Port Fourchon plows toward next wave

The unemployed supply vessels tied to docks throughout southern Louisiana may reflect the near-term prognosis for the deepwater Gulf of Mexico, but the longer-term prospects can be heard in the incessant drone of dredging machines at work in the aquatic arteries crisscrossing Port Fourchon.

So says Port Fourchon Executive Director Chett Chiasson, who points to the cyclical history of the oil and gas industry as proof positive that the continued expansion of the premier deepwater service-and-supply hub in Lafourche Parish is well-justified. “We know it’s a challenging time, but we have to do the things to benefit our customers, and continue to move forward to meet the future demand when the next wave invariably comes,” said Chiasson. “We’re preparing for that next wave now.”

In the meantime, most of the 80 companies holding more than 140 leases in Port Fourchon are taking the brunt of low oil prices, as exploration, deepwater and otherwise have dropped appreciably. As evidence, Baker Hughes reports 26 rigs active in the Gulf of Mexico as of March 11, down 20 rigs year-over-year. The abject state of the current deepwater drilling environment was driven home in January, with Freeport-McMoRan’s decision to idle three drillships and defer much of its planned, 2016 ultra-deepwater drilling program. The operator said it is working to restructure rig contracts.

The annual World Oil forecast has 126 new wells being drilled throughout the Gulf in 2016, exceeding the U.S. Bureau of Safety and Environmental Enforcement’s (BSEE) 100-well projection. In 2015, Gulf of Mexico operators drilled 199 wells, according to BSEE, which, at the beginning of that year, had predicted 144 wells would be drilled.

“We service production, but most of our business comes from drilling, so whatever is out there, for the most part, we service. There’s certainly a lot less activity than we’d like to see,” said Chiasson.

Obviously, the drilling pullback has brought a proportionate reduction in demand for the commodities and services delivered by most of the port’s tenants, whose balance sheets have taken a severe hit. In response, the Greater Lafourche Port Commission extended the current 20% lease rate reduction in February until the end of 2016, unless oil prices reach $60/bbl for 60 consecutive days in the meantime, said Chiasson. The commission originally authorized the blanket rate relief in March 2015, but with a sustained $70/bbl trigger price. It represented the first time that the port authority had approved a discount of basic rental rates because of a market downturn.

“This port commission recognizes that the industry is facing trying times right now. As Port Fourchon is primarily the service base for drilling, the major business of our tenants is supporting exploration. Drilling is down, so the service side is also down quite a lot,” Chiasson said.

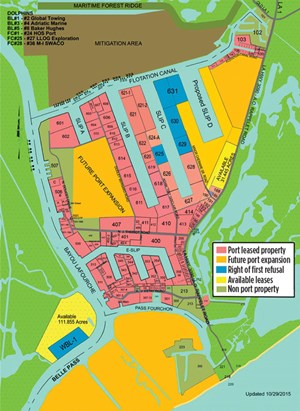

Nevertheless, Chiasson said total leases are actually “up a bit” over last year, Fig. 1. “All of our direct tenants are still in the port, though there has been some movement of companies that were renting from our customers. We also continue to get inquiries from companies that feel they need to have a presence at the port.”

Eric Danos, executive V.P. of family-owned Danos, which provides personnel and related production and project support services, suggests that while companies must retrench to weather the economic storm, cutting too deeply could hamper the ability to take advantage of better times. Now, for example, is a good time for training, he said from Danos’ one-year-old, 64,000-ft2 corporate headquarters in Gray, La., some 33 mi from its original home in Larose, La.

“We all know the industry will come back, so we don’t want to cut so hard and deep that we can’t respond. But, even in today’s market, there are still opportunities out there,” said Danos. “We’re trying very hard to preserve our ability to respond when the market comes back. We feel like we have some really good human capital, both in the field and office, and we want to hold onto that. Our intent is to build a team that is second to none.

“We still envision our company growing significantly. We’ve been on a great trajectory, and now we’ll take a pause for a couple of years and get ready for when the market comes back.”

