Permian producers push the envelope for output growth in 2018

Sought-after shale acreage in the Permian basin has been the jewel of U.S. production growth in the past year. Although its prolific geology should continue to produce oil and gas at increased rates, the leaps and bounds wrought by longer laterals and increased proppant usage could begin to taper off in 2018.

Indeed, lateral lengths focused in the Permian’s highest-quality Bone Spring, Wolfcamp Delaware and Wolfcamp Midland plays have increased by a range of 20% to 35% since 2014. For instance, last June, lateral lengths averaged more than 9,000 ft in the Wolfcamp Midland, versus about 7,200 ft in June 2014. Total Permian proppant usage is on track to increase to 42 billion lb for 2017, nearly a two-fold increase over 2016 usage, according to IHS Markit. Per-well proppant data in the Permian indicate that operators are now using about 2,000 lb/ft in horizontal wells. As a result of such strategies, unconventional Permian wells in 2017 have garnered EUR rates that range from about 800,000 bbl to 1.0 MMbbl, roughly double the rates from 2014. Yet, this trend may soon slow down.

“We are starting to see indications that maybe the industry has determined the optimal well configurations,” said Reed Olmstead, director of North American onshore research and business development for IHS. “Obviously, there are always going to be marginal gains, and the next incremental gain—but these massive gains that we have been seeing—we are probably going to start to see those moderate in 2018, and certainly into 2019,” he said.

As Olmstead explains, although Permian wells have shown vast increases in productivity, this is largely because operators have focused larger completion jobs—with increasingly longer laterals and proppant usage—in the best possible acreage, that has the most productive geology. “Those impacts are starting to be fully realized,” he said. “Typically, your early frac stages—near the heel of the well—produce significantly more than the stages at the toe—near the far end—and so as you drill longer, that next stage is always going to produce less than the one before it.”

Olmstead said he expects operators to keep testing the limits of long laterals and increased proppant volumes, although such strategies are unlikely to provide the same gains that were observed initially. “I think operators are still trying to push the limits, and typically, what we have seen is that operators will go above the optimal limit in order to see negative results, or deteriorated results, before they will come back to what is optimal.”

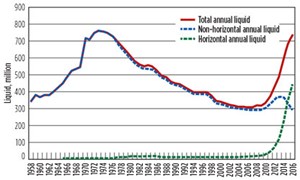

Yet, growth in unconventional drilling activity is the driver that should keep annual production gains steady, Olmstead said. IHS projects that operators will drill 3,700 unconventional wells in 2018, up from 3,300 in 2017, and 2,250 in 2016, Fig. 1. Thus, total Permian basin liquids production is expected to amount to 2.75 MMbpd by the end of 2017, and it is expected to reach 3.25 MMbpd by the end of 2018, assuming that the WTI crude price hovers around $55/bbl, according to IHS.

Long term, IHS forecasts Permian production to grow until at least 2030, with liquids output projected to reach about 5.5 MMbpd, Fig. 2. In fact, output in the basin could remain steady, well beyond 2030. In September, IHS announced findings that indicate the Permian basin still holds 60 Bbbl to 70 Bbbl of recoverable resources. The announcement was made as the firm completed the first, three-year phase of its Permian basin research project, in which IHS completed models and interpretations of key geological characteristics to better estimate the basin’s remaining hydrocarbon potential. Olmstead notes that he expects operators to continue to test new technologies in the Permian, which eventually could cause the company to increase its prediction.

“I think that the industry is certainly going to innovate, and the way estimates have historically worked, is that every year, as we see more technology come into the field and into the business, estimated recoverable resource goes up,” he said. “So, right now, we are expecting 60 Bbbl to 70 Bbbl with what the industry currently has available for extracting hydrocarbons. But as we continue to see wells produce more and be more efficient, that number will likely get increased.” Beyond 2018, other techniques on the horizon that could provide upside for the Permian include proppant mesh size optimization and using finer mesh; a focus on fracture complexity rather than fracture size; and utilizing data to further perfect well and completion design.

