Permian basin leads the pack

A sudden market downturn can make a promising field development uneconomic, with many examples from the last few years. In an effort to gird themselves against volatility, operators have strived more aggressively to lower operating costs, as it is now a necessity to decrease sensitivity to unstable market conditions.

Some operators in the Permian basin have done this successfully by taking the lead in adopting innovations in drilling and completion technology. For completion technology, recent innovations have combined operational improvements with more effective treatments to improve production. The goal behind these completion technology advances is to reduce breakeven prices and strengthen the industry against market unpredictability, while taking advantage of the world-class resource that is the Permian basin.

LONG-TERM GROWTH PROJECTIONS

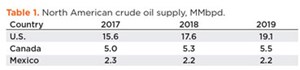

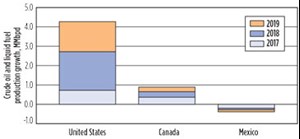

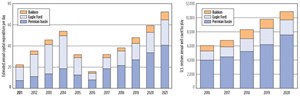

According to short-term forecasts from the U.S. Energy Information Administration (EIA), production growth from North America will essentially account for almost all of the expected growth in global oil supply in 2018 and 2019 among non-OPEC producers, Fig. 1.1

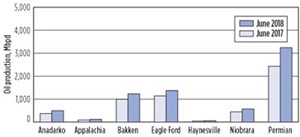

Yet, with minimal estimated production growth in Canada, and declining production in Mexico for 2018, the U.S. is forecast to account for nearly 90% of incremental North American liquids supply growth, Table 1. All key U.S. regions are forecast to increase oil and natural gas production in 2018, with the most significant increases in the Permian Basin for oil, Fig. 2.2

According to IHS Markit, capital expenditures in the Permian basin will represent almost a third of total spending in major onshore plays of the U.S. by 2021, Fig. 3.3 Total completed wells in the Permian basin are also estimated to make up over a third of total onshore U.S. plays by 2020.4 As such, based on current trends, the Permian basin is poised to be the main source of liquids supply growth for the global oil market.

TECHNOLOGICAL ADVANCEMENT FOR HIGHER EFFICIENCY

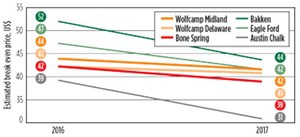

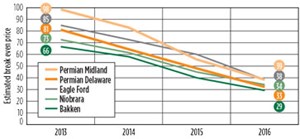

The Permian basin showcases the potential for U.S. unconventional performance, where operators have managed to lower costs, year by year, while achieving higher production. This phenomenon is not restricted to the Permian basin; since 2011, break-even prices have decreased in all key regions, Fig. 4.5

More recently, from 2016 to 2017, estimated break-even prices in the Permian basin have dropped further, Fig. 5. Various sub-plays show a decrease ranging from 4% to 9%.4 This economic efficiency can be attributed to many factors, including discounted service rates, streamlined logistics, optimized operational efficiency, and most importantly, changes in technology.

Technological advancement is the underlying factor that has, and continues to, facilitate better production while lowering costs. As the unconventional industry gathered momentum, the demand for efficiency sparked trends and innovations such as:

- Bullhead stimulation to zonally isolated multi-stage stimulation systems

- Continuously pumped sliding sleeve systems

- Extended lateral drilling.

These changes have been moving steadily toward more operationally efficient systems while improving the effectiveness of treating the entire lateral.

OUR EXPERIENCE IN THE PERMIAN

Packers Plus has been completing wells successfully in the Permian basin since 2009, working with operators to access unconventional reservoirs. Over the years, operators have gradually increased stage count and lateral length, as well as boosted rates and proppant volumes, both ultimately leading to improved production.

These operators have access to a full range of proven completion solutions applicable to the Permian basin, including sliding sleeves for both open-hole and cemented liner systems, liner hangers, hydraulic toe sleeves and stage tools. Furthermore, a new full-bore latch system is set to provide benefits that overcome challenges of current completion methods.

Open-hole completions. StackFRAC HD is a sliding sleeve system that virtually eliminates non-productive time, compared to traditional plug-and-perf. Once the system is installed and the packers are set, the stimulation can be done from start to finish in one continuous pumping operation. The first stage is activated, using a hydraulic sleeve, which does not require an intervention such as coiled tubing to access the toe. For all other stages, sleeves are opened using actuation balls, which also isolate each stage from lower zones.

The ball for each subsequent stage is pumped in the flush of the previous stage, reducing overall completion time and fluid volumes. Degradable balls can further improve efficiency by eliminating the need for mill-out, which saves significant time and equipment costs. Unexpected problems, such as getting stuck, can spiral into major time and cost expenditures. When problems occur, mill-outs can take hours or sometimes days longer than planned.

For these reasons, continuous pumping and sliding sleeve completions are arguably the most efficient of all styles.

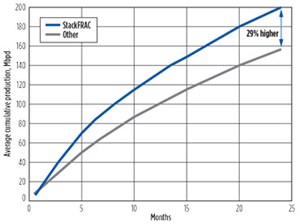

Case study. An operator developing nearly 3 million acres in the Permian basin wanted to access these reservoirs while keeping costs low. The operator uses both open-hole sliding sleeve systems and plug-and-perf.

Comparing production among an area of 40+ horizontal wells completed by this operator, targeting the Yeso reservoir, 10 wells that were completed using sliding sleeve systems show a 30% higher average production after 24 months, Fig. 6. Using StackFRAC HD, the operator has been able to gain significantly higher production while reducing or effectively eliminating non-productive time, and lower operational risk by eliminating well intervention and mill-out.

