Shaletech: Haynesville-Bossier Shale

A Wood Mackenzie number-cruncher has some sage advice for the handful of operators holding positions in the gas-rich Haynesville shale of northern Louisiana and East Texas. “If you have Haynesville acreage, it’s a good time to drill,” analyst Clay Lightfoot told the Wall Street Journal on Oct. 18.

A second wind, for sure, has been blowing steadily across the Haynesville and overlying Bossier shales during 2017, carrying with it nearly twice as many rigs as the year before, with production at its highest level in four years. Until recently, the deep and overpressured Haynesville was among the most striking casualties of the lingering collapse in natural gas prices, where the play’s relatively high well costs put it squarely in an economic pickle. The picture brightened a bit in 2017, as Henry Hub benchmark gas prices settled at an average $3.01/MMBtu, according to the U.S. Energy Information Administration (EIA), which cited the 2016 average of $2.49/MMBtu as the lowest annual price since 1999. The EIA forecasts 2018 prices to average a minimum $3.10/MMBtu, possibly spiking to as high as $4.52/MMBtu for February deliveries.

From strictly a wellhead break-even price (BEP) perspective, Haynesville wells are still around $1/Mcf costlier than their Marcellus and Utica contemporaries, according to Rystad Energy. An analysis of 10 operators, which Rystad cites as drilling 93% of all Haynesville wells in 2016–2017, shows wellhead BEP averaging $3.38/Mcf.

Wellhead costs, however, do not take into account one of the nation’s most established gas infrastructures, located in enviable proximity to a growing market along the Gulf Coast. Between increased industrial demand, Cheniere Energy-led LNG exports (Fig. 1) and deliveries to gas-hungry Mexico, producers say the Haynesville-Bossier has clear, and sustainable, pricing advantages over its northeastern peers. By 2020, it is estimated that Gulf Coast customers could require as much as 16 to 17 Bcfd of additional natural gas, says Comstock Energy Inc. Chairman and CEO Jay Allison.

“The Haynesville and Bossier shale plays are in a prime location to take advantage of the expected growth in the Gulf region, due to their location and the extensive natural gas infrastructure that currently exists in the region. The Haynesville’s proximity to Henry Hub (distribution network) results in the play being economically advantaged versus other plays much farther away, such as the Marcellus and Utica,” he said in an email.

Complementing the geographic pricing advantages, operators point to near-ubiquitous 10,000-ft lateral wells and super-sized completions, featuring proppant loadings up to 5,000 lb/lateral ft, as generating impressive flowrates and estimated ultimate recoveries (EURs) with competitively higher returns/well. New-generation completion strategies, likewise, are being applied in the burgeoning refracing trend spreading across this more mature of the unconventional plays. “One obvious benefit of driving production growth in the Haynesville is the returns and, therefore, the payout on these wells is extremely attractive at $3 gas,” QEP Resources Inc. CEO Chuck Stanley told S&P Global on Oct. 26.

Meanwhile, prompted by the regional explosion in frac sand demand, privately held Performance Proppants, LLC, began production at its in-field Hat Creek mine in October with plans to add a sister facility. When fully operational, the Hat Creek mine will have the capacity to produce 1.4 million to 1.6 million tons/yr. On Oct. 25, Performance Proppants acquired an estimated 60 million tons of sand reserves in another property, 30 mi from Hat Creek.

ACROSS-THE-BOARD UPTICK

According to Baker Hughes, an average 39 active rigs were at work in the Haynesville in November, compared to the 22-rig average of November 2016. Authorized drilling authorizations showed a similar trend, with the Louisiana Department of Natural Resources (DNR) approving 224 new drilling permits for the 10 Haynesville-specific parishes between January–November, compared to approximately 123 approvals for the same 2016 period. Across the border, the Texas Railroad Commission issued 104 drilling permits for the state’s three-county Haynesville-Bossier fairway between Jan. 1 and Nov. 3, compared to 45 for the like period of 2016.

