Shaletech: Permian Basin

The storied wide open spaces of West Texas aren’t so much these days.

Despite an aerial reach of more than 75,000 mi2, overlaying up to 12 prospective zones, the growing population of rigs and frac spreads in the invincible Permian basin of Texas and southeastern New Mexico has made well spacing a dicey issue. Get too close and ultimate reservoir drainage could take a literal hit, or in the vernacular of RSP Permian Inc., fall victim to “frac bashing.”

“What the data is showing us is that we’ve been able to drill wells down to about 400 ft apart, without seeing really any negative results from offset wells. But, when you get below 400 ft, you start to see that,” CEO Steven Gray says of his pure-play company’s experience while developing a 92,000-net-acre leasehold across the Midland and Delaware sub-basins.

With 435 active rigs, like this one drilling for Anadarko in the Delaware sub-basin, well spacing has become a tricky issue across the Permian basin. Image: Anadarko Petroleum Corp.

The more commonly known “frac hits” phenomenon joins rising service, labor and acreage costs, and impending takeaway concerns, in what is arguably the world’s most celebrated unconventional oil play. Headwinds aside, “the Permian continues to look more attractive than most other options for new investment in the global upstream hopper,” Wood Mackenzie Chairman and Chief Analyst Simon Flowers wrote in a Feb. 13 note.

The entrenched collection of major and independent operators agrees, reflected in oil production eclipsing 3 MMbpd and a 124-rig increase over last year. According to Baker Hughes, the Permian averaged 435 active drilling rigs in March, compared to 311 rigs in the same month last year.

A similar trend unfolded in the drilling permits approved for pertinent Texas Railroad Commission (RRC) Districts 8, 8A and 7C. The state’s chief regulator issued 1,343 horizontal drilling permits between Jan. 1 and March 7, up from 1,037 authorizations in the like 2017 period. Between January and March, the cross-state New Mexico Oil Conservation Division (OCD) approved 179 horizontal drilling permits in the three counties (Eddy, Chaves and Lea) making up that state’s Delaware basin core, compared to 122 approvals over the same 2017 period.

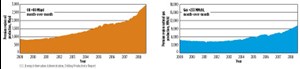

Correspondingly, the U.S. Energy Information Administration (EIA) estimates that the Permian region will produce 3.156 MMbopd in April, up year-over-year from an estimated 2.286 MMbopd (Fig. 1). Notably, the EIA forecasts that largely associated gas production will more than double to 10.252 Bcfd, compared to the estimated 4.270 Bcfd produced in April 2017.

Long overshadowed, gas production is on track for a significant ramp-up with the continuing development of Apache Corp’s Alpine High resource play, comprising 340,000 net acres in Reeves County, Texas, Fig. 2. Along with $500 million earmarked for infrastructure build-out, Apache plans to operate six to seven rigs and drill 85 to 95 wells in 2018, as the Delaware basin wet gas play transitions from delineation and testing to full-scale development, said President and CEO John Christmann.

The 2017 completion of a fifth central processing unit and an additional 50 MMcfd of capacity commissioned in January, brings total Alpine High processing capacity to 280 MMcfd. Another $500 million will be spent in 2019 to further expand the greenfield’s midstream infrastructure.

Apache has directed 70% of its 2018 capital budget to its 1.6-million-acre Permian leasehold where, outside of Alpine High, plans call for three rigs and the drilling of 45 to 50 wells elsewhere in the Delaware basin, with another three to five rigs slated to drill 55 to 60 wells in the Midland basin. After averaging fourth-quarter production of 177,000 boed, Apache plans to run four to five frac crews this year.

INFLATIONARY PRESSURE

The increased basin-wide production, however, is coming at a cost. “The drilling and completion cost increases have made their way into our current AFEs (authorizations for expenditures),” said John Lambuth, senior V.P. of exploration for Cimarex Energy Co., which, like Apache, will spend 70% of its $1.3-billion-to-$1.4-billion 2018 capital budget in the Delaware basin, where it primarily targets the Wolfcamp and Bone Spring formations.

