ShaleTech: Marcellus/Utica Shale

Unseasonably warm temperatures throughout the U.S. northeast in late December underscored the bearish near-term forecasts for the Marcellus-Utica shale play, where gas prices continue to languish amid a delayed winter drawdown that has kept stockpiles bulging.

Nevertheless, in what would have been a major head scratcher just over a year ago, a number of players are pulling what remains out of the liquids-rich Ohio fairway of the comingled Utica-Point Pleasant shale, in favor of its dry gas horizons, including expansion into the Marcellus core of neighboring Pennsylvania and West Virginia. Over the past year, some of the operators still active in the combo play there, which stretches some 95,000 mi2 across the Appalachian basin, have taken a closer look at the dry gas window of the deeper Utica source rock and, particularly, its stacked pay potential with the overlying and comparably low-cost Marcellus.

“This market has certainly rendered many Appalachian areas uneconomic and has forced most producers to shift development to other areas or, in the case of producers who have no economic acreage at current prices, suspend their development altogether,” said Daniel J. Rice IV, CEO of Rice Energy. “As a result, there has been a noticeable shift in producer activity away from liquids-rich and non-core dry gas Marcellus and Utica areas, and into the Marcellus and Utica’s dry gas cores.”

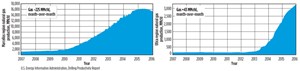

That said, the distressingly perfect storm of mid-January wellhead prices, which topped out at around $2.38/MMbtu, and aggregate inventories at a reported five-year high are starting to take a toll on production from the nation’s most prolific gas play. The latest, best guesstimate of the U.S. Energy Information Administration (EIA) shows a reversal in the annual upward trajectory of the Marcellus, with production expected to drop some 225 MMcfgd between January and February to 15.222 Bcfgd, Fig. 1.

Conversely, month-over-month gas production in the Utica is forecast to climb 43 MMcfd to 3.249 Bcfd, although much of the increased production in 2015 and the early part of this year is attributed to previously drilled, but uncompleted (DUC) wells coming on line. The EIA also expects January to February Utica oil production to increase by a modest 1,000 bpd to 70,000 bpd.

In the meantime, operators throughout the infrastructure-challenged Appalachian basin are biding their time, awaiting the start-up of what Range Resources Corp. tabulated as no less than 37 pipeline systems, planned to begin deliveries between 2016 and 2018 into the prodigious gas markets of the upper U.S. northeast, Canada and elsewhere. Together, with the seven pipelines that were slated to go into service between 2014 and 2015, the new networks, as designed, would collectively add incremental takeaway capacity of up to 33.5 Bcfgd.

“We’re really more focused on timing our drilling and completions to fill the pipeline capacity we have from Northern Access 2015 now, and then Northern Access 2016, by the end of 2016. So, that’s really what drives our activity level, rather than current pricing,” says Matt Cabell, president of Seneca Resources Corp., the E&P arm of Houston’s National Fuel Gas Company (NFG). Cabell was referring to NFGS’s two-pronged pipeline network, designed to transport an estimated 0.5 Bcfd of Marcellus gas into the northeastern U.S. and Canada.

RECOVERY IN OFFING?

Despite a crippling blizzard in late January that temporarily shot prices up to around $5.00/MMbtu in parts of the Northeast, what should have been the start of the winter-heating season was met with freakishly mild temperatures for the second consecutive year. This delayed the typical, seasonal withdrawals and accompanying price spikes. In its pre-blizzard weekly gas storage report, the EIA, on Jan. 8, had the eastern region holding 802 Bcfg, up nearly 16% from the 692 Bcfg held in stockpile during the like period of 2015.

According to Baker Hughes, for the week of Jan. 24, the Marcellus Pennsylvania and West Virginia fairways had 35 active rigs, down three from the prior week. The Utica, meanwhile, was up one, to 14 active rigs.

Rystad Energy believes that gas may be on the verge of lifting out of its persistent funk, citing reduced well costs, a forecasted 2-Bcfd decline in U.S. gas production, and upcoming additional regional takeaway capacity. The Norwegian consultancy expects gas prices to recover by the end of 2016 to around $3.20/Mcf, and $3.50/Mcf in 2017. “Activity is expected to continue to decrease in early 2016, but pick up by the second half as the prices recover,” according to Rystad. “Due to some production curtailment from operators in 2015 as a reaction of the low in-basin prices, the production in 2016 is expected to increase slightly compared to 2015.”

Compared to their oily brethren, gas producers are veteran hands at adjusting to a low-price environment, with Rystad saying the average breakeven price for Marcellus production now stands at roughly $2.70/Mcf, and below $2.00/Mcf in its core.

Pending the wholesale release of year-end earnings and 2016 guidance, it is apparent that most operators are in no hurry to put rigs back to work, or production on the market.

