ShaleTech: Marcellus/Utica Shales

With one eye on the thermometer and the other on pipeline regulators, operators targeting the dry gas windows of the tri-state Marcellus and Utica shale plays are banking that the price rally of late 2016 will continue well into the new year, and beyond.

As evidence, the winter blast that walloped much of the U.S. in January was accompanied by a 12-rig, year-over-year increase, with the active fleet directed entirely to the often-stacked gas horizons of Pennsylvania, West Virginia and Ohio. Moreover, with expectations for increased takeaway capacity and shrinking differentials, operators in the latter half of 2016 shelled out nearly $6 billion, to either expand their existing leaseholds or enter the twin plays traversing the Appalachian basin.

According to Baker Hughes, an average 61 rigs were at work in January, with 39 targeting the dry gas zones of the low-cost Marcellus, and the remainder aimed at the underlying and often comingled Utica-Point Pleasant gas horizons. An average 49 cumulative rigs were drilling ahead in January 2016.

Some, however, believe that the rig count would have to more than double from its current level to meet the nearly 20 Bcfgd of additional pipeline capacity proposed for the Appalachian basin during 2017-2018. Providing pipeline companies can navigate the regulatory and environment minefield, an estimated 23 new networks could be making deliveries to the gas-thirsty Northeast and markets beyond. “There is substantial new outlook capacity projected to come online, which we expect will significantly outpace production growth, leading to improved local prices,” says Daniel Rice, CEO of namesake Rice Energy of Canonsburg, Pa. “In our view, we think in order for the basin to grow enough to approach contracted FT (firm transportation) limits long-term, the basin would need to average 125 rigs, starting today through 2020.”

HISTORIC COMEBACK

Recent price volatility notwithstanding, natural gas greeted the 2016-2017 winter heating season with what Bloomberg labeled, “the biggest fourth-quarter rally in 16 years,” settling at $3.802/MMbtu on Dec. 29. As of Jan. 6, seasonal drawdowns had left the nation’s gas stockpiles 4 Bcf below the five-year average, according to the U.S. Energy Information Administration (EIA). At the same time, EIA estimated that 2016 gas production fell 2.4% from the year prior to 72.4 Bcfd, marking the first annual production decline since 2005. This perfect storm has the federal agency predicting gas prices will average $3.55/MMBtu this year and $3.73/MMBtu in 2018.

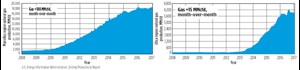

Marcellus gas production between January and February is expected to increase 188 MMcfd to 18.591 Bcfd, while Utica gas wells are forecast to produce 3.956 Bcfd in February, compared to 3.941 Bcfd the month prior, according to EIA, Fig. 1. Reflecting the wholesale shift from Ohio’s liquids-rich Utica core, February oil production is expected to drop, month-over-month, 3,000 bpd to 43,000 bpd. Production also should get a boost with operators’ plans to whittle down a drilled-but-uncompleted (DUC) inventory that, according to EIA, stood at a cumulative 716 wells as of December.

Reported break-even costs in the maturing Marcellus core stand at $2/Mcf or less, while even the growing trend toward longer laterals and beefed-up completions is netting triple-digit returns. Attesting to the attractive completed well costs, pure-play operator EQT Corp. says at $3/Mcfg, its 9,000-ft lateral wells generate a 115% return. Marcellus pioneer Range Resources, for one, expects considerable cost-savings by exploiting an established infrastructure and drilling new wells from its existing 230 pads.

While no specifics were made available, Range said a sizeable chunk of 2017’s new drills would be constructed with longer laterals from earlier-built pads that typically can accommodate 18 to 20 wells. Range says 124 of its pads hold five or fewer wells.

“Although it’s early in the planning process, in southwest Pennsylvania, our current plans have us drilling about a third of our wells on existing pads in 2017. That number could increase to as much as half of our wells in 2018,” COO Ray Walker told analysts on Oct. 26.

