ShaleTech: Bakken-Three Forks shale

Game plans across the once-high-scoring Bakken-Three Forks shale play have taken on a decidedly measured look, as some of its most productive players find the playing field intolerable and have decided to take a time-out, or slow down considerably.

For the most part, even with a significant decline in total well costs and disappearing price differentials, new well construction is taking a back seat to whittling down a drilled-but-uncompleted (DUC) inventory that, as of late May, Rystad Energy put at more than 850 wells.

North Dakota remains the epicenter of the stacked and liquids-rich Bakken-Three Forks play, underlying the Williston basin that extends into eastern Montana and across the Canadian border into Saskatchewan and Manitoba. Baker Hughes tallied a May average of 25 active rigs (Fig. 1) all drilling in North Dakota, compared to an average of 79 in May 2015. Even as oil prices have climbed slowly over the past month, gun-shy operators remain hesitant to put rigs back to work.

Illustrating the wholesale wariness, Bakken pioneer Continental Resources has no intention of ramping up anytime soon. As of May, the first mover was running four rigs and no stimulation crews. “We’re not planning anything toward bringing rigs back,” said CEO Harold Hamm. “And certainly, we understand the nature of this business and the price spikes. We’re not chasing those. We’re going to see stability before we even think about bringing rigs back in.”

Elsewhere, a cash infusion from a late-April JV agreement prevented premier Bakken producer Whiting Petroleum from following through on its earlier plan to suspend all drilling and completions after the second quarter. Still, Whiting is operating under an 80% year-over-year reduction in capital expenditures.

SUB-1.0 MMBOPD ON HORIZON

The current trend suggests that North Dakota oil production is headed below the 1.0-MMbpd threshold, which it eclipsed with much fanfare in early 2014. The most recent data available from the North Dakota Department of Mineral Resources (DMR), the state’s chief regulator, show oil production of 1,116,896 bpd for the first three months of 2016, down by 70,299 bpd, year-over-year. Bakken operators, according to DNR statistics, averaged 1,184,325 bopd in 2015, with cumulative full-year production of 432,278,474 bbl, surpassing the record 396,880,762 bbl produced in 2014.

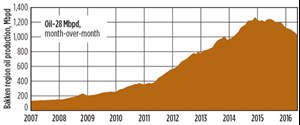

The U.S. Energy Information Administration (EIA), however, shows Bakken oil production in June dropping for the fifth consecutive month to 1.024 MMbpd, a 28,000-bpd decline from the May forecast of 1.052 MMbpd, Fig. 2.

One consolation of declining production is that it comes in the face of an accelerated infrastructure build-up that has nearly evaporated lingering price differentials relative to the WTI benchmark. Not so long ago, takeaway constraints had Bakken oil trading at discounts of up to $15/bbl.

“If you look at the infrastructure that’s being put in place, and is in place now, that totally changes the operating expenses,” says Continental Resources President and COO Jack Stark. “And, on top of that, you’ve got the added pipeline capacity that’s coming in. And so, differentials are being driven down.”

The added capacity includes the planned year-end start-up of Energy Transfer Partners’ 1,168-mi Dakota Access Pipeline that will run from North Dakota to Patoka, Ill. On track to begin deliveries of at least 450,000 bpd of Bakken crude by the fourth quarter, the network has a maximum design capacity of 570,000 bpd.

The expanded market reach took an international turn in late April with Hess Corp’s delivery of a reported 175,000 bbl of Bakken oil to The Netherlands—the first local producer to take advantage of the December lifting of the 40-year ban on U.S. crude exports. The shipment was delivered by rail from Tioga, N.D., to Louisiana, where it was offloaded onto a tanker.

DUC PROGNOSIS

The Bakken’s version of a “keep-it-in-the-ground” movement reached a milestone late last year, when North Dakota’s DUC inventory topped 1,000, according to a Nov. 13 Reuters report. At that time, DMR Director Lynn Helms doubted the backlog would be worked off until late 2016 at the earliest, “and only if oil prices rise.”

