ShaleTech: Eagle Ford/Pearsall shale

With the Eagle Ford shale relegated to playing second fiddle to the Permian basin, operators still in play are pulling out all of the stops to bring returns closer in line with their geriatric neighbor to the immediate west.

Indeed, even with drilling and completion costs inching below $4 million/well, the Eagle Ford finds itself at a gaping competitive disadvantage, which was reinforced in a July 13 Wood Mackenzie report. While break-even costs can vary widely county by county, Eagle Ford operators need $48/bbl to turn a profit, while $37/bbl will generate a reasonable return in the Permian Bone Spring and Wolfcamp plays, according to the consultancy.

Hand-in-hand with hammering down costs, the operators still remaining are tweaking frac, spacing and completion designs to maximize drainage and returns, which is a work-in-progress throughout the basin. “Nobody will tell you this is their final design in the Eagle Ford,” says Cesar Alvarez, Statoil’s Eagle Ford asset manager.

Moreover, any prospect not considered to be in the core of the core, such as the underlying Pearsall shale, is summarily brushed aside. For premier player EOG Resources, that means those wells that fail to deliver a minimum 30% direct after-tax rate of return (ROR) at $40/bbl oil. In what CEO William R. Thomas describes as a “game-changer,” EOG initiated a wholesale shift this year to concentrate only on what it classifies as “premium drilling” locations.

“The 30% return is not an average; it’s a minimum. Second, 30% was established as the minimum direct return to ensure that when indirect costs are included, the drilling program earns healthy full-cycle returns,” he said. “Our shift to premium is permanent and not simply a temporary high-grading process in a low-commodity price environment.”

Going even farther outside the conventional box, EOG also has implemented a distinctive enhanced oil recovery (EOR) project, further upending the time-worn unconventional model. “We do not need 50 rigs drilling thousands of wells per year. It will take far less capital to grow production at strong double-digit rates,” said Thomas.

WHOLESALE CUTBACK

With acreage largely held by production (HBP), Eagle Ford operators are in no hurry to dust off their wallets, Wood Mackenzie said in an examination of 2016–2017 spending trends. The results of that analysis, released on July 21, pegged the one-time South Texas juggernaut as a prime contributor to the $150-billion upstream reduction in Lower 48 capital expenditures. “The plays that saw the highest proportion of their capital expenditure cut were in the Eagle Ford and the Bakken,” said Jeanie Oudin, Wood Mackenzie senior research manager, Lower 48. “That’s because the two plays were in full-scale development, with most operators’ acreage held by production at the time oil prices began to fall, allowing for a more responsive slowdown in activity.”

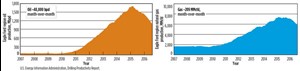

The cavernous Capex reduction is clearly reflected in both production and drilling. Based on notoriously delayed Texas Railroad Commission (RRC) reports, Eagle Ford oil production averaged 961,563 bpd between January and April, compared to the 2015 average of 1,171,501 bpd. Gas and condensate production for the same reporting period was 5.121 Bcfd and 204,200 bpd, respectively, according to the latest available statistics from the state’s chief regulator.

The downward trajectory is expected to continue, with oil production declining 48,000 bpd between July and August, according to the best guesstimate of the U.S. Energy Information Administration (EIA), Fig. 1. The EIA also projects a 209-MMcfd drop in month-over-month gas production.

As for drilling, even as the active rig count of late rose elsewhere, it remained flat in the Eagle Ford, averaging 33 rigs throughout July, according to Baker Hughes. By contrast, an average 100 rigs were active during July 2015, according to Baker Hughes data.

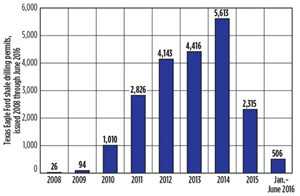

Between January and June, the RRC authorized just 506 new drilling permits (Fig. 2), a staggering decline from the 1,584 horizontal drilling permits issued during the same time frame of 2015 in the three pertinent RRC districts (01,02,04). If more recently approved permits are any indication, no second-half uptick is in the offing. The RRC issued 155 horizontal drilling permits between June 1 and July 17 in the 14 core counties, compared to 356 authorizations in the same period last year.

