ShaleTech: Woodford shale

Across the murky, unconventional landscape, there is but a smattering of areas offering what truly can be described as the sweetest of sweet spots, where margins are still achievable. In Oklahoma’s Woodford shale, that would be the two acronymic sub-plays in the western Anadarko basin, which have been elevated to top-tier status in select asset portfolios.

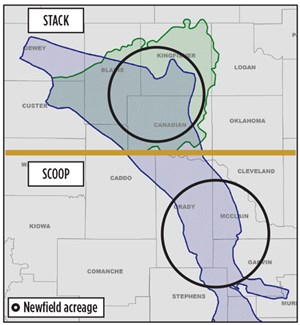

To the point, a tightly concentrated core of early movers cites the largely wet South Central Oklahoma Oil Province (SCOOP), and abutting Sooner Trend Anadarko basin Canadian and Kingfisher Counties (STACK), of the greater Cana Woodford play, as offering respectable returns in an otherwise bleak commodity price environment.

There, along with the complex Woodford—the Devonian source rock for virtually all of Oklahoma’s most prolific oil and gas wells—operators can pick and choose from multiple pay zones. This includes the overlying and comparatively thicker Mississippian Meramec (as thick as 475 ft), and the upper Springer shale, an over-pressured blend of shale and sandstone that SCOOP pioneer Continental Resources, Inc., unveiled with considerable fanfare in September 2014.

While operators continue to fully delineate the twin plays and tweak completion designs, they point to an overall accelerated learning curve—while helping to increase both production and estimated ultimate recoveries (EUR)—and at total well costs that have been hammered down, in some cases to as low as $7 million. Accordingly, more than 76% of the rigs statewide, that were actively targeting the Woodford play at press time, were cloistered in and around SCOOP and STACK. For now, this general trend is poised to continue, albeit with likely downward revisions, once companies release year-end 2015 earnings and New Year guidance.

Noting that the “lion’s share of capital is being invested in the Anadarko basin,” Newfield Exploration Co. CEO Lee Boothby told investors on Nov. 4, “We’ve realigned our organizational structure to reduce [general and administrative] expenses, while deploying talent to our highest-return plays, SCOOP and STACK.”

The same for hometown Enable Midstream Partners, where the Anadarko already is home to the three-year-old company’s largest gas gathering and processing infrastructure. “That’s an area, specifically in the SCOOP shale play in Oklahoma, where at $41-to-$47/bbl oil, producers can still earn a decent return,” new President and CEO Rodney Sailor told the Houston Chronicle on Nov. 30. “We are still anticipating growth at these commodity prices in that area.”

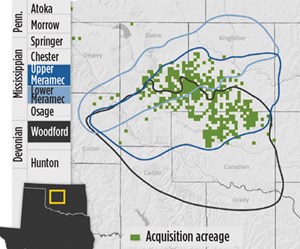

However, it was Devon Energy’s $3.5-billion upstream and midstream acquisition in early December that spoke volumes about the perceived long-term prospects for the duo. The two-part transaction gave Devon 80,000 net acres in the “overpressured oil window of the STACK play,” where it has identified no less than 10 prospective pay zones, Fig. 1.

ATYPICALLY RESILIENT

While an incessant number of rigs elsewhere are legitimately classified as “idled iron,” drilling activity within the three-basin Woodford shale petroleum system has remained relatively steady, and has even shown modest increases of late. Two weeks after 28 rigs were furloughed across the U.S., Baker Hughes reported 48 active rigs in the overall Woodford shale play on Dec. 20, up one from the prior week. By comparison, 54 rigs were making hole during the same 2014 reporting period. With 38 active rigs, the Cana Woodford was up one from the previous week, while the gas-prone Arkoma Woodford and Ardmore Woodford remained unchanged with eight and two rigs, respectively.