CAPEX TO INCREASE WITH SERVICE COSTS

As operators continue investing in new technological innovations to expand shale production in the Permian, so too are companies increasing upstream capex in the basin. Permian spending has amounted to 39% of total U.S. onshore capex in the past year, but the play is expected to continue to eat up U.S. capex in the coming years. IHS predicts that capex in the basin will total $23 billion by the end of 2017, but Permian capex is expected to rise to $30 billion in 2018 and $37 billion in 2019. “Really, when we think about the biggest opportunity for U.S. investment, it is unquestionably the Permian basin,” Olmstead said, explaining that many U.S. operators perceive the Permian as their best chance at production growth. “The eyes of the world are upon it.”

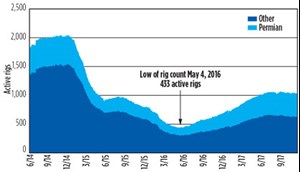

Increasing service costs are expected to cause Permian break-even pricing to rise $5/bbl next year, which means that most plays in the basin will require nearly $50/bbl WTI pricing to produce a 10% internal rate of return, according to IHS. This trend will become a major reason for operators to spend more capital next year. Demand for drilling rigs, pressure pumping units, and proppant is growing, which should allow drilling contractors and oilfield service companies to begin regaining pricing power in 2018, Fig. 3. “When a new rig is added to the Permian, we are getting to the point where the rigs must be moved from other plays, outside of the basin, and so typically there is a charge for that, which is priced into those service contracts,” Olmstead said. “The pumping crews are also getting booked up, and that gives them significantly more pricing power than they have enjoyed over the last couple of years.”

For example, the combined rig count for the Bone Spring, Wolfcamp Midland and Wolfcamp Delaware plays increased 74% from November 2016 to November 2017, rising to 309 active rigs, according to IHS, Fig. 4. Such an increase in drilling activity is putting stress on oilfield service companies to supply operators with hydraulic fracturing units to catch up to new wells drilled. Dayrates for high-spec drilling rigs are averaging about $20,000 in the Permian, and pressure pumping rates in the basin range from $60,000 to $80,000 per stage, although cost inflation for these units is expected to increase 15% to 20% in 2018.

IHS statistics also show that Permian demand will account for 37% of the U.S. market share for proppant in 2017, up from 20% of the market in 2014. On top of that, increasing hydraulic fracturing activity and frac sand mass-per-well projections are leading to a forecast 62% gain in total North American sand demand in 2017, which could contribute to an average 50% increase for mine-gate sand prices across the U.S. by year-end.

DRILLING OVERSHOOTS COMPLETION CAPACITY, DUCs STACK UP

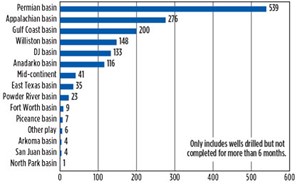

Operators have struggled to keep up with the rise in unconventional wells drilled in the past year, which is leading to a rise in DUCs, as pressure pumping crews strive to keep pace with drilling crews. In the Permian basin, there are 539 DUCs that have remained uncompleted for more than six months, and this statistic has grown by an average of about 30 DUCs per month in 2017, said Sarp Ozkan, manager of energy analytics at DrillingInfo. “If a well is drilled and completed within six months, then that is within a normal spud-to-production lag, and it is what I think of as working inventory,” Ozkan said. “However, if it has been drilled but not completed for more than six months, then this is an indicator that the operator is waiting on something… In the case of the Permian basin, what we’ve been hearing from producers is that there is a shortage of completion crews.”

By comparison, the Permian basin’s six-month DUC count nearly doubles the next-closest U.S. onshore play, which is the Appalachian basin, currently at a count of 276 DUCs, Fig. 5. Barring a sudden spike in oil prices, this buildup in DUC wells could result in diminished rig additions during 2018, if it is left unaddressed, Ozkan said. “On May 4, 2016, the U.S. rig count hit a low of 433 active rigs, but since then, it has climbed to 1,050, and of all of the rigs that have been added back, more than 50% have gone into the Permian basin,” he said, Fig. 6. “However, new additions began to taper off in May, and we haven’t added many new rigs to the Permian.”

To reverse this trend of new DUCs added to the Permian’s inventory, service costs must increase to incentivize more pressure pumping crews to the basin, Ozkan said, Fig. 7. “If we think back to 2014, service costs decreased about 40% from their peak prior to the oil price crash, and that was both a function of service companies dropping costs, as well as operators becoming more efficient and drilling in sweeter spots,” he said. “We won’t be giving all of the 40% back, but we will likely need to give back 10% to 20% in service costs.”

