Newfoundland and Labrador shrug off mediocre market, as offshore projects proceed

Much has gone on in Newfoundland and Labrador’s (NL) offshore sector, since the last article/progress report of our East Canada series, in the January 2017 issue (see page 45 of that issue). For instance, Hebron, the province’s fourth major oil field development, is now set to come onstream in late 2017, following tow-out of the platform to the field site in June. A detailed look at recent milestones in the Hebron development program is contained further down in this article.

Meanwhile, the Hibernia platform restarted drilling earlier this year, following upgrades to its two drilling rigs last year. In addition, the West Aquarius semisubmersible completed an intensive drilling program of subsea water injection wells in early April. The Hibernia installation will celebrate 20 years of production in November 2017, and it continues as one of the most productive on the east coast. It marked its one-billion-barrel production milestone in late 2016, and is expected to continue producing beyond 2040.

Last October, Transocean announced a 15-month drilling program at Suncor’s Terra Nova field, scheduled to begin in third-quarter 2017. The $119-million program will utilize the Transocean Barents, a harsh-environment, ultra-deepwater semisubmersible. The contract scope includes maintenance of existing wells and drilling of new wells at Terra Nova. Earlier this year, Suncor continued to advance planning work in pursuit of the Terra Nova Asset Life Extension project. which could add 10 years of production life to the field. In June, the company confirmed that the Transocean Barents was on its way from Norway, and should begin drilling on schedule.

And Husky Energy last May gave the final go-ahead to the West White Rose field development. If construction goes according to plan, first oil production is expected in 2022. A detailed description of the project follows further down in

this article.

In addition, this installment has an update on exploration-related activity, some details on how crown corporation Nalcor Energy is trying to market the Bull Arm fabrication facility, and a recent, local technology advance.

HEBRON HEADS TOWARD FIRST OIL IN LATE 2017

The fourth and latest mega-project in a series offshore NL that goes back to the late 1980s, Hebron is a heavy oil field estimated to produce more than 700 MMbbl of recoverable resources. The field was first discovered in 1980, and is situated offshore NL in the Jeanne d’Arc basin, 350 km southeast of the provincial capital of St. John’s.

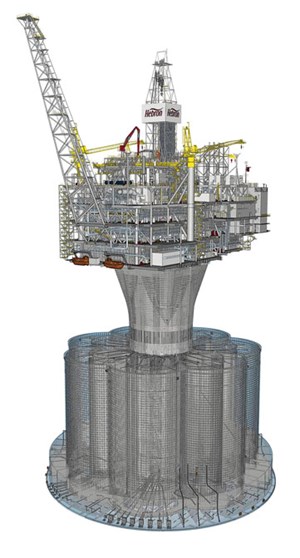

Basic parameters. The water depth at Hebron field is 93 m. The field is being developed, using a stand-alone concrete gravity-based structure (GBS), Fig. 1. The GBS consists of a reinforced concrete structure designed to withstand sea ice, icebergs, and meteorological and oceanographic conditions. The GBS has been designed and built to store approximately 1.2 MMbbl of crude oil. The Bull Arm site (also see a separate discussion of Bull Arm further down in this article) has been the primary construction site for the GBS. The GBS supports an integrated topsides deck that includes a living quarters, as well as drilling and production facilities and equipment.

Fabrication/integration. A substantial portion of the topsides was engineered and fabricated in NL. In addition, fabrication of the Derrick Equipment Set (DES) and the Utilities/Process Module (UPM) of the topsides took place in Ulsan, South Korea.

Last fall, integration of the various topsides modules was performed at the Bull Arm fabrication site. Then, in December, the topsides was mated to the GBS in a massive, impressive floatover operation (see also the cover photo of World Oil’s April 2017 issue, which shows the platform in a night shot, shortly after the mating operation took place). Finally, last April 18, ExxonMobil Canada, along with its project co-venturers and senior government officials, celebrated the completion of the Hebron platform during a pre-tow ceremony at Bull Arm. Participants marked this significant project milestone with a ceremonial “chain-cutting,” symbolizing the cutting of the mooring lines that tethered the platform to land for the various construction phases.