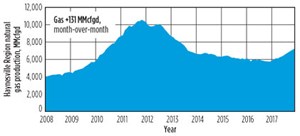

Meanwhile, after remaining stalled at around 6.0 Bcfd for three years, Haynesville gas production in September reached its highest level since 2013, with 6.9 Bcfd put into sales, according to EIA. The federal agency guesstimates that Haynesville-Bossier producers will deliver 7.259 Bcfd in December, up 131 MMcfd over the prior month, Fig. 2. The play’s premier leaseholder, Chesapeake Energy Corp., contributed heavily to the production uptick, with the delivery of 1 Bcfgd in October, representing the company’s highest daily rate since November 2012. “Our Haynesville asset has evolved from an underappreciated asset to one of the most powerful gas basins in North America, rivaling even the Marcellus,” said President and CEO Doug Lawler.

A year removed from its self-described “propageddon” jumbo fracs, early mover Chesapeake connected 12 wells to production in the third quarter, with average lateral lengths of 8,440 ft and IP rates of 31.840 MMcfd. Included in the mix was the four-well BSNR pad in De Soto Parish, which came online in September, delivering a combined 134.0 MMcfgd, followed in October by the three-well PKY pad, with peak combined production of 95.000 MMcfgd. All of the BSNR wells were completed with 9,800-ft laterals; 8,500 ft was the standard for the PKY pad.

Up to seven wells are expected to be placed on production in the fourth quarter, including a 10,000-lateral-ft Bossier well. Those will be followed by the company’s first 15,000-ft-lateral Haynesville well, scheduled for hook-up in early 2018.

“Thanks to our unique ability to successfully couple long laterals with enhanced completions, an IP of 30 MMcfd is now the new normal for Chesapeake. Just three years ago, our Haynesville wells had initial production rates of only 12 MMcfd,” Lawler said.

As of Nov. 2, Chesapeake was running three rigs and two frac crews (Fig. 3) and planned to close out 2017 with the drilling of between 30 and 35 wells, and 32 to 37 wells put on production. The company also initiated a refrac program in the second quarter.

Following the sale of non-core acreage, Chesapeake still controls roughly 255,000 net acres concentrated in the Louisiana fairway. In February, Chesapeake closed the $465-million sale of some 41,500 non-core net acres to Dallas’ tightly held Covey Park Energy LLC, which has quietly built one of the play’s top acreage positions. Prior to the Chesapeake acquisition, Covey Park controlled an estimated 218,000 net (321,000 gross) acres.

Covey Park, which has not disclosed any information on near-term activity, confidentially submitted a draft registration statement with the U.S. Securities and Exchange Commission (SEC) on April 24, relating to its proposed initial public offering (IPO). Covey Park joined Vine Resources Inc., which filed a registration statement on April 10 for a proposed $500-million IPO.

Rystad Energy’s NAS WellCube analysis shows Covey Park and Vine Resources spudding 52 and 69 wells, respectively, between 2016–2017.

TOP TIER ASSET

Comstock Resources is among those placing the Haynesville in the uppermost tier of their asset portfolio. Comstock closed out the year with a three-rig program and the drilling of 28 gross (16.1 net) wells, which included four 10,000-ft-lateral Haynesville wells and two extended-reach Bossier wells. In what the company describes as a “high-return” gas play, fourth-quarter Haynesville production is expected to average roughly 240 MMcfd, up from approximately 230 MMcfd in the prior quarter.

As things now stand, the Frisco, Texas, independent will continue to run three rigs into 2018, with tentative plans to drill 26 gross (13.8 net) Haynesville-Bossier wells, with a preliminary target to increase annual production 30%. Two of the rigs will be dedicated to the newly expanded joint venture with USG Properties Haynesville LLC, and the remaining rig will be directed to Comstock’s legacy 66,200-net-acre position. Comstock says its JV partner also has agreed to participate in the drilling of an undetermined number of Bossier wells in Harrison County, Texas.

CEO Allison said the company’s takeaway arrangements also allow the company to fully exploit the intrinsic geographical advantages. “Comstock Resources is fortunate not to have long-term, above-market, fixed transportation contracts, so we are able to realize higher margins than the majority of natural gas producers,” he said.