The Fort Worth, Texas, operator wrapped up 2016 with five active rigs and the drilling of 99 Marcellus/Utica wells on its roughly 900,000-net-acre Pennsylvania leasehold, of which 615,000 acres sequentially offer Upper Devonian, Marcellus and Utica stacked play potential. Third-quarter net production averaged 1.396 Bcfed, a 9% increase over the prior-year quarter.

Cabot Oil & Gas, which controls a tightly-concentrated 200,000 net acres in the Marcellus dry gas core in prolific Susquehanna County, Pa., said test runs on higher-intensity, fourth-generation completions last year generated a “20% uplift” in cumulative production. “As a result, we have decided to implement this completion design for all of our wells going forward,” said CEO Dan Dinges. He added, “At a $2 (per Mcf) realized price, our wells generate a rate of return over 100%.”

Cabot plans to drill at least 55 wells this year and complete 50, compared to the 30 wells drilled and 67 completed during 2016. The company had 26 DUC wells at year-end, and expects to have a 34-well DUC stockpile at the close of 2017.

JUGGLING ASSETS

Meanwhile, Rice Energy’s $2.7-billion acquisition of Vantage Energy in October topped an Appalachian basin shopping spree that saw no less than 478,900 acres change hands in late 2016, including one operator that returned to the fold after a nearly six-year absence.

In what it claims is the “largest core dry gas Marcellus acquisition to date,” Rice added 85,000 net Marcellus and deep Utica acreage in Greene County, Pa., increasing its leasehold to 231,000 net acres with incremental production last pegged at 268 MMcfed.

Rice planned to exit 2016 with the drilling of 73 net Marcellus and Utica wells, with 61 turned into sales. Averaging six rigs, Rice drilled and completed 10 net Marcellus and four gross Utica wells in the third quarter. In October, a second rig began drilling in the Ohio Utica, where Rice planned to land two additional wells before year-end.

After liquidating its then Susquehanna County leasehold in 2010, closely held Alta Resources Development of Houston re-entered the Marcellus play in late December with back-to-back acquisitions totaling more than $1.4 billion. On Dec. 21, Alta snatched up Anadarko Petroleum’s remaining 195,00 net acres and approximately 470 MMcfd of production in north-central Pennsylvania for $1.24 billion. The next day, Alta paid Mitsui and Co. Ltd an estimated $207 million to acquire a 14.3% interest in the Tokyo company’s Pennsylvania Marcellus assets.

In other key 2016 transactions:

EQT went on a buying binge, highlighted by three separate transactions that added a cumulative 122,100 net acres to its now-more-than 1.2-million-acre Pennsylvania and West Virginia leasehold. On Oct. 25, EQT announced twin deals comprising an aggregate 59,600 net acres, including the $513-million acquisition of 42,600 acres and 42 MMcfd of gas production in West Virginia from Trans Energy. At the same time, the Pittsburgh independent paid an undisclosed seller $170 million for 17,000 net acres in Pennsylvania, with current production of roughly 2 MMcfed.

Those deals followed the July 8 closing of EQT’s $407-million acquisition of Statoil’s non-core 62,500 net acres in West Virginia, with current production of 50 MMcfed. Statoil said it would retain its 350,000-acre Utica interests in Ohio.

In September, Antero Resources closed its $450-million acquisition of 55,000 net acres in West Virginia operated by Southwestern Energy. The acreage included both the Marcellus and Utica stacked dry gas plays.

Antero plans to operate seven rigs this year on the 628,000 net acres it now controls, with four targeting the Marcellus in West Virginia and three earmarked for its Utica holdings in eastern Ohio, Fig. 2. The company plans to complete 170 wells in 2017, with production expected to average 2.160 to 2.250 Bcfed, up 20% to 25% from 2016’s guidance.

Antero said total costs for Marcellus and Utica wells drilled with 9,000-ft laterals, and completed with proppant concentrations of more than 1,300 lb/lateral ft last year, came in at $7.8 million and $9.1 million, respectively, down an average 16.5% over 2015. Antero says longer laterals will be the new normal going forward, pointing to a newly completed Marcellus well constructed with a 14,000-ft horizontal section.

