“To everything, there is a season, and a time to every purpose under heaven. A time to plant and a time to harvest that which is planted. A time to break down and a time to build up.” Ecclesiastes 3:1-8.

It’s amazing how quickly the world can turn upside down. Most of the oil industry professionals in my age bracket (64 to be exact) were looking forward to closing out our careers on top. We expected to win laurels for achieving record profits for our enterprises with WTI crude price above $100/bbl. Since late 2014, when WTI dropped with a thud to $45/bbl, we’re having to scrimp, cut back and innovate, just to survive for the umpteenth time (four to be exact during my career). How do we climb out of this latest downturn?

Shelter in place. Just like a hurricane sweeping across the U.S. Gulf Coast, the price decline triggered by OPEC has swept across the world, forcing crude oil producers outside OPEC to hunker down. That means cutting E&P budgets, delaying projects and reducing head counts. With the Saudis determined to protect their market share, it has been left up to oil producers sensitive to market conditions (independents and IOCs) to serve as the swing producers.

Wait and see. Since the beginning of the year, WTI has improved to about $59/bbl. The uptick could be the result of renewed turmoil in the Middle East, as well as the drilling and production slowdown in North America. The $14/bbl increase makes the break-even cost a little bit closer. If the price rises above $65/bbl, many of the shale producers are expected to spring back into action and be in a position to recover the lost 500,000 bopd. What this means is that if the Saudis want to retain their market share, they will have to keep the WTI crude price below $65/bbl. Doesn’t seem like a long-term revenue optimization strategy.

Collaborative action. Wouldn’t it be better if the world’s major producers—OPEC, Russia and the U.S.—could collectively reduce production by 1.5 MMbopd? The U.S. already has cut back its share. According to news reports, Russia is planning to meet with OPEC before the cartel’s June meeting to discuss a possible adjustment of production limits. If OPEC and Russia throttle back their production by 500,000 bopd, each, we’ll have the world’s total demand in excess of supply. If DeBeers can control the diamond market, why can’t the major crude producers control the oil market? It is not a free market solution, but the present market is not free either. After a crude price collapse in 1930, it was the Texas Railroad Commission that set production quotas until the 1960s and essentially controlled world crude oil prices.

Innovating out of the downturn. Time and again, technology has been the savior of the industry. Speaking at IHS CERAWeek in mid-May, Exxon Mobil CEO Rex Tillerson pointed to the shale gas sector, which has been struggling with low prices since 2008. “About a decade ago, there were 1,200 rigs producing 55 Bcfd of gas,” Tillerson explained. “Now with less than 300 rigs, production is 72 Bcfd. Significant declines in rig activity did not lead to production declines.” If the past is any guide, the shale oil producers will be profitable at WTI crude as low was $65/bbl through technology innovations and the application of best practices.

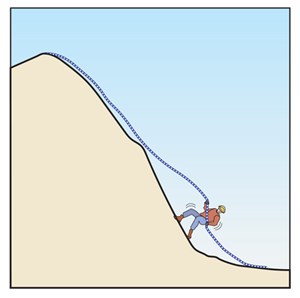

The climb back to higher oil prices will be tough, but we’ve done it before. ![]()

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)

- U.S. operators reduce activity as crude prices plunge (February 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)