After directing nearly all of its 2017 capital budget to its Haynesville-Bossier assets, Houston’s Goodrich Petroleum Corp. plans to exit the year with production between 55 MMcfd and 60 MMcfd, up from 34.011 MMcfd delivered to sales over the first three quarters. Goodrich attributes its production growth largely to super-sized completions with proppant loadings between 3,000 and 5,000 lb/lateral ft., which it says is “yielding greater than 2.5 Bcf/1,000 ft of lateral.”

The company was running a single rig at year end, which will be used mainly to drill two-well pads with lateral reaches up to 10,000 ft. “Approximately half of the locations are capable of 10,000-ft laterals, with the remaining half split between 4,600- and 7,500-ft laterals,” says Chairman and CEO Gil Goodrich. “We have gridded our acreage with the plan to maximize long laterals, and expect to be in a position to swap acreage or drilled joint wells with offset operators to further increase our long-lateral inventory.”

Two second-quarter acquisitions of a cumulative 3,000 net acres increased Goodrich’s position to 26,000 net (50,200 gross) acres, targeting the Haynesville in Louisiana and the Haynesville-Bossier in Texas’ Angelina River Trend. Goodrich operates 50% of the leasehold, with most of the reminder operated by Chesapeake in a joint venture arrangement.

Though Goodrich also holds an aggregate 94,000 net acres in the Eagle Ford, and the Tuscaloosa Marine Shale (TMS), the company of late is focusing exclusively on its Haynesville-Bossier assets.

BACK TO DRILLING

Emboldened by the results of a multi-well refracing campaign, QEP Resources in September mobilized a rig to its 48,900-net-acre Haynesville/Cotton Valley leasehold for the first time in five years. “Based on the strong results from our refrac program, we moved a rig into the Haynesville and commenced drilling new wells for the first time since 2012,” said Stanley.

Since launching the refrac program in mid-2016, the Denver, Colo., independent had completed nine refracs by Oct. 28, which subsequently added around 215 MMcfed in gross gas production, with average incremental 24-hr rates of 15.3 MMcfed. QEP expects to have refraced some 29 wells at year-end, at an average cost of $4.9 million/well.

The first well in the revived drilling schedule was a re-entry of a 5,000-ft lateral that had been drilled to the intermediate casing point in 2009. The rig has since mobilized to begin drilling “the first in a series of planned 10,000-ft laterals,” Stanley said.

While working to shore up an ailing balance sheet, EXCO Resources Inc., likewise, restarted activity in January and will wrap up 2017 with four rigs and the planned drilling of 36 gross (17.8 net) Haynesville and Bossier wells across its 97,800-net-acre position, which is mostly held-by-production (HBP).

EXCO ended the third quarter with the drilling of 10 gross Haynesville wells and one Bossier well, with nine Haynesville wells and one cross-unit Bossier appraisal well planned for connection to sales in the fourth quarter. Non-operated third-quarter activity in the East Texas Shelby area included the drilling of an extended-reach Bossier well that was stack-completed with the Haynesville.

“The Haynesville play has been re-energized with advancements in completion design and longer laterals,” said COO Harold Jameson, adding that nearly half of the wells that EXCO drilled in 2017 featured laterals up to 10,000 ft, with 30% higher proppant concentration, more fluid and tighter clusters. The resumed drilling campaign kicked off with a Bossier appraisal well that includes a 7,000-ft lateral and was completed with 3,500 lb/ft of proppant in 48 stages, delivering initial production rates of 12.1 MMcfd, he said.

In a related development, the purported termination of a gas sales contract forced EXCO to terminate the proposed $300-million sale of its 49,300-net-acre Eagle Ford position on Aug. 15. The proceeds were to be directed toward advancing Haynesville development.

Elsewhere, BHP Billiton was running four rigs on its roughly 239,000-net-acre leasehold at the end of the third quarter, even as it looks to unload its U.S. unconventional assets. Speaking to the Oil and Money Conference in London on Oct. 19, BHP Petroleum President Steve Pastor said, “following a recent portfolio review, we re-classified our onshore U.S. shale assets as non-core, and we publicly announced that we are pursuing options to exit our U.S. onshore positions, for value.” ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)