Permian producers become "victims of their own success"

The prolific Permian basin, which stretches across much of West Texas and southeastern New Mexico, continues to lead the U.S. shale expansion. In June 2018, American crude exports soared to 2.200 MMbpd, up from 2.005 MMbpd reported the month prior, according to U.S. Energy Information Administration (EIA) data. With global oil demand on the rise, and refiners running at or near capacity, more and more crude is being sent abroad. Additionally, U.S. sanctions on Iran, to a certain degree, are creating more demand for U.S. exports, as some buyers worldwide seek to replace Iranian crude. However, the granting of waivers to eight countries by President Trump, allowing them to continue buying Iranian crude in the short term, has blunted the impact of this factor.

According to EIA’s most recent Drilling Productivity Report, the Permian basin in November was producing 3.632 MMbopd and 12.162 Bcfgd. This doesn’t include the 3,866 reported DUC wells awaiting completion in the Permian, suggesting that a flood of new production is likely to be released into the market during 2019. Average lateral lengths in horizontal wells grew more than 1,500 ft, to an average 7,500 ft at the end of 2017. This year, the range of lateral lengths has been mostly between 4,500 ft and 10,500 ft, although some wells have featured lengths up to 15,000 ft. It is believed that the average lateral length has grown to more than 8,000 ft during 2018.

MOUNTING PRODUCTION

As the E&P industry works to realize President Trump’s plan for U.S. energy independence, albeit somewhat unwittingly, it has increasingly exploited abundant resources at home. As a result, crude production has jumped higher in conjunction with recovered prices. Production from major U.S. shale plays was expected to rise 113,000 bopd, month-on-month, in December 2018, to 7.944 MMbopd—of which 46.5% is coming from the Permian basin.

The EIA’s Short-Term Energy Outlook predicted in November that average U.S. crude oil production will continue to rise, from an average 10.9 MMbpd in 2018 to approximately 12.1 MMbpd in 2019. If these levels are attained, the average production rate will exceed the previous record that was set in 1970. The Permian is expected to lead the way, with an average production rate of 3.9 MMbopd next year.

According to an IHS Markit Outlook released in June, production from the “super basin” could reach 5.4 MMbopd by 2023. This is more than the current output of any OPEC member, except Saudi Arabia. The outlook estimated that nearly 41,000 new wells and $308 billion in upstream spending will be the primary drivers for the projected growth.

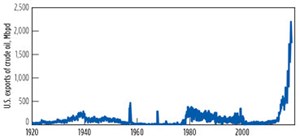

Exports. Right now, the Texas portion of the Permian accounts for approximately 27% of the country’s total crude production, while the New Mexico portion makes up about 5% of total U.S. output. Because of the region’s mounting production rates, the U.S. was able to claim the title for top global crude oil producer earlier this year, surpassing Russia and Saudi Arabia. In turn, gross energy exports rose to 18 quadrillion Btu—a 27% increase from the year prior and the highest annual U.S. energy exports on record. Crude oil exports, specifically, rose 89% from 2016 to 2017, Fig. 1. Likewise, natural gas exports increased 36%.

Imports. The U.S. has seen a corresponding drop in energy imports over the last few years. According to the EIA, total net energy imports to the U.S. fell to 7.3 quadrillion Btu last year, which was a 35% decrease from the year prior. It purportedly was the lowest level since 1982.

A TEXAS-SIZED PROBLEM

Although regional production is seen driving growth in the U.S.—particularly from the Permian—recent pipeline constraints have hampered wellhead prices for producers. Lower wellhead prices are subsequently expected to slow Permian production growth to some extent next year.

Last June, Bloomberg reported that crude output in the Permian basin had grown 25% in the last year, and that natural gas pipelines in the region had already reached 98% of capacity. Because its northern and southern neighbors, Canada (0.87 MMbopd in 2017) and Mexico (1.08 MMbopd), are its primary buyers, America’s pipeline systems are a vital part of its distribution strategy. The recent logjam has raised serious concerns for producers, who have been forced to consider shutting in wells and, as a result, lose revenue.

Flaring. While there is a reported 10.5 Bcfd of added gas pipeline in the works, relief may not come soon enough for those operating in the nation’s largest petroleum-producing basin. Much of the supplemental pipeline capacity proposed is not expected to become available until the end of next year, at the earliest.

There also has been apprehension regarding extended flaring that may penalize companies already heavily invested in remaining lines. “We are operating under the assumption that the Texas Railroad Commission will not allow us, or the industry, to flare gas for an extended period when takeaway capacity is full,” Centennial’s chief operating officer, Sean Smith, reportedly said during one of the company’s earnings calls with analysts.