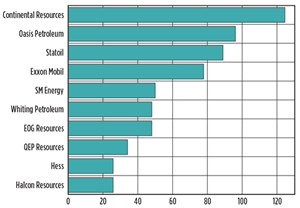

Five months later, the Rystad Energy analysis shows a sizeable fraclog remains, with Continental holding the top spot as of April, with roughly 125 DUC wells within its commanding 1,045,000-net-acre leasehold, Fig. 3. “At the April completion pace, Continental’s DUC inventory could support completion activity for around nine months,” said Rystad Senior Analyst Olga Kerimova.

The Oklahoma City independent, however, expects to exit 2016 with 195 “gross operated drilled and uncompleted wells in the Bakken,” which represents a “high-graded inventory, with an average EUR (estimated ultimate recovery) of approximately 850,000 boe.”

Continental’s first-quarter estimate of the average cost to complete the DUC backlog is roughly $3.5 million/well. “Our primary emphasis, first of all, would be balance sheet, paying down debt, next would be DUCs and then maybe ramping up the completion of those DUCs before we ever considering bringing rigs back,” says Hamm.

Nevertheless, Kerimova said that since February, most of the producers surveyed, including Continental, appear to be working down DUC inventories. “This is a result of deferred drilling this year, and most companies choosing to complete the already drilled wells where drilling costs have already been sunk,” said Kerimova, Rystad’s chief Bakken analyst. “Hess stands out as the operator that has reduced DUC wells the most compared to the peer group, from around 120 at the beginning of 2014 to 26 as of April. A similar trend can be observed for Whiting, which has more than halved its inventory of DUC wells from over 100 in 2014 to around 50 in April of this year.”

In late February, Whiting said it expected to close out 2016 with a 73-well DUC inventory in the Bakken, based on initial plans to suspend drilling and completions beginning in the second quarter. However, that was before the Denver independent signed a wellbore participation agreement with an undisclosed private party on April 14, which will cover 65% of the drilling and completion costs for a 50% working interest in 44 gross Williston basin wells. Under the agreement, Whiting now will continue to run two rigs and add a completion crew with no increase in its severely slashed budget. “As a result (of the JV), we plan to complete 44 additional wells in our 2016 program and have increased our production guidance while keeping Capex unchanged,” President and CEO James Volker said in an April 28 earnings call.

Meanwhile, given the widespread layoffs since prices plummeted, any significant rush to convert those DUC into producers could be easier said than done. “There’s plenty of idled equipment on the ground. The interesting thing is going to be the crews to run that equipment,” says Oasis Petroleum President and COO Taylor Reid. “In an orderly progression of increasing capacity, I think we’re going to be in good shape. People will be able to man that equipment. If everybody tries to pile on and pick up a bunch of crews real fast, which I think is not real likely, that could be more of a challenge.”

With its wholly owned Oasis Well Services (OWS), the Houston-based independent has the luxury of internal frac and completion capacity. The pure-play operator exited the first quarter with two active rigs and 83 gross wells awating completion. “We continue to view this set of drilled-but-uncompleted wells as a strategic asset that provides us flexibility from a price recovery and operational standpoint, uniquely positioning Oasis to capitalize on a rebound,” Reid said.

Oasis completed 15 gross operated wells with “high-intensity fracs” during the first quarter, concentrated entirely on the operator’s Indian Hills asset, and representing about one-third of the 2016 completions program. Development activity for the remainder of the year will transition to the adjacent Wild basin property to the immediate east. “OWS again completed 100% of our wells in the quarter, and that remains the plan for the balance of the year,” Reid said.

First-quarter production was just over 50,000 boed, and Oasis plans to exit 2016 with a production range of 46,000–49,000 boed.

$60/BBL TRIGGER?

Echoing Hamm, Continental CFO John Hart said the company would not increase its Bakken rig fleet until prices increase to $60/bbl and stay there. “Once we see WTI process around $60 with stability in the price, we would consider adding additional drilling rigs. We not only want a price recovery, but also sustainability in prices before we would add any capital,” he said.

