A hydrocarbon hotbed, West Africa entices explorers with auspicious prospects

While much of West Africa suffers from economic hardship, political turmoil and corruption, other regions are thriving. Despite the risk to E&P activity in these precarious areas of operation, producers cannot ignore its abundant resources and its affluent potential to be an international hydrocarbon hotbed.

NIGERIA

Despite having the tenth-largest proven reserves in the world, war-torn Nigeria has been faced with underinvestment and ongoing tension from militant groups, the Niger Delta Avengers and the Boko Haram Islamist insurgency. These challenges have led to a significant drop in output of late, and explains why the OPEC member was exempt from the December agreement to cut oil production.

In August 2016, production fell to 1.39 MMbopd, which was the lowest level the country had seen since 1988, according to Bloomberg data. Last year, alone, the country says it lost more than $7 billion in export revenue, due to militant attacks on oil infrastructure. This has had an adverse effect on the country economically, as oil exports serve as its primary source of revenue.

Following the drop in output, Nigeria struggled to make up for lost time. Negotiations for a peaceful resolution with militants began in November, and a new production target of 2.2 MMbbl by the end of the year was established.

In early January, however, the African nation saw another drop in oil production, as Royal Dutch Shell was forced to shut the Trans Niger oil pipeline, due to a fire. Production ceased and the pipeline, which is capable of transporting approximately 180,000 bopd to the Bonny Export Terminal in the Niger Delta, ended a three-month streak of gains.

By the end of the month, it was reported that Nigeria was pumping approximately 1.5 MMbopd—only a modest recovery. All the while, the nation’s government was working to regain rapport with communities in the Niger Delta region, which is home to the lion’s share of Nigeria’s oil production. With a new production target of 2.5 MMbopd by 2020, the Nigerian government says it hopes to boost export earnings and achieve full economic recovery.

To help fund President Muhammadu Buhari’s new four-year plan, the government announced in March that it would sell some of its oil assets. The country reportedly has an average 55% stake in JVs headed by Shell, Exxon Mobil, Chevron, Total and Eni, which produce approximately 90% of the nation’s crude oil. By cutting its stake in oil and gas assets, the country aims to increase revenue by more than $2.5 billion annually.

Additionally, Nigerian senators passed a bill to reform the country’s oil and gas industry in late May. “This is a bill that has been delayed for many years,” Senate President Bukola Saraki said. Its provisions “will ensure transparency and accountability and create an enabling environment for the petroleum sector that will be necessary to stimulate growth.” The bill, which also must be approved by the House of Representatives before it is officially signed into law, will reform the way in which Nigerian oil and gas production is regulated and funded.

In early June, Nigeria’s oil and gas industry took another step forward when Shell lifted restrictions on Forcados crude oil shipments. The Forcados export terminal suffered several underwater militant attacks, causing Shell’s Nigerian unit to declare a force majeure more than a year ago. The subsea export line’s lapse in production cost the country billions of dollars in revenue. However, the return of Forcados is expected to add more than 10% to the country’s output.

CONGO/ANGOLA

Nearly 47 mi offshore Pointe-Noire, in the Republic of Congo, Total has progressed considerably in the development of its Moho Nord project. It is the company’s second project in the Moho Bilondo offshore license, and it is the largest oil project ever to be undertaken in the Congo.

In early March, the deepwater project began producing. After being developed through 34 wells that are tied back to a TLP and to Likouf (Fig. 1), a new floating production unit, the oil is processed and exported via pipeline to the Djeno onshore terminal—also operated by Total. The project taps into deposits found in water depths of about 1,476 ft to 3,937 ft, and is expected to have a production capacity of more than 100,000 bopd.

As operator, with a 53.5% interest, Total and its partners designed the facilities to have minimal environmental impact. According to Total, there is no routine flaring and the all-electric design improves energy efficiency through the optimization of power needed to run the installations. Additionally, all produced water is to be reinjected into the reservoir.

Southwest of the Congo, the Republic of Angola saw progress in late March, as well, when Chevron announced the start of production at the main production facility of Mafumeira Sul in Block 0.

Situated 15 mi offshore Cabinda Province, in 200 ft of water, the Mafumeira Sul project includes a central processing facility, two wellhead platforms, approximately 75 mi of subsea pipelines, 34 producing wells and 16 water injection wells. According to Chevron, the facility has an overall capacity of 150,000 bpd of liquids and 350 MMcfgd. Ramp-up to full production reportedly is expected to continue through 2018.