Lambuth said total costs for Wolfcamp wells with 10,500-ft laterals run between $11 million and $13 million, while an AFE for deeper Bone Spring wells in New Mexico, with 5,280-ft laterals, is $7 million to $8.5 million. Nevertheless, Cimarex is operating 10 rigs and plans to complete 84 wells this year, after drilling and completing 55 wells in 2017, with production averaging 105,000 boed.

Expectations of higher costs prompted a number of players to nail down long-term rig and service contracts at more favorable rates. “Two-thirds of our spend in the Permian is protected with contracts right now,” said Chevron Corp. CEO Mike Wirth.

Rystad Energy, however, forecasts 2018 wellhead break-even prices (BEP) averaging $38/bbl, down 1% in the Midland and 3% in the Delaware sub-basins. Sonia Mlada Passos, senior analyst of shale research, attributed to a significant shift to multi-well pads and continued focus on Tier 1 assets. “About 50% of all activity is going on in the very best sweet spots,” she said in an email.

Marginally lower BEP notwithstanding, Rystad sees stressors on the horizon. This is true, even with increasing pressure-pumping capacity and the opening of new Texas sand mines later this year that promise to help control fracing costs. “Labor in all service segments—trucking, proppant supply and road infrastructure—are serious bottlenecks, which put some constraints on the pace of activity recovery in the Permian,” said Artem Abramov, senior V.P. of shale research. “They also trigger quite significant cost inflation. Meanwhile, price differentials also are likely to become more stressed, as we move towards 2019, as there is a significant bottleneck on the outbound takeaway capacity side.”

Completion costs, indeed, are taking a bigger bite, says Occidental Petroleum Corp., which plans to operate 11 rigs and appraise at least six new benches across the 1.4 million net acres that comprise its unconventional footprint. “We see pressure on inflation, obviously. It’s probably in the 5% range in the drilling area, and more like 10% to 15% in the completion space,” says Jody Elliott, president of the company’s domestic oil and gas business.

Owing in part to logistical improvements, Occidental has set a lower all-in target of $8.9 million this year for a representative 10,000-ft lateral, three-string well targeting the second bench of the Bone Spring and completed with proppant loading of 2,000 lb/lateral ft. Total costs for a similarly designed New Mexico well were $9.9 million in the fourth quarter.

Given the high cost of entry, the surge of top-dollar mergers and acquisitions in 2017 has since been replaced with widespread asset swaps, as operators core up acreage to accommodate longer laterals. ConocoPhillips, for one, has elected to stand pat with its estimated 1-million-acre leasehold, including 75,000 net acres in the Delaware basin, where fourth-quarter production averaged 21,000 bopd. “Some of the hot stuff in the Delaware basin is expensive. And, while we look at it, it’s just not competitive in the portfolio at $30,000 an acre,” said Chairman and CEO Ryan Lance.

The same for Noble Energy Inc., which paid $2.7 billion to Clayton Williams Energy Inc. last year to buy nearly 120,000 net acres in the southern Delaware basin. With the acquired acreage expected to deliver up to 140,000 boed over the next three years, “we do not envision our need for any additional large scale M&A in this basin,” said Chairman, President and CEO David Stover.

Noble operated five rigs in the fourth quarter (Fig. 3), drilling 20 and completing 14 operated wells at average lateral lengths of 9,300 ft. Fourth-quarter production averaged 38,000 boed.

However, one mega-deal, reportedly in the works in March, has Shell Oil Co. and private equity firm Blackstone Group LP teaming up for a $10-billion bid for the U.S. shale holdings of BHP Billiton Plc, according to Reuters and others. If consummated, the transaction will include BHP’s estimated 78,000 net acres in the Delaware basin.

PARENT-CHILD DYNAMICS

Along with cost pressures, the transition from nearly a century of conventional drilling to the high-octane construction of often tightly spaced horizontal wellbores has exacerbated inter-well interference issues, which can severely compromise estimated ultimate recoveries (EUR). “Proximity is your enemy,” says frac specialist Lyle Lehman, founder of Houston’s Frac Diagnostics, LLC.

