Innovative proppant technology reduces cost per boe

Rapid changes in oil and gas pricing have necessitated that operators find new ways to reduce the cost per boe, to improve their well economics. Consequently, operators are focusing on incremental well production and decreasing well operating costs. Proppant suppliers, such as Hexion, are thus striving to develop new technologies that increase well production and lower costs, to help optimize well productivity.

Traditional, resin-coated proppants provide solutions that include reducing proppant flowback, proppant fines and embedment. The industry’s leading operators are looking beyond these benefits, for technical solutions that can improve wells’ estimated ultimate recovery (EUR) and reduce well operating costs.

OPERATING IN A LOW-PRICED ENVIRONMENT

Motivated by the desire for higher financial returns, and fueled by the rise of innovative technology, optimization efforts have become the standard operating procedure for most operators. Thus, several new trends have emerged.

Optimization of proppant volume. Many operators in North America have been increasing the average proppant volume pumped, per foot of lateral length. A Permian basin operator increased proppant volume from 600 lb/ft to 1,600 lb/ft, and 30-day IP rates increased 60%. The company is testing as much as 3,000 lb of sand per lateral foot, in an effort to lower cost per boe.1 Increasing the average proppant volume pumped, per foot of lateral length, results in more cumulative boe per well.

Minimization of proppant flowback. It is important to address proppant flowback, due to the costs associated with damaged equipment, downtime associated with repairing or replacing equipment, and impact to fracture conductivity. Operators are focusing on minimizing the costs associated with proppant flowing back out of the formation and are taking steps to prevent it.

Maximization of fracture conductivity. The proppant pack is a porous medium, so resistance to flow—which manifests as reduced conductivity—arises from a combination of residual gel damage, fines migration, multi-phase flow, drag forces, capillary forces, proppant crushing, proppant embedment, proppant flowback and fluid momentum losses (β factor).2 These issues must be addressed properly to maximize conductivity.

Stimulation of microfractures. The use of 100-mesh frac sand, carried by a low-viscosity, slickwater frac fluid at a high pump rate, is recommended to stimulate far-field microfractures.3

RESIN-COATED PROPPANTS’ BENEFITS

Selecting the proppant best suited for the completion design is critical. Proppant selection can be a major component to well success, as it is the proppant that stays downhole for the life of the well. While uncoated frac sand can perform in shallower wells, it does not address proppant flowback, fines generation, embedment, pack rearrangement or cyclic stress. Curable resin-coated proppants have the ability to form grain-to-grain bonds, which can help solve these issues, due to their ability to create a unified proppant pack.

Proppant flowback control. Proppants, such as uncoated frac sand and ceramics, have a tendency to flow out of the formation once a well is put on production. If proppant comes out of the fracture near the wellbore—where the fluid velocity is highest—fractures can pinch off near the perforations, leading to underperformance of the entire zone.

Proppant flowback can cause deposition of proppant in the lateral wellbore, leading to costs associated with cleanout and other remediation. Damage to electronic submersible pumps, for example, leads to costly repairs and downtime.

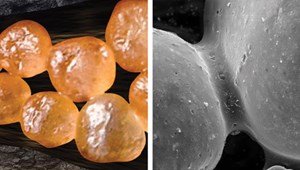

Curable resin-coated proppants mitigate proppant flowback (Fig. 1) by creating a unified, bonded proppant pack, which holds the proppant in the formation. Operators often utilize curable resin-coated proppants as “tail-ins” to hold uncoated proppants in the fracture, due to this feature.

A case study compared 34, 100%-uncoated frac sand wells and 35 wells that used a curable resin-coated sand tail-in in Dimmit and Zavala counties, Texas. The results showed that curable resin-coated proppants are an effective means of controlling proppant flowback. Failures—due to proppant production—were reduced significantly, because of the use of curable resin-coated proppants.4

Reduced proppant fines improve fracture porosity, permeability. The crushing of proppant grains can lead to a decrease in fracture width and the generation of small broken pieces, known as proppant fines. These proppant fines can migrate through the proppant pack and block pathways for oil and gas to flow. Generation of 5% fines can reduce conductivity in the proppant pack by 60%.5

The resin layer on resin-coated proppants encapsulates any broken substrate pieces and immobilizes them, thus preventing migration throughout the proppant pack. Curable resin-coated proppants also create a unified, bonded proppant pack, that can distribute the force being exerted on individual grains, which leads to fewer proppant fines.

Cyclic stress and proppant pack integrity. Cyclic stress events can occur multiple times during the life of the well, when it is shut in for workovers, pipeline connection or other activities. These changes in closure stress can result in greater generation of proppant fines when uncoated proppants are used. A recent study concluded that cyclic stress reduces proppant pack conductivity, decreases fracture width, and increases the amount of proppant fines generated.6

Therefore, we know that the unified proppant pack of curable resin-coated proppants will resist rearrangement and maintain conductive pathways for oil and gas to flow. The bonded proppant pack withstands the cyclic stress changes by distributing the force throughout the bonded lattice network, resulting in less proppant fines.