EQUITORIAL GUINEA

Prior to officially joining OPEC in May, Equatorial Guinea agreed to join those nations contributing to the group’s production cuts. In December, the country—which is the third-largest oil and gas producer in sub-Saharan Africa—committed to a reduction of approximately 12,000 bopd.

Although the country makes up an area of just 11,000 mi2, its offshore oil and gas sector has proven illustrious of late. In July 2016, Marathon Oil announced first gas from its Alba B3 offshore compression platform. The platform allowed the company to convert approximately 130 MMboe of proved undeveloped reserves. Additionally, it doubled its remaining proved, developed reserve base in Equatorial Guinea.

With a 20-year history in Equatorial Guinea, Exxon Mobil has expanded its position in the country’s offshore E&P sector. The company’s wholly owned affiliate, E&P Equatorial Guinea (Deepwater) Ltd., signed a PSC with the country’s government in early June. Deepwater Block EG-11, which is situated approximately 36 mi west of Malabo, is adjacent to Zafiro field in Block B. It measures about 1,242 km2. Exxon Mobil reported that under terms of the contract, the company will hold operatorship with an 80% working interest, while GEPetrol holds the remaining 20%.

Another major development took place last year when Ophir Energy and OneLNGSM—a JV between subsidiaries of Golar LNG and Schlumberger—signed an agreement to jointly develop the Fortuna project, in Equatorial Guinea’s offshore Block R. Under terms of the agreement, OneLNG and Ophir were given 66.2% and 33.8% ownership of the joint operating company (JOC), respectively. The JOC reportedly will facilitate all financing, construction and operations related to the project. In addition, the JOC will own Ophir’s share of Block R and the Gandria FLNG vessel from final investment decision, which is expected to take place this year. According to the JOC, the project’s initial ascent is expected to reach 2.2 to 2.5 mtpa for a period of 15 to 20 years, which will monetize around 2.6 Tcf of the discovered resource. First gas is anticipated for 2020.

In May, Equatorial Guinea partnered with Arabian Energy to develop the Bioko Oil Terminal. Upon completion, the $500-million project will be West Africa’s largest petroleum storage facility. It is expected to transform the region’s energy sector into a chief trading and services hub. The hub—which will be made up of 22 storage tanks, with a total capacity of 7.55 MMbbl—will be built in two phases. The first phase reportedly will consist of refined production, while the second phase will include storing, handling and blending middle distillate and lights, such as diesel, jet fuel, gasoline, naphtha and crude oil.

Not only will the terminal create a distribution center for the region’s petroleum products and attract investment, but it also will result in meaningful economic relief through job creation and a substantial decrease in imports.

CAMEROON/GABON

The vast majority of Cameroon’s GDP is generated from agriculture. It has one of the highest per-capita GDPs in sub-Saharan Africa, making it prime real estate for oil explorers.

Bowleven Oil & Gas, an independent E&P company, holds interests in both offshore shallow-water and onshore Cameroon. A number of discoveries have been made in the shallow waters of the Etinde Permit, which lies within the Rio Del Rey basin. Bowleven (20%) and its partners—NewAge (operator, 30%), Lukoil (30%) and SNH (20%)—have been focused on bringing the existing discoveries into production. According to the company, appraisal well locations have been agreed to, and well design and planning is underway.

In January, Bowleven was awarded a two-year extension to the onshore Bomono Exploration licence, and a provisional exploitation authorization (PEA) was signed. The PEA reportedly grants the company the right to further develop and commercialize Bomono, which ultimately will enable the sale of gas to either the domestic gas market or power generation.

With 100% equity in the Bomono Permit, Bowleven has reported plans to continue development planning, gas sales discussions and farm-out plans, as well as the continued evaluation of the region’s deeper sands.

After rejoining OPEC last year, Gabon’s E&P sector has remained strong, as well. Despite its contribution to the group’s reduction in output, the country’s energy industry endures. It has established itself as sub-Saharan Africa’s fourth-largest producer and exporter of crude oil.

With more than half of its E&P business in Gabon, VAALCO Energy acquired additional working interest in the Etame Marin Permit in August 2016. As operator and, prior to the acquisition, holder of a 30.35% participating interest in the Etame Marin Block, the company reported that the buy has the potential to boost its net production almost 11%.