Basically, problems arise when newly treated infill offsets (“child” wells) communicate with earlier completed and often depleted vertical or horizontal “parent” wells, effectively creating a pressure sink that draws down productivity.

While investigating the root cause of Permian inter-well interference issues, EP Energy Corp. President and CEO Russell Parker says the blame usually is traced to inefficient completion of the parent well, resulting in unequal frac lengths and restricted drainage. “We design each one of those completions individually, and try to make sure that we are contacting new rock and doing the least possible damage to the offset wells, and we have had good success with that,” he said.

With 182,000 net acres, EP completed 71 wells in 2017, with average production of 28,700 boed, up 34% from the year prior.

Pointing to extensive analysis of frac data from contiguous Delaware basin wells, Lehman cites extremely low perforation efficiency as a primary culprit. “When you’re near an older well, you need to take precautions and measure perforation efficiency. I advocate doing a step-rate test, and if you have low efficiency, do something about it, like drop in a diverter to open up more perfs,” he said.

For RSP Permian, which is operating eight rigs and plans to complete 100 to 120 wells this year, the definition of optimum spacing depends on the commodity price. “If oil is $100/bbl, you could afford to drill more wells and capture less oil and gas per well and still maximize your NAV (net asset value), because you’re going to recover more oil and gas,” said CEO Steven Gray. “For us right now, with what we know and the current oil price environment we’re in, we think anything north of 400 ft between wells seems to be doing just great.”

Encana Corp. credits its exclusive cube development strategy, which essentially treats every well as a parent well, enabling simultaneous development of up to five benches with no communication incidents and “overall improvement in our type curves over time,” a spokesman said. The exclusive approach is clearly demonstrated in the 33 wells that are now producing on the RAB Davidson super-pad (Fig. 4) in Encana’s 127,000-net-acre Midland basin asset.

“In the Permian, microseismic data is giving us insights into how completions intensity and reservoir geo-mechanics impact fracture geometry. Our latest advanced completion design concentrates the frac energy close to the wellbore, which increases stimulated rock volume and allows us to more effectively drain the reservoir,” says COO Mike McAllister.

Encana averaged 66,200 boed in 2017, up 37% over the previous year. With a five-rig and three, frac-crew fleet, the Calgary-based operator expects to increase production 30% in 2018, “for less capital than we spent in 2017,” the spokesman said.

MAJORS STAND OUT

Chevron is emblematic of the comparatively outsized position that super-majors hold in a play that has singularly reshaped the U.S. energy landscape and, in the process, become a thorn in the side of OPEC. With year-end shale and tight production averaging 181,000 boed, CEO Mike Wirth said the Permian basin “was the largest contributor” to Chevron’s cumulative reserve additions in 2017. As of January, Chevron was operating 16 rigs and six pressure pumping crews, with plans to have 20 rigs running by year-end.

The addition of some 60,000 acres last year provided running room for nearly 600 additional long lateral wells. “I think there is strong reason to believe that we’ll conclude further value-creating transactions this year and into the future,” Wirth said.

ExxonMobil intends to triple production to more than 600,000 boed by 2025, much of which is likely to flow from some of the basin’s longest lateral wells. The second of two Midland basin wells, with just under 16,000-ft laterals, was being drilled in early February, following the January production start-up of the company’s first 12,500-ft lateral Delaware basin well. Through its XTO Energy subsidiary, ExxonMobil plans to run 30 rigs this year.

ExxonMobil took top billing in the 2017 Permian land grab with its $6.6-billion acquisition of more than 227,000-net acres in the New Mexico Delaware basin, once controlled by the renowned Bass family of Fort Worth, Texas. The contiguous stacked pays of the property are estimated to provide more than 4,800 drilling locations, for average lateral lengths exceeding 12,000 ft, the company says.

Meanwhile, Shell and Anadarko Petroleum Corp. have patched up their once-tenuous joint venture that expired last July. After resolving spending and operatorship issues, the two decided in March to continue working together. Shell was running six rigs in the Permian as of last month.

Anadarko, for its part, captured 70% operatorship in the subject 240,000-net-acre Texas Delaware position, and is now moving toward full development. The Woodlands, Texas, independent, which holds interests in just under 600,000 gross acres, expects to increase oil production 50% this year.