EARLY PULLBACK

Cabot Oil & Gas Corp. is among those closing the faucet on a significant volume of its Marcellus production, as it awaits the planned start-up of the Constitution and Atlantic Sunrise pipelines in fourth-quarter 2016, and the second half of 2017, respectively. The two networks are designed to deliver an aggregate 2.4 Bcfgd into the northeastern U.S. and, in the case of the Williams-operated Atlantic Sunrise, the Mid-Atlantic and southeastern U.S. market.

“We’re cautiously optimistic for an improvement in price realizations in 2016, due to the impact of new takeaway capacity coming online over the next few quarters on the demand side, and the impact of significant reduction in industry activity on the supply side,” President and CEO Dan Dinges told investors in October.

Cabot exited 2015 with two rigs running in its tightly concentrated 200,000-net-acre Marcellus leasehold in Pennsylvania’s prolific Susquehanna County. The Houston-based independent drilled some 80 net wells in 2015, with around 60 completed, and expected to end the year with a 55-well DBU inventory. As of press time, 2016 guidance calls for the drilling and completion of 50 to 65 net wells, respectively. Pointing to additional service cost reductions, improved operating efficiencies and longer lateral lengths, Cabot says its Marcellus assets generate a roughly 70% internal rate of return (IRR) at a realized price of $2.00 MMbtu.

Chesapeake Energy suggests that whatever level of activity it maintains in 2016, will be directed largely to the commanding

1 million net acres it controls in eastern Ohio’s Utica, which President and CEO Robert Douglas Lawler described as “a powerhouse asset within our portfolio.” The Oklahoma City independent closed 2015 with two rigs active in the Utica, averaging a third-quarter production of 106,000 boed, down 15% sequentially, as an estimated 20,000 boed was withheld from production.

Chesapeake says its completed well costs, with average 7,900-ft laterals and 40 frac stages, came in at $7.7 million in 2015, up from the average $7.2 million/well in 2014, with 6,200-ft laterals and 29 frac stages. In the third quarter, Chesapeake said it completed a Utica well with a record 12,976-ft horizontal section.

Moreover, beginning in January, Chesapeake moved to a fixed-fee agreement with Williams Companies that includes the dedication of 50,000 net acres, with a minimum volume commitment of 250 MMbtu/day, which, the operator says, can meet with one rig per year.

Elsewhere, with its $4.98-billion sale of 413,000 acres in northern West Virginia to Southwestern Energy, in October 2014, Chesapeake still holds 230,000 net acres in the Pennsylvania Marcellus core, most of which is held by production (HBP). At year-end, the company was operating one rig in the Marcellus (Fig. 2), where third-quarter production averaged 820 MMcfgd. During that quarter, Chesapeake tested two Upper Marcellus wells in Bradford County, Pa., with peak production rates averaging 18 MMcfgd.

In November, Lawler said that until prices improve, roughly 500 MMcf of Marcellus gas will remain behind the choke. “We have pulled off all of our activity, or largely all of our activity,” he told analysts. “We’re excited about the resource. Obviously, we highlight the Upper Marcellus. We anticipate bringing some of that gas online in the fourth quarter, but it’s going to require higher gas prices. We anticipate that will happen, but we’re not going to bring gas on just to hit a production number.”

Southwestern Energy—which, in February 2015, finalized a $394-million purchase and sale agreement with Statoil, that increased its working interest in 30,000 net acres in West Virginia and southwestern Pennsylvania—entered 2016 with a suspension of all drilling activity. Southwestern was averaging around seven rigs as of Oct. 23, and planned to finish 2015 by drilling 88 to 92 operated Marcellus wells.

Marcellus first-mover Range Resources holds more than 900,000 net acres across Pennsylvania, where it expected to exit 2015 with 133 new wells hooked up to production. The Fort Worth, Texas, independent says most of its holdings offer stacked play potential for the Marcellus, Utica and Upper Devonian, which it plans to exploit with 1,000-ft and, later, 500-ft spacing.

Cumulative Pennsylvania production included two Utica dry gas wells, the second of which delivered choke-controlled production of 13 MMcfd. A third Utica well was set for completion early this year in southwest Pennsylvania, where Range holds 400,000 net acres. “The best part of the dry core of the Utica, we believe, will be down in southwest Pennsylvania,” said Range President and CEO Jeffrey Ventura.

Recognized as one of the lowest-cost producers in the play, with a reported average break-even cost of $2.62/Mcf, Range had not yet released its tentative rig count for this year. Despite the early performance of the Utica wells, Ventura said the 2016 focus will be on the Marcellus, where production averaged 1,277 MMcfgd in the third quarter, a 27% jump over the previous quarter. “We think, with those three [Utica] wells, coupled with the activity in and around us, it’ll give us a really good handle on what the Utica ultimately is,” he said. “But in the short run, you’re going to see our focus be totally on the Marcellus.”

Elsewhere, after cutting its capital budget from $1.9 billion to $1 billion, Pittsburgh’s EQT Corp. says its 2016 plans call for drilling 72 Marcellus wells, down from around 122 drilled in 2015, and split 51-21 between its core southwest Pennsylvania and West Virginia properties. The operator also plans to drill five deep Utica wells on its combined one-million-acre leasehold in the two states.