The Railroad Commission (RRC) upholds its Statewide Rule 32, which allows operators to flare gas while drilling a well, and for up to 10 days after a well’s completion, so that operators can conduct well potential testing. According to the commission, most flaring permit requests received are for flaring casinghead gas from oil wells. Flaring permits for gas wells are uncommon. However, the RRC will grant some extensions, most commonly for operators waiting for pipeline construction to be completed.

Water management. As production continues to rise, a shortage of pipeline capacity is not the only dilemma facing Permian producers. A massive amount of water is being generated by fraced wells. Because the water being pumped out of the underground shale reservoirs is a mixture of salt, sand and chemicals, it requires proper handling and disposal. The problem is “just going to get bigger and bigger,” Wood Mackenzie analyst Ryan Duman told Bloomberg. “Operators are victims of their own success.”

“If we don’t have a water solution, we can’t produce the well, it’s as simple as that,” Colgate Energy CEO Will Hickey told Bloomberg in an interview. “It used to be that each operator handled water themselves. But the sheer volume of what’s now being produced has created an opportunity for specialized water companies to step in.”

Consequently, the cost of water management in the Permian basin is expected to nearly double to more than $22 billion over the next five years, according to IHS Markit.

Wood Mackenzie’s Duman says that recycling will likely grow in popularity, as projects expand and treatment costs decline with increased throughput volumes and fixed overhead. He said, “Expect producers to invest more in water management solutions, and if budgets stay relatively flat the next few years, watch drilling capital be diverted to water-related investments. Just as the level of drilling intensity in the Permian breaks basin records, so should the scale of water management solutions.”

Decline rates. As its position as one of the world’s top producing regions strengthens, the Permian is now under more pressure to meet increasing demand. In October, Bloomberg reported that analysts were noting that some maturing wells are falling short of initial projections. A study by Wood Mackenzie found that maturing wells in some parts of the Permian’s Wolfcamp shale are losing nearly 15% of output annually, five years after startup. This reportedly compares to the 5%-10% range that was originally estimated.

“If you were expecting a well to hit the normal 6% or 8% after five years, and you start seeing a 12% decline, this becomes more of a reserves issue than an economic issue,” R. T. Dukes, a director at Wood Mackenzie, told Bloomberg. It means that “you have to grow activity year-over-year, or it gets harder and harder to offset decline.”

In fact, the Permian’s short-term growth has been shrinking consistently each month. And in parallel, declines in older wells are seen trending higher, according to EIA. In October, government data showed declines counteracting output by approximately 18%, compared to the 4% offset at the beginning of this year.

A BIG DEAL

Increased investment in the Permian has spurred significant cost inflation, triggering a great deal of consolidation in the basin. Smaller companies are being forced into M&A deals, as increased cost and risk become too great to handle alone.

M&A’s. Concho Resources completed its acquisition of RSP Permian, Inc., in July. The $9.5-billion merger added approximately 92,000 net acres to its holdings, expanding its regional portfolio to approximately 640,000 net acres, Fig. 2. It also adds about 2.2 Bboe of resource potential, substantially enhancing the company’s three-year annualized production growth outlook. With the largest drilling and completion program in the region, Concho is now considered the largest unconventional shale producer in the Permian basin.

Similarly, BP bought most of BHP Billiton’s onshore U.S. oil and gas assets, including extensive acreage in the Permian, in July. The $10.5-billion acquisition, which reportedly represented the oil major’s biggest deal since 1999, added 83,000 acres to BP’s position in the Permian’s Delaware sub-basin, Fig. 3. It added ~3,400 gross drilling locations, along with production of ~40,000 boed, of which 70% is liquids. “This is a major upgrade for one of BP’s key upstream regions, giving us some of the best acreage in some of the best basins in the onshore U.S.,” BP’s upstream chief executive Bernard Looney said in a release.

The multi-billion-dollar deals early in the year appeared to have a domino effect for those operating in the Permian. In August, Diamondback Energy agreed to buy Energen Corporation in an $8.4-billion all-stock deal. The transaction, which was announced just one week after the company announced its $1.2-billion acquisition of Ajax Resources, added 266,000 net Tier One acres to the its Permian assets. Likewise, the Ajax acquisition added about 25,000 Permian acres. With combined second-quarter production of more than 222,000 boed, the company says it now boasts the third-largest production for a pure play company in the Permian basin.