The company closed out 2017 with fourth-quarter production of 77,00 boed—a 69% year-over-year increase. As of February, Anadarko was operating nine rigs and seven completion crews, after turning a quarterly-record 44 wells to sales. More than 160 new wells are planned to go online this year, at expected costs of $8 million/well.

CAPITAL EPICENTER

Fellow independent Pioneer Natural Resources Co. will become the Permian’s newest pure-play operator, after putting its Eagle Ford and West Panhandle assets in Texas and Colorado Raton basin holdings up for sale. Pioneer holds 750,000 gross acres in the Permian and has earmarked its entire $2-billion 2018 capital budget to the Midland basin, where it delivered 252,000 boed in the fourth quarter.

Pioneer plans to maintain a 20-rig fleet this year, including four dedicated to the Southern Wolfcamp joint venture with China’s Sinochem. The company connected 64 horizontal wells to production in the fourth quarter and expects to bring 250 to 275 wells online in 2018. Of those, approximately 45 wells will be prepped for production in the first half, using the Version 3.0+ completion, which builds off of an enhanced methodology that includes proppant loadings of around 2,000 lb/lateral ft, up to 50 bbl/ft fluid concentrations, tighter 15-ft cluster and shorter 100-ft stage spacings.

In similar storylines:

Concho Resources Inc., which bills itself as the Permian’s largest pure-play operator, delivered fourth-quarter production of 211,000 boed, and is running 19 rigs to help meet a 16%-to-20% production growth target this year. Concho drilled 217 and completed 211 operated wells in 2017, within the 470,000 net acres that it holds in the Delaware and Midland basins. Recent highlights include the completion of the multi-well Brass Monkey project in the southern Delaware that includes 10 wells testing the stacked development of the third bench of the Bone Spring, the Wolfcamp A and the Wolfcamp B. The wells flowed at an average 30-day peak rate of 26,000 boed.

Diamondback Energy Inc, likewise, places the whole of its drilling and completion expenditures in the Texas Permian basket, where it holds around 207,000 net acres. Following 2017 production of 79,200 boed—up 84% year-over-year—Diamondback has set year-end 2018 guidance of 108,000 to 116,000 boed. To that end, the company will operate 10 to 12 rigs and turn between 170 and 190 gross operated wells to production, at average lateral lengths of roughly 9,300 ft.

Diamondback drilled 150 gross wells last year, with 123 gross operated horizontal wells turned to production. Recent completions included a four-well pad in the Midland basin, targeting the Wolfcamp A and B benches and the Lower Spraberry, and a two-well pad in Reeves County, with stacked pay from the Wolfcamp A and B benches, at average lateral reaches of 8,315 ft. At average lateral lengths of 12,843 ft, the four-well pad is producing more than 5,000 boed.

EOG Resources Inc. plans to average 19 rigs and seven completion spreads this year, after wrapping up what it described as a “watershed year,” marked with the First Bone Spring and Woodford oil windows emerging as new premium oil plays. EOG expects to complete 230 net wells in its 416,000-net-acre Delaware basin leasehold, prospective for the Wolfcamp, First and Second Bone Spring and the Leonard shales. Year-over-year production increased more than 80% in 2017, exceeding 100,000 bopd in the fourth quarter.

Parsley Energy Inc. expects to exit 2018 with an average production of 98,000 to 108,000 boed, with some 160 wells turned online. With a net leasehold of some 216,000 acres, Parsley plans to run 16 rigs and 10 frac crews. Among the fourth-quarter highlights was the completion of a three-well pad in Martin County, Texas, stacking the Lower Sprayberry, Wolfcamp A and Wolfcamp B horizons.

Marathon Oil Corp. produced 11,000 net boed in the fourth quarter, compared to 9,000 boed in the prior quarter, from a 91,000-net-acre position in New Mexico’s highly competitive northern Delaware basin, acquired in two acquisitions last year. During the final 2017 quarter, Marathon initiated production on 11 gross operated wells in Eddy and Lee counties with average 30-day initial production rates of 1,835 boed. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)