With no stimulation crews operating in the first quarter, Continental nonetheless brought 10 net wells online that had been drilled and completed in 2015, and participated in another 42 gross non-operated wells. First-quarter production averaged 139,602 boed, up modestly from the 136,400 boed delivered in fourth-quarter 2015.

Continental attributes enhanced slickwater and hybrid 30-stage completions, and 2-mi laterals, with the 45%-to-60%-higher 180-day production rates and 35%-to-45% hikes in average EUR recorded for its individual wells in Williams and McKenzie counties. Completed well costs now stand at $6.3 million/well, with a year-end target of $6 million/well, the company said. Hess, likewise, has pegged $60/bbl as the trigger price for any uptick in activity.

Throughout the second quarter, the operator ran three rigs in its 615,000-net-acre leasehold, which as of now, will be reduced to two rigs in the third quarter. “We’re going to be guided by capital discipline and financial returns, and that’s why we’ve said that $60/bbl is our price that we will focus on where we start ramping up Bakken activity,” said CEO John Hess.

The company drilled 19 wells and hooked 31 new wells to production in the first quarter, compared to 60 new drills and 70 new producers in the like period of 2015. This year, Hess plans to drill 62 wells and add 87 to production, down sharply from 2015 when 182 and 219 wells were drilled and put on production, respectively. First-quarter Bakken production was up 2.7% from the prior three months, to 110,000 boed.

Hess says its operated drilling and completion costs averaged $5.1 million/well during the first quarter, down 25% year-over-year. Hess attributes the sharp decline in costs, in no small part, to its Bakken-specific “lean manufacturing approach”—more commonly aligned with an automobile manufacturing floor than a rig floor—which it describes as a model that “streamlines the identification and resolution of issues, so that drilling can be done faster and more efficiently.”

Moreover, Hess also says it does not anticipate major personnel-related hiccups in putting rigs back to work when prices so allow. “We have gone down substantially in manpower, but we think with the manpower we do have, we can efficiently ramp up from two to six rigs over a nine-to-12-month period,” said President and COO Gregory Hill. “We can go from two to six rigs relatively painlessly without losing a lot of the efficiencies that we’ve worked so hard to maintain with the lean manufacturing capabilities.”

As for Whiting, Volker said a sustained $50/bbl would prompt a jump in activity, with the first order of business to reduce its DUC build-up. Whiting controls 454,782 net acres prospective for the Bakken-Three Forks in North Dakota and Montana, of which 99% is held by production (HBP). “We’d just like to watch that for at least a 90-day period, if and when $50 is hit,” Volker said. “Bringing down that number of DUCs would be one of the first things we would do at higher prices.”

With the JV, Whiting raised its year-end production target to between 131,400 boed and 136,900 boed, with most of the completions scheduled for the second half. Production averaged 146,770 boed in the first quarter, but Whiting’s pre-JV guidance had established a 2016 exit rate of 128,000 boed to 138,000 boed.

In a related development, Whiting says it is evaluating potential re-frac candidates within its leasehold. “We’ve gone through our entire 1,400-well inventory up in the Bakken, and we’re sorting through all those,” said Mark Williams, senior V.P., exploration and development. “A number of them have very readily risen to the top of being great refrac candidates. We’ve identified about 40 candidates so far, and they look like there are going to be good opportunities for us.”

ONE-RIG PROGRAMS

Upon the March completion of a six-well pad, WPX Energy said in May it will defer all completions “for the next few months.” If those plans remain intact, the company plans to have a 29-well DUC inventory by year-end. WPX is operating one rig within its 85,000-net-acre Fort Berthold leasehold.

First-quarter production was up 5% sequentially to 26,000 boed, with drilling and completion costs of $5.9 million/well compared to $8.5 million/well costs in the like quarter of 2015. WPX drilled two gross Bakken wells and two Three Forks wells during the first quarter, with all four wells constructed with 3-mi laterals in an average of 24.9 days.