The block, which is made up of about 28,700 gross acres in shallow water, includes four production platforms and nine producing wells, as well as three subsea well tie-backs. More than 93 MMbbl of oil reportedly have been produced since production started in 2002.

While some companies are increasing interest in the waters off of Gabon, Harvest Natural Resources made the decision to divest all of its oil and gas interests in the region for $32 million, upon the company’s dissolution. In December, the company reported that its wholly owned subsidiary, HNR Energia BV, had entered into a sale and purchase agreement (SPA) with BW Energy Gabon, a private Singapore-based company. Under terms of the agreement, BW acquired 100% interest in Harvest Dussafu BV, which owns a 66.667% interest in the Dussafu PSC, covering a 210,000-acre area.

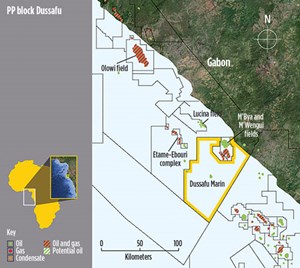

The Dussafu Marin permit is a development block that is situated in the Southern Gabon basin, Fig. 2. The Dussafu permit, which includes Ruche, Tortue, Moubenga and Walt Whitman fields, is a prolific area covering more than 850 km2. It is adjacent to the Etame-Ebouri Trend, a group of fields producing from the pre-salt Gamba and Dentale sandstones. Additionally, Lucina and M’Bya fields lie north of the block. These fields produce from the syn-rift Lucina sandstones below the Gamba. Development of Dussafu is still underway; however, two wells at Tortue field are expected to begin producing next year, according to Panoro Energy.

In February, Panoro Energy announced a sale and purchase agreement with BW Energy Gabon, as well. Under terms of the SPA, a wholly owned subsidiary of Panoro sold its 25% working interest in the Dussafu PSC for a total cash consideration of $12 million. Following the transaction, Panoro was left with an 8.33% working interest in Dussafu.

Oil majors Total and Shell have recently sold stakes in Gabon, as well. In late February, Total signed an agreement with Perenco, transferring operatorship in several mature assets. The agreement included the sale of Total’s wholly owned affiliate, Total Participations Petolières Gabon, which holds interests in ten fields. In addition, the company sold interests in five fields, as well as interest in the Rabi-Coucal-Cap Lopez pipeline. Overall value of the divestitures reportedly amounted to $350 million.

In March, Shell followed suit, selling 100% of its onshore assets to Assala Energy Holdings for $587 million. The assets sold included operated fields Rabi, Toucan-Robin, Gamba-Ivinga, Koula-Damier and Bende-M’Bassou-Totou; non-operated fields Atora, Avocette-M’Boukou, Coucal and Tsiengui West; and all associated infrastructure of the onshore pipeline system.

COTE D’IVOIRE/GHANA

While the Republic of Cote d’Ivoire, also known as Ivory Coast, is primarily acknowledged as the world’s largest exporter of cocoa beans, its offshore oil and gas sector is beginning to emerge, as well. This historically under-explored area is starting to pique the interest of producers operating in neighboring Ghana.

Eni was awarded majority stakes in two new exploration blocks off the coast of Cote d’Ivoire in March. The blocks, CI-101 and CI-205, are situated approximately 31 mi from the coastline and cover a total area of about 2,850 km2. Moreover, the blocks are in the eastern part of the prolific Tano basin, where the company already operates.

In late 2016, the CI-GNL (Ivory Coast LNG) consortium, which is led by Total (34%), was awarded rights to build an LNG re-gasification terminal in Cote d’Ivoire. Shareholders agreed in November to terms involving the construction of a terminal with a floating storage and re-gasification unit (FSRU) in Vridi, as well as a pipeline connecting the FSRU to existing and planned infrastructure in Abidjan. According to Total, the project will establish Cote d’Ivoire as home to the first regional LNG import hub in West Africa. The terminal is expected to begin operating by mid-2018.

In the nearby Republic of Ghana, hydrocarbon exploitation continues to serve as one of the nation’s top markets. The country is believed to contain up to 5 Bbbl to 7 Bbbl of petroleum reserves, which would make it the fifth-largest in Africa.

