Permian oil production requires additional pipeline infrastructure

With regard to the short-term future of the Permian basin, through the rest of this year and into early 2019, it is now the consensus of the World Oil staff that activity will level off during second-half 2018. Indeed, it is possible that anywhere from a 10% to 20% drop in drilling and development work could occur in the second half. The reason is simple—there just won’t be enough pipeline capacity to handle the extra production that a full activity rate would generate.

Accordingly, building additional pipeline capacity in the Permian is job number one. Already, counting all the projects confirmed on the books, Permian pipeline capacity could eventually total 7.0 MMbopd. There also is eventual potential for up to 9.0 MMbopd of Permian pipeline capacity, if all goes well. But first the pipelines on the books have to be built. It appears that a first wave of a half-dozen pipeline projects will go online during 2019, followed by a second wave of four or more projects in 2020.

In the meantime, Permian pipeline capacity will be constrained through at least mid-2019, exacerbated by growth in the region’s oil production rate, anticipated to hit 4.0 MMbpd by the beginning of next year. So, for the next 12 months, Permian operators will have to rely on storage capacity and alternative transportation methods to make up the difference. Yet, given the shortage of trucks and truck drivers, the trucking of oil, particularly over long distances, is not expected to be a factor. This leaves rail as the only reasonable alternative. There are indications that rail capacity out of the region could be expanded to 300,000 to 400,000 bopd. In addition, some local sand mine terminals could be converted to alleviate rail congestion and boost capacity on the tracks further.

So, given the serious capacity situation, not to mention the possibility that flaring of associated gas output may have to rise to 700 MMcfd to 800 MMcfd, the pipeline infrastructure must be expanded quickly. Accordingly, we feel it is important to feature the following status report on Permian pipeline projecs from the Energy Web Atlas, a division of our parent company, Gulf Energy Information.

PERMIAN BASIN PRODUCTION

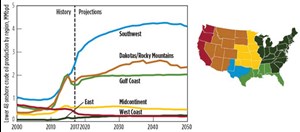

The EIA’s Annual Energy Outlook for 2018 forecasts that oil production in the Permian basin will experience the largest growth of all U.S. shale plays, increasing 60% from an average 2.5 MMbpd in 2018 to 4 MMbpd by 2030, Fig. 1. However, recent production in the shale play has far surpassed the predicted 2.5 MMbopd for 2018. According to the EIA’s Drilling Productivity Report, oil production reached 3.333 MMbpd in July, a 56,000-bpd increase over June.

The Baker Hughes North American Rig Count reported that there were 476 operating rigs targeting oil in July, compared to 374 operating a year earlier. Based on that report, the rig count in the Permian basin accounts for 55% of all operating rigs targeting oil in the U.S.

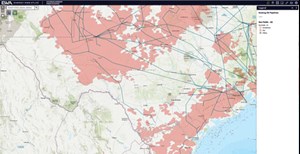

According to Genscape, the Permian basin had 3.175 MMbopd of total takeaway capacity in March 2018, with outgoing pipeline capacity at 2.725 MMbpd. Given that production has surpassed pipeline takeaway capacity in the past few months, existing pipelines are falling short. This leaves the region relying heavily on new infrastructure development to keep afloat.

SATISFYING DEMAND: CURRENT AND PLANNED PIPELINES

Existing pipelines. According to the Energy Web Atlas, two pipelines have gone online recently in the Permian basin to help alleviate the current strain on takeaway capacity in the play, Fig. 2. In the first project, Enterprise Products Partners LP completed the Midland-to-Sealy Pipeline that runs 416 mi from Midland, Texas, to Sealy, Texas It provides 450,000 bpd of takeaway capacity from the Permian basin to U.S. Gulf Coast markets.

In the second project, Medallion Pipeline Company LLC has completed the Delaware Express Pipeline that runs 95 mi from Ward County, Texas, to Crane, Texas, and has a capacity of 200,000 bpd. This pipeline provides Delaware basin customers with access to the Permian basin long-haul takeaway pipelines, local refineries and downstream markets.

In addition, some existing Permian basin pipelines are undergoing expansions:

- Magellan Midstream Partners LP and Plains All American Pipeline LP own the BridgeTex Pipeline that runs 400 mi from the Permian basin to U.S. Gulf Coast markets. The pipeline has a current capacity of 400,000 bopd and will be expanded to 440,000 bopd.

- Energy Transfer Partners LP and ExxonMobil own the Permian Express 1 and Permian Express 2 pipelines that transport Permian basin crude to both the Nederland and Longview markets in Texas. The system includes 700 mi of pipeline with a joint capacity of 350,000 bopd. It will be expanded 300,000 bopd upon completion of the Permian Express 3 Pipeline.

- Plains All American Pipeline LP owns the Cactus Pipeline that runs 310 mi from McCamey, Texas, to Gardendale, Texas, and transports Permian basin crude to the Eagle Ford JV Pipeline serving U.S. Gulf Coast markets. The pipeline has a current capacity of 390,000 bopd, and the system will be expanded to 965,000 bopd.

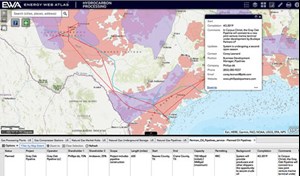

Planned pipelines. According to the Energy Web Atlas, several midstream companies are planning new pipeline infrastructure and expansions to develop additional infrastructure, to meet takeaway demand in the Permian basin, Fig. 3.