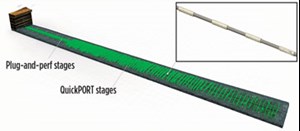

Cemented liner completions. Combining a cemented liner with the operational efficiency of a sleeve system, QuickPORT IV sleeves can be run as part of the liner for a limited entry treatment. Individually isolated entry points are treated together in a single stage, and each nozzle is reinforced with tungsten carbide to prevent entry point erosion. One ball opens all sleeves in a stage, and like StackFRAC HD, incrementally larger balls open subsequent sleeves while providing zonal isolation. From the toe to the heel, the stimulation is done in one continuous pumping operation.

By removing wireline and coiled tubing operations, and using degradable balls to avoid mill-outs, overall completion time and fluid volumes are more efficient using the limited-entry sliding sleeve than plug-and-perf.

Case study. Another operator using plug-and-perf in the Permian had been having problems with wireline and coiled tubing. These issues included plug pre-setting, perforating, and applying sufficient weight on bit for mill-outs, particularly in wells with an MD greater than 20,000 ft.

To resolve this issue, the operator began running the first four or five stages of its extended-reach laterals with clusters of limited-entry sleeves. This successfully eliminated unnecessary costs associated with operations at extreme depths, while maintaining the limited-entry stimulation design, and eliminating entry point erosion. After the toe stages, the operator continued with plug-and-perf for the rest of the stimulation. This hybrid design became standard for wells exceeding 20,000 ft, MD.

More recently, the operator completed a particularly long well targeting the Wolfcamp formation. The well had a 23,300-ft MD, including a long, 12,200-ft lateral section. To cover the deepest 3,900 ft of the lateral, 80 sleeves were grouped into the first 20 stages before, as usual, plug-and-perf was planned for the rest of the completion.

This hybrid completion technique proved effective in the significantly longer well, and the first 20 stages were completed in just 70 hr of pumping time. Considering the longer-than-average MD, the strategy successfully reduced operational risk, non-productive time, and potential cost over-runs. The success of the 80-sleeve completion proves the effectiveness of the limited entry system in its ability to perform as a high-density, high-stage count completion solution, Fig. 7.

A reliable liner hanger. The basic expectation of a liner hanger is that it should anchor the completion system and maintain pressure integrity throughout the life of the well. Furthermore, a liner hanger also should function reliably to lower operational risk, saving time and money. To do these things, a liner hanger must have capabilities in these areas:

- Pressure rating

- Hanging and rotational capability

- Built-in mitigation and contingency.

For pressure rating, a liner hanger should be rated above the system that it is paired with, to ensure that it will not be the weak link during hydraulic pressure spikes. The PrimeSET system is fully gas-tight (V0 qualified) up to 15,000 psi, making it appropriate for a wide variety of applications, Fig. 8.

As extended laterals become more commonplace, rotational ability can be a limiting factor. During installation, the Drill Down Running Tool (DDRT) allows the operator to push, pull, and rotate with over 20,000 ft-lb of torque. This can be valuable when working in longer wells, which typically have more doglegs and deviations.

Finally, risk mitigation is an important consideration for liner hangers, particularly the issue of a premature setting while pushing and rotating the system to depth. Since an accidental pre-set can cost millions to recover from, the PrimeSET DDRT is designed with a balanced piston releasing system that makes it unaffected by pressure spikes, and avoids premature release. The secondary mechanical release option, using left-hand rotation, is also designed as a contingency.

Over 30 of these liner hangers have been used to install completion systems in the Permian basin without issue, with more than 100 systems deployed over North America.

The Future: Full-bore sleeve completions. The completions industry is on the brink of proving a new technology that improves upon existing completion systems and provides features that operators have long desired. The benefits of this new technology include:

- Full-bore during stimulation with no inside diameter restrictions

- No stage limitations

- Degradable isolation components to avoid mill-out

- Operationally efficient, with minimized non-productive time.

The Latch-and-Perf system allows operators to increase reservoir coverage with high-stage count capability, pump high rates throughout stimulation with a full bore, avoid mill-out time and costs, and improve operation efficiency using latches that have fast pump-down rates.

This system was installed recently and run successfully in the Permian basin. During this trial, five stages were placed at the heel of the well. For each stage, an isolation latch was pumped downhole on wireline and latched into the locating sub. The casing was perforated, and the stage was treated.

All five latches were pumped down successfully and latched into the profile, and treated without incident.

A pump-down version of this system that operates without wireline and is pumped continuously is also in field trials. This system will help operators lower break-even prices further by reducing NPT and eliminating the need for interventions and mill-out, while maximizing reservoir contact in long laterals.

CONCLUSION

If industry trends and economic projections follow through as predicted, the Permian basin is set to be the main source of liquids supply growth for the global oil market. Lowering break-even prices will lower sensitivity to market volatility. Many operators in the Permian basin have successfully done this by taking the lead in adopting innovations in drilling and completion technology.

Key advancements in completion technologies have allowed operators in the Permian basin to accelerate acreage development. Improved efficiency has led to an ongoing reduction in breakeven prices, which in turn has enabled operators to be more profitable and less sensitive to oil price fluctuations.

The next generation of completion technology is just getting ready to build further on this success. ![]()

REFERENCES

- U.S. Energy Information Administration, Short-Term Energy Outlook, May 2018.

- U.S. Energy Information Administration, Drilling Productivity Report for key tight oil and shale gas regions, May 2018.

- IHS Markit; The Permian Basin: A magnet for risk capital; Jan 2017.

- IHS Markit; Outlook for U.S. Oil and Gas Production 2018-2020; April 2018.

- Rystad Energy, NASWellCube.

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)