Key nations keep pumping despite oil price decline

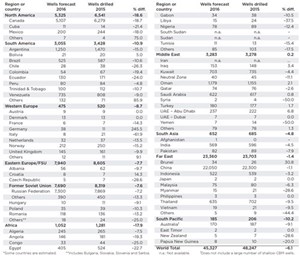

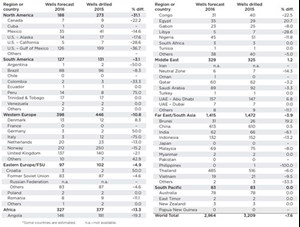

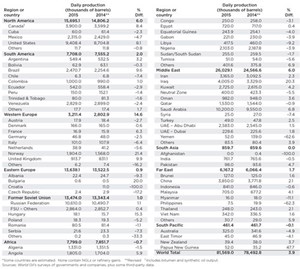

After several years of high oil prices, the upstream industry got a sharp reality check, when prices started to head southward in late 2014. While many observers were, at first, expecting a recovery toward the latter quarter of 2015, oil continued its downward descent throughout the year, before reaching a fresh low in January 2016. To date, North America has taken the brunt of the downturn; however, the impacts of lower-for-longer oil prices are being felt by operators and service companies across the globe. Production has, however, continued to exceed demand. Global output of crude and condensate grew at an astonishing rate of 3.9%, to average 81.6 MMbpd.

NORTH AMERICA

Canada. Drilling in Canada was down 45% last year, according to the Canadian Association of Petroleum Producers (CAPP), with operators spudding 6,279 wells. This year, CAPP and World Oil expect another decline, albeit a mere 18.7%, to 5,107 wells expected. Oil production was up more than 8%, to 3.9 MMbpd, while gas output rose 7%, to 15 Bcfd. The share of oil production coming from the oil sands was 2.4 MMbpd, or 62%.

According to Evercore ISI, at least 20 Canadian oil sands projects have been shelved or postponed, comprising roughly 1.3 MMbpd or ~65% of capacity growth targeted for 2017-2018, due to lower oil prices. For more information on Canada, please turn to the article on page 67.

Mexico. Although Mexico is Latin America’s largest producer, legislative reform, designed to end Pemex’s seven-decade monopoly and facilitate foreign investment, has yet to reverse the country’s oil production decline. During 2015, Mexico’s average monthly production was 2.32 MMbopd or 4.7% less than the country’s average monthly production in 2014.

Mexican drilling fell 54% last year, to 244 wells. A further decline of 18% is expected during 2016. In June 2015, Pemex announced its biggest discovery in five years, comprising four new fields in shallow water close to Cantarell field. Initial production from some of these deposits is scheduled to start within 16 months.

SOUTH AMERICA

Not surprisingly, given the free-fall of oil prices, South American drilling declined last year, although not as severely as other regions, due to the large role played by state oil companies. Regional drilling was off 6.6%, to 3,428 wells. This year, a further drop of 10.9%, to 3,055 wells, is forecast. Nonetheless, regional oil output rose 2.0% last year, to 7.71 MMbpd.

Columbia. The country’s upstream sector continues to prosper from the influx of veteran Venezuelan professionals, who fled the oppression of their own country and are working to build up Colombia’s production. After a temporary lag in 2014, Colombian oil output posted a 1.0% gain, to again hit the 1.0-MMbpd mark. The country’s two largest producers, state-run Ecopetrol and Pacific Rubiales, account for at least 85% of all oil output. Mirroring the wider, global picture, drilling is predicted to fall 19%, to 54 wells.

Brazil remained the second-largest regional oil producer behind Venezuela during 2015. Output rose 9.6%, to 2.47 MMbpd. According to the U.S. EIA, a growing share of production comes from Brazil’s pre-salt oil deposits offshore, making up about 25% of total Brazilian output by April 2015 and increasing 63%, year-over-year. Last July, pre-salt oil production hit a record 865,000 bpd, as new wells came onstream in the Santos basin. Meanwhile, investigations of Petrobras for bribery and money laundering continue in Brazil and the U.S.

And with the investigation ongoing, the Petrobras auditor has refused to certify financial statements, which has kept Petrobras from accessing international capital markets. Thus, the corruption scandal has forced Petrobras to alter its investment plans and conduct a sizeable divestment program to raise funds. Drilling in the country is set to shrink 10.6%, to 525 wells, including 88 offshore.

