Canada’s E&P industry faces uphill struggle

Deeply entrenched in a recession, and with the long-hoped-for recovery still seemingly a distant hope, industry observers have begun to debate if the bottom of the cycle is past. Notwithstanding some positive portents, the situation remains bleak for the Canadian oil and gas industry.

Economics. Since late 2014, it is estimated that as many as 100,000 Canadians that are directly or indirectly linked to the oil and gas business have lost their jobs. Bankruptcies continue to mount, and most analysts agree that there will be more before any turnaround is seen. After almost two years of weak commodity prices, even the low Canadian dollar is not enough to shield producers against the tidal wave of red ink.

Natural gas and crude oil prices have shown some signs of recovery in recent weeks, but nowhere near the levels needed to spur renewed growth, or confidence, in Canada’s troubled energy industry. In fact, the AECO spot natural gas price dropped to near 20-year lows in the second quarter of 2016.

Normally, the upside for companies exporting oil to the U.S. is that the lower Canadian dollar provides a significant boost to the bottom line, because they are paid in American dollars. A 74-cent Canadian dollar would translate into a 35% premium over current oil prices. Recently, it has been trading around the 77-cent mark.

In the midst of all this, the city of Fort McMurray, at the heart of Alberta’s Athabasca oil sands area, was evacuated after wildfires roared through the area in early May. The city and surrounding area remained under a mandatory evacuation order for over a month, and producers shut down operations as well, leading to a 25% drop in oil sands production in May. Even though there was little damage to any of the shut-in operations, the price tag of the wildfires has been pegged at C$3.58 billion by the Insurance Bureau of Canada, making it the most costly natural disaster in Canadian history, Fig. 1.

Regulation and pipelines. Market access also continues to plague the Canadian industry. Following U.S. President Barack Obama’s veto of TransCanada Corporation’s Keystone XL pipeline, Enbridge’s proposed C$7.9-billion Northern Gateway project may also have hit an insurmountable obstacle, albeit from the Canadian courts, rather than the political circuit.

Despite securing approval from Canada’s National Energy Board (NEB) two years ago, the project has been dealt a major blow, as the Federal Court of Appeal overturned the approval in June, because the federal government of the day failed in its duty to consult with aboriginal groups along the 740-mi route. As a result, the former approval has been sent back to Canada’s new Liberal government for “redetermination.”

What happens next is a matter of some debate, although Prime Minister Justin Trudeau reiterated his opposition to the line’s proposed route in early July.

Meanwhile, the NEB has begun its 21-month public review of TransCanada’s C$15.7-billion Energy East proposal, a 2,800-mi, 1.1-MMbpd pipeline that would carry Alberta crude to Eastern Canadian refineries, as well as a marine terminal in New Brunswick.

Trudeau’s government also has announced a review of the NEB, seeking recommendations from an expert panel on reforms needed to ‘modernize’ the NEB. It is unknown what impact, if any, the review will have on any current NEB processes or decisions.

Most recently, the NEB recommended that the federal government approve NOVA Gas Transmission’s proposed 2017 system expansion in Alberta, which would meet increasing natural gas demand from oil sands producers. The NEB actually doesn’t make binding decisions, instead making recommendations to the federal cabinet, which, ultimately, makes the decision to accept or reject the recommendation. The NOVA recommendation also includes 36 conditions from the NEB.

For its part, Alberta’s provincial government, with a year of governing now under its belt, believes that its new climate change policy will be sufficient to combat much of the rhetoric about oil sands emissions that has crept into the dialogue around pipelines, despite Alberta’s strict regulatory regime.

Alberta Premier Rachel Notley recently appeared before a federal ministerial panel, lauding the province’s efforts on greenhouse gas emissions, and urging them to consider Kinder Morgan Canada’s proposed Trans Mountain pipeline expansion on its own merits. The NEB already has recommended approval of the proposal, with conditions.

Alberta’s producers also are hoping that the province’s recently announced new royalty incentive programs, designed to encourage activity, also may help the industry climb out of the current recession. Producers also may opt-in early to the government’s new modernized royalty framework, originally not designed to kick in until 2017.

M&A activity. Given the difficult market conditions in Canada, and with so many companies in dire financial straits, it is a buyer’s market, with the few producers that do boast strong balance sheets well-positioned to scoop up assets from the less fortunate.

