ShaleTech: Niobrara-Codell shale

While the ever-tightening competition for capital has largely relegated the U.S. Rockies to lower-tier status, the one-time geological enigma that is the multi-zone Niobrara shale play has quietly come of age with its core in the Denver-Julesburg (DJ) basin, generating among the highest returns in the nation’s turbulent unconventional sector.

Nevertheless, save for a handful of operators, given the troublesome age in which the triple-bench Niobrara has firmly emerged from geologically tricky prospect to full-blown development, it continues to take a backseat to its more established counterparts, mainly to the south. However, count Noble Energy among those who consider the Niobrara, along with the often-stacked Mancos shale and underlying Codell sandstone horizons, much more than an afterthought.

“We have five or seven core positions, and the DJ has always been at the top,” President and CEO David Stover told the Denver Business Journal on Aug. 27, during a presentation to the Colorado Oil & Gas Association’s (COGA) Rocky Mountain Energy Summit. “When we look at the returns for the DJ, especially as you move into the oil window, they’re right up there with the premier fields in the country. I can’t see it never being a core position for us.”

Noble and fellow Texas independent Anadarko Petroleum (Fig. 1) remain the premier operators in what is commonly designated the DJ-Niobrara or the Niobrara-Codell, in deference to the primary pay zone for the DJ basin’s most productive wells. While prospective across multiple basins in Colorado and Wyoming, nearly all activity and production today is centered in northeastern Colorado, and in particular the giant Wattenberg field of Weld County, which abuts the heavily populated Front Range—the epicenter for a stubborn anti-fracing coalition. There, having cracked the once-thorny geological code of this ultra-sweet spot, operators are now in full-scale development mode with optimized stimulation and completion programs, increased lateral lengths and steadily shrinking well costs. Moreover, thanks primarily to an expanded infrastructure of late, the differential price gap, relative to the West Texas Intermediate (WTI) benchmark, has narrowed appreciably, further elevating the now-competitive nature of the play.

Norway’s Rystad Energy, in fact, says that the Niobrara Wattenberg core has the third-lowest breakeven costs of any U.S. shale play. Data from the consultancy’s proprietary UCube, integrated upstream database show Wattenberg Niobrara wells averaging breakeven costs around $55/bbl, trailing only the separate oil and wet gas/condensate segments of the eastern Eagle Ford. However, in what essentially is a tale of two plays, the economic picture changes dramatically in the less developed northern portion of the DJ and the Powder River and Green River basins of Wyoming. According to UCube data, breakeven costs for Niobrara wells in those areas range just under $70/bbl to more than $102/bbl in the Powder River basin (PRB).

“The Niobrara (Wattenberg) is a play where the costs have been decreasing significantly,” says Rystad shale analyst Leslie Wei. “A normalized well with a 5,000-ft lateral cost $4 million last year. That same well costs $3.4 million this year. Operators also have really ramped up pad drilling, which, as a percentage of total wells drilled, has increased from zero in 2011 to more than 80% in 2015. This has been another one of the key drivers for cost cutting there.”

Wei added that companies this year also report they plan to drill longer laterals. One of those companies is homegrown Bill Barrett Corp., which operates exclusively in the northeastern Wattenberg and Uinta basin. Even with its ongoing, extended-reach drilling program with up to 9,500-ft laterals, the Denver independent said lease operating expenses (LOE) in the Wattenberg average $5.84/boe, compared to $9 to $10/bbl in its Utah holdings. In a September update, the company cited an estimated “40% rate of return at the current commodity price strip” as justification for adding a second rig to its 98,188-net acre Wattenberg leasehold, where it targets the Niobrara A, B and C benches, as well as the Codell formation.

“We continue to maintain discipline as our contracted northeast Wattenberg extended reach lateral wells are averaging $6.25 million to drill and complete. We have been able to garner significant efficiency gains, thanks to faster drilling times on these wells,” says CEO R. Scot Woodall.

METRICS REFLECT MARKET

Obviously, attractive well economics notwithstanding, the DJ Niobrara likewise is caught squarely in the crosshairs of deteriorating commodity prices, with some operators either choosing to suspend operations or continue to shift limited resources elsewhere. In the meantime, for the week of Sept. 20, Baker Hughes reported 29 active rigs in the Niobrara region, unchanged from the week prior, but, not surprisingly, down sharply from 63 active rigs during the like period of 2014. Only two of the currently drilling rigs were targeting the Wyoming swath of the Niobrara.