Tullow Oil reported first oil from one of the country’s biggest offshore projects in August 2016. After more than three years of development, the $4.9-billion TEN project started producing oil from Tweneboa, Enyenra and Ntomme (TEN) fields to the FPSO Prof. John Evans Atta Mills.

Also in the Tano basin, off Ghana’s western coast, Sankofa-Gye Nyame field became home to Eni’s John Agyekum Kufuor FPSO in April. The vessel is operating as part of the Offshore Cape Three Points (OCTP) project—consisting of Sankofa Main, Sankofa East and Gye-Nyame fields. As operator with a 44.44% stake in the OCTP project, Eni’s partners include Vitol (35.56%) and GNPC (20%).

Eni launched production from the OCTP block in May, about three months ahead of schedule. Connected to 18 subsea wells, the John Agyekum Kufuor FPSO reportedly will produce up to 85,000 boed. Eni CEO Claudio Descalzi said, “The launch of OCTP will provide gas to Ghana for over 15 years and the resulting electricity will give a real boost to the country’s development.”

MAURITANIA/SENEGAL

Although oil reportedly was not discovered in Mauritania until 2001, the resource-rich country’s offshore E&P activity has hastened in recent years. Operators, including Total, Kosmos Energy and Tullow Oil, have been expanding license areas in the region.

Total signed a new E&P contract with Mauritania in May. Under terms of the agreement, the company reportedly will expand its exploration activity into Block C7, which covers an area of 7,300 km2. Guy Maurice, senior V.P. of Total E&P Africa, said, “This agreement is part of Total’s strategy to explore new deepwater basins in Africa. The addition of the C7 Block to our existing C9 deepwater license creates a contiguous exploration area of around 17,000 km2 in a high-potential zone in offshore Mauritania.”

The Republic of Senegal is seeing an influx of offshore exploration, as well. Following reports of five consecutive discoveries in the Greater Tortue area by Kosmos Energy last year, BP acquired a 49.99% interest in Kosmos BP Senegal Limited, the company’s controlled affiliate.

Meanwhile, Cairn continues to focus on the acreage surrounding its SNE-1 discovery well, which was recognized as the largest global oil discovery in 2014, Fig. 3. In March, the company reported results of its SNE-5 appraisal well, which included two drillstem tests (DST). DST 1a reportedly flowed from a 59-ft interval at a maximum rate of about 4,500 bopd, while DST 1b flowed at a maximum rate of 4,200 bopd, with an additional 28-ft zone.

Following analysis of the well results, SNE-5 was P&A’d and the Stena DrillMAX drillship was scheduled to begin operations on the Vega-Regulus (VR-1) well, about 3 mi west of the SNE-1 discovery well. VR-1 targeted the Vega-Regulus exploration prospect in the Aptian Carbonates underlying SNE field, which reportedly holds potential gross mean consolidated prospective resource of more than 100 MMbbl.

In early April, Cairn reported that VR-1 had encountered the targeted lower reservoirs within the oil column as anticipated, confirming their presence. Preliminary analysis indicated that the lower reservoir is of better quality and is marginally thicker than what was previously encountered. “VR-1 is the sixth successful appraisal well on the SNE field and has encountered some of the best-quality reservoirs found to date,” Simon Thomson, Cairn Energy CEO, said.

By mid-May, the company announced positive results from SNE-6. Pressure data confirmed good connectivity with SNE-5, almost 1 mi away. Consequently, two DSTs were conducted. DST 1a flowed from a 36-ft interval at a maximum rate of about 4,600 bopd, while DST 1b flowed at a maximum rate of about 5,400 bopd, with an additional 39-ft zone.

Cairn reported that SNE-6 was being P&A’d, and the Stena DrillMAX drillship was heading to the FAN SOUTH exploration well, about 12.5 mi southwest of the SNE-3 well. That well is said to be targeting a mean prospective resource of more than 110 MMbbl with dual prospects.

At the same time, BP and its partner, Kosmos Energy, announced a major gas discovery offshore Senegal. The Atwood Achiever drillship drilled the Yakaar-1 exploration well to a TD of approximately 15,420 ft, in nearly 8,366 ft of water. The well, which is situated in the Cayar Offshore Profond Block, has confirmed the company’s belief that recent discoveries in the area are laying the groundwork for a further LNG hub in the basin. Accordingly, BP reported that it plans to drill three additional exploration wells offshore Senegal and Mauritania in the next year. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)