Venezuela. Drilling was down about 4% last year, totaling 808 wells. A further reduction of 9%, to 735 wells, is expected this year. Oil output declined about 70,000 bpd, to 2.83 MMbpd. There is concern that with the departure of many experienced managers and workers from state firm PDVSA to nearby Colombia and other countries, Venezuela’s oil fields are not being maintained properly.

Meanwhile, Eni started production last year from the 17-Tcf Perla gas field in the Gulf of Venezuela. According to Eni, Perla is the largest offshore gas field discovered, to date, in Latin America, and the first gas field to be brought into production offshore Venezuela. The JV is owned by Eni (50%) and Repsol (50%).

Guyana. Exxon Mobil and Production Guyana Ltd. reported a significant oil discovery last year on the Stabroek Block, approximately 120 mi offshore Guyana. The well was drilled to a 17,825-ft TD in 5,719 ft of water, and encountered 295 ft of high-quality oil-bearing sandstone.

WESTERN EUROPE

Several new fields went onstream offshore Norway and the UK during 2015, which pushed regional oil production 14.6% higher, to 3.21 MMbpd. Drilling was off about 5%, to 520 wells, including 446 offshore. This year, drilling is forecast to decline 8.7%, to 475 wells, of which 398 will be offshore.

Norway. Despite the downdraft in commodity prices, 2015 proved to be an active year on the NCS, with oil production increasing for the second consecutive year and averaging 1.90 MMbpd. Drilling was up 14.7% during 2015, to a near-record 250 wells. A 15.2% reduction, to 212 wells, is predicted for 2016.

According to the Norwegian Petroleum Directorate (NPD), four new fields went onstream last year. According to the NPD, 11 North Sea discoveries were made, with another six reported in the Norwegian Sea; however, most were minor. In January 2015, Norway’s Ministry of Petroleum and Energy opened the nation’s 23rd licensing round, offering 57 blocks or partial blocks. The results of the licensing round, which attracted applications from 26 companies, are expected to be announced during first-half 2016. In April, the ministry announced the opening of APA 2015, which covers the most explored areas on the NCS. The awards resulted in 56 exploration licenses being awarded to 22 operators.

United Kingdom. In January 2016, Oil & Gas UK—a trade association representing the nation’s offshore industry—welcomed the country’s first rise in oil and gas production in over 15 years. “Government data for the first 10 months of 2015 shows that the total volume of oil and gas produced on the UK Continental Shelf was up 8.6% compared with 2014, with the production of liquids up 10.6%, and gas up 6.1%,” the group’s Chief Executive Deirdre Michie said. “Output in November and December tends historically to be more stable, but even so, Oil & Gas UK now expects year-end production for the full year of 2015 to be 7% to 8% higher than last year.” Indeed, World Oil’s analysis of governmental data shows that UK crude and condensate production was up closer to 10%, averaging 913,700 bpd.

In July, the Oil and Gas Authority (OGA)—the nation’s oil and gas regulator—awarded 41 additional offshore licenses as part of the nation’s 28th Offshore Licensing Round—an initial tranche of 134 licenses was awarded in late 2014, with the remainder deferred, pending additional environmental screening. In December, the OGA offered 159 onshore blocks, incorporated into 93 licenses, as part of the nation’s 14th Onshore Oil and Gas Licensing Round. Around 75% of the 159 blocks offered relate to unconventional resources. British drilling was down 9% last year, at 161 wells, of which 140 were offshore. For 2016, a further 9.9% reduction to 145 wells is forecast, including 137 offshore.

Netherlands. In November, a Dutch court ruled that production should be curbed at Groningen gas field in the Netherlands. The court capped production at 27 Bcm for the year from Oct. 1, a decision later upheld by the government.

EASTERN EUROPE/FSU

Owing to the fact that Russian operators continued to drill at 2014 levels or higher, regional drilling was up 9.5%, at 8,605 wells. This year, operators will begin to ease off their high-level pace, but the 7.7% reduction will be less than in most regions, with 7,940 wells expected. With Russian producers operating nearly at capacity, oil production across the area was up 0.9%, to 13.64 MMbpd.