Rumors have begun to circulate involving the potential sale of the Permian’s largest privately-held company, Endeavor Energy Resources. In November, Bloomberg reported that ExxonMobil and Chevron are among the companies vying for first round bids. Endeavor is said to have approximately 329,000 net acres in the Midland basin. The tract of land is so large that only about 2% of it has been developed, to date. Net production in second-quarter 2018 reportedly stood at 64,000 boed, with ten rigs and four frac crews in operation. It is said that the potential sale could bring as much as $10 billion.

Through development optimization, shared infrastructure and capital efficiencies, companies in the Permian are joining forces to strengthen their position in one of the top producing, and most competitive, plays in the world. “The Permian is the largest U.S. shale play, with the most inventory, so it’s not hard to see the long-term attraction,” NatAlliance Securities Analyst Leo Mariani told Bloomberg.

Major players. XTO Energy is one of the most active operators in the Permian. The ExxonMobil subsidiary says it has expanded its Permian resource base to approximately 10 Bboe since 2014, and it plans to continue expanding. The company says it will triple its production rate, aiming to reach 600,000 bopd by 2025. To achieve this, XTO ‘s horizontal rig count is projected to increase 65% over the next few years, Fig. 4.

Pioneer Natural Resources holds a 785,000-acre position in the Permian basin’s Spraberry and Wolfcamp shale intervals. According to the company’s 2017 annual report, approximately 115,000 bopd were shipped to the Gulf Coast during fourth-quarter 2017. The company has been working to increase Permian production, including NGLs and gas, by 19% to 24% this year.

Looking further ahead, Pioneer says it has a ten-year vision for the company that involves a steady increase in Permian drilling. It reportedly aims to achieve oil production greater than 700,000 bopd and total production greater than 1 MMboed by 2026.

Likewise, the Permian basin is a core growth area for Apache Corporation. With over 2.8 million gross acres, covering the Northwest Shelf and the Midland and Delaware basins, the region represents about 58% of the company’s worldwide reserves. At the end of 2017, the company reported estimated proved reserves of 681 MMboe in the Permian basin.

The company’s fourth-quarter 2017 production increased 10% from the previous quarter. According to Apache, the increase was largely a reflection of the success of its Midland basin drilling program, in addition to a boost in Alpine High production. Alpine High, which was discovered in September 2016, lies in the southern portion of the Delaware basin. It is estimated to contain about 75 Tcf of rich gas and 3 Bbbl of oil in the Barnett and Woodford formations, alone.

The new play came online in May 2017, creating a flood of new production for the company. Apache reported oil production of 222,259 boed in third-quarter 2018, which is a significant increase from the 160,823 boed that was reported for the same quarter one year prior. During that time, Apache’s Permian activity reportedly averaged 16 rigs, while the company drilled or participated in 215 wells, with a 97% success rate.

Occidental Petroleum is another major player in the Permian, producing about 9% of its oil. According to the company, it has nearly 2.5 million net acres and produces from every active formation in the basin. It holds approximately 1.4 million unconventional net acres in the Delaware basin’s Wolfcamp and Bone Springs formations, as well as in the Midland basin’s Spraberry and Wolfcamp formations. The company’s Permian output accounted for nearly 50% of its of its total worldwide production last year.

According to its third-quarter 2018 results, the company’s Permian Resources production stands at 225,000 boed, which is a 60% year-over-year increase. Total average production volumes swelled to 681,000 boed, from the 639,000 boed that was reported during the previous quarter.

BIDDING WARS

Because the Permian basin has become one of the world’s most sought-after regions for drilling and production, this year’s oil auction made history. In September, the price to access unexplored shale assets on the New Mexico side of the Permian basin climbed to $95,001/acre in a federal auction—a record high. The state’s previous record stood at $40,001/acre in December.

According to the Bureau of Land Management (BLM), the two-day sale brought in more revenue than all of BLM’s 2017 oil and gas sales combined. Revenue from the 142-parcel (over 28,036 acres) sale amounted to $972,483,619.50. Matador Resources was later confirmed as the high bidder in the auction, spending $387 million on 8,400 net acres in the Delaware basin. The Dallas, Texas-based independent now holds rights to approximately 123,800 net acres in the Delaware, Fig. 5. It estimated that the newly acquired acreage will immediately add an incremental 16.3 MMboe to its total proved reserves base.

Leases reportedly were offered for a ten-year term and a royalty of 12.5%, which operators found more favorable than those in the Texas portion of the Permian. “We were expecting high bids. I can’t say I was expecting $95,000 [an acre],” Wood Mackenzie’s R. T. Dukes told Bloomberg, “The Permian is the center of the oil universe when it comes to investment right now, and just because of a few pipeline constraints, that’s not going to change.” ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)