Illustrating the current state of the play, a number of operators have joined Pioneer Natural Resources in either suspending activity or conducting the minimum work required to meet lease commitments. Pioneer earlier suspended 2016 drilling and completion activity, and diverted 90% of its available capital to the Permian basin. As of late July, the company was maintaining the status quo with a spokesman saying, “all of our pumping services fleets are currently deployed in the Permian.”

Another case-in-point is Cabot Oil & Gas, which, after releasing its lone rig in February, is focusing temporarily on completions necessary to meet obligations on its 85,000-net-acre position.

SM Energy also furloughed its remaining rig in August 2015 and ceased completion activity from mid-fourth quarter through February, with capital also redirected to the Permian basin. In the meantime, the Houston independent is re-negotiating lease terms to defer drilling commitments. “Clearly, the lessors are aligned with us and not driving us to drill up quality inventory during a low in the commodity price cycle,” said Herbert S. Vogel, executive V.P. of operations.

Anadarko Petroleum, likewise, is in suspension mode after drilling three and completing 17 wells in the first quarter with a single rig. Anadarko says it will not resume Eagle Ford activity anytime soon. “We’ll pretty much be producing what we have right now until prices come up,” Darrell E. Hollek, executive V.P., U.S. Onshore Exploration and Production, said in May.

Despite a 44% reduction in year-over-year drilling and completion costs to an expected 2016 average of around $3.5 million/well, Encana Oil & Gas (USA) will run one rig for the balance of the year, while increasing completions intensity in what it describes as a “drill-to-fill” program.

ConocoPhillips is down to three operated rigs within its entire Lower 48 onshore portfolio with no plans for increasing its fleet this year. “Overall, I would say there is no set spot price that we’re trying to watch as a trigger to start adding back activity,” said Alan Hirshberg, executive V.P., Production, Drilling and Projects.

In 2015, those six independents collectively ran up to 25 rigs.

NO-RIG GROWTH

Though it plans to average five operated rigs this year, EOG says it will add roughly 1,000 bopd in incremental net production without new drilling or completions. In what is billed as the first gas injection EOR campaign in any U.S. horizontal shale play, EOG says it can deliver the additional production at a capital investment of less than $1 million/well.

While keeping technical specifics close to the vest, EOG says four recently completed gas-injection pilot projects with 15

producing wells proved up the proprietary process. Another pilot, now underway, will comprise 32 producing wells.

EOG, while assessing the technique’s applicability throughout its commanding 608,000-net-acre leasehold, says the same geologic characteristics that make the Eagle Ford an attractive primary development target also make it uniquely suited to EOR.

“We have long discussed the competent barriers that encase the Eagle Ford and provide vertical containment for completions. This unique feature also plays a significant role in keeping the injection in contact with the targeted reservoir,” says Lloyd Helms, executive V.P., Exploration and Production. “The injected gas is thus able to become miscible with the oil in the reservoir and subsequently drive incremental oil recovery.”

In a related development, EOG says it has “cracked the code” on a new geologic concept that makes the overlying Austin Chalk a top-tier horizontal play within its South Texas portfolio, “earning returns on par with the Eagle Ford, Permian and Bakken.”

The initial lateral test well of the long-explored target delivered 30-day IP rates of 2,100 bopd and 1.9 MMcfgd, while a follow-up well in April came in at 2,265 bopd and 2.7 MMcfgd. EOG plans to complete roughly 150 wells this year, including seven Austin Chalk wells, to further delineate the formation’s potential. The operator completed 329 Eagle Ford wells in 2015.

TIGHTER SPACING

Houston’s Carrizo Oil and Gas is running two rigs for the time being and plans to drill 53 net (57 gross) wells, an atypical eight-well increase over its original 2016 guidance. Carrizo also plans to frac 52 net (55 gross) wells, one less than previously forecasted.

In the first quarter, Carrizo drilled 17 net (18 gross) operated wells and completed 12.5 net (14 gross) wells, with quarterly production of 22,800 bopd, up 2% over the prior quarter.