Reduction of proppant embedment in the fracture face. As fracture closure stress on proppants increases, uncoated frac sand and ceramics can experience point-loading on individual grains. This can result in the embedding of the proppant into the formation rock, especially in softer shales. When proppants embed in the formation, fracture width is reduced, resulting in less production.

Since curable resin-coated proppants bond together and create a unified proppant pack, force is distributed throughout the pack, preventing point-loading on individual grains and reducing embedment.

ADVANCED PROPPANTS CAN REDUCE COST PER BOE

Today’s oil and gas industry continues to face many challenges during well completions, some of which include increasing oil production, reducing unwanted formation water production, and increasing microfracture stimulation. New resin technology has helped operators to reduce cost per boe beyond the benefits of traditional resin-coated proppants.

Increased oil production. An operator objective is to increase oil production while reducing the cost per boe. One proven way to accomplish this is by using advanced proppant technology, designed specifically to increase oil production over traditional proppants. Hexion’s OilPlus proppants (Fig. 2) have advanced resin technology that has yielded years of enhanced oil production in all the major plays of North America. They provide higher oil flowrates compared to traditional resin-coated proppants, ceramics, and uncoated frac sand.

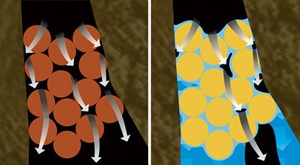

The company’s patented technology increases proppant pack relative permeability to oil. When traditional proppants are used, water adheres to their hydrophilic surfaces, blocking pathways for oil and gas to flow. With the new proppant technology, water does not cling to the surface of the proppant. This allows a clear path through the proppant pack, resulting in increased flow of hydrocarbons, compared to traditional proppants.

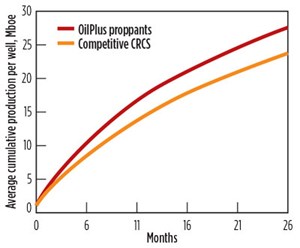

Case study: Increasing oil production. The company’s resin-coated proppants have proven that they can enhance oil production over traditional proppants, Fig. 3. These advanced proppants are field-proven in more than 1,000 wells throughout North America. The data set in this case study contained 50 wells, including 32 OilPlus proppant wells and 18 other curable, resin-coated sand wells (CRCS). All wells were completed by a single Permian basin operator in Howard County, Texas. The operator used both 20/40 and 30/50 mesh sizes in all wells. The data in Fig. 4 show a 20% average production increase per each well utilizing the new proppant. Based on $43 oil, these wells produced, on average, $185,000 more revenue per well over the first two years than the others.

If the operator had used the new proppants on the other wells, they would have yielded an additional $3.33 million in revenue. The completion engineers responsible for these wells moved to other operators and continue to pump these proppants, due to the success they experienced in the Permian basin. They continue to see financial value in utilizing the new proppant technology through all market cycles.

Reducing formation water production. The formation water produced after hydraulic fracturing is a challenge to most operators in North America. The disposal of unwanted formation water increases the cost of boe per well. In the U.S., formation water produced averages around 5 to 6 bbl of water for every barrel of oil produced. The Permian basin, for example, produces 6 to 8 bbl of water per barrel of oil. And because this water is full of minerals, petroleum residue, and salt, producers must dispose of the water in a safe and environmentally responsible manner.7

The rise in completion activity has led to an increase in water intensity and formation water production. The basin’s saltwater disposal well (SWD) capacity is facing heavy constraints in key areas. As SWDs—that are near a well, that is producing high volumes of produced water—reach capacity, operators have to transport water to more distant locations for disposal. This has led to a material increase in water disposal costs. Presuming that the price of oil continues to stabilize, it is estimated that water production in the Permian basin could increase by as much as 50 MMbbl each month. If production increases by this amount, approximately 70 MMbbl of produced water would need to be diverted from current disposal facilities to new facilities, or be diverted for reuse.8

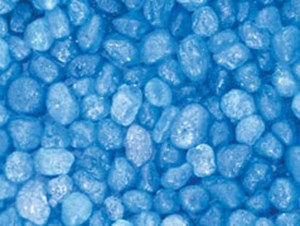

Without compromising oil and gas production, Hexion’s AquaBond proppants (Fig. 5) have advanced technology specifically designed to reduce formation water production, compared to traditional proppants. The lower water production results in reduced cost per boe, per well. The innovative resin chemistry of these unique proppants alters the relative permeability of the proppant pack for preferential flow of hydrocarbons over water. The water-reducing properties are part of the chemistry of these resin-coated proppants, which provides water reduction benefits over the life of the well.