Southwestern, meanwhile, restarted activity in mid-2016 within its remaining northeastern and southwestern Appalachia holdings with four rigs running as of Oct. 21. In the third quarter, Southwestern drilled 21 and completed 17 wells, and planned to initiate production from another 30 wells in the fourth quarter. Aggregate third-quarter 2016 production was 121 Bcfe, compared to 130 Bcfe for the same period of 2015.

In December, Gulfport Energy said it would spend approximately $87 million to acquire 12,600 net undeveloped Ohio acres in the Utica dry gas window. Utica-focused Gulfport plans to maintain its current six-rig fleet in 2017, “with the potential to add additional rigs throughout the year,” President and CEO Michael Moore told analysts. “Our current plan obviously is to allocate almost all of those rigs to the dry gas window.”

Gulfport drilled 31 gross Utica wells in the first nine months of 2016, with lateral lengths averaging 8,520 ft. Third-quarter 2016 production was up 11% over the preceding three months.

Pennsylvania-based Eclipse Resources in late December completed the sale of approximately 9,900 net acres in the Ohio Utica to an undisclosed buyer for approximately $63.8 million.

In a related development, CONSOL Energy and Noble Energy on Oct. 31 dissolved the 50-50 JV that they signed in 2011, which covered an aggregate 669,000 net Marcellus acres in Pennsylvania and West Virginia. The separation gives CONSOL a 100% working interest in 306,000 Pennsylvania acres and associated production of 620 MMcfd. Noble, in turn, now has sole operation of approximately 363,000 net acres and roughly 450 MMcfed of production, primarily in West Virginia.

Noble averaged third-quarter production of 557 MMcfed, up 13% from the like period a year earlier. The company suspended drilling activities in the third quarter, but completed six wells.

CONSOL, which now controls a 584,000-net-acre position, plans to average two rigs this year, while also working down a 68-well DUC inventory.

UTICA DEEP DIVE

At a measured depth (MD) of more than 20,000 ft, CONSOL’s Gaut 4IH well in Westmoreland County, Pa., remains the standard bearer for the dry gas prospects of the deep Utica. Since going online in third-quarter 2015, the well entered 2017 with cumulative production of 7.04 Bcf.

EQT hopes to replicate that pacesetting well, dedicating one rig to drilling from six to eight deep Utica wells in Pennsylvania, to go along with the planned 119 Marcellus and 81 Upper Devonian wells on tap for 2017. EQT first targeted the deeper Utica with its Scotts Run wells on a Marcellus pad in Greene County, Pa. As one of the only operators targeting the deep Utica, EQT remains mum on planned development strategies, other than saying the higher compressive strengths require ceramic proppant.

“We had a view that maybe sand would work, and at the time would be significantly cheaper than ceramics, so we switched over,” says new CEO Steven T. Schlotterbeck. “Those next couple of wells were significant underperformers from the Scotts Run. And then we switched back to ceramics for the last couple of wells, and they were significantly better than the wells with sand. Those two wells have gotten us much closer to the target recoveries that we think we need. Our current plan is to use ceramics for all wells in the future.”

EQT forecasts 2017 production growth of 70 Bcfe, with sales volume of 810–830 Bcfe.

Elsewhere, Utica first mover Chesapeake Energy plans to run one to two rigs this year, mostly in the more-than-one-million net acres it controls in eastern Ohio, where it cites break-even costs of $2.14/Mcf. Chesapeake plans to maintain a “modest drilling program” over the next two years to hold acreage, while concentrating on paring down its DUC inventory this year.

“The nice thing about the Utica is that it gives us a lot of flexibility in the way that we invest, because we have dry gas, and we have oil, and we have everything in-between. So as the commodity deck moves, we can adjust our investment style here and move back into the wet or stay in the dry,” says Executive V.P. Frank J. Patterson. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- When electric meets intelligence: Powering a new era in hydraulic fracturing (January 2024)