Russia. Russian oil production proved remarkably resilient in response to continued downward pressure on prices last year, hitting a post-Soviet record in December. According to Reuters, Russia produced 10.83 MMbopd in December, up from the 10.78 MMbopd produced the preceding month. Despite the low commodity prices, Russian operators raised their drilling 13%, with the largest producer, Rosneft, boosting its well total 30% higher.

Last May, Total said that it had started gas and condensate production from the onshore Termokarstovoye field, which is operated by Terneftegas, a JV between Novatek (51%) and Total (49%), in Russia’s Yamalo Nenets Autonomous District. In November, Gazprom Neft announced that the millionth tonne of oil had been produced at Prirazlomnoye field—the first, and only, oil producing field on the Russian Arctic Shelf.

AFRICA

Although Africa was one of only two regions to register an oil production decline last year, it was less than 1%, with average output of 7.80 MMbpd. As bureaucratic bungling has piled up in some countries, and civil unrest and wars have occurred in others, regional drilling has suffered, falling 14% last year. Another 17.9% decline, to 1,052 wells, is forecast. Offshore drilling will fare slightly better, off 13.3% at 327 wells.

Nigeria is Africa’s leading oil producer and the world’s fifth-largest LNG exporter. In 2014, Nigeria’s crude oil production had stagnated at about 2.2 MMbpd, falling 3.9% last year, to 2.1 MMbpd. Exports of Nigeria’s light sweet crude have been affected drastically by U.S. light shale oil production. Prior to 2012, Nigerian crude ranged from 9% to 11% of total U.S. imports. That volume has dropped to less than 1% (approximately 300,000 bbl).

E&P activity during 2015 included the start of production from Shell Nigeria’s Bonga Phase 3 project, with peak production expected to be 50,000 boed. Meanwhile, international oil companies have been divesting their assets from the onshore Niger delta. In March, Eni sold three of its leases (OML 18, 24 and 29) to Nigerian companies for $1 billion. At about the same time, Shell Nigeria sold 30% of its share in OML 18 for $737 million. After declining 14% in 2015, drilling is expected to fall another 12.4%, to 78 wells.

Angola. In 2014, Angola produced 1.70 MMbpd of crude oil, and that rate jumped 5.9% in 2015, to 1.81 MMbpd. From 2002 to 2008, average oil production grew at a 15% rate, as a consequence of several deepwater discoveries in the 1990s. In March 2015, Exxon Mobil started production from the Kizomba Satellites Phase 2 development in Block 15, and it should peak at 70,000 bopd. Also from Block 15, Eni achieved first oil from Cinguvu oil field in March 2015 (100,000 bopd) and Mpungi field in January 2016 (100,000 boed). However, drilling was down 20% last year (all offshore), and another 19.3% reduction, to 146 wells (again, all offshore) is predicted.

Others. UK-based Tullow Oil resumed production from Jubilee field offshore Ghana in August at the rate of 105,000 bopd and 100 MMcfgd. Oil production had been reduced to 65,000 bpd while technical issues were being resolved with gas compression systems. Meanwhile, exploration offshore Ghana is being focused in the Cape Three Points area, where Lukoil made a discovery in September 2014.

In 2015, Mauritania paid off decades of suboptimal exploration successes with a “play opening” discovery made by U.S. independent Kosmos Energy in the offshore Greater Tortue Complex in Block C-8. The Tortue-1 well intersected 107 m of net hydrocarbon pay in the Lower Cenomanian formation. Meanwhile, at the other end of the continent, an exploration frontier is developing offshore South Africa. In October, Statoil completed a farm-in

transaction with Exxon Mobil, acquiring a 35% interest in the Tugela South area, offshore eastern South Africa in water depths of up to 1,800 m. Work commitments between 2015 and 2017 include acquisition of 3D seismic data and G&G studies.

In December 2015, Anadarko announced the signing of 90% of supply agreements with Asian buyers to bring its $15-billion LNG project offshore Mozambique closer to fruition. Meanwhile, Eni and three partners have been awarded the license for Block A5-A, following the 5th Competitive Mozambique bid round. A consortium of Exxon Mobil, Rosneft and Mozambique Offshore have won licenses for three additional blocks. To the north, East Africa’s biggest reserves of natural gas after Mozambique have been discovered offshore Tanzania (55 Tcf). A partnership of Statoil and Exxon Mobil, has made discoveries totaling 22 Tcf. In addition, BG Group’s Kamba-1 well had found 1.03 Tcfg in October 2014. Operators in the region are expected to collaborate in the building of an LNG plant for gas exports to Asia.