Meanwhile, it also comes as no surprise that new drilling permits issued over the past year reflect little confidence in a recovery anytime soon. Using Weld County as the barometer for activity going forward, a dissection of permits issued by the Colorado Oil and Gas Conservation Commission (COGCC), the state’s chief regulator, shows an estimated 2,208 new drilling authorizations for Niobrara and/or Codell prospects in the county between Sept. 2, 2014 and Sept. 16, 2015. By comparison, the COGCC issued a record 2,468 new drilling permits for Weld County wells in 2013.

The state’s leading producer by an unapproachable margin, Weld County, as of July, contributed 49,813,319 bbl of the 56,463,720 bbl oil that Colorado produced in the first seven months of 2015, according to notoriously belated COGCC data. For all of 2014, COGCC had Colorado producing a cumulative 94,452,092 bbl of oil, of which 80,662,809 bbl came from the Wattenberg home county.

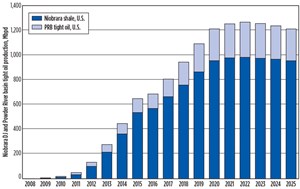

Throughout the delineated Niobrara region, the U.S. Energy Information Administration (EIA) has oil production dropping by 19,000 bpd in October, compared to the previous month (Fig. 2), while gas is forecast to decline month-over-month by 50 MMcfd. Meanwhile, combining production from the DJ Niobrara and the tight oil play in Wyoming’s PRB, a Rystad Energy analysis projects aggregate oil production rising to more than 651,500 bpd at year-end 2015, up from more than 448,800 bpd in 2014 and increasing sequentially out to 2022, Fig. 3. At the same time, Rystad says cumulative drilling activity in the DJ and PRB, as well as the Green River basin in Wyoming, will likely be hard-pressed to reach 2014 levels anytime soon.

“In all three basins combined, we saw around 1,600 wells drilled in 2014. That number should decrease to around 1,000 wells for 2015,” Wei said from Oslo. “We expect the well count to be roughly the same between 2015 and 2016, before it starts increasing again, though we will not see 2014 levels before 2018.”

A considerable chunk of those new projected wells will be drilled by Noble and Anadarko, which together operate more than 26.5% of the total active rigs and, according to Rystad as of late September, was maintaining an aggregate DJ spend estimated at $3 billion.

DOMINANT DUO

Noble Energy holds more than 500,000 net acres across the northern Colorado portion of the DJ basin and ranks as the Wattenberg’s premier leaseholder, with activity focused primarily on its core 61,000-acre Wells Ranch and 44,000-acre East Pony areas. Production from its largest onshore play has averaged roughly 110,000 boed through the first two months of the third quarter, peaking at 115,000 boed. By comparison, Noble exited 2014 with net DJ production of 101,000 boed.

“With current rig efficiencies and four rigs for the rest of the year, we expect to drill a total of 240 equivalent wells in 2015, compared to our original budget expectation of about 200 with the same number of rigs,” says Executive V.P. Gary W. Willingham.

Thanks in no small part to the centralized, integrated development plans (IDP) that were announced earlier, within the Wells Ranch and East Pony developments, Willingham said total well costs are expected to drop precipitously over the rest of 2015. “Second-half 2015, all-in well costs, including drilling, completion and allocated facilities, are expected to be $3.5 million in Wells Ranch and $3.9 million in East Pony. These are both $300,000 below our budget assumptions,” he says.

He added that Noble continues to tweak completions across the IDPs, primarily with respect to stage lengths, proppant loads and fluid types. “Most recently, we’ve seen very strong performance utilizing slickwater in East Pony, with the majority of these wells outperforming nearby hybrid gel completions,” he said, adding that net production in the East Pony IDP has ramped up to 25,000 boed—a nearly 100% year-over-year increase.

Despite laying down more than half of the rigs that it operated last year, Anadarko increased year-over-year second-quarter production in Wattenberg field to 232,000 boed from 169,000 boed. The second-quarter net sales volume was up more than 16,000 boed from the first three months of the year, but production is expected to level off for the rest of 2015, as the company defers completion on some 120 wells.

After dropping two rigs in the first quarter, Anadarko averaged an eight-rig fleet and drilled 96 wells within its 350,000-acre Wattenberg leasehold in the second quarter. “We’ve driven our cost down in the Wattenberg field by almost 35% in the last six months and doubled our rig efficiency over the last year, drilling the same number of wells with half the rigs,” Chairman, President and CEO Robert Walker said on July 29.

