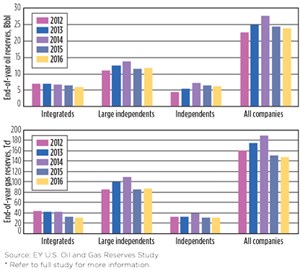

According to EY’s U.S. Oil and Gas Reserves Study, U.S. oil reserves saw another decline in 2016. The 500-MMbbl decline represents a mere 2% drop, from 24.4 Bbbl to 23.9 Bbbl. The study is a compilation and analysis of oil and gas reserve disclosure information submitted by publicly traded companies in their annual SEC (U.S. Securities and Exchange Commission) reports. It surveys the 50 largest companies based on their 2016 year-end oil and gas reserve estimates, and includes condensate and natural gas liquids.

The U.S. Energy Information Administration (EIA) says proved reserves are defined as estimated volumes of hydrocarbons that analysis of geologic and engineering data demonstrates, with reasonable certainty, are recoverable under existing economic and operating conditions.

Oil. Extensions and discoveries decreased 13% in 2016. According to the study, Chesapeake Energy and Marathon Oil had the largest-recorded extensions and discoveries, with 280.2 MMbbl and 243.0 MMbbl, respectively.

Participating companies reported additional downward reserve revisions of 0.9 Bbbl in 2016, which is mild compared to the 4.2-Bbbl downward revisions seen in 2015. The most severe downward revisions were reported by ExxonMobil (304 MMbbl) and ConocoPhillips (182 MMbbl). Conversely, Antero Resources and Chevron Corp. posted the largest net upward reserve revisions, at 278 MMbbl and 109 MMbbl, respectively.

In addition to the slight drop in oil reserves, oil production fell 3%, from 2.4 Bbbl in 2015 to 2.3 Bbbl. Noble Energy (13 MMbbl), Pioneer Natural Resources (12.3 MMbbl) and Antero Resources (11 MMbbl) posted the largest increases, while the largest decreases in production were reported by Devon Energy (21 MMbbl), Marathon Oil (14 MMbbl) and Linn Energy (13.9 MMbbl).

Natural gas. Similar to oil’s modest decline, end-of-year gas reserves for companies in the study dropped just 1%, to 148 Tcf. This can be compared to the 21% decline the year prior. EY says this largely can be attributed to significant downward reserve revisions. More than 74.5 Tcf of net downward reserve revisions have been recorded between 2012 and 2016, which includes a 41-Tcf reduction posted in 2015. In 2016, overall downward revisions were 5.9 Tcf. Antero Resources (2.1 Tcf), BHP Billiton (1.6 Tcf) and ExxonMobil (1.6 Tcf) reported the largest downward revisions for the year. Likewise, Chesapeake Energy and Devon Energy posted the largest increases of 0.6 Tcf and 0.5 Tcf, respectively.

EQT Corp. (2.2 Tcf), Antero Resources (2 Tcf) and Chesapeake Energy (1.8 Tcf) led the way with the largest extensions and discoveries. Based on the information submitted in 2016, extensions and discoveries remained steady at 18.8 Tcf. According to EY, this is what largely counterbalanced production and smaller downward reserve revisions.

Gas production reportedly decreased from 13.8 Tcf in 2015, to 13.4 Tcf in 2016. This represents a minor 3% decline. EY’s study shows that the largest declines were split between WPX Energy (158.4 Bcf), Southwestern Energy (111 Bcf) and ConocoPhillips (104 Bcf). The production declines were, however, offset by increases from companies including EQT and Rice Energy, with increases of 139 Bcf and 103.1 Bcf, respectively. ![]()

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)