The independent also says a continuing series of stagger-stack tests could add from 220 to 880 net locations to its inventory. Two pilot tests are underway this year, joining the three stagger-stack pilots now on production, to test effective lateral spacing of 165 ft to 280 ft, compared to Carrizo’s once-standard 330-to-500-ft spacing.

Completed costs for a 6,100-ft. lateral well are expected to average roughly $4.1 million this year, down from $4.6 million at the end of 2015. President and CEO Sylvester P. Johnson said that with the lowered completion costs, Carrizo is more inclined to add a frac crew, as opposed to another rig. “If we add another frac crew in the Eagle Ford, we can basically go for about six months with the inventory we have and the pace we’re adding inventory with the two rigs,” he said.

Earlier this year, Carrizo augmented its 88,000-net-acre leasehold with the acquisition of 4,000 acres contiguous to its North LaSalle holdings.

Marathon Oil says it, likewise, is seeing marked improvement in per-well performance with a recent shift to 200-ft stage spacing, with the 15 wells brought online in the first quarter performing some 20% better than offsets completed with 250-ft spacing. “We continue to see well performance uplift from tighter stage spacing in our high-GOR (gas-oil ratio) oil wells while driving completed well cost down by about $2 million from last year,” said President and CEO Lee M. Tillman.

Marathon expects to drill 91 to 96 net (132 to 141 gross) wells this year, with five rigs active within its 204,000-net-acre leasehold. A cumulative 32 net lower and upper Eagle Ford and Austin Chalk wells were brought online in the first quarter, compared to 44 net wells completed in the three months prior. First-quarter production averaged 120,000 net boed, compared to 128,000 net boed in fourth-quarter 2015. Marathon’s first-quarter 2015 production averaged 147,000 net boed.

EP Energy, which is operating a single rig on its 91,675 net acres, completed 16 wells in the first quarter, down sharply from the 38 wells completed in the first three months of 2015. First quarter oil production of 32,400 bpd, likewise, was down 15% from the first quarter of 2015.

The Houston independent, which has established a total cost target of just under $4.1 million/well, says, if nothing else, the dramatic slowdown has provided breathing room to explore optimized lateral placement and completions. “When you’re in that (high-activity) environment, it’s running pretty hard to keep up with the capital program. And this environment is just the opposite,” says President and CEO Brent J. Smolik. “We can re-task our technical professionals to look back at all of what we’ve learned in the Eagle Ford example. We’ve got interest in over 650 wells and a lot of data that comes with that. Now is the perfect time to dig into all that and make sure that we learn as much as we can from it.”

One area particularly ripe for investigation and improvement throughout the Eagle Ford is the design of typical frac stimulation and completion programs, says Robert F. Shelley, director of Well Performance Evaluation for StrataGen, a CARBO business. “Optimizing horizontal Eagle Ford completions and frac design is presenting significant new challenges to the industry,” he said. “Our analyses indicate that, generally, hydraulic fractures are not very efficient or effective. In other words, from a production perspective, there appears to be large portions of the created frac area that do not contribute to well production performance.”

Citing a number of distinctive issues, including well complexity, formation evaluation limitations, logistics and operational constraints, Shelley said operators must determine the investment level that will generate the highest return, while keeping operational risk within an acceptable margin. “Finding ways to cost-effectively improve hydraulic fracture effectiveness and longevity will be key to achieving the next level of well performance, especially from deeper Eagle Ford horizons,” he said.

DESIGN TWEAKS

Noble Energy is transferring the completion designs of its core Gates Ranch field in Webb County to elsewhere within its 45,000-net-acre leasehold. Noble says it is running one rig “off and on” between the Permian and Eagle Ford.

Noble drilled two lower Eagle Ford wells in the first quarter, with another eight hooked up to production, including two Briscoe Ranch wells in southern Dimmitt County, the company’s first wells outside its core area. Drilled with an average 4,912-ft lateral length, and completed with 2,000 lb of proppant/ft, both wells also served as test cases for varying cluster spacing patterns. The 30-day IP rate of the well completed with 20-ft clusters was 3,525 boed, while the 40-ft-cluster well came in at 2,236 boed, which, according to Noble, is “substantially above historic results and type curve for the acreage.”