Ozkan said that such an increase in service costs should make no difference for most E&P companies choosing to operate in the Permian. “It lowers the margin, definitely, but it doesn’t make these wells uneconomic,” he said. “It still allows for a very robust rate of return that you wouldn’t get in any other industry.”

Another challenge that is supporting the higher DUC count is a need for new infrastructure to add takeaway capacity from the basin, he said. For example, he referenced the Midland-to-Sealy pipeline, which is expected to ramp up within the next six months. “We have expectations for additional takeaway capacity to come online, and unless that takeaway capacity materializes, production from the Permian basin can’t grow,” Ozkan said. “If we have any sort of bottleneck in takeaway capacity for crude oil, natural gas or NGLs, we could see operators start to slow down the pace of drilling and completions and build a DUC count in expectation of new infrastructure coming online, similar to the trend that we see in the Appalachian basin.”

Ozkan forecast that if completion costs increase at least 10%, and that if planned pipeline projects remain on schedule, Permian operators could begin to draw down the DUC count by mid-2018, at the earliest. “There will continue to be builds in the DUC count, probably through the first half of 2018, because we are not going to be able to respond right away to this shortage in crews,” he said. “Still, if we are incentivized enough, and we have the takeaway capacity, we would likely draw down those DUCs at a pace similar to the buildup over the last couple of months—a drawdown of about 30 DUCs each month.”

TOP PRODUCERS EXPLOIT MOST PRODUCTIVE REGIONS

The operators that are driving the Permian’s productivity are propelling the basin forward by capitalizing on acreage in the area’s most dynamic shale formations—the unconventional plays in the Bone Spring, Wolfcamp Delaware, and Wolfcamp Midland. The underlying source rock in the Wolfcamp A and Wolfcamp B benches has been highly productive, and to date, represents the most targeted Permian shale formations, with a combined 630 wells drilled from January 2015 to January 2017, IHS data show. Some of the top producers focusing on these plays include Pioneer Natural Resources, Occidental Petroleum (Oxy), Concho Resources, ExxonMobil and Apache Corp.

Pioneer has the largest acreage position in the Midland basin, in the Spraberry/Wolfcamp area. The company holds 800,000 gross acres in the region, with more than 20,000 drilling locations. Of the company’s $2.75-billion 2017 capital program, 95% of funds have been directed to the Permian’s Spraberry/Wolfcamp. In third-quarter 2017, the company produced 231,000 boed in the Spraberry/Wolfcamp, up from a reported 201,000 boed in the first quarter and 213,000 in the second quarter. The company also placed 160 wells on production in the third quarter. Pioneer is operating 20 horizontal rigs in the Spraberry/Wolfcamp, and has reported lateral lengths of 10,000 ft in the Wolfcamp B, and lengths of 9,500 ft in Wolfcamp A and the Lower Spraberry, with well costs ranging from $7.5 million to $8.8 million, and with well EUR rates ranging from 1.0 MMboe to 1.7 MMboe.

Oxy reported holding about 1.4 million unconventional net acres in the Permian basin at year-end 2016, and the company is targeting resources in the Delaware basin’s Wolfcamp and Bone Spring formations, as well as the Midland basin’s Spraberry and Wolfcamp formations. The operator’s third-quarter Permian production increased 1,000 boed, to 139,000 boed, due to increased drilling activity and well productivity, although the growth was potentially lessened, due to sales of non-core unconventional acreage and impact from Hurricane Harvey, according to the company. Five wells in New Mexico’s Third Bone Spring held an average 30-day production rate of 3,780 boed, and one well in New Mexico’s Second Bone Spring held a 30-day production rate of 4,500 boed. The company reported that average daily production for enhanced oil recovery in the Permian amounted to 153,000 boe in the third quarter, a 7,000-boe quarterly increase.

Concho holds about 940,000 gross acres in the Permian, with more than 19,000 horizontal drilling locations. The company has reported 720 MMboe in estimated proved reserves and an estimated 8-Bboe total resource potential. Concho drilled 80 Permian wells in the third quarter, including 40 Northern Delaware basin wells, 11 Southern Delaware basin wells, 16 Midland basin wells and 13 New Mexico Shelf wells. It completed 73 Permian wells, with 41 in the Northern Delaware, seven in the Southern Delaware, eight in the Midland basin and 17 in the New Mexico Shelf. The company produced 193,200 boed in the third quarter, a 4.6% increase over the second quarter.