Tow-out/commissioning. Following the completion-of-construction celebration, Exxon Mobil Canada and its co-venturers spent the latter part of April and all of May, readying the Hebron platform for its tow-out to the field site, Fig. 2. Nevertheless, on June 3, the long, slow tow-out of the platform commenced from the Bull Arm construction facility at Mosquito Cove, to the Hebron field site in the Atlantic, Fig. 3.

The Hebron platform, which measures about 220 m in height and weighs about 750,000 tonnes, travelled at about 2 to 3 knots per hour and took 12 days to reach its final destination. After its long journey, the platform finally reached the field site on June 14. Officials from ExxonMobil confirmed that the $14-billion oil platform was set down on the ocean floor in Newfoundland’s Grand Banks.

The towing fleet included 10 large, anchor-handling tug supply vessels, designed specifically for managing large towing operations. Many of the local Atlantic Towing and Maersk vessels in the St. John’s area were employed for the tow. Upon arrival at Hebron field, the towing fleet was reconfigured, and the platform was ballasted to sit on the sea floor in its permanent position.

Commenting at the time that the tow-out began, Geoff Parker, senior project manager for Hebron and vice president of ExxonMobil Canada Properties, said, “Tow-out of the platform is a major step toward our ultimate goal of commencing production from the Hebron field, later in 2017. This is a proud day for the entire Hebron team, including the thousands of Newfoundlanders and Labradorians, who have worked safely on this project.”

Indeed, plans specified that once the platform was fully commissioned, and all regulatory permits were in place, drilling operations would begin, with first oil anticipated before the end of 2017. Eventually, Hebron field will produce 150,000 bopd at peak rates. ExxonMobil, along with its co-venturers and contractors, as well as governmental officials, is taking pride in the fact that this project achieved a phenomenal 40 million hours in the province without a lost-time incident.

WEST WHITE ROSE GETS GREEN LIGHT

As had been expected, Husky Energy (operator, 70%) confirmed on May 29 that it is moving forward with the West White Rose Project, offshore NL. The company and its partners (Suncor Energy, 26%; and Nalcor Energy – Oil and Gas, 5%) will use a fixed wellhead platform (Fig. 4), tied back to the SeaRose FPSO vessel, to produce the field, in addition to other hydrocarbon pools. The platform has received regulatory approval.

First oil is due in 2022, and the project should achieve peak production of 75,000 bopd in 2025, as additional development wells are brought online. “Over the years, the Atlantic business has provided some of the strongest returns in the company’s portfolio, and West White Rose is the next chapter,” said Husky CEO Rob Peabody. “This project is of a scale approaching the original White Rose development, and is able to use the existing SeaRose FPSO (Fig. 5) to process and export production.”

“We’ve made significant improvements to the project since it was first considered for sanction,” continued Peabody, “including identifying numerous cost savings, achieving a 30% improvement in capital efficiency, and increasing the expected peak production rate by 40% over our initial estimate.” By utilizing a tie-back to the SeaRose, incremental operating costs should be less than $3/bbl over the first 10 years, further driving down per-barrel operating costs for the entire White Rose field.

Project highlights. In addition to the planned, peak output of roughly 75,000 bopd, (52,500 bopd to Husky, working interest), the company’s net project cost is $2.2 billion to first oil ($3.6 billion over project life), including about $180 million reflected in 2017 capital guidance. Total cost to all partners, combined, is $5.2 billion over project life. A concrete gravity structure will support the wellhead platform, which will include drilling facilities, utilities, support services, and personnel accommodations.

The NL province will realize significant direct employment, business and other industrial benefits as a result of the project, including more than $3 billion in provincial royalties, equity and taxes. A purpose-built graving dock at Argentia, NL, was completed in 2015, to enable construction of the concrete gravity structure. Construction is set to begin during fourth-quarter 2017. Following construction, the facility will be towed to White Rose field, where the platform’s topsides will be installed before connection to the FPSO via existing subsea infrastructure.