Onshore East Africa. UK-independent Tullow Oil has discovered about 2.3 Bbbl of resources onshore East Africa, with discoveries in Kenya and Uganda. Meanwhile, Maersk Oil has farmed into three onshore exploration licenses in Kenya and a further two in Ethiopia.

MIDDLE EAST

The strongest area of upstream activity continues to be the Middle Eastern region, where oil production rose a whopping 6% last year, to average 26.03 MMbpd. As state firms pursue long-term agendas, regional drilling rose 1.7%, to 3,278 wells. A small increase to 3,283 wells is expected for 2016.

Saudi Arabia. In spite of persistent oversupply that has driven benchmark crude prices to 12-year lows, Saudi Arabia kept producing and exporting oil at record levels. In January 2015, Saudi Arabia’s crude oil exports rose 7.8%, reaching their highest level in 11 months. The world’s largest oil exporter shipped 7.47 MMbpd in January 2015, compared with 6.93 MMbpd in December 2014. The kingdom produced 9.59 MMbopd in January, up 0.5% or 50,000 bopd, from the previous month. At mid-year, Saudi Aramco further escalated its battle for market share by increasing production output to a 30-year high of 10.46 MMbopd, adding to the global glut and increasing downward pressure on commodity prices. During second-half 2015, Saudi decreased monthly production to an average 10.22 MMbopd, a 2.5% reduction compared to the June high-water mark. The Kingdom increased overall average production 6.8% in 2015 (10.20 MMbopd).

During 2015, the number of wells drilled rose 21%, to 617 wells, including 92 offshore. A slight gain to 622 wells (including 89 offshore) is predicted this year.

Iraq’s crude production continued to surge in 2015, making it the fastest-growing OPEC producer, despite unrest in the country’s northern portion. During first-half 2015, monthly oil production averaged 3.7 MMbpd, but it surged during the second half, averaging 4.2 MMbpd, with November reaching a plateau of 4.31 MMbpd. The gain in production capability represents a year-over-year increase of 13.5%, and the highest level achieved by the country since 1962.

In northeastern Iraq, drilling in the Kurdistan region confirmed a 2014 discovery, when the Shewashan-2 reached a TD of 2,573 m in October and was completed in the Cretaceous Shiranish formation. The well confirms the commercial viability of the initial discovery well, and delineated a productive area covering 122 km2. Drilling totaled 148 wells, down from 221 in 2014. A small increase to 153 wells is expected this year.

Iran. In 2015, Iran continued to operate under sanctions imposed by the EU and the international community. Despite the restrictions, the country pumped crude at a monthly average of 3.17 MMbpd, and hit a year-long peak in December.

With the lifting of sanctions, Iran plans to recapture oil sales, rather than limit its production, to help stabilize crude markets. The nation plans to restore output to the level that it achieved before economic curbs limited its production. This means pumping up to 4.0 MMbopd within seven months of the removal of the sanctions, and 4.7 MMbopd, as soon as possible, after that.

Eastern Mediterranean. In August, Eni reported a major gas discovery at its Zohr deepwater prospect, offshore Egypt. The discovery could hold up to 30 Tcf of lean gas-in-place, the Italian company said in a statement announcing the discovery. In December, Noble Energy reported that the Israeli government had acted to implement the Natural Gas Framework. According to the Houston-based company, the framework establishes the regulatory certainty and stability necessary to proceed with development of both the Tamar expansion and Leviathan field.

SOUTH ASIA

Drilling was off 8%, to 685 wells, including 66 offshore. A further 4.8% decline to 652 wells is slated this year, including 62 offshore. The area’s oil production was virtually unchanged, at 859,700 bpd.

India. As the world’s second-most populous country, India is seen more as an oil and gas consumer than a producer. While the country produces approximately 1 MMbopd, it must import nearly 3 MMbopd to satisfy growing consumer and industrial demand. The natural gas shortfall is approximately 500 MMcfd, satisfied through LNG imports.