Last June, Louisiana’s PetroQuest Energy Inc., for one, unloaded most of its Arkoma Woodford acreage, but retained interest in the East Hoss dry gas field near McAlester, Okla., which it operates under a JV with subsidiaries of NextEra Energy Resources. PetroQuest was running two rigs at year-end 2015, as part of a 38-well program that was scheduled to wrap up in the fourth quarter.

Unlike the Arkoma, which Bentek Energy tagged a year ago as one of its five weakest performing basins in a low-price climate, the Cana Woodford, by most accounts, is still delivering atypical returns, given the times. In a Dallas Business Journal article last March, Wood Mackenzie singled out the Springer Shale and SCOOP as among the handful of sweet spots capable of generating returns at a $50/bbl price. For a more current perspective, premier Cana Woodford leaseholder Continental claimed in a November investor presentation, that at its current $7.8-million/well cost, Springer wells can deliver a nearly 30% rate of return (ROR) at $40/bbl oil, double-digit percentage points better than its $7-million Bakken wells. The company added that its SCOOP condensate wells provide just over a 20% ROR at $2/Mcf gas, factoring in current $9.6 million/well costs.

Moreover, despite Cana Woodford operators individually reporting higher year-over-year oil production, overall output in Oklahoma was on pace to decline in 2015. According to the latest data available from the U.S. Department of Energy’s (DOE) Energy Information Administration (EIA), Oklahoma’s oil production averaged 316,000 bpd in the first nine months of 2015, down sequentially from the average 340,000 bpd delivered during the prior year. Conversely, marketed gas production for the first three quarters of 2015 increased to an average monthly total of 208.9 Bcf, the EIA reported, from 195.2 Bcf per month for the same period of 2014. Given Oklahoma’s notorious reporting delays, more up-to-date production numbers are unavailable, nor do EIA and the Oklahoma Corporation Commission (OCC), the state’s chief regulator, break out production between conventional and

unconventional sources.

There has been no such hesitancy, however, in responding to growing concerns over the perceived link between disposal wells and the most recent spate of earthquakes to rock the state. In early December, the OCC ordered the shut-in of seven saltwater disposal wells in northwestern Oklahoma, and volumes reduced on another 66 injection wells, after two earthquakes of 4.7 and 4.4 magnitude, respectively, shook the region. Another multi-injector shut-in was ordered in November.

UPPING THE ANTE

Meanwhile, in keeping with its strategy of “sharpening the focus” on U.S. shale, Devon said that with last month’s acquisition, it now holds an aggregate 430,000 net acres in the Anadarko basin, 250,000 of which are in the Cana Woodford fairway. The $1.9-billion upstream portion of the acquisition includes producing STACK acreage, which was controlled previously by privately held Felix Energy of Denver. In a separate $1.55-billion transaction, Devon’s EnLink Midstream entity snatched up the network of pipelines and gas processing plants owned by Tall Oak Midstream, which, like Felix Energy, is a portfolio company of Houston’s EnCap Investments, Fig. 2. The Oklahoma deals coincided with Devon’s $600-million purchase of 253,000 acres in Wyoming’s Powder River basin.

“This will sharpen our focus on what we believe to be the best oil and gas assets in North America,” said Devon CEO Dave Hagler about the newly acquired Oklahoma and Wyoming assets.

In a post-acquisition webcast, Devon said the additional STACK-area acreage adds roughly 400 MMboe in incremental, risked resource potential, translating to a purchase price of around $4/boe. Excluding the estimated 9,000-boed contribution expected from its new properties, Devon said it plans to exit 2015 with STACK production of roughly 70,000 boed, up from the 64,000 boed delivered in the third quarter, Fig. 3. Devon finished the third quarter with aggregate Anadarko basin production of 83,000 boed.

While Devon has identified multiple wet pay zones in the acquired acreage, including the overlying Springer shale, the continuous silty-shale reservoirs of the upper and lower Meramec have emerged as prime targets going forward. “The Meramec is going to be another top-tier asset for us. We’ve characterized about 500 locations there. In my own mind, that’s conservative. And as we drill that out, it will have the potential to greatly improve. So it’s going to be one of our go-to areas as we go forward,” Hager told investors in November.

