ShaleTech: Niobrara Shale

Having dodged an electoral bullet, operators in the Colorado-centric Niobrara shale play are finding near-term economic reality a much tougher nut to crack, with the transition toward full-blown development frustrated by oil prices that refuse to cooperate.

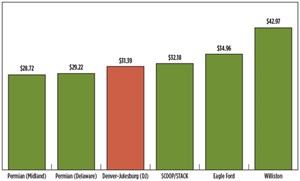

Although the triple-bench Niobrara has evolved steadily from a tricky geological prospect to a fertile play, with some of the lowest break-even costs (Fig. 1) in the U.S. shale sector, it largely remains a footnote in the unconventional hierarchy, save for a handful of operators. And, as drilling capital continues to migrate toward West Texas, the closely-knit players remaining on the lease rolls have, for the most part, either taken sabbaticals or instigated wholesale well construction and completion makeovers.

The latter allow them to squeeze more production from the tightly-controlled Niobrara core in the heart of the Denver-Julesburg (DJ) basin. Over the past year, monobore well designs, with laterals reaching out as far as 10,000 ft, and beefed-up completions, with substantially higher proppant loadings, have generally become standard for those still maintaining a semblance of activity.

The complex, many-sided Niobrara petroleum system, which is often stacked with the underlying Codell sandstone, extends across the DJ basin through most of northern Colorado, southeastern Wyoming and portions of Nebraska and Kansas. The self-sourcing unit of alternating chalk and shale is most closely recognized as the source rock for the prolific Wattenberg and Silo fields of Colorado and Wyoming, respectively. However, the overwhelming majority of drilling and production is concentrated tightly in the well-established infrastructure of Weld County, Colo., specifically in and around the nearly 47-year Wattenberg.

Deep-rooted Anadarko Petroleum Co. and Noble Energy Inc. hold a combined 713,100 net acres in the estimated 2,000-mi2 Wattenberg, which has less than half the aerial reach of the Bakken shale’s core. With limited surface running room available, a familial-like strategy has taken root, with Wattenberg operators swapping acreage to consolidate their respective lease positions, to accommodate longer laterals and simplify development strategies.

“It is hard to not see it (Niobrara) being a key, core area where we invest money,” the Denver Post quoted Noble President and CEO Dave Stover as saying during the late-August Rocky Mountain Energy Summit in Denver.

Encana Corp., however, chose otherwise, selling its more than 51,000 net acres and 1,600 wells in an estimated $900-million deal that closed on July 29. With that sale to fellow Canadian firm, Crestone Peak Resources, Encana will concentrate wholly on its core Permian basin, Eagle Ford, Duvernay and Montney assets in Texas and Canada.

Meanwhile, as the giant Wattenberg abuts Colorado’s heavily populated Front Range, operators also have to contend with a relentless anti-fracing groundswell. The industry did manage to stave off two detrimental measures proposed for the November election, when the initiatives’ proponents failed to obtain enough legitimate signatures to put them on the ballot. The separate constitutional amendments would have given local communities the right to either ban or heavily regulate fracing, and impose a 2,500-ft setback, which the Colorado Oil & Gas Association (COGA) argued would have put “90% of Colorado off-limits for new oil and gas development.”

In an attempt to avoid a repeat, Coloradoans will vote next month on a measure that would make it tougher to amend the state’s constitution. Proposed Amendment 7, if passed, would require future constitutional ballot initiative proponents to gather signatures from 2% of all registered voters in each of Colorado’s 35 state senate districts. The proposal also requires approval from 55% of voters before a ballot amendment can be added to the constitution.

RIGS STEADY, PERMITS DOWN

In the meantime, what the DJ-Niobrara lacks in overall scale, it makes up in relative stability, at least as far as the recent rig count is concerned. In September, the active rigs across the Niobrara region fluctuated between 15 and 16 units, according to Baker Hughes data, which documented a steady 29 rigs working in September 2015.

The authorized drilling permits, however, are another matter altogether. Using Weld County as the barometer, a breakdown of permits issued by the Colorado Oil and Gas Conservation Commission (COGCC), the state’s chief regulator, shows roughly 1,158 permits authorized between Oct. 1, 2015, and Sept. 16, 2016. By comparison, the COGCC approved an estimated 2,208 drilling permits in the county between Sept. 2, 2014, and Sept. 16, 2015. Most of the 2016 permit authorizations were for Niobrara targets, with a smattering of permit requests for Codell-specific wells.