PRODUCTION CLIMBING

There is no such pause on the production side, where Wood Mackenzie estimates the Gulf of Mexico will reach a milestone in 2016, with an additional 250,000 boed coming onstream. In its global upstream analysis released in January, the consultancy said that 2016 Gulf of Mexico production will reach a new peak of 1.9 MMboed, despite a 9% decline in capital investment.

Bolstering that projection are the four new deepwater fields that the U.S. Energy Information Administration (EIA) says will hit sales lines this year, joining the eight developments that began production on the Outer Continental Shelf (OCS) last year. In January, the Anadarko-operated Heidelberg field began flowing up to 80,000 bopd from 5,271 ft of water in Green Canyon. It will be followed by the start-up of Shell’s record-setting Stones development on Walker Ridge. Located in 9,556 ft of water and targeting the Lower Tertiary, Stones will become the world’s deepest production installation. It also will mark the Gulf of Mexico’s second floating production, storage and offloading (FPSO) facility. The first phase of the development is designed to produce at a 50,000-boed capacity.

Also on tap for first oil this year are Noble Energy’s Gunflint project in Mississippi Canyon and Freeport’s Holstein Deep in Green Canyon, which will produce oil and gas from 6,138 ft and 4,326 ft of water, respectively. LLOG Exploration’s Son of Bluto 2 in 6,461 ft of water, and Freeport’s Horn Mountain Deep (5,400 ft of water), are on tap to commence production in early 2017, according to EIA.

“One of the most fascinating things for me over the past year, especially on the production services side of our business, is that our customer base has really been re-invented,” said Danos. “We’ve traditionally worked in a very significant way with the super majors, but now we’re seeing our headcount come down significantly with those companies. But overall, it’s being replaced by a completely different set of companies. Now, we’re picking up opportunities with mid-tier companies and definitely on land, so the profile of our business has changed significantly.”

MOVING FORWARD

Current economic conditions notwithstanding, Chiasson said the port authority has not relented in its commitment to the continued development of what has been oft-portrayed as a once-inaccessible swamp, transformed into one of the nation’s most valuable pieces of real estate. To that end, work continues full throttle on the 15-year-old Northern Expansion campaign, which will add considerably to the more than 66,000 linear ft of waterfront and just over 1,100 leased acres that the port now controls, Fig. 2. “We can’t stop, because prices are down. We’re actually catching up, and we’ll be ahead of the game and more than ready to meet the demand, when it comes back strong,” he said.

Along with routine maintenance dredging, most of the work this year will concentrate on the continuing build-out of Slip C, with the simultaneous construction of two bulkheads that will open up 800 linear ft of waterfront on the east side and another 950 ft on the west side. The east-side development is expected to be ready for occupancy by the third quarter, while completion of the 950 ft of additional waterfront on the west side is expected by the end of 2016. “This year, we’ll be focusing largely on these two bulkheads, as well as some maintenance dredging in Flotation Canal,” said Chiasson. “Both of these bulkheads have rights-of-first refusal. We’ll likely be continuing to develop Slip C through 2017, and probably into 2018.”

Bollinger Shipyards of nearby Lockport is among the tenants, which recently began new operations along the rapidly developed slip. Bollinger’s 46-acre Fourchon North, full-service shipyard, at the head of Slip C, comprises two 10,500-ton, one 5,000-ton and one 2,000-ton dry-dock.

Also on Slip C, Halliburton plans to be fully operational in July at its new 23.6-acre, multi-service facility that expands its existing drilling and completion fluid mixing and storage facilities, and cementing capacities at the port. The new complex also will accommodate the company’s stimulation and well intervention vessels. “The facility has four slips that can handle two vessels, each, along with an additional 500 ft of bulk area for larger vessels, for a total of nine 300-ft class vessels,” said a Halliburton spokesperson. “Production enhancement (stimulation) vessels are already operational from this facility, with the full complement of services, including stimulation, acidizing, sand control and nitrogen, as well as providing the fuel and water to supply vessels while loading fluids and products.”