Prior to the acquisition, Devon ran nine rigs, including four with JV partner Cimarex Energy Co., with provisional plans to increase its STACK drilling activity by one rig. After hooking up its first 14 operated wells in September, Devon and its partner, by year-end, planned to have some 60 wells on production at the Gordon Row in-fill program. To the immediate south, Devon said its eight-well Haley pad delivered “record-setting” average IP rates of 1,850 boed, using its Cana Woodford standard, upsized completion design, featuring increased stage spacing, more perf clusters and 50% more proppant.

INCREASED MERAMEC FOCUS

Like Devon, STACK pioneer Newfield Exploration, which holds more than 165,000 net acres in the play (Fig. 4) , has a Meramec-centric focus of late, with nearly all of the 22 new wells put online in the third quarter, targeting that thicker pay zone. “When you look at the overall dataset, as we approach 70-odd wells, through the course of the drilling, we’ve got about two-thirds of the total tests in the Meramec, and about a third in the Woodford,” Boothby told investors in November.

Those wells contributed in no small part to Newfield’s Anadarko basin leasehold, singly surpassing its total U.S. production in the third quarter, averaging 67,610 boed and inspiring a higher fourth-quarter target of 74,000 boed. Year-over-year production in the play was up 50%, the company said. “For the first time, our net daily production from the Anadarko basin has now eclipsed the combined production from the remainder of our domestic assets,” Boothby said. “This is quite a milestone, considering that the SCOOP and STACK plays literally started from scratch just four years ago.”

The Texas-based independent was running 10 rigs as of Dec. 9, focusing primarily on hold-by-production (HBP) drilling of its STACK acreage. “Although the primary focus of our STACK drilling program today is to HBP our acreage, we are learning about well spacing, both on the surface and sub-surface, and we will be ready to enter full-field development in 2017,” Boothby said. “By the end of this year, we expect to have drilled about 100 STACK wells.”

Newfield, which pegs its basin-wide individual well costs at around $7.5 million, also has initiated full-field development and pad drilling within its SCOOP leasehold to the immediate south. There, five wells were completed recently on its Williams pad, delivering average, 30-day, initial production (IP) rates of 1,177 boed.

Cimarex Energy Co., meanwhile, took the younger Meramec to new lengths in late 2015, with the completion of its first 10,000-ft lateral, doubling the standard within the 128,000 net acres that it controls. Though early in its Meramec program, Cimarex forecasts total individual well costs at between $7 million and $7.4 million.

Primarily targeting Cana Woodford gas and NGL windows, Cimarex says preliminary results show the 10,000-ft Meramec wells competing favorably with the 2-mi laterals drilled in its flagship Permian basin leasehold. The initial, long-lateral well delivered peak, 30-day IP of 16 MMcfed, compared to the 9.3-MMcfed average of the 11 Meramec wells with 5,000-ft laterals now

on production.

“Especially from a standpoint of 10,000 ft, those [Meramec] wells come right to the top, as far as the type of returns that we can generate,” said John Lambuth., V.P. of exploration. “They compete head-on with some of our best Bone Spring drilling, as well as some of our best Culberson Wolfcamp long-lateral drilling. As far as going forward, especially in terms of holding acreage and future drilling in the Meramec, once we understand the ultimate spacing pattern, our plans are to drill 10,000-ft laterals over the majority of our Meramec/Woodford acreage.”

Cimarex exited the quarter with the drilling and completion of 52 gross (10 net) wells hooked up to production, with another 53 gross (22 net) wells awaiting completion. Third-quarter Cana Woodford production averaged 321.6 MMcfed, representing at least 33% of the operator’s cumulative U.S. production.