Ironically, in southeastern Wyoming, Niobrara-specific drilling authorizations nearly tripled year-over-year, according to the Wyoming Oil and Gas Conservation Commission (WOGCC). The regulator has approved 1,762 Niobrara drilling permits as of Sept. 20, compared to 592 permits issued for all of 2015.

As Colorado’s largest producer by an unapproachable margin, Niobrara pacesetter Weld County delivered a cumulative 52,258,477 bbl of oil during the first six months of 2016, according to notoriously tardy COGCC data. The COGCC documented Weld with producing approximately 66,011,112 bbl from January through July 2015.

Across the border, the WOGCC shows Wyoming Niobrara aggregate production of 2,081,107 bbl of oil and 10,766,494 Mcf of gas, as of Sept. 20. Wyoming’s swath of the Niobrara delivered 5,206,066 bbl of oil and 28,059,490 Mcf of gas for all of 2015, the commission said. Unlike its cross-state peer, the WOGCC breaks out production by reservoir.

The U.S. Energy Information Administration (EIA), meanwhile, forecasts oil production from the entire Niobrara region dropping from 369,000 bpd in September to 361,000 bpd in October, Fig. 2. Niobrara gas production is expected to decline 60 MMcfd, from 4.137 Bcfd in September to 4.077 Bcfd in October, according to the EIA’s best guesstimate. Moreover, the EIA tabbed the Niobrara region with a 712-well drilled-but-uncompleted (DUC) inventory in September, which it predicts will drop to 701 in October.

For now, the changing face of the Wattenberg Niobrara may well be reflected in long-entrenched Anadarko, which is down to a single rig (Fig. 3) within its prized 350,000-net-acre leasehold. Regardless, The Woodlands, Texas, operator ranks the Wattenberg among its three core plays, alongside the Gulf of Mexico and West Texas Delaware basin.

Despite the reduced activity, second-quarter production came in at a record 243,000 boed, up by 11,000 boed year-over-year, with associated lease operating costs/BOE dropping to $1.29, down 15% from the first quarter. Anadarko completed 115 wells in the first half of 2016, with an aggregate 137 wells put on production. By comparison, the company averaged nine operated rigs and drilled 112 wells in the second quarter of 2015.

CONSOLIDATED LEASEHOLDS

A cumulative 25,200 acres are in play, as Noble and PDC Energy Inc. exchange select holdings to consolidate positions in their principal Wattenberg development areas, and provide leg room for their respective, extended-reach well construction programs. The deal is expected to close in the fourth quarter.

For its part, PDC will receive roughly 13,500 acres from Noble’s Bronco development area in the Wattenberg’s Middle Core, Fig. 4. Noble, in turn, will receive 11,700 acres, which expands its northeastern Wells Ranch development by 78,100 acres. Noble said its near-term activity will focus on Wells Ranch and the neighboring East Pony asset, which are being developed under the operator’s centralized, integrated development plan (IDP) strategy.

In a separate transaction, Noble in June closed on the sale of approximately 33,100 primarily undeveloped acres, in its non-core Greeley Crescent area of Weld County, to pure play operator Synergy Resources Corp. Even with the $505-million liquidation and asset trade, Noble still holds a commanding 363,100 net acres in the Wattenberg.

PDC, flush off its $1.5-billion entry fee to the Delaware basin in August, nonetheless, remains among the most active Wattenberg players. The home-grown independent, which now holds 96,000 net acres, plans to run three rigs for the remainder of the year, down one from its operated pre-trade fleet. PDC says it will drill 52 new wells during second-half 2016, with 59 wells hooked up to production. Prior to the asset trade, PDC had planned to spud 60 wells and place 80 wells on production. At the end of the second quarter, PDC had put 34 gross operated wells onstream, helping boost average production to 54,478 boed, a 14% increase over the first quarter.