New oil find at Northwest White Rose. A series of discoveries and satellite developments in the White Rose production area has improved the original field’s longevity since its discovery in 1984, said Husky. The latest find has been made at Northwest White Rose. The White Rose A-78 well was drilled 11 km northwest of the SeaRose FPSO during first-quarter 2017 and delineated a light oil column of more than 100 m. The discovery continues to be assessed. Husky has a 93.2% ownership interest. The company says that a potential Northwest White Rose development could leverage the FPSO, existing subsea infrastructure, and the new West White Rose wellhead platform.

EXPLORATION UPDATE

A large seismic acquisition program is currently underway, offshore NL, plus, over the last several months, the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) issued a Call for Bids and also identified a sector for a future lease sale. In addition, Statoil drilled two exploratory wells.

TGS and PGS ramp up 3D activity offshore Eastern Canada. In May, TGS and Petroleum Geo-Services (“PGS”) announced two new multi-client, 3D seismic projects offshore Eastern Canada. Following on from the recently announced 2017 2D seismic campaign and the Cape Broyle 3D effort, the joint venture is now ramping up its 3D seismic acquisition in Newfoundland and Labrador with these additional projects, reflecting high customer interest in this region.

East Flemish Pass 3D Phase II is a 1,950-km2 extension of a 3D survey acquired by the JV in 2016, in the Eastern Newfoundland region. The survey will extend eastward into Block EL1150, which is expected to see drilling activity in the future.

Harbour Deep 3D will comprise a minimum of 2,700 km2 of 3D GeoStreamer data in the Eastern Newfoundland region, covering a mix of held and open acreage to be included in the November 2018 licensing round under Newfoundland Labrador’s Scheduled Land Tenure system.

Following completion of these surveys, the jointly-owned library will have more than 175,000 km of 2D GeoStreamer data and 19,400 km2 of 3D GeoStreamer data. An expansive well log library is also available in the region, along with advanced multi-client interpretation products that will improve play, trend and prospect delineation.

“Newfoundland and Labrador continues to attract high interest from E&P companies. We have built significant geological and operational experience in this region over many years which, combined with the leading multi-client data library, positions us well to support E&P companies in their drilling and exploration activities,” commented Kristian Johansen, CEO and Interim Leader of North and South America, at TGS.

“Our growing MultiClient data library benefits the oil companies exploring this high potential area, and makes us well positioned for upcoming license rounds. This will be our most active season in the Newfoundland Labrador region to date, reflecting high customer interest,” says Jon Erik Reinhardsen, President & CEO of PGS.

C-NLOPB announces 2017 Call for Bids. Back in April, the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) issued a Call for Bids in the Jeanne d’Arc region, under the Scheduled Land Tenure Regime. Interested parties will have until 12:00 p.m., NST, on Nov. 8, 2017, to submit sealed bids for the parcels offered in Call for Bids NL17-CFB01.

The sole criterion for selecting a winning bid will be the total amount of money the bidder commits to spend on exploration of the parcel during Period I (the first period of a nine-year license). The minimum bid for the parcel offered is $10 million in work commitments. Notification of any changes to this Call for Bids is posted on the Board’s website. This current Call for Bids consists of three parcels and a total of 317,407 hectares.

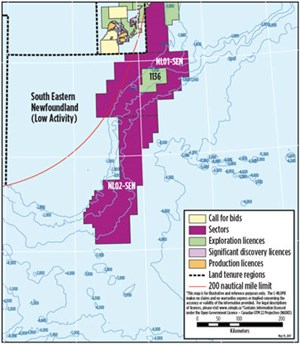

Southeastern Newfoundland Region Sector identified. In June, a new basin was identified by the C-NLOPB for an eventual 2020 Call for Bids. Under its scheduled land tenure system, the C-NLOPB has identified Sector NL02-SEN in the Southeastern Newfoundland Region. Sector NL02-SEN can be seen in the map in Fig. 6. This sector was included in the 2014 Eastern Newfoundland Strategic Environmental Assessment (SEA).