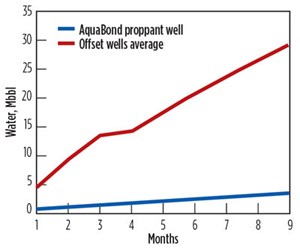

Reduction in produced water case study. In the Granite Wash formation of Oklahoma and Texas, production from one well, that used a 23% AquaBond proppant tail-in, was compared to three offset wells that used 100% uncoated frac sand. Total proppant volumes, depths, and lateral lengths were all similar, and the wells were all completed for the same operator in the same time period. Over nine months, the well with the new proppant produced approximately 26,000 fewer barrels of water than an average of the offset wells, Fig. 6. The well also produced more than three times the boe than the average of the offsets.

INCREASED MICROFRACTURE STIMULATION

Increasing microfracture stimulation is a way to increase EUR and lower cost per boe in wells. Many of the small, secondary fractures are simply not stimulated, unless smaller grains like those with 100 mesh are used. However, as a well is produced, high velocities in propped microfractures may cause uncoated packs to shift and rearrange. Proppant pack rearrangement in the fracture can cause a significant reduction in propped width. As the pack rearranges, the microfractures can narrow, or possibly close completely, leading to reduced fracture flow and connectivity to the wellbore.

A new innovative solution, kRT 100 proppant, was developed to stimulate microfractures, while providing all of the advantages of a resin-coated proppant. The resin coating supports the intended use of 100-mesh grains within the fracture network. These proppants now provide all of the benefits of a resin-coated proppant, such as mitigating proppant flowback, limiting proppant fines, and reducing proppant embedment, compared to uncoated frac sand. Because these small proppants bond in the microfractures, they also keep proppant rearrangement from occurring. A bond strength test (Fig. 7) showed that these proppants bonded into a unified proppant pack at 130˚F, while uncoated frac sand does not form bonds.

CONCLUSIONS

Operators today are focused on optimizing completions to further drive down the cost per boe. The vast majority of hydraulic fracturing jobs are using uncoated frac sand. While these wells can produce sufficiently, well economics could be improved by utilizing resin-coated proppants. The initial cost-savings of uncoated frac sand are negligible, compared to the long-term benefits of increased production that can be seen from resin-coated proppants. Production declines clearly show that the continued stress on uncoated frac sand causes the grains to fail over time. Conversely, resin-coated proppant technology is proven to improve EUR.

Traditional resin-coated proppants can provide many benefits over uncoated frac sand, such as mitigating proppant flowback, along with providing high porosity and fracture conductivity. However, advanced resin-coated proppants can offer additional solutions over traditional proppants, such as increasing oil production, reducing unwanted formation water, and propping microfractures with grain-to-grain bonding. Pumping proppants with innovative technologies can improve well production and reduce cost per boe, compared to traditional proppants. ![]()

Note: OilPlus proppants, AquaBond proppants and kRT proppants are trademarks owned or licensed by Hexion Inc.

References

- “Permian perseveres,” http://www.oilandgasinvestor.com/permian-perseveres-801641, May 2015.

- Gomaa, A. M., H. Hudson, S. Nelson and H. Brannon, “Hydraulic fracturing treatment design considerations for effective proppant pillar construction,” SPE paper doi 10.2118/181508-MS, September 2016.

- Klingensmith, B. C., M. Hossaini and S. Fleenor, “Considering far-field fracture connectivity in stimulation treatment designs in the Permian basin,” Unconventional Resources Technology Conference. doi 10.15530/URTEC-2015-21538212015, July 2015.

- Pope, C. D., T. Wiles, and B. Pierce, “Curable resin-coated sand controls proppant flowback,” SPE paper doi 10.2118/16209-MS, January 1987.

- Coulter, G. R. and R. Wells, “The advantages of high proppant concentration in fracture stimulation,” SPE paper doi 10.2118/3298-PA, June 1972.

- Holditch, S.A., D. Blakely, Texas A&M Univ. “Flow characteristics of hydraulic fracture proppants subjected to repeated production cycles,” SPE paper 19091-PA, SPE Production Engineering, February 1992, Volume 7, Number 1, pp. 15–20, doi: 10.2118/19091-PA.

- Carr, Housley, “Wipe out!—How will Permian E&Ps dispose of all that produced water?,” RBN Energy, LLC., June 2017.

- Whitfield, S., “Permian, Bakken operators face produced water challenges,” Journal of Petroleum Technology, June 2017.

- Using data to create new completion efficiencies (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Digital completions platform provides complete operations visibility to enhance efficiency, collaboration (December 2023)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)