ExxonMobil announced last September that it added 22,000 acres to its Permian basin portfolio, in the Delaware and Midland basins. The company also acquired 250,000 acres in the Delaware basin in February, and over the last few years, it has doubled its core operated acreage in the Midland basin to more than 130,000 acres, through multiple transactions. In third quarter, the company reported operating 20 drilling rigs in the Permian, and released its plans to operate about 30 Permian rigs by year-end 2018. As of September, the operator had drilled 200 wells in core Midland basin acreage, since mid-2014. The company also recently reported drilling a Delaware well with a 12,500-ft lateral length. In October, Exxon announced the acquisition of a new crude oil terminal to support growth in the Delaware basin, and the terminal was said to be permitted for 100,000 bpd of throughput, with the ability to expand.

Apache holds more than 3.1 million gross acres in the Permian, including acreage in the Midland basin, Central basin Platform/Northwest Shelf, and the Delaware basin, with 611 MMboe of estimated proved reserves reported at year-end 2016. The company reported 160,823 boed in Permian production in the third quarter. It also drilled and completed 38 net wells and operated an average 17 drilling rigs in the Permian, during the third quarter. Three pads were brought online in the Southern Midland basin—the June Tippet 1213, the Lynch A, and the CC 4045—and well lateral lengths ranged from 7,646 ft to 10,432 ft. Apache also operated three frac crews in the Midland basin and three frac crews in the Delaware.

During October, Apache provided an update on its Alpine High formation that was discovered in September 2016. So far, the company has drilled more than 70 wells at Alpine High. Average production from the area was 13,300 boed in the third quarter, and the company anticipates a 2017 exit rate of about 25,000 boed. Three wells at Alpine High were drilled and completed in the third quarter, with an average lateral length of 4,500 ft, and average well costs of $5.5 million. Apache holds about 336,000 net mineral acres at Alpine High.

BEYOND 2018

Though the near-term concern for Permian growth is stagnation, a long-term concern is that the basin’s tight oil production could peak early. In a recent report by Wood Mackenzie titled, “Geology vs. technology: how sustainable is Permian tight oil growth?,” the research firm postulates that drilling long-lateral wells in close proximity, combined with high-intensity hydraulic fracturing, could reduce future well EUR, due to completion interference. The company still predicts Permian unconventional oil production to increase to more than 5 MMbopd by 2025, but suggests that well interference, as well as early fatigue of sweet spots, provide some downside in the basin.

“These reservoir issues could begin to manifest as sweet spots become exhausted,” said Robert Clarke, Wood Mackenzie’s research director for Lower 48 upstream. “Taking into account some bearish assumptions, if future wells tap more difficult rocks, and are not offset by continued technology evolution, the Permian may peak in 2021.”

Well interference could cause the Permian’s EURs to diminish 30%, compared to current rates, Wood Mackenzie notes. Moreover, if the basin’s best geology is exhausted, “child wells” drilled in the future, could be exposed to less productive reservoir conditions than today’s “parent wells,” as Wood Mackenzie describes the situation. “We believe future child wells, because they’re effectively drilled into pressure sinks, could have EURs 20% to 40% smaller than their parent producers,” said Alex Beeker, senior research analyst at Wood Mackenzie and co-author of the report.

These downside risks could cause the Permian to lose more than 1.5 MMbopd, bringing peak tight oil production into 2021, according to the firm. The findings come as a word of caution, but as noted by Wood Mackenzie research director and host of the company’s podcast, Crude For Thought, R.T. Dukes, “Betting against tight oil is also a bet against technology.” Dukes made the comment on an episode of the podcast titled “Will Permian Geology or Technology Win,” from Sept. 18, while talking with Clarke regarding the findings of the report.

Clarke noted that there are upside technology trends that could support better growth in the future. These include using finer mesh sizes for proppant, particularly using 100-mesh proppant in shale wells, optimizing pump schedules to enhance completion productivity and better understanding downhole fracture complexity to design optimal completion operations. “We are smarter in the Wolfcamp than we have ever been before, and it is tough to say that ends,” Clarke remarked. “To say that (the Permian) is capped, might not be the smartest thing to say.”