Statoil experiences disappointing results. During early July, Statoil, along with partner Husky Energy, finalized a two-well exploration drilling program in the frontier Flemish Pass basin offshore, about 500 km east of St. John’s, NL. Both wells were drilled by the West Aquarius semisubmersible within tie-back vicinity to Statoil’s 2013 Bay du Nord discovery, but neither of them resulted in a discovery.

“These results are disappointing, as we had hoped to add additional optionality to the near-field area at Bay du Nord,” said Trond Jacobsen, vice president, Exploration, Statoil Canada. “We will now take the time needed to evaluate the results before firming up any plans for additional drilling near-field to Bay du Nord.”

Volume estimates for Bay du Nord, including two other discoveries announced in 2016, remain an estimated 300 MMbbl of recoverable oil. Statoil continues to evaluate future drilling activities in other areas of the basin.

BULL ARM FABRICATION – WHAT NEXT?

In March 2017, Nalcor Energy issued a request for Expressions of Interest (EOI) across local, national and international markets. The purpose was to invite and assess interest for the potential future use of the Bull Arm Fabrication facility (Fig. 7) following completion of the ExxonMobil Canada Properties lease for the construction of the Hebron project. Varying submissions have been received and are under review. This was the first step in identifying what potential opportunities may exist for the site.

“Nalcor Energy is focused on building sustainable business opportunities for Bull Arm Fabrication, following the completion of the current lease,” said Chris Kieley, vice president, Business Development. “The site’s diversity of infrastructure and strategic location offer a unique opportunity for a wide range of potential uses. The EOI is a key step in the process to identify and evaluate future opportunities.”

Since its development, Bull Arm Fabrication has played a key role in the province’s first three offshore field mega-projects: Hibernia (1990–1998), Terra Nova (1998–2001) and White Rose (extension project, 2008–2009). In fact, Bull Arm was built specifically to fabricate the Hibernia Offshore Oil Project. Most recently, since 2011, the site has hosted construction of the multi-billion-dollar Hebron Offshore Oil Project.

Bull Arm Fabrication is Atlantic Canada’s largest industrial fabrication site. It spans over 6,300 acres, and has fully integrated and comprehensive infrastructure to support simultaneous fabrication and assembly in its three key project areas: Fabrication Yard; Marine Facility; and Deepwater Site.

Close to international shipping lanes, and E&P developments in the Atlantic margin, the site has year-round, unobstructed deepwater access to the Atlantic Ocean. Information is available at bullarm.nalcorenergy.com

RECENT TECHNOLOGY DEVELOPMENT

A recent technical addition to the NL industry’s capabilities that potentially could affect local activity significantly is the Nalcor Energy Exploration Strategy System (NESS). Nalcor Energy has launched the latest version of NESS. This state-of-the-art, web-based application is the first of its kind in NL, and is available to industry, academic institutions and the general public at no cost, allowing multiple audiences to conveniently explore vast amounts of information on the province’s offshore.

“We’re taking a systematic and scientific approach to evaluating Newfoundland and Labrador’s frontier basins,” said Jim Keating, executive vice president, Offshore Development and Corporate Services. “This proprietary system ensures key basin information is made readily available to industry, to help inform key engineering, development and operation decisions, and attract further investment.”

NESS captures information from multiple sources, studies and reports, and unites it all within an interactive map. This enables users to display, filter and analyze a vast array of data and information in one location. The diverse information provide users with a comprehensive look into key elements that relate to exploration and development offshore NL.

“The application offers easily accessible data for important exploration considerations, such as historical metocean conditions, well and rock evaluation data, and reports on oil and gas resource potential,” added Dr. Richard Wright, exploration manager at Nalcor Energy Oil and Gas. “The integrated nature of NESS allows global explorers to transform large amounts of data on our offshore into actionable intelligence, to help inform future exploration investments.” The application is available on all devices by visiting ness.nalcorenergy.com. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap? (March 2024)

- What's new in production (February 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)