In addition, the newly commissioned second phase of the Lancaster cryogenic gas plant increased Anadarko’s processing capacity at the complex to 600 MMcfd, while the 180 MMcfd of compression added this year effectively lowers average wellhead pressure in the Wattenberg to less than 100 psi, which Walker says, “enhances system efficiency and improves the base production profile.” Anadarko also expects its centralized oil stabilization facility to be up and running in fourth-quarter 2015.

Across the border, Anadarko also participated in 14 wells in Laramie County, Wyo., where it has interests in more than 100,000 acres prospective for the Niobrara and Codell.

OVERALL ACTIVITY MIXED

The near-term plans for the remaining players in the Niobrara-Codell run the gamut from capitalizing on lower well costs to suspending operations until the market shows some hint of improving.

Bonanza Creek Energy, for one, has entered full-field development on the 97,000 gross acres that it holds in the Wattenberg, where the latest earnings report has its Niobrara-Codell horizontal wells delivering record three-stream production of 22,700 boed. As of now, Bonanza Creek says its two-rig program is on track to deliver 77 wells this year.

While its holdings are prospective for five stacked pay zones, Bonanza Creek says it is focusing on fully developing the Niobrara B and C benches, and the Codell, with 4,000-ft laterals. However, an extended reach drilling program is underway on the 86,400 gross acres that it acquired last year, adjacent to its legacy Wattenberg leasehold. In the northern block of the recently acquired acreage, its first Niobrara B well completed with a 7,300-ft lateral is tracking estimated ultimate recovery (EUR) of 550,000 boe after more than 100 days of production, the company says.

Bonanza Creek says it has reduced standard reach lateral well costs 23%, from $3.45 million in the fourth quarter of 2014 to $3 million in the second half of 2015. “Looking to 2016, we have a line of sight to take costs down to $2.7 million or below by utilizing a two-stream, mono-bore well design, and evolving our frac fluids to a higher mix of slickwater within our hybrid gel dominated designs,” said Executive V.P. and COO Tony Buchanon. “Extended reach laterals are following this same trend and moving towards $5 million for a 9,000-footer.”

PDC Energy reported second-quarter production of 33,716 boed from its 97,000-net-acre Wattenberg leasehold, up from the 23,274 boed delivered in the like period of 2014. During the quarter, PDC drilled 43 Niobrara and Codell horizontal wells and put 44 on production within its core acreage. The latest update has the company running five rigs, with plans to drill 47 extended-reach laterals this year, at a projected per-well cost of $4.1 million, split 75-25 between the Niobrara and Codell. Senior V.P. Scott Reasoner said the company’s standard-length lateral cost is roughly $3.1 million.

The company has transitioned steadily from sliding sleeve to plug-n-perf completions, which it says are generating 30% to 35% more production. PDC says it expects to employ plug-n-perf completions on 39 additional wells in the second half of 2015.

When the year began, Encana tentatively planned to run three to four rigs and drill up to 35 net wells within its 51,000-net-acre DJ leasehold, but market conditions refused to cooperate. Consequently, the Canadian operator plans to run a single rig for the remainder of 2015 and drill between 15 and 20 net wells, Fig. 4. With 80% of its 2015 capital budget earmarked for its Permian basin, Eagle Ford, Duvernay and Montney assets, Encana plans a DJ spend of between $190 million and $210 million this year, with oil and condensate production estimated at 10,000–11,000 bpd, with a target of 50–60 MMcfgd and 5,000–5,500 bpd of NGLs.

Whiting Petroleum controls 167,070 gross acres in Weld County, where its DJ Redtail field averaged 17,065 boed in the second quarter, up 31% over the previous quarter. As of late September, Whiting was running two rigs at Redtail, where the primary targets are the three Niobrara benches and the Codell-Fort Hays formations. Whiting plans to complete 25 net Niobrara wells in the second half of the year.

In a related development, with the newly commissioned second phase of the Redtail gas plant, in-field processing capacity was expanded from 20 MMcfd to 50 MMcfd in the third quarter, with a projected increase to 70 MMcfd in the first half of 2016, according to Whiting.