With its more consolidated leasehold, PDC says it will concentrate fully on its earlier, initiated extended-reach drilling program (9,500-ft laterals), with all upcoming Wattenberg wells designed with 51/2-in. monobore casing schemes. PDC says that eliminating an intermediate casing string has saved between $50,000 and $100,000/well, while also accommodating larger completion volumes and higher flowrates. “With the success of these longer laterals, coupled with enhanced completion designs, we expect to be able to deliver additional value in the Middle Core portion of the field,” says CEO and President Bart Brookman.

Noble, meanwhile, plans to run two rigs for the remainder of the year and likewise is shifting to monobore well designs with longer laterals and enhanced completions. In the second quarter, Noble drilled 26 wells, mostly in Wells Ranch, where despite average laterals exceeding 8,100 ft, and beefed-up completions with up to 1,000 lb/ft proppant volume, normalized total costs came in at $2.6 million/well on average, it says.

“This includes the cost-efficiencies of monobore drilling, which accounted for nearly all of our drilling activity during the second quarter, as well as the increased costs of higher sand concentrations and tighter stages,” said Gary Willingham, executive V.P., Operations, while speaking with analysts in August. “We’ve said for quite some time, that in the DJ basin, it takes three to four rigs to keep production flat. We’ve been running two obviously for a while now. Balancing part of that is clearly the fact that we’ve seen better results from these enhanced completions.”

As evidence, Noble pointed to second-quarter production that increased nearly 5%, year-over-year, to an average 113,000 boed. Contributing to the higher sales volumes were 10 wells brought online during the second quarter within the Mustang IDP, representing Noble’s first enhanced completions outside of the core Wells Ranch and East Pony areas.

FURLOUGHED COMPLETIONS

Whiting Petroleum Corp., for one, has elected to await better times by building up a DUC inventory. After announcing a suspension of all completions in the second half of the year, Whiting plans to enter 2017 with approximately 117 wells awaiting completion. “All we really want to do is watch that oil price. If it stays up there, let’s say, for a quarter or two at $50 or better, we’ll be back at it,” says President and CEO James J. Volker.

Activity is centered squarely on the core, 129,076-net-acre Redtail development in the northeastern Wattenberg, where Whiting closed out the second quarter by hooking up a stacked 16-well pad to production. In the second-quarter, Redtail production from the three Niobrara benches, and the lower Codell/Fort Hays horizon, averaged 10,150 boed, down from the average 14,345 boed

delivered at year-end 2015. Whiting says its gas capture rate stands at 98%.

As part of its “green completions” strategy, Whiting says Redtail is being developed with a closed flowback system. “Basically, when we begin flow-back after frac, you’re flowing those into closed vessels,” says Volker.

The Denver-based company plans to maintain a two-rig program for the remainder of the year, where it continues to mix 960- and 1,280-acre well spacing scenarios. Whiting says the 7,500-ft laterals typifying wells in its 960-acre spacing developments are coming in at $4 million, while the extended-reach (10,000-ft) laterals in its 1,280-acre spacing units are averaging total well costs of $4.5 million. Like many of its peers, Whiting has turned to monobore configurations with 51/2-in. casing from surface to TD and oversized completions, with favorable economics, thanks in no small part to one of the leftovers of the halcyon days of higher oil prices.

“With respect to the cost side of the equation, if you kind of think about all the money that got put into these sand mines, and when prices were up there in the $70s to $90s, there was a lot of sand (proppants) available,” Volker said. “There also happens to be, frankly, a lot of ceramic available right now. So, mixing the two is another way that we can help bring down cost, as well as get very efficient along the path of the wellbore in the near-wellbore area.”

Bolstered by the largely contiguous acreage acquired from Noble, Synergy says it will maintain a two-rig program in FY17, mainly within the enlarged Greeley Crescent leasehold, where drilling plans call for mid-to-long laterals of around 7,500 ft to 9,500 ft, with 20-24 wells/drilling spacing unit (DSU). The Dallas independent, which now holds 69,300 net acres across the Greater Wattenberg, broke down its FY17 drilling program with plans for 68 gross mid-length and 34 gross long-length wells, spread across all three benches of the Niobrara and the underlying Codell.

Synergy’s drilling and completions activity is focused on five pads, with an aggregate 59 gross wells in various stages of development. Drilling continues on the 22-well Evans East and West pads, with all wells programmed for average 9,560-ft laterals. “One of the things you’ve always got to keep in mind is where we’re drilling these wells. We are in the municipal area right now, and we try to look at this as what would we like in front of our homes,’’ said President and CEO Lynn A. Peterson. “I think bringing two rigs in, in the case of the Evans (pad), is the only thing to do. We’ll be in there for a few months, and we’re going to be out of there.”