For the time being at least, Newfield Exploration also is operating one rig in the 85,000 net acres that it controls,

Fig. 4. “We are just finishing up with our last pad. Of course, plans could change, but once we are finished with this section, that will be it for now,” a spokesperson said in late May. Even with a one-rig program, Newfield said first-quarter production from wells drilled along the Nesson Anticline reached a quarterly high of 22,815 boed.

QEP Resources, which Rystad singled out as having the lowest break-even costs among its peers at around $25/bbl, is running one rig after laying down two operated rigs since the fourth quarter. The Denver operator holds 116,000 net acres and delivered roughly 53,800 boed in the first quarter, up 4% over fourth-quarter 2015. Even after cutting its 2016 drilling and completion budget in half compared to 2015, QEP expects to end the year with flat year-over-year production.

During the first quarter, QEP completed 17 gross-operated wells at its South Antelope acreage in McKenzie County, N.D., all of which were put on production. Five additional high-density infill pilot wells also were completed, along with the company’s first 12-well high-density pad. QEP says it continues to test the second and third benches of the Three Forks with eight wells completed late last year.

“We continue to make progress driving down wells costs in the Williston basin, current AFE (authorization for expenditure) gross drilled and completed well costs for South Antelope, which assumes a sliding sleeve completion, averages about $5.3 million (well) with costs associated with facilities and artificial lift adding approximately $800,000 per well,” said CEO Chuck Stanley. Wells in the company’s legacy Fort Berthold Indian Reservation acreage in Dunn and Mclean counties are coming in at $5.8 million.

Houston-based SM Energy, likewise, is running a single rig on the 245,000 net acres it holds in the Williston basin, where it completed five Bakken-Three Forks wells in the first quarter. Cumulative first-quarter production came in at 2.0 MMboe. SM says its Gooseneck wells in northern Divide County, N.D., are being drilled in 12–13 days with 10,000-ft laterals at less than $4 million/well.

Marathon Oil, on the other hand, released its lone remaining rig in the first quarter, after drilling three net wells within its 290,000-net-acre leasehold traversing North Dakota and eastern Montana. The independent averaged net production of 57,000 boed over the first three months, down year-over-year by 1,000 boed. During the first quarter, Marathon put four Middle Bakken and two Three Forks wells online, which were to be followed in the second quarter by five wells drilled earlier on the Clark’s Creek pad in West Myrmidon.

EOG Resources also plans to dial back significantly this year, with plans to complete 10 net wells, compared to the 25 wells completed in 2015. The operator, which holds 120,000 net acres in its Bakken core, completed one well in the first quarter. ![]()

NDPC questions ethane study methodology

The North Dakota Petroleum Council (NDPC) is hitting back at the protocol employed in an academia-led study that showed the Bakken shale play emitting some 2% of the world’s fugitive ethane emissions.

In late April, a University of Michigan-directed research team released the results of a study initiated in May 2014 using air samples collected by a National Oceanic and Atmospheric Administration (NOAA) aircraft directly overhead and downwind of active Bakken rigs. The release of the ethane study preceded a separate examination, released on May 11, which showed the Bakken discharging less methane than previously expected.

A spokesperson for the NDPC said the trade association questions the methodology of the ethane study, in particular its discounting of other regional sources of ethane emissions, such as biomass burning and biofuel production. “In respect to the Michigan study, our members did have some concerns over the methodology used, one being that the researchers assume that there are no other ethane emissions in the North Dakota region,” said NDPC spokesperson Tessa Sandstrom. “In addition, as with other top-down studies, these measurements for ethane are limited to 15 hours of data (collected) over four days, all during mid-afternoon and then they extrapolate to annual.”

The NDPC, however, is taking a more conciliatory approach toward the second study, which was led by the University of Colorado’s Cooperative Institute for Research in Environmental Sciences and found the Bakken region leaking 275,000 tons of methane annually, but less than earlier forecasted. “This is an issue that the industry has been aware of and has been working to address. Technology has advanced with FLIR (forward looking infrared) cameras and other equipment, so we can now see it, better detect it, and that means we are able to now better find the solutions to minimize emissions,” Sandstrom said. ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Using data to create new completion efficiencies (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)