Carrizo Oil & Gas laid down its single rig in the second quarter and has curtailed any additional drilling and completion activity in its 36,200-net-acre DJ Niobrara leasehold for the remainder of the year. The independent, however, said it will participate in non-operated wells with Noble and Whiting, including interests in wells drilled on the two operators’ jointly operated “super pads” in Weld County, testing the three Niobrara benches at various spacings. Carrizo said it plans to exit the year by drilling 13 and completing three gross wells. Before the suspension, Carrizo’s Niobrara wells produced more than 2,600 bopd, net, during the second quarter, up 11% from the first quarter.

During the second quarter, the Dallas-based independent added more than 1,300 net acres to its core Niobrara holdings in northeastern Colorado, which it says adds 45 net locations to its highest-return area. The operator also is monitoring offset activity, targeting the deeper Codell, “as this could materially increase our drilling inventory,” says CEO Sylvester Johnson. “Nearby industry wells have targeted Codell thicknesses of 10 to 13 ft of pay, and more than 30% of our Niobrara position has at least 10 ft of Codell thickness.”

Synergy Resources, likewise, is expected to close by Oct. 30 on its $78-million acquisition of 4,300 net acres in the Wattenberg, which includes non-operated interests in 25 gross Niobrara and Codell wells. Formerly held by K.P. Kauffman Company, the newly acquired assets are producing roughly 1,200 boed.

Synergy has one rig under contract for the remainder of 2015, drilling a pad comprising eight standard-length lateral wells. For its FY 2016 drilling program, Synergy said it projects total costs for its standard-length wells of between $2.5-$3 million, which it said would continue to make its drilling program “solidly economic, even at oil prices as low as $50/bbl.”

Earlier this year, EOG Resources said it will limit drilling to the minimum required for lease retention within its aggregate 148,000-net-acre holdings in the northernmost DJ basin and the PRB, much of which is prospective for the Niobrara and Codell. The Houston independent, which ironically is credited with helping ignite the Niobrara play with its 2009 Jake well, is concentrating activity on its top-tier assets that include the Bakken-Three Forks core, the Eagle Ford and Delaware basin.

In September, EOG announced an auction, for what it stresses is “non-core assets,” comprising 129,673 net acres across Colorado, Wyoming and Utah. The planned divestiture includes acreage in Wyoming’s Washakie and Powder River basins, the Piceance basin in Colorado and Utah’s Uinta basin.

EXPANDED TAKEAWAY

If all goes as planned, by year-end 2016, as much as 1,112,000 bpd of additional common carrier takeaway capacity will be available to move DJ basin crude to the Cushing, Okla., gathering hub. As with the Bakken, escalating production had caused bottlenecks and forced DJ producers to trade at a premium relative to WTI. Owing to the new capacity this year, however, and depending on the operator, price differentials to the WTI benchmark have dropped below $8/bbl.

The 66-mi Northeast Colorado Lateral extension to Tallgrass Energy’s Pony Express pipeline network began service in the first half of the year, to which the now-integrated network is adding an aggregate 320,000 bopd of takeaway capacity. Before the end of 2015, the SEMGroup’s White Cliffs Expansion will tie in with the existing White Cliffs pipeline, which together will move 200,000 bopd to the Cushing hub.

Going forward, the Rimrock Midstream and NGL Energy Partners are expected to begin deliveries in late 2016 on the planned 150-mi DJ basin gathering system, which will tie in to the Grand Mesa pipeline network with a combined capacity of 200,000 bopd. Elsewhere, among the more ambitious takeaway projects, is the planned 550-mi Saddlehorn pipeline system that would transport 200,000 bpd to 400,000 bpd of DJ-produced oil to Cushing. A consortium, comprising Magellan Midstream, Plains All American Pipeline L.P. and Anadarko, owns the network, which is expected to be in service before the end of 2016.

Meanwhile, in-field gas processing capacities, likewise, increased appreciably this year, bolstered by the June commissioning of the DCP Midstream Lucerne II cryogenic gas plant, with a designed capacity of 200 MMcfd. The third-party processing facility adds significantly to individual operators’ increased gas compression projects throughout the DJ basin, Fig. 5. “Definitely, Lucern II is going to help us,” says Bill Barnett’s Woodall. “Almost all of our gas flows towards Lucerne II, and since it has had some pretty good run times here recently, I think we are observing a plus-or-minus 100-psi drop in wellhead pressures because of Lucerne II.” ![]()

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- What's new in production (February 2024)

- Using data to create new completion efficiencies (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)

- ConocoPhillips’ Greg Leveille sees rapid trajectory of technical advancement continuing (February 2019)