The Denver independent, which tentatively plans to run six rigs in the Cana Woodford in 2016, says its infill drilling program is set to go into production in July. Including the 14 new gross wells that it was drilling at year-end 2015, the latest infill row will include 50 gross (23 net) production wells. Cimarex, likewise, has initiated a stacked/staggered pilot program that will comprise six Meramec wells—staggered between the upper and lower zones—and five underlying Woodford wells.

“Our bias would be to drill the Meramec first, and come in later and get the Woodford underneath it, rather than the other way around,” said CEO Thomas Jorden. “That’s just because the Woodford and the Meramec behave very differently when you offset them. But, we don’t know the answer to that yet. One thing we do know is, if we co-develop it all simultaneously, we don’t really have to spend a lot of time worrying about this.”

NEW RESOURCE PLAY

Stealing some of the spotlight from its SCOOP crown jewel, Continental Resources, by the second quarter of 2015, had assembled a 146,000-net-acre leasehold in STACK, which it describes as “a new resource play” for the company. Even before the first barrel of production had been booked, CEO Harold Hamm told analysts on Nov. 5 that STACK “has emerged as yet another high-value growth opportunity for Continental.”

The STACK play represents the latest addition to Continental’s commanding 832,000-net-acre leasehold, with more than half (445,000 net acres) located in SCOOP. As of now, the Oklahoma City independent plans to continue running a 15-to-16-rig fleet, which, at the end of the third quarter, was spread out between SCOOP (7-8 rigs), STACK (3 rigs), and five rigs as part of its Northwest Cana joint development with the wholly-owned U.S. subsidiary of South Korea’s SK E&S Co. Ltd.

At the end of the third quarter, Continental had completed two of three newly drilled STACK Meramec wells, with average IP rates of 1,588 boed from 9,742-ft and 10,092-ft laterals. Continental had planned to drill up to three additional STACK wells at year-end 2015, as it continues to de-risk the new holdings.

“Continental and others continue to successfully expand the productive footprint of STACK, west into Blaine, Dewey and Custer counties, where the STACK reservoirs are thicker, over-pressured, and are delivering superior production rates,” said President and COO

Jack Stark.

Elsewhere, Continental said the Woodford and Springer pay zones of its SCOOP play averaged a combined 69,136 boed in the third quarter, up 90% year-over-year. Of that, 57,933 boed were delivered from the Woodford, where Continental completed five net (27 gross) wells in the quarter. Six net (7 gross) Springer wells were completed during the latest reporting period. The company also participated in the completion of four gross wells in the Northwest Cana JDA, where net production averaged 6,629 boed.

In another new resource of sorts, Marathon Oil Co. says its first operated Springer well was scheduled to go online in the fourth quarter of 2015, as part of its SCOOP infill pilot. Marathon averaged three rigs within its estimated 149,000 net acres within the SCOOP and STACK plays, where it planned to drill 21-25 wells by year-end 2015.

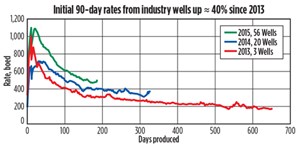

Marathon said its SCOOP in-fill program delivered an average 23,000 boed in the third quarter (Fig. 5), up 21% sequentially, with nine gross wells added to the production stream. During the quarter, four wells were drilled to TD, including the inaugural Springer well, which Marathon said was drilled 470 ft/day faster than the offset average. Elsewhere, Marathon added two operated and three non-operated STACK Meramec wells to the sales line.

As it continues to delineate both its STACK and SCOOP assets, Marathon says it has a way to go in the learning curve. “We have a lot of confidence in that we’re so early in the development cycle in the Oklahoma resource basins, both SCOOP and STACK, that we’re nowhere near the highest efficiency, the best completions yet,” said Lance Robertson, V.P. of North American production operations. “So, we expect well productivity to continue to increase over time, particularly as we get to scale and have more opportunity to experiment in a structured way.” ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)