Some major planned pipeline projects include:

- Phillips 66 Partners and Andeavor are proceeding with the Gray Oak Pipeline (Fig. 4) that will run 600 mi from Reeves County, Texas, to Crane County, Texas. The pipeline will provide producers and other shippers the opportunity to secure crude oil transportation from West Texas to the destination markets of Corpus Christi, Freeport, and Houston, Texas. The pipeline will have an initial capacity of 800,000 bopd and a maximum capacity of 1.0 MMbopd. The pipeline is scheduled for completion in fourth-quarter 2019. On July 30, 2018, the partners announced that the line will cost $2 billion to build.

- Enterprise Products Partners LP plans to convert one of its natural gas liquids (NGLs) pipelines that runs from the Permian basin to the Texas Gulf Coast to crude oil service. This conversion will provide the company with a total crude oil takeaway capacity of over 650,000 bpd from the Permian basin to a crude oil hub in Houston, Texas. Enterprise will convert one of its three existing NGL pipelines that stretch from the Permian basin to the Texas Gulf Coast, which includes the Seminole Blue, Seminole Red and Chaparral pipelines. The conversion is scheduled for completion in first-quarter 2020.

- Magellan Midstream Partners LP has proposed the Crane to Three Rivers Pipeline that will run 375 mi from Crane, Texas, to Three Rivers, Texas. The pipeline will have an initial capacity of 350,000 bopd and a maximum capacity of 600,000 bopd. Shippers will have the option to deliver crude oil and condensate from the Three Rivers area to the Houston area via a new 200-mi pipeline, or to the Corpus Christi area via a new 70-mi pipeline. The project, initially scheduled for completion in fourth-quarter 2019, is currently delayed.

- Magellan Midstream Partners LP and Plains All American Pipeline LP have launched an open season to expand the existing BridgeTex Pipeline through enhancements of existing pumps and related equipment in Bryan, Texas. The expansion will add 40,000 bopd of capacity, bringing total pipeline capacity to 440,000 bopd. The expansion in scheduled for completion in second-quarter 2019.

- Energy Transfer Partners LP (ETP) and ExxonMobil have proposed the Permian Express 3 Pipeline Expansion that will utilize existing pipelines from the Midland and Delaware basins to Nederland, Texas. The expansion will provide producers with new crude oil takeaway capacity to multiple markets, including the 26-MMbbl ETP Terminal in Nederland. Phase I of the project went online in fourth-quarter 2017 and has a capacity of 100,000 bopd. Once all phases are complete, the expansion will add 300,000 bopd of capacity to the existing network.

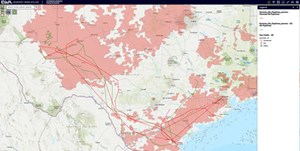

Pipelines under construction. According to the Energy Web Atlas, several midstream operators have started construction already on new pipeline infrastructure and expansions in the Permian basin, with many of them expected to go online in 2019.

Some major pipeline projects in development include:

- Epic Pipeline Co. LLC is developing the EPIC Crude Pipeline (Fig. 5) that will run 700 mi from Orla, Texas, to Corpus Christi, Texas. The pipeline will provide takeaway capacity from the Permian and Eagle Ford basins to both refining and export markets in, and around, Corpus Christi, Texas. It will run parallel with the previously announced EPIC NGL Pipeline. That line will have an initial capacity of 590,000 bopd and is scheduled for completion in second-quarter 2019. As of late July 2018, Epic had successfully completed its first open season for the project.

- Andeavor is developing the Conan Crude Oil Gathering Pipeline System that will run 130 mi from Lea County, N.M., to a proposed terminal in Loving County, Texas. There, the gathering system will interconnect with long-haul pipeline carriers. The pipeline will have an initial capacity of 250,000 bopd and a maximum capacity of 500,000 bopd. The gathering system was scheduled for completion in mid-2018.

- Magellan Midstream Partners LP is developing the Wink Pipeline that will run 60 mi from Wink, Texas, to Crane, Texas. The pipeline will offer direct service from the Delaware Basin to the existing Longhorn Pipeline, which provides crude oil and condensate transportation service to the Houston and Texas City refining complex and marine export facilities. The pipeline will have an initial capacity of 250,000 bopd and a maximum capacity of 600,000 bopd. The pipeline is scheduled for completion in second-quarter 2019.

- Plains All American Pipeline LP is developing the Cactus II Pipeline that will run 515 mi and connect to the existing 310-mi Cactus Pipeline System. The pipeline will run from Orla, Texas, to Corpus Christi, Texas, and will have a capacity of 575,000 bopd. The expansion is scheduled for completion in fourth-quarter 2019.

Potential obstacles. While many pipeline projects are on the horizon in the Permian basin, some have experienced delays, due to lack of shipper support that could prevent the pipelines from ever breaking ground.

Magellan Midstream Partners LP announced that they are putting the proposed 375-mi Crane-to-Three Rivers Pipeline on hold, after an unsuccessful open season failed to gain shipper commitments. The pipeline could provide a potential 600,000 bopd of takeaway capacity in the region, but the company stated that it won’t proceed with the project until it receives satisfactory interest from potential customers.

In May, Buckeye Partners LP unexpectedly cancelled an open season for the proposed 513-mi South Texas Gateway Pipeline. The line would run from Wink, Texas, to Corpus Christi, Texas, and deliver over 600,000 bpd of crude oil and condensate from the region to U.S. Gulf Coast markets. The company has yet to release a reason for the project’s sudden suspension and has, instead, announced plans to focus on the proposed South Texas Gateway Terminal in Corpus Christi.

While no plans have been made public that either the Crane-to-Three Rivers Pipeline or South Texas Gateway Pipeline are cancelled, the prospect of these shelved projects being built doesn’t seem promising. ![]()

Editor’s note: The Energy Web Atlas is a product of Gulf Energy Information, the parent company of World Oil.

- What's new in production (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)