Through the first half of 2016, upstream oil and gas deals totaled approximately C$6 billion, highlighted by Penn West Petroleum’s sale of its entire liquids-rich Saskatchewan asset base to Teine Energy for $975 million in cash in mid-June, representing production of some 16,300 boed. Teine is a private company, owned by the Canada Pension Plan Investment Board.

The second-largest, first-half deal was Birchcliff Energy’s all-cash $625-million acquisition of Montney assets in Alberta from Encana Corporation in late June, with about 26,000 boed.

And then July hit, and with it came a couple of blockbusters. First, in early July, Seven Generations Energy shelled out C$1.9 billion—in a cash, shares and debt deal—for another package of Montney assets from Paramount Resources, including approximately 30,000 boed.

And about a week later, Devon Energy divested its 50% share of Access Pipeline—which operates heavy oil facilities across northwestern Alberta—to Wolf Midstream, another arm of the Canada Pension Plan Investment Board—for C$1.4 billion.

Spending plans appear to be fully in step with the grim outlook. Numbers compiled by the Daily Oil Bulletin peg expenditures at about C$15 billion through the first half, compared to original estimates of $18.5 billion. It also appears that the few producers that increased planned spending, based on increasing oil prices through May 2016, could have been overly optimistic, as crude prices sagged again recently.

Oil sands operators remain focused on reducing costs, both in the short and long term, but the crude oil price slump has shaken short-term spending and development plans, and the recent wildfires have further complicated matters for producers, who also face tough new rules on carbon emissions from the Alberta government.

So far, oil sands producers remain bowed, but not beaten, and most have resumed full operations, as Alberta’s Wood Buffalo region recovers from the wildfires. Suncor, Syncrude, Shell, Husky, and Canadian Natural Resources Limited have all resumed operations at their respective mines. Less fortunate has been Nexen Energy ULC’s Long Lake facility, where the upgrader has been down since an explosion occurred in January, Fig. 2. In July, Nexen announced that it would not repair the shut-in unit in the short term, but it will review its decision again later this year.

Land sales. Possibly the clearest indicator of the severity of the current economic climate is land sale activity. After falling to a 20-year low in 2015, industry payments to provincial governments for mineral rights through the first six months of 2016 have fallen once again, according to Daily Oil Bulletin records, to C$80.18 million, down more than 60% over last year’s $205.8 million. It seems astounding that the six-month record was set a decade ago, in 2006, when governments took in $2.66 billion.

Alberta once again led the way, taking in 80% of the total amount, $63.77 million, 29% lower than last year, when the province brought in $165.1 million.

Spending in British Columbia continues to plummet, to $4.2 million, compared to $6.8 million in 2014, a decrease of 38%, putting the province on course for an all-time low. Both of these totals are dwarfed by the $609 million collected in 2010.

Saskatchewan also saw its revenue levels decrease, to $12 million, down 63% from the $32.7 million received through six months last year.

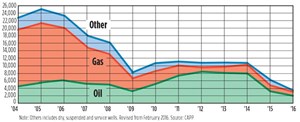

Drilling outlook. Drilling numbers are also down significantly during the first six months of 2016, when a total of 1,428 wells were drilled, down 44% from last year’s 2,553. Of the total drilled in 2015, 58% targeted oil, according to Daily Oil Bulletin records. Overall, meters drilled declined 40%, indicating that the trend toward longer completions has continued despite the lower activity.

For the first time in many years, Canada’s service industry associations have very different 2016 forecasts. Last November, the Canadian Association of Oilwell Drilling Contractors (CAODC) issued its 2016 Western Canadian forecast, but typically revises that number during the current year. In 2016, that forecast remains unchanged, and substantially out of step with other forecasts, and current well totals. CAODC is predicting that 4,728 wells will be drilled this year, compared to 5,394 in 2015.

Meanwhile, the Petroleum Services Association of Canada (PSAC) revised its forecast downward in late April to 3,315 (Fig. 3) wells, down 36% from its original forecast of 5,150 issued last November. PSAC’s figure approximates the 3,515 wells forecast by the Canadian Association of Petroleum Producers (CAPP). By way of contrast, CAPP data show that 5,486 new wells were drilled in 2015, which was less than half of the 11,277 recorded a year prior. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- What's new in production (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)