“We’re seeing early success, bringing our improved completion designs from South Gates Ranch to new areas and unlocking additional resource potential,” said Executive V.P. of Operations Gary W. Willingham.

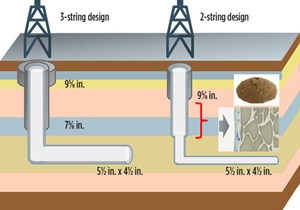

BHP Billiton, for another, says a shift from three- to two-string casing designs in much of its oily Blackhawk field, in DeWitt County, is reaping drilling cost savings of around 30%/well, Fig. 3. BHP credits the application of an ultra-low invasion, wellbore shielding additive, developed by Houston’s Impact Fluid Solutions, with stabilizing the overlying, mechanically weak Wilcox formation, thereby allowing the elimination of an intermediate casing string, Fig. 4. Historically, the mud weight required to drill the overpressured Eagle Ford exceeded the fracture gradient of the highly depleted Wilcox, requiring the extra string of casing to avoid severe losses and wellbore stability issues.

BHP Billiton holds approximately 300,000 net acres throughout the oil and gas windows, and is running two rigs, both in the Blackhawk, which it operates in a 50-50 JV with Devon Energy.

According to Devon, which also operates in Lavaca County, first-quarter production was 107,000 boed, compared to 122,000 boed in the like quarter of 2015.

Devon said that the JV partners plan to average two to three rigs and a completion crew for the second half of 2016, and expect to stabilize production at second-quarter levels of around 80,000 boed for the remainder of the year. ![]()

Now in control, Statoil uses the Eagle Ford as a field lab

Statoil is in full-blown optimization mode after increasing its stake in the Eagle Ford shale late last year, giving it full operatorship of a roughly 72,000-net-acre leasehold spread throughout the oil and gas windows. “We can now optimize our field development (strategies) across the entire leasehold, where before we were only controlling one part,” said Eagle Ford Asset Manager Cesar Alvarez, referring to the previously split operating zones between Statoil and its partner Repsol, which continues to hold a 37% interest.

With the December acquisition, Statoil went from a 50% interest to a controlling 63% interest in the wide-ranging asset, giving it the latitude to examine a variety of well placement and completion design scenarios throughout the leasehold. Trials, to date, have tested a wide range of between-well spacing and frac-size combinations, in an elusive attempt to isolate the optimal design for maximum reservoir drainage. The acreage is fully HBP, which affords testing flexibility, he said.

“I would say the frac design is almost set for the spacing we are testing, but we are still looking at the optimal spacing between wells,” he said. “A big testing focus for us over the past year is also seeing if we can stagger wells in the Eagle Ford, and the optimal spacing between the upper and lower Eagle Ford.”

Spacing tests also have extended to per-well perforation clusters, where a single frac typically had five clusters, spaced 340-ft apart, enabling the pumping of 14–15 fracs/well. “What we are doing is spacing those same five clusters at 250-ft, so now we’re getting 20 to 22 fracs/well and seeing quite an interesting uplift on these wells,” Alvarez said. “It’s all about finding the right balance of how much you pump in the well, the well spacing and the frac spacing.”

For this year, Statoil plans to continue running one rig and drill around 25 wells with roughly 28 wells slated for completion. In its 2015 SEC Form 20-F filing, the operator reported year-end equity and entitlement production from the Eagle Ford at 34.7 Mboed and 26.6 Mboed, respectively. The U.S. Securities and Exchange Commission requires the yearly filing of all international companies listed on the U.S. Stock Exchange.

“The Eagle Ford is definitely an interesting part of our (U.S.) portfolio and will remain in our portfolio. We have to continue to stretch our thinking to increase our returns and lower break-even (costs). This is a continual exercise in good and bad pricing environments.” ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- Using data to create new completion efficiencies (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)