Elsewhere, completions are continuing on the 14 mid-length wells on the Fegerberg pad, which are expected to go online in the fourth quarter. Net production in the second quarter increased 34% to 1.010 MMboe, compared to 755,000 boe in the same year-ago quarter.

“With oil currently challenging the $40 level, we intend to move slowly and judiciously over the next several months, until we can start to see a clear vision to stronger commodity prices,” Peterson said in August. “We remain in the bull category, with a strong conviction that commodity prices, particularly oil, will trend higher as we go into 2017 and beyond. But frankly, until we see some sustainable higher prices, we do not intend to accelerate our activity level.”

REINING IN

After laying down its remaining rig at the end of the second quarter, Bill Barrett Corp. remains undecided as to when it will resume its suspended, extended-reach development drilling program. “As we look ahead to the remainder of the year, we are monitoring industry conditions to determine the appropriate time to resume our development drilling program in the second half of this year,” says President and CEO Scot Woodall.

Before taking a hiatus, the Denver independent, which controls 49,025 net acres in the northeastern Wattenberg, placed two 1,280-acre spacing units on initial flowback in the second quarter. The two DSUs comprise a cumulative 24 wells, 23 of which were drilled and completed with its now-standard 9,500-ft laterals with plug-and-perf, 55-stage completions and roughly 1,000 lb/ft of sand. Second-quarter production increased 21% from the prior quarter, to an average 14,176 boed.

Denver-based independent, Bonanza Creek Energy Inc., however, says it has no intention of restarting drilling or completion activity for the remainder of the year. The company suspended all activity at the end of the first quarter on its 97,000-gross-acre Wattenberg leasehold, which was reflected in a year-over-year drop in production. Second-quarter production averaged 19,100 boed, down 4% from the previous quarter and off 16% from the like period of 2015.

In a related development, Bonanza Creek has reversed its earlier announced decision to sell the year-old Rocky Mountain Infrastructure (RMI) gas gathering and compression entity, and focus on other measures to shore up its balance sheet.

For all practical purposes, Carrizo Oil & Gas Inc. also has curtailed further development of its 32,600-net-acre DJ Niobrara leasehold. The Houston independent’s Niobrara game plan for the rest of 2016 consists of completing nine gross DUC wells. Carrizo did not drill or complete a Niobrara well in the second quarter, which saw production slip to about 2,000 bopd, down from approximately 2,600 bopd in second-quarter 2015, when it also had suspended drilling and completion activity.

“Given that our acreage in the play is primarily held by production, we’re electing to limit spending in the Niobrara during 2016,” said President and CEO Sylvester P. Johnson. “Our current plan calls for the completion of some drilled but uncompleted wells later in the year, as well as additional non-operated activity.” ![]()

Continuous completion innovation in the Niobrara

Packers Plus, Denver

Although exploration in the Niobrara formation began more than a century ago, some of the most promising advancements in completion design have occurred in just the last 10 years. The vertical wells that were commonly run for decades in this region primarily targeted natural gas. With the advent of horizontal drilling and multi-stage completions, operators were able to access new hydrocarbon resources and convert this region from a tight gas play into a light, tight oil play.

Packers Plus was at the forefront of this change, when it introduced the StackFRAC open-hole, ball-activated completion system in the Niobrara during 2008. This four-stage system was run, on 4.5-in. liner, into a horizontal well that had a lateral length of 3,245 ft. Since then, both stage counts and lateral lengths have increased gradually, and new completion technologies and concepts have been introduced to help operators complete longer, more technically complex wells in the formation. As of 2016, horizontal wells with lateral lengths over 9,400 ft are not uncommon, and stage counts have exceeded 50.

EVOLUTION

Increasing stage count. As horizontal well completions became popular, operators began planning longer wells with higher stage counts. Within a few years, the maximum stage count was reached, due to the limitations of 1/8-in. ball seat increments and maximum ball sizes. At this size, a 4.5-in. system had a maximum stage count of 22, and a 5.5-in. system had a maximum stage count of 28. More stages were needed to effectively treat longer laterals.