Following the 2015 completion of its 1,400-linear-ft bulkhead on Slip C, Schlumberger also is moving forward with the construction of a cement mixing facility.

Elsewhere in the port, Harvey Gulf International Marine has completed installation of the nation’s only liquefied natural gas (LNG) bunkering facility, designed specifically for refueling offshore support vessels (OSV), Fig. 3. Completion of the fueling station coincides with the delivery of the 302-ft newbuild Harvey Power, the second OSV in what is the first U.S.-flagged, dual-fueled support vessel fleet.

The Harvey Power joins sister vessel, Harvey Energy, which was delivered last year from Gulf Coast Shipyard Group (GCSG) in Gulfport, Miss. Harvey is building six LNG-fueled OSVs, five of which are locked into five-year deepwater charters with Shell.

On fully developed Slip B, major leaseholder Chouest is in full operation at C-Port 3, the third rendition of the covered deepwater supply design unique to Port Fourchon. Also on Slip B, Weatherford says business remains steady at its almost fully automated casing bucking facility. “We’ve bucked thousands of feet of casing and tubing since this time last year,” says Ricky Guidroz, district manager of Weatherford Tubular Management Services. “We have been very busy, and operating at maximum capacity at times.”

The progressive strategy inherent to the 800-acre Northern Expansion project is exemplified with the preliminary work underway on undeveloped Slip D, which, upon completion, will add nearly 10,000 linear ft of waterfront. “We’ve just completed the initial bucket dredging of Slip D, and hopefully by the end of the year we’ll begin hydraulic dredging to design that slip,” said Chiasson.

From an economic perspective, Chiasson said the reduced demand during the extended downturn presents an opportune time for development. “For us, now is a good time to develop, because there’s not a lot going on for construction and development right now. We have a lot of contractors bidding for work, and the prices are good. We’re using that to our advantage and being wise with our money, so we can continue to ensure the port remains the premier center for deepwater oil and gas.”

Importantly, in anticipation of future deepwater demand and the associated need for more super-sized supply vessels, the port commission has been given the green light to work with the U.S. Corps of Engineers to investigate the deepening of drafts throughout Port Fourchon. Chiasson said the U.S. Army assistant secretary for Public Works earlier this year approved the preparation of a feasibility study, under the auspices of Section 203 of the Water Resources Development Act of 2000. “We now have approval to enter into an agreement with the district Corps of Engineers to actually investigate deeper drafts within the port to accommodate the larger vessels that will be required. We’re certainly confident that once this report is complete, we’ll have authorization to proceed with deeper drafts,” he said.

AIRPORT IN MIX

The aggressive expansion program also extends to the South Lafourche Leonard Miller Jr. Airport, which the Greater Lafourche Port Commission now wholly controls. Effective Feb. 1, the commission officially took over as fixed base operator (FBO). “While we own the airport and all the property around it, the fixed-base operations—including the hangar and the selling of fuel—had been with a contractor,” Chiasson said. “By taking over operation of the FBO, we can lower fuel prices and generally make the airport more marketable.”

As with its marine counterpart, the airport has undergone major expansion over the past few years, highlighted by Chevron’s new $30-million facility, designed to consolidate its entire Gulf of Mexico aircraft fleet, Fig. 4. Chevron’s new complex was designed to accommodate some 40 aircraft, and upwards of 6,000 incoming and outgoing passengers a month. “Chevron has told us it actually has more people going out there each month than it had originally planned,” Chiasson said.

In addition, the port commission has completed cosmetic and electronic upgrades at the terminal, according to Chiasson, who said tenant Rotorcraft Leasing, Inc., also completed its planned airport expansion. The next step, Chiasson said, is rounding up funding for a new access road to the airport, which could pave the way for long-awaited construction on the adjacent and undeveloped 1,200-acre industrial complex. ![]()

- Coiled tubing drilling’s role in the energy transition (March 2024)

- Advancing offshore decarbonization through electrification of FPSOs (March 2024)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Digital tool kit enhances real-time decision-making to improve drilling efficiency and performance (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)