UTICA SHIFT

Despite the southwestern Pennsylvania Utica having rock characteristics and productive potential nearly identical to its “world class” fairway in and around Belmont County, Ohio, homegrown Rice Energy says it is not yet ready to jump in full bore. Rice controls 86,000 net acres in southwestern Pennsylvania and some 55,000 net acres in southeastern Ohio, where it targets the Utica, Fig. 3.

“The only discernible difference between the two is the more favorable pressures and depths in Pennsylvania, which are approximately 3,500 ft deeper,” says the Rice CEO, who added a caveat. “Getting up the learning curve with $20-million to $30-million wells is an expensive proposition. We think Pennsylvania Utica has the potential to eventually compete with our Marcellus and Ohio Utica returns, but this isn’t the right market to really begin its development.”

In a more favorable price environment, the Pennsylvania Utica could become a go-to dry gas play, he suggested, pointing to a comparative pilot well that the Canonsburg, Pa., operator completed last year. The Greene County Utica prospect was designed to mimic Rice’s Bigfoot 9H crown jewel in Belmont County, including an identical 5,800-ft lateral. Even though the Bigfoot well ranks among Ohio’s most productive wells, the Rice CEO said its Pennsylvania counterpart “is shaping up to be the strongest well Rice has ever drilled, and we’re highly encouraged for what this resource could mean for Rice and our midstream business.”

Meanwhile, Rice expected to complete the fourth quarter of 2015 with average net production of 515 MMcfgd to 540 MMcfgd, down from the 580 MMcfgd put to sales in the prior quarter. For the year, Rice expected to bring 46 net wells onstream. The company, which plans to release its New Year guidance in February, said in late December that an unidentified energy infrastructure fund is expected to invest up to $500 million in the Rice Midstream Partners LP entity, which would help fund the independent’s 2016 capital plans.

Last year, CONSOL Energy Inc. drilled and completed its first Utica Pennsylvania dry gas well (Gaut 41H), which tested at initial flowrates of 61.4 MMcfd. For the time being, however, CONSOL says it will concentrate on cutting down its DUC backlog.

Also based in Canonsburg, Pa., the coal and gas producer halted new drilling in late 2015, but, in January, announced plans to drill a deep Utica test well on one of its Marcellus gas pads on Pittsburgh International Airport (PIT) property this year. The proposed well, which would replace one of the 12 Marcellus wells on CONSOL’s Pad 4 in Findley, is intended to help delineate the productive range of the Pennsylvania Utica. “We have no plans yet as to when we will test the dry Utica at PIT,” a CONSOL spokesman said. “We do have all necessary approvals in hand, however, from the local and federal authorities.”

He added that CONSOL’s Pad 2 at PIT is scheduled to initiate production in the second quarter, while one well on nearby Pad 1 also is scheduled to be completed and turned in line during the quarter.

CONSOL further reduced its 2016 drilling and completion expenditures by $180 million, most of which will be earmarked for a 37% reduction in its aggregate 94-well DUC inventory, including 83 uncompleted Marcellus wells. As of early January, the company planned 25 Marcellus and 10 Utica completions, spread across the estimated 614,000 net acres it controls across Pennsylvania, West Virginia and Ohio.

Some 413,639 of those net acres are included in two 50/50 JVs with Noble Energy, which targets the Marcellus in southwest Pennsylvania and northwestern West Virginia, and Hess, which covers 68,488 acres in the more liquids-rich portion of the eastern Ohio Utica. Noble has suspended drilling, while Hess says it will lay down its single rig after the drilling of five planned wells. “It’s not economic really to want to drill wet wells today,” CONSOL CEO Nicholas Deluliis said.

Denver’s Antero Resources has shifted its focus of late to West Virginia, where it closed 2015 with seven rigs running, which includes drilling the company’s first Utica dry gas well in the Mountain State. At 18,029 ft, MD, including a 6,620-ft lateral, the Tyler County Utica well was completed in the third quarter and flowed 20 MMcfgd on a restricted choke. Outside of West Virginia, Antero, which holds 569,000 net acres prospective for the Marcellus and Utica, spread across the three core states, also ended 2015 operating three rigs targeting the Ohio Utica.

Antero placed 14 newly completed Marcellus wells on production in the fourth quarter, at average lateral lengths of around 7,777 ft. Elsewhere, during the fourth quarter, Antero completed and placed 16 Utica wells on production at average laterals of roughly 8,883 ft.

Production in the Marcellus shale has averaged 1,051 MMcfed in the fourth quarter of 2015, while the Utica averaged 446 MMcfed. Antero said it curtailed about 45 MMcfd of Utica production in the fourth quarter.

Meanwhile, after a one-year drilling hiatus, Denver’s PDC Energy says it will resume drilling in 2016, on the estimated 67,000 net acres it holds in the Utica. In December, PDC said it would spend around $34 million to drill and complete five Utica wells this year. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)