To meet this need, the ball-activated system was redesigned in 2010 with smaller seat increments of 1/16-in., which would allow for maximum stage counts of 46 (4.5-in. system) and 56 (5.5-in. system).

Hybrid completions. To achieve higher stage counts while lowering technology costs, operators began designing hybrid completions, commonly using open-hole ball-activated systems for the toe and lower stages, and plug-and-perf systems for upper stages.

Since 2013, Packers Plus has run 25 hybrid completions in the Niobrara, with stage counts ranging from 40 to 56. At an average lateral length of 8,600 ft, running a ball-activated system at the toe minimizes the time required for tripping wireline to, and from, the toes of these long wells. Moreover, it reduces the risk of being unable to convey wireline or coiled tubing to the toe—both for stimulation and flowback.

Monobore completions. The monobore, or longstring, well concept has been around since the 1990s. This well construction design lowers cost by eliminating the intermediate casing, and cementing the well’s vertical and build sections, using a stage tool. This also eliminates the extra trip required to remove the running string and install the fracture string. Completion studies, worldwide, have shown repeatedly that the monobore design provides significant cost-savings. For example, this can be 10% in the full construction cost of a well1, or 20%2 to 26% of total well costs3, not to mention reduced hours, with fewer trips in and out of the well.

The Packers Plus SF Cementor D cementing stage tool was first used in the Niobrara for a 38-stage completion in early 2015. With the stage tool’s 95% success rate, monobore wells have increased their popularity among major operators in this formation.

Burst disk installation. In drilling longer and longer wells, operators face new challenges. A primary challenge of extended reach laterals4 is the difficulty of pushing the completion system to total depth (TD) of the wellbore, due to cumulative friction from doglegs and other obstacles.

The easiest, most common method of installation is to put weight on the tool string to push the system into the well. If that fails, operators can rotate the string, which can overcome static friction, essentially screwing the system into the well. However, for open hole systems, this can damage packers significantly and is not recommended.

To address these issues, a tool was developed to use buoyancy to “float” the system into long wells. This burst disk sub isolates the tool string from fluid, so that it can be run into the well, full of air. After installation, the glass disk in the tool is shattered, to allow the air to bleed off, and standard completion operations can begin. This method was used for a number of installations, beginning in mid-2015, significantly reducing rig time.

Retina. As the number of stages, and volume of fluid and proppant used in every well increases, the importance of a smooth operation also increases. The ePLUS Retina monitoring system uses a proprietary array of sensors to confirm surface and downhole events in real-time. The system operates independently of conventional measurement equipment, gathering 10,000 data points per second, compared with conventional stimulation programs that capture one data point per second. As an additional layer of confidence for decision-making, the system is particularly useful when conventional measurement readings from the data van are missing or ambiguous.

Using this monitoring system, operators have been able to immediately confirm standard events, such as ball launches, seat landings and sleeve shifts for StackFRAC completions since mid-2015. They’ve also confirmed unexpected issues, such as pump failures or casing breaches, saving operators hours or days of troubleshooting time.

CONCLUSION

With over 1,400 completions in the Niobrara since 2008, Packers Plus has collaborated with operators to continually improve completion operations, to reduce cost and improve production. From initial four-stage completions, operators now have a multitude of options for lowering costs and optimizing completions, and many more advances will be made in the next 10 years. ![]()

REFERENCES/NOTES

1. Macfarlane, M., et al., “Monobores – Making a difference to the life cycle cost of a development,” SPE paper 50046, 1998.

2. Lowe, J., et al., “Reducing cost and risk with cemented-back monobore well construction in the Cardium formation,” SPE paper 171585-MS, SPE/CSUR Unconventional Resources Conference – Canada, Calgary, Alberta, 30 Sept. 30-Oct. 2, 2014.

3. Total costs includes drilling, casing, completing, perforating; Pearson, C., et al., “The use of slimhole drilling and monobore completions to reduce development costs at the Kuparuk River field,” SPE paper 57717, Annual Technical Conference & Exhibition, Houston, Texas, Oct. 3-6, 1999.

4. MD/TVD ratio greater than 2 can be considered an extended-reach lateral

- Coiled tubing drilling’s role in the energy transition (March 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)