Rig counts brace for a second round of declines

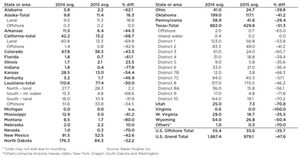

The catastrophic oil price decline wreaked havoc on the U.S. rotary rig count during 2015, with the industry bracing for a continued slowdown this year. The average U.S. rotary rig count for 2015 was 979.1 active units, a 48% decline in activity compared to the previous year’s average of 1,867.4. During 2015, the average monthly rig count dropped nine times, with the two modest gains reported in July and August. In the 10 most active states, rig usage dropped by an average 47%. The largest percentage drop was reported in California, which suffered a 69% loss of activity. Louisiana experienced the smallest decrease, losing just 30% of its yearly average, due mainly to relatively stable activity in southern areas and the Gulf of Mexico.

The Permian basin of West Texas and New Mexico experienced a 48% decline in year-over-year activity, with the Texas side dropping 53% or 221 less rigs, while New Mexico reported a 43% reduction in activity, a loss of 39 active units. Rig counts in the Eagle Ford shale of south-central Texas also collapsed, with activity dropping about 49%.

In spite of a 52% decline in North Dakota, activity in the Bakken shale retained some strength, with an average 84 units working in the shale play during 2015. The other most active states, including Oklahoma, Wyoming, Ohio, Kansas and West Virginia, all posted significant drilling decreases compared to last year.

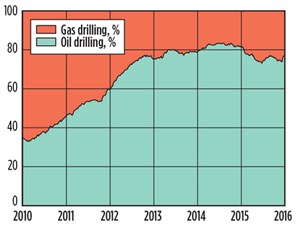

The steep increase in wells targeting oil reservoirs, which started in 2010 contemporaneous with the sustained rise in oil prices, reached a crescendo in 2014, when 83% of all rigs drilling in the U.S. were seeking oil.

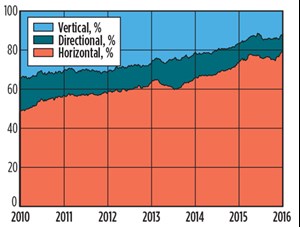

The U.S. drilling split, by trajectory, was relatively stable in 2015. During the year, 76% of rigs active in the U.S. were drilled horizontally, while 10% were directional. Vertical drilling accounted for just 14% of the total. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)