Texas Railroad Commissioner Ryan Sitton: More infrastructure needed to support long-term Permian growth

Drilling permits in Texas Railroad Commission (TRRC) Districts 7C, District 8 and District 8A—those that encompass the expansive Permian basin—have demonstrated a 41% gain from late 2016 to October 2017, and according to Texas Railroad Commissioner Ryan Sitton, there’s even more room to run in 2018. “I think the investment in the Permian basin’s expansion will be substantial next year,” he said, remarking that if oil prices can remain in the $50-to-$60/bbl range, the basin’s Dec. 1 count of about 400 active rigs could grow by 20% next year. “You can get new oil onto the market in a matter of months, you can respond to market conditions much faster, and you still get a lot of very nice production—it’s just the best place to drill right now.”

TRRC records indicate that production in the segment of the Permian that stretches over West Texas averaged about 1.6 MMbopd from January to August in 2017, and Sitton said he expects output to reach 2.0 MMbopd to 3.0 MMbopd within the next 10 years. However, for companies in Texas to make this happen, the state needs new infrastructure, he said. “When you think about the kind of production we could have, we are absolutely going to require a lot of new infrastructure to be able to attain that, and the biggest piece is going to be getting additional pipelines in place to move the product.”

Pipeline capacity. Sitton said he believes that Texas will have sufficient pipeline capacity to handle production in 2018, but that if any disruptions occur in the midstream segment, the state could run into bottlenecks. For instance, when Hurricane Harvey hit the U.S. in late August, several major pipeline routes were interrupted, including the Magellan, Explorer and Colonial pipelines. On top of that, 24% of U.S. refining capacity was shut down, and up to 10% of U.S. drilling was forecast to be paused.

“That was a pretty major disruption that affected everybody, and we probably won’t see something that big for a long time,” he said. “But, we still need an additional couple hundred-thousand barrels of pipeline capacity to provide some breathing room. It is kind of a redundancy thing—we want the Permian basin to really be able to get all of its product to market, and to grow quickly and efficiently. We need enough excess capacity, so that when there are disruptions in certain pieces of the market, those disruptions don’t affect the guys at the wellhead.”

Permitting improvements. To encourage further Permian infrastructure growth, Sitton said that the Railroad Commission is working to become more efficient in its permitting process. Over the course of the next two years, the state agency is looking to add 80 to 100 new employees—mostly inspector roles—to streamline oil and gas permitting. “We are working to evaluate how our staff can be growing, flexing and developing today, to be ready for the boom that we feel very comfortable is coming,” he said. “In 2013 and 2014, when the oil boom was in full swing, we got to a point where permits were really getting drawn out. You were looking at two- and three-month permit times, versus a day, and we since have worked that back down to about a day, but we want to be thoughtful, so that when the boom comes back, we are prepared to handle it.”

Several Permian pipelines have been permitted in the past year, including the ETC Comanche, Trans Pecos and Oneok Roadrunner systems, but Sitton expects that many more will be coming before the Railroad Commission soon. Multiple pipelines already are planned to come online in 2019. These include Houston-based Enterprise Products Partners’ Shin Oak project, a 571-mi NGL connection from the Permian to Mont Belvieu, Texas; the Epic pipeline, a 730-mi crude and condensate connection from the Permian to Corpus Christi by three different companies; and another connection from West Texas to the Gulf Coast, a 430-mi natural gas line planned by Kinder Morgan. Thus, the Railroad Commission estimates that new capacity will be able to add upwards of 600,000 boed of transport capacity by 2019.

Other factors. The secondary piece of infrastructure is ancillary support, Sitton said, such as homes, roads and schools. As E&P companies consider how to increase upstream activity in the future, it will be important to have accommodations for new workers. He and his staff are communicating with local elected officials in West Texas to ensure that they are properly informed of where the market is expected to grow, he said.

As federal officials consider changes to trade agreements that pertain to the border between Texas and Mexico, Sitton also insisted that the ability to seamlessly trade energy between the two countries would be paramount to future Permian growth. “If Mexico wants the product, and we want to sell it to them, it is up to government entities to make that possible,” he said. “Long-term, I’m optimistic that there are not going to be any big regulatory changes that affect our ability to export energy. In fact, five to 10 years out, I think that the U.S. could become one of the biggest energy exporters in the world, because we are better at manufacturing it and exploring for it than anybody else in the world.” ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)