With the dramatic fall in both oil and gas prices, India’s economy has benefited through a substantial reduction of its oil and gas import bill. Nevertheless, leading state oil company ONGC is tasked by the government to increase domestic production, which declined slightly during 2015 to 761,700 bpd. Drilling this year is expected to slip 4.5%, to 569 wells.

FAR EAST

Statistically speaking, as China goes, so goes the entire region. Chinese output pushed regional oil production 1.7% higher, to an average 6.17 MMbpd during 2015. Drilling will be nearly flat this year, at 23,360 wells.

China. According to estimates by the U.S. Energy Information Administration, the East China Sea has about

200 MMbbl of oil, and as much as 2 Tcfg in proved and probable reserves. However, as its economy grows at the slowest pace in 25 years, China is curtailing commodities consumption. The government is cutting natural gas prices for industrial users to stimulate demand. And, as a result of the slowing economy, China made six interest-rate cuts in 2015 in an effort to combat deflationary pressures.

In an attempt to shield domestic producers from the price collapse, the country also is refusing to adjust the price of fuels, as long as crude is below $40/bbl. They have opted to promote energy conservation and security, as well as improve fuel quality, by using profits from fuel sales below the $40 level. In that environment, Chinese operators were able to squeeze out a 2.1% production increase, to 3.85 MMbopd. This was achieved by maintaining a high rate of drilling. This year, a slight decline to 22,050 wells is expected.

According to EIA, China’s shale plays contain 1,115 Tcf of recoverable gas, as well as substantial amounts of tight oil. However, Changqing field in northwestern China’s Ordos basin—where production peaked at 500,000 bopd in 2014—has tapered off significantly, due to decreased drilling and E&P spending reductions. Additionally, Fuling field, is being kept idle because of a lack of buyers.

Indonesia. After a seven-year absence, Indonesia rejoined OPEC as an oil-consuming nation in December. Nevertheless, the start-up of Indonesia’s Banyu Urip oil field on Java was the single-largest addition to global supply in 2015. However, haze from forest fires on Sumatra Island resulted in a significant setback in October’s production. The increased pollution has affected the country’s industry, as oil fields are forced to undergo more frequent maintenance, and staff have been unable to work properly due to the poor air quality. Hundreds of oil wells had to be shut down during 2015, and crude oil output fell below 800,000 bpd in October. Overall, Indonesian output was off 0.6% during 2015, at 841,000 bopd. Drilling was off 16%, at 539 wells, including 152 offshore. This year, wells should total 522.

SOUTH PACIFIC

Due mostly to declining output in Australia, regional oil production was off slightly, at 461,400 bpd. Drilling was impacted considerably by low commodity prices, falling 27%, to 206 wells. This year, a 10.2% decrease to 185 wells is predicted.

Australia. Ending the year with a disappointing production average of 325,000 bopd, Australia has nevertheless undergone development both onshore and offshore. A major development took place in 2015, as Australia Pacific LNG started production in December, and exported its first LNG cargo in January 2016.

Woodside also has made strides during the last year on its $2-billion North West Shelf (NWS) project, receiving approval for the Greater Western Flank Phase 2 off the coast. It will develop 1.6 Tcf of raw gas from the combined Keast, Dockrell, Sculptor, Rankin, Lady Nora and Pemberton fields. Official start-up, however, is not expected until the second half of 2019.

Chevron’s $54-billion Gorgon project is expected to begin LNG shipments during first-quarter 2016.

New Zealand. The award of nine new exploration permits for Block Offer 2015 took place in December. The offer included three onshore permits and six offshore permits, all in the Taranaki basin. This, the government hopes, will jump-start a very disappointing drilling rate, which saw just seven wells drilled last year, compared to 21 during 2014. In the short run, however, we predict another decline to five wells for 2016.

Papua New Guinea. After Total assumed operatorship during August of Petroleum Retention License 15, in the Gulf Province, the Papua LNG project moved forward with the development of the Elk-Antelope JV. Additionally, the PNG LNG project, operated by Exxon Mobil, achieved its 100th cargo of LNG in June. Drilling was down moderately, at 10 wells, compared to 13 in 2014. The outlook calls for eight wells in 2016. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- The last barrel (February 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)